Business Liquidation Definition and Process: A Comprehensive Guide for Companies

What Is Business Liquidation?

Business liquidation involves closing down a company and selling its assets to pay creditors. This legal process ends a company’s existence and settles its financial obligations. Understanding liquidation is crucial for business owners facing insolvency or considering voluntary closure.

Definition of Business Liquidation

Business liquidation is the formal process of winding up a company’s affairs. It entails selling the company’s assets, paying off creditors, and distributing any remaining funds to shareholders. The company ceases to exist after liquidation.

During this process, a licensed insolvency practitioner, known as a liquidator, takes control of the company. They manage the sale of assets and ensure proper distribution of funds according to legal priorities.

Liquidation can be voluntary, initiated by the company’s directors or shareholders, or compulsory, ordered by a court. Both types follow strict legal procedures to protect creditors’ interests and ensure fair treatment.

Purpose and Objectives of Liquidation

The primary purpose of liquidation is to close a company in an orderly manner. It aims to maximise the value of assets for creditors and resolve outstanding debts.

Key objectives include:

- Selling company assets

- Settling debts with creditors

- Investigating company affairs

- Distributing remaining funds to shareholders

Liquidation provides a fresh start for insolvent companies, allowing directors to move on without ongoing financial burdens. It also protects creditors by ensuring fair treatment in debt repayment.

For solvent companies, liquidation can be a strategic choice to close operations and release capital for shareholders.

Legal Framework Governing Liquidation in the UK

In the UK, the Insolvency Act 1986 and the Companies Act 2006 govern business liquidation. These laws outline procedures, rights, and responsibilities for all parties involved.

Key aspects of the legal framework include:

- Appointment of liquidators

- Powers and duties of liquidators

- Order of creditor priority

- Timelines for various stages of liquidation

The framework ensures transparency and fairness throughout the process. It protects creditors’ interests while allowing for efficient company closure.

Liquidators must adhere to strict regulations set by professional bodies. This oversight maintains high standards and protects all stakeholders in the liquidation process.

Types of Business Liquidation

Business liquidation comes in three main forms, each suited to different circumstances and company situations. These types vary in their initiation, processes, and outcomes for the business and its stakeholders.

Creditors’ Voluntary Liquidation (CVL)

A CVL occurs when a company’s directors decide to voluntarily wind up an insolvent business. This process begins with a board meeting where directors acknowledge the company can’t pay its debts. They then appoint a licensed insolvency practitioner as liquidator.

The liquidator takes control of the company’s assets and affairs. They’ll sell off assets, collect outstanding debts, and distribute proceeds to creditors. This type of liquidation aims to maximise returns for creditors.

A CVL can help directors avoid potential wrongful trading accusations. It also allows for a more orderly winding up of the business compared to compulsory liquidation.

Compulsory Liquidation

This type of liquidation is initiated by creditors through a court order. It usually happens when a company fails to pay its debts and creditors lose patience.

The process starts with a creditor filing a winding-up petition. If granted, the court appoints an official receiver to manage the liquidation. They’ll investigate the company’s affairs and may appoint a liquidator.

Compulsory liquidation can have serious consequences for directors. They may face disqualification if found guilty of misconduct. The company’s assets are sold, and proceeds distributed to creditors according to a set priority order.

Members’ Voluntary Liquidation (MVL)

An MVL is used when a solvent company wishes to close down. It’s often chosen when shareholders want to extract profits tax-efficiently or retire.

Directors must make a declaration of solvency, stating the company can pay all debts within 12 months. Shareholders then pass a resolution to wind up the company and appoint a liquidator.

The liquidator realises the company’s assets and settles any outstanding liabilities. Remaining funds are distributed to shareholders. An MVL can offer tax advantages over simply closing a company, particularly for those with significant retained profits.

The Liquidation Process

Liquidation Process – Quick Example

Liquidation involves several key steps to wind down a company’s operations and settle its affairs. A liquidator plays a crucial role in overseeing the process, while assets are realised and debts are settled according to legal priorities.

Steps Involved in Liquidating a Business

The liquidation process begins with the decision to liquidate, which can be voluntary or compulsory. For voluntary liquidation, directors call a board meeting and shareholders must pass a resolution. In compulsory cases, creditors petition the court.

Next, a licensed insolvency practitioner is appointed as liquidator. They take control of the company’s affairs and notify all relevant parties, including employees, creditors, and HMRC.

The company ceases trading and employees are typically made redundant. The liquidator then assesses and values all assets, prepares financial statements, and investigates the company’s affairs.

Role of the Liquidator

The liquidator acts as an impartial third party, managing the entire liquidation process. Their primary duties include:

- Taking control of company assets

- Investigating the company’s financial affairs

- Realising assets for the best possible price

- Distributing proceeds to creditors

- Ensuring all legal requirements are met

Liquidators also have the power to pursue directors for wrongful trading if necessary. They provide regular updates to creditors and shareholders throughout the process.

Asset Realisation and Debt Settlement

Asset realisation involves selling the company’s assets to generate funds. This can include:

- Property and equipment

- Stock and inventory

- Intellectual property

- Outstanding invoices

The liquidator aims to maximise returns for creditors. Once assets are sold, debts are settled according to a strict legal order of priority:

- Secured creditors

- Preferential creditors (e.g., employees)

- Unsecured creditors

- Shareholders (if any funds remain)

The liquidator distributes funds to each group in turn. If insufficient funds are available, lower-ranking creditors may receive partial payment or nothing at all.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

Signs Your Business May Need Liquidation

Recognising the warning signs of potential insolvency is crucial for business owners. Certain financial and operational indicators can point to the need for liquidation.

Financial Indicators of Insolvency

Mounting debt is a key red flag. If your company consistently struggles to pay creditors on time, it may signal serious cash flow issues. Check if your liabilities exceed assets on the balance sheet.

Declining revenue and profit margins over multiple quarters or years are worrying trends. Monitor your cash reserves closely – if they’re steadily depleting, it’s a cause for concern.

Defaulting on loans or falling behind on tax payments are severe warning signs. These can quickly lead to legal action from creditors or HMRC.

Consider seeking professional advice if you’re relying heavily on credit to fund day-to-day operations or if suppliers are demanding upfront payments due to concerns about your ability to pay.

Operational Challenges Leading to Liquidation

Loss of key clients or contracts can severely impact your business’s viability. If you’re unable to replace lost revenue streams, it may be time to consider liquidation.

Persistent staffing issues, such as high turnover or difficulty attracting skilled employees, can hinder your ability to deliver products or services effectively.

Outdated technology or equipment that you can’t afford to upgrade can make your business uncompetitive. If you’re unable to keep pace with industry standards, it may be a sign of deeper problems.

Legal issues, such as ongoing litigation or regulatory non-compliance, can drain resources and damage your reputation. These challenges may indicate that liquidation is the most prudent course of action.

Implications of Business Liquidation

Business liquidation has far-reaching consequences for various stakeholders. The process affects directors, employees, creditors, and shareholders in significant ways.

Impact on Directors

As a director, you face potential personal liability during liquidation. Your conduct leading up to insolvency will be scrutinised. If found guilty of wrongful trading or fraudulent activities, you could be disqualified from directorship for up to 15 years.

You may also be required to repay company funds if you’ve taken loans or dividends improperly. Personal guarantees on company debts could leave you financially exposed.

Your reputation might suffer, making it challenging to secure future business roles. However, if you’ve acted responsibly and cooperated with the liquidator, you can mitigate these risks.

Effect on Employees and Redundancies

For employees, liquidation often results in job losses. You’ll likely be made redundant with immediate effect. The liquidator will handle your redundancy claims.

You may be entitled to:

- Unpaid wages (up to 8 weeks)

- Holiday pay (up to 6 weeks)

- Statutory notice pay

- Redundancy pay (if you’ve worked for the company for 2+ years)

These payments are made by the National Insurance Fund, subject to statutory limits. You’ll need to file claims with the Redundancy Payments Service.

Finding new employment can be challenging, especially if the liquidation affects an entire industry sector.

Consequences for Creditors and Shareholders

As a creditor, your ability to recover debts depends on your status. Secured creditors have first claim on assets. Unsecured creditors often recover little, if anything.

The liquidator will rank creditors:

- Secured creditors

- Preferential creditors (e.g., employees)

- Unsecured creditors

- You’ll receive payments based on this hierarchy and available funds. The liquidator will communicate the expected dividend, if any.

For shareholders, liquidation typically means a total loss of investment. You’re last in line for any remaining funds after creditors are paid. In most cases, your shares become worthless.

Alternatives to Business Liquidation

When facing financial difficulties, companies have options beyond liquidation to resolve their issues. These alternatives aim to help businesses recover or restructure while avoiding complete closure.

Company Voluntary Arrangements (CVAs)

A CVA is a legally binding agreement between a company and its creditors. It allows the business to continue operating whilst repaying debts over an extended period, typically 3-5 years.

To initiate a CVA, you’ll need to appoint an insolvency practitioner. They’ll assess your company’s finances and propose a repayment plan to creditors. If 75% of creditors (by value) approve, the CVA becomes binding on all unsecured creditors.

CVAs offer flexibility in repayment terms and can help you retain control of your business. However, they require careful management and adherence to agreed terms to succeed.

Administration as a Rescue Mechanism

Administration is a formal insolvency process designed to protect your company from creditor actions whilst a rescue plan is formulated. An administrator, who must be a licensed insolvency practitioner, takes control of the business.

The administrator’s primary goal is to rescue the company as a going concern. They may:

- Restructure operations

- Sell profitable parts of the business

- Negotiate with creditors

Administration can provide breathing space to turn your business around. It also allows for a potential pre-pack sale, where assets are sold to a new company, often preserving jobs and value.

Informal Creditor Agreements

Informal agreements with creditors can be a straightforward alternative to formal insolvency processes. These involve negotiating directly with your creditors to adjust payment terms or amounts.

You might propose:

- Extended payment periods

- Reduced regular payments

- Debt write-offs

Informal agreements can be quicker and less costly than formal processes. They also allow you to maintain control of your business. However, they require creditors’ voluntary cooperation and don’t provide legal protection from creditor actions.

Success depends on clear communication and presenting a viable plan for repayment. It’s crucial to be transparent about your financial situation and future prospects.

How Anderson Brookes Can Assist

Anderson Brookes offers specialised support for businesses considering liquidation. Their team of experts provides guidance through the complex process, tailored solutions, and a free initial consultation to assess your situation.

Expert Advice on Liquidation Processes

Anderson Brookes’ team comprises professionals from diverse backgrounds, ensuring comprehensive advice on liquidation. We guide you through each step, explaining the legal requirements and financial implications.

Our experts help you understand the different types of liquidation, such as voluntary and compulsory – assisting in preparing necessary documentation and communicating with creditors.

Anderson Brookes also advises on potential alternatives to liquidation, ensuring you make an informed decision about your business’s future.

Tailored Solutions for Struggling Businesses

Every business faces unique challenges, and Anderson Brookes recognises this. We analyse your specific situation to develop a bespoke liquidation strategy.

Our advisers consider factors such as:

Your company’s financial position

- Creditor relationships

- Employee considerations

- Asset valuation and disposal

This personalised approach helps maximise returns for creditors whilst minimising stress for you as a business owner.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

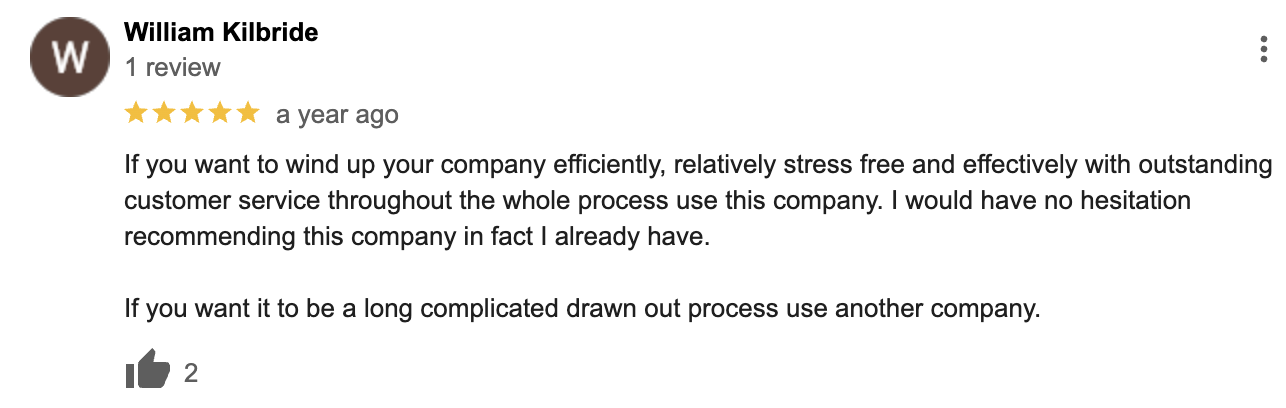

Business Liquidation Google Reviews

&

Frequently Asked Questions

Business liquidation involves complex processes and consequences. The following questions address key aspects of liquidation that companies and stakeholders often inquire about.

What is entailed in the business liquidation process?

Liquidation begins with a decision to wind up the company. For voluntary liquidations, directors hold a board meeting and shareholders pass a resolution. A licensed insolvency practitioner is appointed as liquidator.

The liquidator takes control of company assets and affairs. They sell assets, settle debts where possible, and distribute remaining funds to creditors. The process typically takes 8-14 days to initiate but can last months to fully complete.

How does liquidation affect a company’s directors?

Directors’ powers cease once liquidation begins. They must cooperate with the liquidator and provide company records and information. Directors may face scrutiny of their pre-insolvency conduct.

If wrongful trading is proven, directors could be held personally liable for company debts. Disqualification from acting as a director for up to 15 years is possible in cases of unfit conduct.

Can you outline the primary reasons a company may opt for liquidation?

Insolvency is the main driver of liquidation. A company may be unable to pay debts as they fall due or have liabilities exceeding assets. Declining sales, mounting debts, or loss of major clients can trigger insolvency.

Some companies choose liquidation to close a solvent business and extract value. This can happen when owners wish to retire or pursue other ventures.

What are the implications for employees during a company’s liquidation?

Liquidation usually results in job losses. Employees become creditors for unpaid wages and redundancy pay. They may claim these from the National Insurance Fund up to statutory limits.

The liquidator must inform employees about the liquidation and their rights. They assist with paperwork for government claims and provide information on job seeking support.

What constitutes a voluntary liquidation and why might a company choose this route?

Voluntary liquidation occurs when shareholders decide to wind up the company. It can be a Creditors’ Voluntary Liquidation (CVL) for insolvent firms or a Members’ Voluntary Liquidation (MVL) for solvent ones.

Companies may choose CVL to address insolvency proactively, avoiding compulsory liquidation. MVL allows solvent companies to close efficiently and distribute assets to shareholders tax-effectively.

Is there a cost-effective method for initiating company liquidation?

Liquidation fees vary based on complexity and assets. For insolvent companies, costs are often covered by asset sales. Directors may need to contribute if assets are insufficient.

To minimise costs, gather all financial information before appointing a liquidator. Consider negotiating a fixed fee and compare quotes from several insolvency practitioners.