Business Bankruptcy: Common Concerns for UK Company Directors – What You Need to Know

Facing financial distress as a company director in the UK is stressful. Whether it’s concerns over personal liability, the risk of disqualification, or the potential for personal bankruptcy, understanding your position is crucial. At Anderson Brookes, we provide clear, practical advice to help you manage your company’s insolvency and protect your future.

Insolvency vs. Bankruptcy: Clearing the Confusion

While “bankruptcy” is often used colloquially, its legal meaning in the UK applies to individuals and sole traders. For limited companies, the correct term is insolvency. Insolvency occurs when a company’s liabilities exceed its assets or when it cannot pay its bills on time.

Liquidation: A process for companies. It involves closing the business and selling assets to pay off debts.

?– Compulsory Liquidation: Court-ordered, usually initiated by creditors.

?– Voluntary Liquidation: Initiated by directors when they recognise insolvency, without needing court action.

Key Tests for Insolvency:

- Balance Sheet Test: Compare your total liabilities with available assets (cash, property, stock). If liabilities outweigh assets, your company is likely insolvent.

- Cash Flow Test: Evaluate your ability to pay monthly bills and overheads. Persistent arrears are an early warning sign of financial distress.

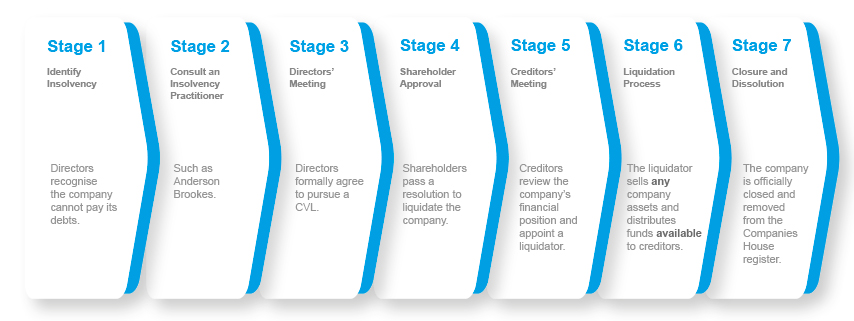

Voluntary Liquidation Process (common route for business ‘bankruptcy’)

Concise UK Bankruptcy Process (personal)

Application: Apply online (or receive a petition from a creditor) to start the process.

Bankruptcy Order: Once approved, a bankruptcy order is issued and an Official Receiver (acting as trustee) is appointed.

Asset Control: Your assets are assessed and, if not exempt, sold to repay debts.

Interview: Attend a mandatory interview with the Official Receiver to review your financial details.

Income Contributions: If you have surplus income, you may be required to make regular payments.

Discharge: Typically after 12 months, you are discharged from most debts, ending the bankruptcy process.

Unsure? Prefer to discuss?

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

Managing Personal Liability

Directors are naturally concerned about the personal risks when a company faces insolvency. While limited company status generally protects your personal finances, there are circumstances where that protection can be breached.

Personal Guarantees and Misuse of Funds

- Personal Guarantees: Signing personal guarantees for business loans or credit lines means you remain personally liable if the company fails.

- Fund Mismanagement: Paying dividends without sufficient profits or misusing directors’ loans can expose you to personal financial responsibility.

Actionable Tip:

Review all personal guarantees regularly and maintain transparent financial records. Early consultation with a specialist is crucial to protecting your personal assets.

How Business Failure Can Lead to Personal Bankruptcy

A common question for directors is: How can a business failure result in personal bankruptcy? Although a limited company’s failure does not automatically follow through to personal bankruptcy, there are scenarios where the line becomes blurred. Drawing on insights from industry experts, consider the following examples:

Key Scenarios:

-

Personal Guarantees:

When you sign a personal guarantee, you effectively merge your personal and business liabilities. If the company enters liquidation and creditors pursue repayment—and restructuring deals aren’t reached—you may face personal bankruptcy. -

Overdrawn Director’s Loan Accounts:

An overdrawn director’s loan account becomes a significant risk. For instance, if a liquidator determines that you owe a substantial sum from an overdrawn loan, and you fail to take remedial action, this debt can trigger personal bankruptcy proceedings. -

Misconduct and Undervalue Transactions:

If an insolvency practitioner identifies wrongdoing—such as deliberately selling assets below market value or diverting company funds for personal gain—these actions can lead to personal liability. In extreme cases, this misconduct may result in the director being declared bankrupt.

Actionable Tip:

Keep business and personal finances separate wherever possible. If you must sign a personal guarantee, be fully aware of its implications and prepare a strategy to manage it should your business face difficulties.

Business Bankruptcy – Google Reviews

&

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

Director Disqualification: Risks and Prevention

The prospect of disqualification – where you could be barred from serving as a director for up to 15 years—is another serious concern.

Behaviours That Increase Disqualification Risk:

- Continuing to Incur Debt: Incurring further debt when insolvency is evident can lead to disqualification.

- Asset Mismanagement: Selling assets below market value or using company funds for personal gain may be viewed as misconduct.

- Inappropriate Handling of Directors’ Loans: Failing to manage these loans properly can expose you to personal liability and disqualification.

Preventive Measures:

- Maintain detailed and accurate financial records.

- Seek professional advice as soon as signs of financial distress emerge.

Protecting Your Personal Credit Rating

A widespread misconception is that a company’s insolvency automatically tarnishes your personal credit. In most cases, your personal credit file remains separate unless you have provided personal guarantees or engaged in risky financial practices.

Key Considerations:

- Separation Principle:

The limited liability structure of your company generally shields your personal credit. - Exceptions:

If personal guarantees are involved or if you’ve mismanaged company funds, your personal credit could be adversely affected.

Actionable Tip:

Keep personal and business finances distinct, and consult with an insolvency practitioner if you’re uncertain about any potential risks.

Exploring Your Options When Insolvency Strikes

Even when a company is insolvent, bankruptcy (or, more accurately, insolvency) is not the end of the road. There are both formal and informal rescue options available:

Rescue and Recovery Routes:

- Informal Negotiations:

Early discussions with creditors can sometimes lead to manageable restructuring without formal proceedings. - Company Voluntary Arrangements (CVA):

CVAs offer a formal, legally binding repayment plan that typically lasts 3–5 years, allowing your company to continue trading while gradually repaying debts. - Administration:

Entering administration provides a moratorium on legal actions, giving an appointed practitioner time to explore rescue strategies. - Restructuring and Refinancing:

Simplifying your business structure or obtaining more cost-effective financing may relieve cash flow pressures and prevent insolvency.

Actionable Tip:

Conduct a self-assessment using both the balance sheet and cash flow tests, then contact a licensed insolvency practitioner immediately to discuss your options.

Immediate Support: Taking Action Under HMRC and Creditor Pressure

When HMRC or other creditors begin to apply pressure, time is of the essence. Immediate steps include:

- Assessing Your Financial Position:

Quickly perform insolvency tests and document your financial status. - Seeking Expert Advice:

Contact a licensed insolvency practitioner without delay to discuss potential restructuring or liquidation. - Utilising Support Helplines:

For urgent advice, consider reaching out to our dedicated helpline—available to provide free, confidential support.

Actionable Tip:

If creditor pressure intensifies, take swift action. Early engagement with experts increases the range of options available and can prevent escalation to personal bankruptcy.

Frequently Asked Questions – Business Bankruptcy

Q: Will my personal credit be affected by my company’s insolvency?

A: Generally, no – unless you have provided personal guarantees or engaged in misconduct that results in personal liability.

Q: What can trigger personal bankruptcy for a limited company director?

A: Personal bankruptcy may occur if you sign personal guarantees, accumulate a significant overdrawn director’s loan account, or if misconduct is identified during liquidation.

Q: How can I avoid personal bankruptcy in a business failure?

A: Keep business and personal finances separate, avoid unnecessary personal guarantees, maintain clear records, and seek professional advice early.

Early Warning Signs & Preventive Strategies

Recognising the early warning signs of financial distress can help you take action before the situation deteriorates further. Look out for:

- Delayed Payments: Repeatedly missing payment deadlines or having difficulty meeting cash flow obligations.

- Rising Debt Levels: A steady increase in liabilities compared to your assets.

- Decreasing Profit Margins: Falling profit margins despite stable or increasing sales, which may indicate inefficiencies.

- Employee Turnover: High staff turnover can signal internal issues affecting business stability.

Preventive Strategies:

- Regularly review financial statements.

- Implement strict budget controls.

- Engage in proactive communication with creditors.

- Seek professional advice at the first sign of trouble.

Legal Duties and Responsibilities

As a director, you have clear statutory obligations under the Companies Act and other relevant legislation:

- Fiduciary Duties: Act in the best interests of the company and its creditors.

- Wrongful Trading: Avoid continuing to incur debts once it is clear that insolvency is unavoidable.

- Compliance Requirements: Ensure all corporate decisions are properly documented and comply with legal standards.

Actionable Tip:

Familiarise yourself with these duties and consult legal counsel if you’re uncertain about your obligations during financial distress.

Recovery & Future Planning

Even after facing insolvency, there are steps you can take to recover and plan for the future:

- Rebuilding Credit:

Work with financial advisors to repair any damage to your personal or business credit. - Restructuring for Success:

Consider business restructuring to streamline operations and reduce costs. - Learning from Experience:

Use the lessons learned from the insolvency process to inform better decision-making in future ventures. - Personal Development:

Invest in training and education to stay updated on best practices in financial management and corporate governance.

Common Myths vs. Facts

There are many misconceptions surrounding business bankruptcy. Here are a few to clarify:

- Myth: Insolvency automatically ruins your personal credit.

Fact: Your personal credit is usually protected unless you have personal guarantees or misconduct is involved. - Myth: Bankruptcy is the same for companies and individuals.

Fact: Only individuals and sole traders can be declared bankrupt; limited companies are classified as insolvent. - Myth: There’s no way to recover from insolvency.

Fact: With the right strategies and expert advice, many companies can restructure and return to profitability.

Protecting Your Future as a Director

Insolvency is a complex challenge, but with proactive planning and expert guidance, you can protect your personal finances and career. By understanding the differences between insolvency and bankruptcy, managing personal liabilities carefully, and taking immediate action when faced with creditor pressure, you’ll be in a stronger position to navigate these turbulent times.

At Anderson Brookes, our experienced insolvency practitioners are ready to provide tailored, confidential advice to help you secure your future.

Contact us today for expert support and a clear path forward.