Voluntary Liquidation for Companies in Debt

Anderson Brookes Insolvency Practitioners help directors close limited companies with debt quickly, legally and with expert guidance every step of the way.

Get a quote today

When your Business is in Debt

If your company can no longer afford to pay its debts, a Creditors’ Voluntary Liquidation (CVL) is often the most appropriate and legally compliant route forward. This process allows directors to take control of the situation and close the company in an orderly and professional way.

What Is Voluntary Liquidation?

Voluntary liquidation is a formal insolvency procedure started by the company directors. It is used when a business is insolvent – unable to meet its financial obligations as they fall due or where liabilities exceed assets. Unlike compulsory liquidation, which is forced through the courts by a creditor, voluntary liquidation gives directors the chance to act responsibly and avoid further legal or financial risks. You may also be interested in our Company Liquidation Guide.

The CVL Process Explained

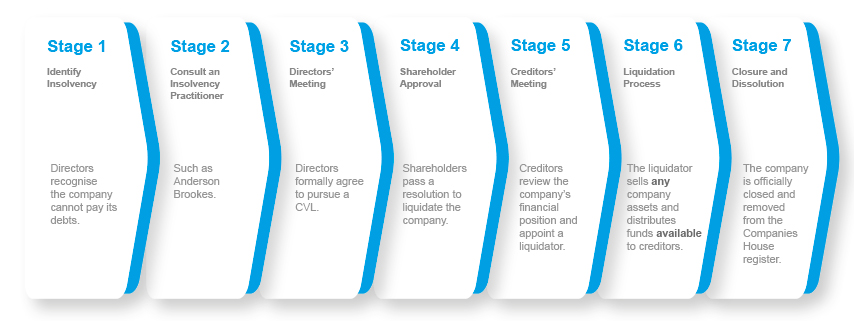

A Creditors’ Voluntary Liquidation is managed by a licensed insolvency practitioner (IP), who will take over the company’s affairs. The IP is responsible for:

Valuing and selling any company assets

Communicating with creditors

Ensuring legal compliance

Investigating the company’s financial history

Once the CVL is complete, the company is dissolved and removed from the Companies House register. Any debts that cannot be repaid from company assets are written off, giving directors a clean break.

Why Directors Choose Anderson Brookes

With more than 25 years’ experience and thousands of directors helped, we’re trusted by business owners across the UK. You can speak directly with an expert insolvency practitioner and we’ll help you understand your options clearly and quickly. We specialise in working with small and medium businesses and we understand your perspective and priorities.

Ready to

Move On?

If you’re ready to close your company, stop creditor pressure, or just want to understand your next steps, we’re here to talk.

Call us now on 0800 1804 933 or request a call back - we’re here to help.

Voluntary Liquidation - 7 Step Process

Can you liquidate your limited company?

Why Choose a CVL?

Many directors prefer a CVL because it offers more control and less stress than waiting for a creditor to take legal action. It also allows for better communication with creditors and a more transparent process.

| Benefit of CVL | Why It Matters |

|---|---|

| Legal protection | Stops further creditor action and bailiff visits |

| Managed by a licensed IP | Ensures compliance and fairness to all parties |

| Clean company closure | Ends trading, finalises tax matters, and dissolves the company |

| Opportunity for director redundancy | May help fund the cost of liquidation |

What Happens to the Debts?

Debts that remain after company assets have been sold are written off, unless a director has personally guaranteed them. Most directors do not have to pay company debts from personal funds unless they’ve signed a guarantee, acted wrongfully, or continued to trade while insolvent.

What About Director Investigations?

Every liquidation includes a statutory investigation into the conduct of directors. This is routine and helps ensure directors have acted properly in the lead-up to insolvency. As long as you’ve been honest, kept records, and sought advice early, there’s no reason to worry.

Is CVL Right for Your Business?

If your company has mounting debts, declining cash flow, or legal pressure from creditors or HMRC, a CVL could be the right solution. The sooner you act, the more options you’ll have and the better protected you’ll be as a director.

Speak to Anderson Brookes

We’ve supported thousands of directors through the voluntary liquidation process. Our licensed insolvency practitioners will explain your options in plain English and guide you through every step.

Free Advice Line: 0800 1804 933

Email: advice@andersonbrookes.co.uk

Confidential, regulated and professional support is just a call away. Don’t wait for things to get worse – get clarity now with Anderson Brookes.

Testimonials

Our clients praise our professionalism, reliability, and the exceptional support we provide during challenging times, helping thousands of company directors through insolvency, liquidation, and business debt solutions.