Business Going into Administration: Understanding the Process and Implications

What Does It Mean When A Business Goes Into Administration?

When a business goes into administration, it enters a formal insolvency procedure aimed at rescuing the company or realising its assets. An independent insolvency practitioner takes control to protect the business from creditors whilst attempting to salvage value.

Definition Of Business Administration

Business administration refers to the process where an insolvent company is placed under the management of a licensed insolvency practitioner. This administrator, such as Anderson Brookes, assumes control of the company’s affairs, business and property. Their primary goal is to rescue the company as a going concern or achieve a better result for creditors than if the company were wound up.

The administrator has broad powers to continue trading, restructure operations, and sell assets. They act in the interests of all creditors and aim to maximise returns. Administration provides breathing space from creditor pressure, allowing time to formulate a recovery plan.

Why A Business May Enter Administration

Businesses typically enter administration when facing severe financial difficulties and imminent insolvency. Common reasons include:

- Cash flow problems and inability to pay debts

- Pressure from creditors threatening legal action

- Unsustainable losses and declining revenues

- Loss of major contracts or customers

- Market changes impacting the business model

Administration can offer a chance to restructure and survive. It may allow the company to negotiate with creditors, shed unprofitable parts of the business, or find a buyer for viable elements. For some companies, it’s a last resort to avoid immediate liquidation.

The Legal Framework Governing Administration In The UK

The administration process in the UK is governed by the Insolvency Act 1986 and the Enterprise Act 2002. Key aspects include:

- An administrator can be appointed by the court, company directors, or a qualifying floating charge holder

- There is an initial 8-week period to send proposals to creditors

- Administration is time-limited, typically lasting up to one year

- Creditors’ rights are restricted during administration

- The administrator has a duty to act in creditors’ interests

Administrators must be licensed insolvency practitioners – such as Anderson Brookes. We have legal obligations to file regular progress reports. The process aims to balance creditor interests with the possibility of business rescue where viable.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

The Process of a Business Going into Administration

When a company enters administration, it triggers a structured process aimed at rescuing the business or achieving the best outcome for creditors. This involves several key steps, the appointment of an administrator with specific duties, and impacts on the company’s operations.

Steps Involved When a Business Goes into Administration

The process typically begins with the company directors, creditors, or court filing for administration. Once approved, an administrator is appointed. They immediately take control of the company’s affairs and assets.

The administrator must notify Companies House and inform all creditors within 7 days. They then have 8 weeks to develop a proposal for the company’s future.

A creditors’ meeting is held within 10 weeks to vote on the proposal. If approved, the administrator implements the plan. If rejected, the company may face liquidation.

Throughout this period, a moratorium protects the company from creditor actions, providing breathing space for restructuring efforts.

Role and Responsibilities of the Administrator

The administrator, a licensed insolvency practitioner, acts as the company’s temporary manager. Their primary duty is to act in the best interests of all creditors.

Key responsibilities include:

- Assessing the company’s financial position

- Developing a rescue plan or strategy for asset realisation

- Managing day-to-day operations

- Negotiating with creditors and stakeholders

- Investigating the conduct of directors

- Reporting to creditors on progress

The administrator has broad powers, including the ability to sell assets, continue trading, and make redundancies if necessary. They must act swiftly and efficiently to maximise returns for creditors.

What Happens to the Business During Administration

During administration, the company continues to operate, but under the administrator’s control. Employees remain in their roles unless the administrator decides redundancies are necessary.

The administrator may seek to sell the business as a going concern or parts of it to preserve value. This can sometimes involve a ‘pre-pack’ sale, where a buyer is lined up before administration begins.

Existing contracts may be renegotiated or terminated. Suppliers might be asked to continue providing goods or services, often on revised terms.

Directors lose control of the company but may be retained to assist the administrator. Shareholders’ interests are effectively frozen during this period.

Advantages and Disadvantages of a Business Going into Administration

Entering administration can have significant impacts on a struggling business. The process offers potential benefits but also comes with notable drawbacks that companies must weigh carefully.

Benefits for a Business Entering Administration

Administration provides protection from creditor actions through a moratorium, giving the company breathing space to explore restructuring options. This pause on legal proceedings allows the administrator time to assess the situation and develop a rescue plan.

You may be able to continue trading during administration, preserving the value of business assets. The administrator can negotiate with creditors and potentially arrange more favourable terms or debt write-offs.

If the business cannot be saved as a whole, administration offers the chance for a pre-packaged sale of viable parts. This can help preserve jobs and maximise returns for creditors compared to liquidation.

Drawbacks of Going into Administration

Entering administration is a public process that can damage your company’s reputation with clients, suppliers and stakeholders. You must disclose the administration status in all correspondence, which may impact business relationships.

Directors lose control of the company, with the administrator taking over decision-making. You’ll have no input into potential sale processes, even if you wish to bid for the business yourself.

Administration costs can be significant, with administrator fees reducing funds available to creditors. The process may still end in liquidation if a viable rescue plan cannot be implemented.

Job losses are common, as administrators often need to cut costs. Unsecured creditors may receive little or no repayment, potentially harming your business relationships.

Alternatives To A Business Going Into Administration

Several options exist for struggling businesses to avoid administration. These alternatives aim to restructure debts, improve cash flow, or wind down operations in a controlled manner.

Informal Agreements With Creditors

Negotiating directly with creditors can provide breathing room for your business. You might propose reduced payments, extended payment terms, or debt write-offs. This approach works best when you have a small number of key creditors.

Benefits include:

- Flexibility in negotiations

- Avoiding formal insolvency processes

- Maintaining control of your business

Drawbacks:

- Lack of legal protection

- Risk of individual creditors taking action

- Difficulty coordinating multiple creditors

To succeed, you’ll need to present a clear plan for business improvement and debt repayment. Be transparent about your financial situation and demonstrate your commitment to resolving issues.

Company Voluntary Arrangement (CVA)

A CVA is a formal agreement between your company and creditors. It allows you to repay debts over an extended period, typically 3-5 years. An insolvency practitioner oversees the process.

Key features:

- Legally binding on all creditors

- Protection from creditor actions

- Continued trading under existing management

Requirements:

- Approval by 75% of voting creditors (by value)

- Viable business plan

- Regular payments to creditors

A CVA can provide a structured path to recovery, but it requires careful planning and creditor support. You’ll need to balance creditor demands with your ability to generate sufficient cash flow.

Liquidation As A Last Resort

If other options aren’t viable, liquidation might be the best course of action. This involves selling company assets and closing the business. While not an alternative to administration in the strictest sense, it can be a more straightforward process.

Types of liquidation:

- Creditors’ Voluntary Liquidation (CVL). You may also be interested in CVL costs.

- Compulsory Liquidation

Benefits of voluntary liquidation:

- Directors maintain control of the process

- Potentially faster and less expensive than administration

- Clear end point for the business

Liquidation should only be considered after exploring other options. It’s important to seek professional advice to ensure you’re meeting your legal obligations as a director.

Voluntary Liquidation Process – Quick Example

Legal Obligations and Responsibilities of Directors

Directors have legal duties when a company faces financial difficulties. They must act in the best interests of creditors and comply with insolvency laws. Understanding these obligations is essential to avoid personal liability and support the administration process properly.

Directors’ Duties When A Business Faces Administration

When a company approaches insolvency, directors must prioritise creditors’ interests over shareholders’. You have a duty to minimise losses to creditors and consider whether administration is appropriate. Key responsibilities include:

- Monitoring the company’s financial position closely

- Seeking professional advice promptly

- Keeping accurate financial records

- Avoiding preferential payments to certain creditors

- Considering whether to continue trading

You must also disclose all relevant information to the administrator once appointed. Failure to fulfil these duties could lead to disqualification or personal liability for company debts.

Wrongful Trading and Its Consequences

Wrongful trading occurs when directors continue to trade despite knowing the company has no reasonable prospect of avoiding insolvency. You could be held personally liable if:

- You knew or ought to have known insolvency was unavoidable

- You failed to take every step to minimise losses to creditors

Consequences of wrongful trading may include:

- Contributing personally to company debts

- Disqualification from acting as a director (up to 15 years)

- Criminal charges in severe cases

To protect yourself, document all decisions and seek professional advice if you’re unsure about the company’s financial position.

How Directors Can Support the Administration Process

Your cooperation is crucial for a smooth administration. Key ways to support the process include:

- Provide full access to company records and assets

- Assist with preparing the statement of affairs

- Help identify and preserve valuable assets

- Facilitate communication with employees and creditors

- Cooperate with investigations into the company’s affairs

Be prepared to attend meetings and answer questions about the business. Honesty and transparency are vital. By working closely with the administrator, you can help achieve the best possible outcome for all stakeholders.

Impact of Administration on Stakeholders

Administration affects various parties involved with the company, from employees to creditors and shareholders. Each group faces unique challenges and potential outcomes as the process unfolds.

What Happens to Employees When a Business Goes into Administration

When a company enters administration, employees face an uncertain future. The administrator may decide to continue trading, which could preserve some jobs. However, redundancies are common as the business restructures.

You’ll find your employment rights are largely protected during this period. If you’re made redundant, you can claim unpaid wages and holiday pay from the National Insurance Fund. This covers up to 8 weeks’ wages and up to 6 weeks’ holiday pay.

The administrator must consult with employees about potential job losses. They’ll provide information on the company’s situation and any planned redundancies.

Impact on Creditors and Their Claims

Creditors often face significant losses when a company goes into administration. Secured creditors, like banks with charges over company assets, have priority for repayment.

Unsecured creditors, including suppliers and landlords, typically recover only a fraction of what they’re owed. The administrator will rank claims and distribute available funds accordingly.

You may be asked to continue supplying goods or services to keep the business running. The administrator can offer a guarantee of payment for these new supplies.

Creditors’ meetings allow you to vote on proposals for the company’s future. You’ll receive regular updates on the administration’s progress and any potential returns.

Effect on Shareholders and Investments

Shareholders usually bear the brunt of losses in administration. Your shares may become worthless if the company can’t be rescued or sold as a going concern.

You’ll lose voting rights and control over the company’s affairs. The administrator takes over decision-making powers from directors and shareholders.

If there’s any value left after creditors are paid, it’s distributed to shareholders. However, this is rare in administration cases.

You should seek financial advice about your investment. There may be tax implications or opportunities to claim capital losses on your shares.

How We Support Businesses Going Into Administration

At Anderson Brookes, we support businesses that are considering administration. If your company is struggling with debt or pressure from creditors, we’ll explain your options and help you take the right steps.

Our experienced advisers will talk you through what administration means, what your responsibilities are as a director, and help you prepare the paperwork if needed.

Every business is different, so we’ll take the time to understand your situation and offer advice that suits you. This may include negotiating with creditors or looking at ways to recover the business, depending on what’s possible.

We also offer free, no-obligation consultations so you can speak to us in confidence, get some initial advice, and decide how you want to move forward.

We’re here to help – just get in touch.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

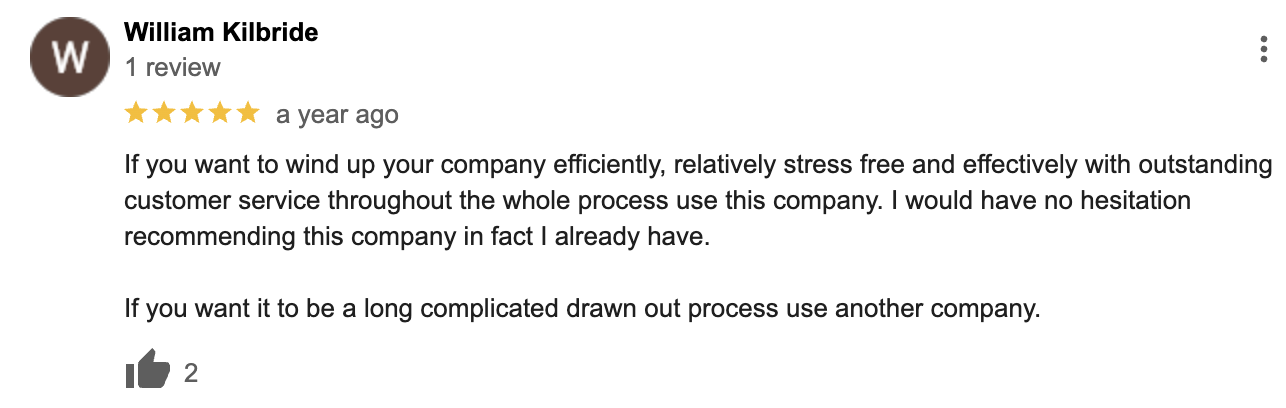

Google Reviews

&

Frequently Asked Questions

Company administration impacts various stakeholders and involves specific procedures. Let’s address some common queries about this process.

What are the implications for employees when a business enters administration?

When a company enters administration, employees face uncertainty. Job losses are possible, but administrators aim to preserve employment where feasible. You may continue working during the administration period, but your role could change. Redundancy payments might be available if your position is eliminated.

How does company administration affect the position of directors?

Directors lose control of the company when it enters administration. You must cooperate with the administrator and provide necessary information. Your powers are suspended, but you retain certain duties. The administrator may investigate your conduct leading up to the insolvency.

Can you explain the steps involved in the business administration process?

The process begins with appointing an administrator. They assess the company’s situation and develop a strategy. This may involve restructuring, selling assets, or finding a buyer. The administrator reports to creditors and manages day-to-day operations. The goal is to achieve the best outcome for all parties.

Does entering administration equate to a company becoming insolvent?

Yes, entering administration typically means a company is insolvent. It cannot pay its debts as they fall due or has liabilities exceeding its assets. Administration is a formal insolvency procedure designed to protect the company from creditor actions while seeking a solution.

What are the consequences for creditors when a company is placed into administration?

Creditors face potential financial losses. You cannot pursue legal action against the company without court permission. Secured creditors may have more protection. The administrator will communicate with you about potential returns. Your claim’s priority depends on your creditor status.

In the event of a company’s administration, will employees receive their outstanding wages?

Employees often receive priority for unpaid wages. You may be entitled to claim up to £800 from the National Insurance Fund. This covers arrears of pay, holiday pay, and notice pay. Any additional amounts owed become unsecured claims in the administration process.