Business Liquidation Fees: Essential Costs for Company Closure in 2025

Overview of Business Liquidation

Business liquidation transforms company assets into cash through a structured legal process, with specific procedures and financial implications that vary based on the company’s circumstances and chosen liquidation path.

Definition and Purpose of Liquidation

Liquidation represents the formal end of a limited company’s life. The process involves converting all business assets into cash to settle outstanding debts and distribute any remaining funds to shareholders.

A licensed insolvenc

y practitioner manages the entire procedure, ensuring compliance with UK law and proper asset distribution. Your company’s operations cease during liquidation, and employees are typically made redundant.

The primary aims include:

- Selling company assets

- Settling creditor claims

- Removing the company from Companies House register

- Investigating director conduct

- Distributing remaining funds to shareholders (if applicable)

Types of Liquidation

Three main types of liquidation exist in the UK:

Creditors’ Voluntary Liquidation (CVL)

- Directors choose to close an insolvent company

- Most common form of liquidation

- Requires creditor approval

Members’ Voluntary Liquidation (MVL)

- Used for solvent companies

- Directors must sign a declaration of solvency

- Tax-efficient method for closing profitable businesses

Compulsory Liquidation

- Court-ordered closure

- Often initiated by creditors

- Occurs when companies fail to pay debts exceeding £750

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

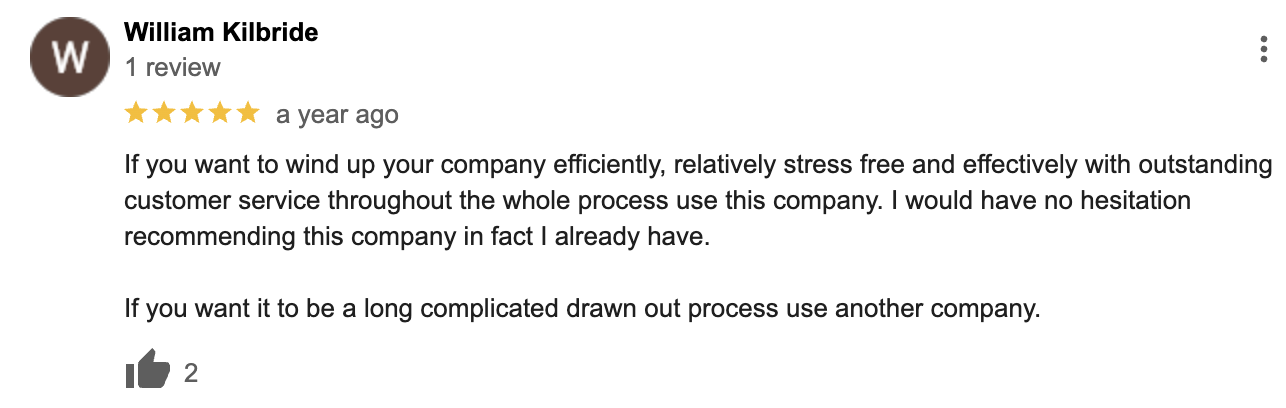

Google Reviews

What Are the Business Liquidation Fees?

1. Getting Started Fee (Statement of Affairs)

This covers the paperwork and meetings to put your company into liquidation:

- Preparing documents

- Telling creditors

- Holding meetings

Cost: £3,000 to £8,000 (depends on how complex your situation is)

You pay from company money, or personally if there’s none left.

2. Ongoing Work Fee (Liquidator’s Fee)

This covers everything after the first meeting. Good news: you only pay if we recover money from assets. No assets = no fee (but we still do the work). You may also be interested in CVL Costs.

How We Keep Business Liquidation Fees Low

We keep business liquidation fees affordable by:

- Only working with limited companies needing to close

- Keeping our business simple (no fancy offices or complex structures)

- Understanding SMEs because we are one

- Being efficient despite being one of the UK’s biggest in this sector

When closing your business is hard enough, we make sure business liquidation fees aren’t a extra headache. We give you professional help at a fair price.

Legal Framework for Liquidation Fees

The legal system establishes clear guidelines for liquidation fees through statutory regulations and oversight from governing bodies that protect creditors’ interests whilst ensuring fair compensation for liquidators.

Statutory Provisions

Liquidators’ fees in the UK operate under the Insolvency Act 1986 and the Insolvency Rules 2016. These laws establish three primary methods for setting fees:

- Time and rate basis

- Percentage of assets realised

- Fixed fee arrangement

The creditors must approve the chosen fee basis. Your rights as a creditor include requesting detailed fee breakdowns and challenging excessive charges through court proceedings.

A liquidation committee of 3-5 members can be appointed to monitor fees and expenses. This committee serves as a crucial check on the liquidator’s financial decisions.

Governing Bodies and Authorities

The Insolvency Service acts as the primary regulatory body overseeing liquidator conduct and fee arrangements. Licensed insolvency practitioners must follow strict professional guidelines.

Key regulatory requirements include:

- Regular reporting of time and expenses

- Transparent fee approval processes

- Documentation of all financial decisions

Courts maintain ultimate authority over fee disputes. You can apply to the court for a detailed assessment of costs if you believe the fees are unreasonable.

The recognised professional bodies (RPBs) monitor their members’ compliance with fee regulations and ethical standards.

Determining Liquidation Fees

Liquidation fees depend heavily on the size and complexity of your company, with costs varying based on asset values and the amount of work required from insolvency practitioners. Professional fees typically range from £4,000 to £15,000 for standard cases.

Assessment of Company Assets

Your company’s assets directly impact liquidation costs. The insolvency practitioner must evaluate all physical assets, accounts receivable, and intellectual property.

The larger your asset base, the more time-intensive the liquidation process becomes. A small company with minimal assets might require 30-40 hours of practitioner time, whilst complex cases can exceed 100 hours.

Property holdings and equipment require professional valuations, adding to the base costs. Stock assessments and debt recovery efforts also influence the final fee structure.

Fee Structures and Calculations

Your liquidation costs consist of fixed and variable components. The base fee covers essential administrative tasks, regulatory compliance, and basic creditor communications.

Time-based fees apply for complex asset disposals, negotiations with creditors, and legal proceedings. Practitioners typically charge £150-£350 per hour based on seniority and expertise.

Asset realisations may affect costs through percentage-based fees, commonly ranging from 5% to 15% of recovered values.

You might need to pay upfront fees, though many practitioners can recover their costs from company assets during the process.

Components of Liquidation Fees

Liquidation fees consist of essential charges required to wind down a business properly, with the primary costs going towards professional expertise, administrative requirements and necessary disbursements.

Professional Service Charges

The insolvency practitioner’s fees form the largest portion of liquidation costs. These charges reflect their expertise and time spent managing the process.

Your liquidator typically charges either an hourly rate or a fixed fee based on the complexity of your case. Rates vary between £150 to £500 per hour depending on seniority and location.

The practitioner’s responsibilities include:

- Valuing and selling company assets

- Dealing with creditor claims

- Managing employee redundancies

- Investigating company affairs

Administrative Costs

Standard administrative expenses cover the essential paperwork and legal requirements of the liquidation process.

These costs include:

- Legal notices in The Gazette

- Company filing fees

- Document preparation

- Statutory reporting requirements

You’ll need to budget for regular administrative activities throughout the process, which can span several months or longer depending on your company’s complexity.

Additional Disbursements

Direct expenses occur throughout the liquidation process and must be paid to third parties.

Common disbursements include:

- Asset valuation fees

- Locksmith charges for securing premises

- Storage costs for company records

- Insurance during the liquidation period

- Professional indemnity insurance

These costs vary significantly based on your business size and circumstances. Most disbursements are paid from company assets before distributions to creditors.

The Role of the Liquidator

A liquidator takes control of a company’s assets and manages the entire liquidation process whilst ensuring creditors receive fair treatment in accordance with legal requirements.

Appointment and Responsibilities

The liquidator becomes the primary authority over your company’s affairs immediately upon appointment. As an authorised insolvency practitioner or official receiver, they gain full control of business operations and assets.

Your company’s assets fall under the liquidator’s management. They assess, value, and sell these assets to generate funds for creditor payments.

The liquidator examines your company’s financial records and investigates any potential misconduct. They communicate with creditors, handle claims, and distribute available funds according to legal priorities.

They must maintain detailed records of all transactions and decisions throughout the process.

Remuneration Factors

The liquidator’s fees typically receive priority payment from the realised assets. For official receivers, Parliament sets a fixed rate of 15% of assets realised.

Your liquidator must provide a clear estimate of expected fees and expenses before beginning the process. Their remuneration depends on several factors:

- Time spent on case management

- Complexity of the liquidation

- Value of assets handled

- Skills required for specific tasks

The fees require approval from creditors or the court, ensuring transparency in the payment structure.

Liquidation Process and Timeline

Company liquidation involves a structured sequence of legal procedures to wind up business operations and distribute assets. The process typically spans 6-12 months, though complex cases may take longer. However, we can place a business into liquidation within 8 days – often for directors this can significantly help with many of the pressures they are facing.

Initial Steps and Meetings

A licensed insolvency practitioner must be appointed to manage the liquidation process. They will review your company’s financial records and assets.

You’ll need to organise a shareholders’ meeting to pass a winding-up resolution. This requires 75% shareholder approval.

The insolvency practitioner will notify all creditors of the liquidation and place a notice in The Gazette.

Your company must cease trading immediately unless the liquidator authorises specific activities to help maximise asset values.

Asset Realisation and Distribution

The liquidator will catalogue and value all company assets. This includes property, equipment, stock, and outstanding debts.

Assets are sold through various methods:

- Public auctions

- Private sales

- Online marketplaces

- Direct negotiations with interested buyers

Funds from asset sales are distributed according to a strict priority order:

- Secured creditors

- Preferential creditors (employees)

- Unsecured creditors

- Shareholders

The liquidator provides regular progress reports to creditors throughout the asset distribution phase.

Voluntary Liquidation – Insolvency Advisory Process – Quick Example

Tax Considerations in Liquidation

Tax obligations continue through the liquidation process, and it’s critical to address both your immediate tax liabilities and potential relief options to maximise financial outcomes.

Tax Liabilities

You must file a final Corporation Tax return and settle any outstanding liabilities before completing the liquidation process. The company needs to deregister for VAT and PAYE schemes.

A distribution of assets exceeding £25,000 requires formal liquidation procedures, with associated tax implications on the distributed amounts.

Any profits generated during the wind-down period remain subject to standard Corporation Tax rates.

Tax Relief and Exemptions

Business Asset Disposal Relief can reduce your Capital Gains Tax rate to 10% on qualifying assets, with a lifetime limit applying to the total gains.

The tax-free dividend allowance remains available during the liquidation year, helping to minimise the tax impact on final distributions.

Capital allowances may be claimed on eligible business assets, with an individual allowance of £12,300 per tax year.

Professional guidance is essential to structure your liquidation in the most tax-efficient manner, as the timing of asset disposals can significantly impact your tax position.

Frequently Asked Questions

Business liquidation involves specific costs, timeframes, and legal obligations that company directors must understand before proceeding with dissolving their organisation.

What is the typical cost associated with liquidating a company in the UK?

The base cost for liquidating an insolvent company typically starts from £1,800 plus VAT in the UK – but as noted above £3k to £8k is a good guide. This fee includes basic expenses and administrative costs.

Prices can vary significantly based on the complexity of the case and the liquidator chosen.

How is the cost for liquidating a business calculated?

Liquidators assess company size, asset value, and outstanding liabilities to determine fees.

The final cost includes initial assessment fees, asset valuation charges, and administrative expenses for managing creditor communications.

Professional fees are deducted from the company’s assets before any distributions are made.

Who is responsible for covering the costs of business liquidation?

The company’s assets primarily fund the liquidation process.

If company assets are insufficient, directors might need to personally contribute to the liquidation costs.

What are the legal responsibilities of a director during the liquidation process?

Directors must provide all company records and financial information to the liquidator.

You must cease trading immediately upon entering liquidation and surrender control to the appointed liquidator.

Your powers as a director end when liquidation begins, and you must cooperate fully with investigations into company affairs.

How long is the process expected to take from initiation to completion of business liquidation?

The initial process of placing a company into liquidation takes 8 to 14 days.

The complete liquidation process duration varies depending on asset complexity and creditor claims.

What are the main differences between voluntary and compulsory liquidation?

Voluntary liquidation begins with a director or shareholder decision, offering more control over the process and choice of liquidator.

Compulsory liquidation occurs through court order, typically initiated by creditors, with less control over the process.

The costs tend to be higher for compulsory liquidation due to court fees and additional legal requirements.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).