If your bank has had your business overdraft withdrawn, it can feel sudden and final. Payments bounce. Cash dries up. Pressure rises. What can your business do now?

The good news is that you still have options. The key is to act quickly, stay calm, and follow a clear plan. We’ll explain why banks take this step, what it means for your company, and the practical actions to take today. If closure is the right route, Anderson Brookes can guide you through a compliant and orderly process as licensed insolvency practitioners.

Why Banks Withdraw Business Overdrafts

When your bank withdraws overdraft facilities from your business, it can feel sudden and confusing. Most overdrafts are repayable on demand under standard terms and conditions, but that rarely explains why your bank has taken such drastic action now. Below, we outline the most common reasons this happens and what it means in practice.

Common Reasons

- Covenant or terms breaches. Missed interest or fees, or failure to refresh accounts and management information.

- Persistent account stress. Bounced payments, excesses over the limit, or unpaid charges signal higher risk.

- Adverse trading. Falling turnover, shrinking margins, or late debtor collections that point to cash flow strain.

- Expired or non-renewed facility. Many overdrafts are reviewed annually and may not be renewed on the same terms.

- Security concerns. Weakening asset cover or issues around a personal guarantee.

- Sector or macro risk reviews. Lenders adjust exposure when outlooks change, even if your own position seems stable.

Wider Backdrop

Recent surveys show a mixed picture. Credit availability to businesses improved through parts of 2024 and 2025, yet lenders also refined risk appetite and facility sizing. UK Finance reported a rise in new loans and overdrafts approved in 2024, with overdraft approvals surging in Q3, while overall net lending remained negative as many firms repaid pandemic-era debt. The Bank of England’s Credit Conditions Survey also signalled improved availability alongside caution for smaller firms.

What this means in practice: if monitoring flags higher risk or covenants are missed, a bank may reduce the limit, refuse renewal, or demand immediate repayment, even where a facility was used routinely. Ombudsman guidance highlights that fairness and notice expectations vary by product type, but on-demand clauses usually give banks broad discretion.

Sectors We Support

We support company directors in every sector, from construction firms and logistics companies to pubs, cafés, restaurants, hotels, retailers and manufacturers. Our advice is always clear, confidential and shaped by real experience in your industry. Whether you’re dealing with unpaid tax, supplier pressure or falling income, our team understands the challenges and will guide you through the best next steps.

What This Means for Your Company

When a business overdraft withdrawn notice lands, the bank can ask for full repayment immediately. Most overdrafts are repayable on demand. In practice, that can mean the limit is reduced, renewal is refused, or the facility is called in without further lending.

Immediate Effects You May See

- Account set-off. Your bank may use money in the current account to reduce the overdraft. This can happen even if it is not spelled out in the small print. Payments can then bounce and cash flow can stall.

- Supplier and payroll pressure. Returned direct debits strain key relationships and can risk wages not clearing on time.

- Personal exposure. If you signed a personal guarantee, the lender may contact you directly. A debenture over company assets can also allow the lender to appoint an enforcement route.

- Knock-on to staff. If trading cannot continue and liquidation becomes likely, employees may face redundancy and will look to statutory claims for what they are owed. Employees have rights if their employer is insolvent, as explained on the GOV.UK website. We also provide further detail in our guide to the impact of a CVL on employees.

Impact on Cash Flow and Control

- Reduced room to manoeuvre. Working capital shrinks overnight when set-off applies. Short-term priorities shift to wages, essential suppliers, and taxes.

- Higher scrutiny. Recoveries teams often request up-to-date financials. If affordability looks weak, the facility may not be reinstated.

What It Means for You as a Director

Lenders can withdraw or reduce an overdraft in line with on-demand terms. That does not mean you are out of options. It does mean decisions should be made with creditor interests in mind if insolvency risk is present. The Insolvency Service sets out the duties that apply at this point.Practical Actions for the First 24 Hours

Control and clarity are key when your business’s overdraft is withdrawn. The goal is to steady cash, protect stakeholders, and make informed decisions.1. Stabilise cash today

- Freeze non-essential spend. Pause purchases that do not keep trading safe.

- List today’s critical payments. Prioritise wages, key suppliers, utilities, and essential tax.

- Produce a rapid 13-week cash flow. Use simple weekly inflows and outflows. Update it daily.

2. Speak to the bank early

- Call the recoveries or relationship team. Be factual and calm.

- Share a short cash update and any steps you have taken to reduce risk.

- Ask about time to repay, temporary limit support, or a short standstill while you assess options.

3. Protect receipts

- Chase overdue invoices and ask for same-day part payments where possible.

- Consider pro-forma terms for new orders. Do not take work you cannot deliver.

4. Keep trading decisions safe

- If you doubt viability, avoid taking fresh credit you cannot repay.

- Stop any transactions that could prefer one creditor over others.

- Record every key decision. Keep board minutes and copies of forecasts.

5. Look after people

- Confirm if payroll will run. If not, speak to us immediately about options.

- Communicate with staff early and honestly about next steps and timeframes.

6. Manage suppliers and HMRC

- Contact critical suppliers. Agree short payment plans that match cash flow.

- If taxes are overdue or upcoming, explore a Time to Pay arrangement with HMRC.

Prepare documents

- Gather the latest management accounts, aged debtors and creditors, bank statements, VAT and PAYE schedules, payroll, and key contracts.

- Having clean, current information speeds up bank discussions and any formal process.

8. Open lines to advice

- Speak to us for a same-day review. We will assess viability, outline safe trading steps, and, if needed, start a compliant closure process.

Your Legal Duties

When cash is tight and an overdraft is withdrawn, you must check if the company is insolvent on a cash flow or balance sheet basis. If insolvency is likely, your focus shifts to protecting creditors. The Companies Act duty to promote the success of the company is qualified in these circumstances, so creditor interests need to be considered first.What to Do

- Act to minimise losses to creditors. Only take steps that are in creditors’ best interests. Keep decisions under review and record board minutes.

- Avoid wrongful trading. Do not continue trading if there is no reasonable prospect of avoiding insolvent liquidation. Take all reasonable steps to limit creditor loss.

- Do not prefer one creditor over others. Avoid repayments or security that put a chosen creditor in a better position before liquidation.

- Keep records up to date. Maintain accurate cash flow forecasts, management accounts, and a decision log. If the company later enters liquidation, the office-holder will review director conduct over the period leading up to insolvency.

Simple Tests to Keep in Mind

- Cash flow test: Can the company pay debts as they fall due?

- Balance sheet test: Are liabilities, including contingent ones, greater than the value of assets?

Free Confidential Advice & Quote

Short-Term Options to Stabilise

Your business might have had its overdraft withdrawn, but this doesn’t have to lead to closure. There are practical routes to buy time and protect value. The right path depends on cash flow, creditor support, and viability.

1. Negotiate with the Bank

Start with facts. Share a short cash update, steps taken to cut costs, and realistic timings for receipts. Ask for a repayment plan, temporary limit support, or a standstill while you complete a viability review. Confirm everything in writing.

2. Reshape Working Capital

Tighten terms with customers. Shorten payment periods. Consider pro-forma for new orders. Offer small early-payment discounts if margins allow. Release surplus or slow-moving stock. Pause non-essential projects.

3. Explore Alternative Finance

If the core business is viable, test options such as invoice finance, asset-based lending, or a short-term loan. Avoid facilities that rely on assumptions you cannot evidence. Compare cost, security, covenants, and speed to draw.

4. Reduce the Cash Burn

Cut discretionary spend. Renegotiate key supplier terms. Defer non-critical capex. Review staffing levels against current demand. Model each action in a simple rolling 13-week forecast.

5. Controlled Wind-Down

If the numbers do not support rescue, move quickly to an orderly closure to protect creditors. We will explain options, including voluntary liquidation, and guide you through a compliant process.

Questions? Speak to our experts today on 0800 1804 935.

Creditors' Voluntary Liquidation: How the Process Can Work

Need confidential advice about closing your company? Contact us today.

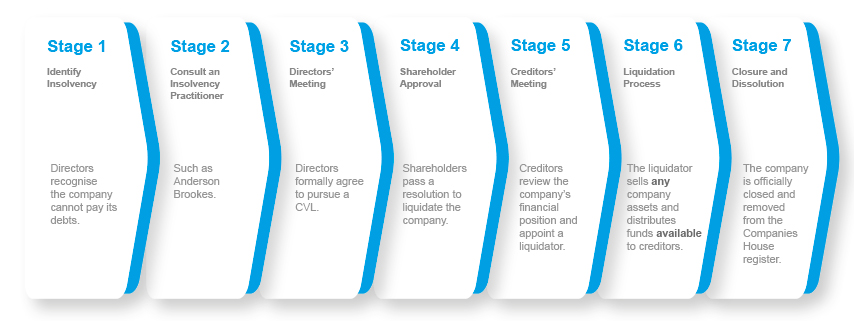

When Closure Is Right: How a CVL Works

If rescue is not realistic, a Creditors’ Voluntary Liquidation provides a controlled, compliant closure. It brings creditor pressure to an end, stops further losses, and allows assets to be realised for creditors in the correct order. As licensed insolvency practitioners, we manage the process, protect records, and communicate with stakeholders from start to finish.

What a CVL Involves

- Directors decide the company cannot continue to trade safely.

- We prepare the statement of affairs, board minutes, and creditor notices.

- Shareholders pass a resolution to wind up. Creditors then confirm the appointment of a liquidator.

- The liquidator realises assets, agrees claims, investigates antecedent transactions where required, and distributes funds to creditors.

You can expect clear milestones from first advice to liquidation appointment. We explain the timeline of a CVL so you know what happens and when.

Costs and Practicalities

CVL costs depend on complexity, asset values, creditor numbers, and the work required by the liquidator. We set out likely fees transparently, including fixed and variable elements, and discuss funding options at the outset. We can provide detail on typical fee structures when you get in touch.

Common Misconceptions

Several CVL myths stop directors acting early. You do not automatically face a ban, you are not barred from being a director in future, and personal assets are not at risk unless there are guarantees or misconduct.

What Happens After Appointment

Trading stops unless specifically authorised to complete existing work. Employees are made redundant and can usually claim owed amounts from the government scheme. Creditors deal with the liquidator rather than contacting you. We guide you on handover, records, and your statutory duties, then keep you updated on progress.

Help from Anderson Brookes

Speed matters. We respond the same day, help you stabilise, and prepare the documents needed for a lawful wind-down. Our team handles creditor communication, statutory filings, and asset realisations with care and transparency. You get calm, practical advice and a clear plan.

Decision Guide: CVL or Keep Trading?

Use this simple check to decide your next step. Be honest with the numbers and document each decision.

Is there a realistic path to cash positivity?

- Can you pay debts as they fall due within weeks, not months?

- Do you have confirmed orders with acceptable margins and short payment terms?

- If yes, consider a short repayment plan with the bank and tighter working capital. If no, move to the next test.

Do creditors support a rescue?

- Are key suppliers willing to keep trading on sensible terms?

- Is HMRC open to a Time to Pay that your forecast can actually meet?

- Weak support points towards managed closure.

Can funding fill the gap safely?

- Would alternative finance reduce risk rather than increase it?

- Are covenants, fees, and security acceptable against conservative forecasts?

- If funding relies on hopeful assumptions, do not proceed.

Are director duties protected?

- If there’s no reasonable prospect of avoiding insolvent liquidation, trading on risks wrongful trading.

- Protect creditors first and record decisions.

Choose the right route

If the tests above do not stack up, a Creditors’ Voluntary Liquidation provides an orderly wind-down. Where creditor action is already advanced or a winding-up petition is likely, compare a CVL or compulsory liquidation and act before control is lost.

Closing a Limited Company with Debts?

Fast and Stress-Free Solutions.

Start closing your limited company today. Placed into liquidation within 8 days. We fully understand that timing is critical.

Worried about your Bounce Back Loan?

Need to close your limited company? Speak to an expert who’s helped thousands do the same – even with company debts or creditor pressure.

Stop Creditor Pressure

Getting constant calls from creditors? Closing your company through liquidation can give you the relief to move forward.

Directors: Avoid Risks When Winding Up Your Company

We guide you, simply, honestly. Let us handle everything.

How Anderson Brookes Can Help

Our team is experienced in helping businesses to deal with financial difficulties and navigate the company closure process confidently. We move quickly, keep things simple, and take the weight off your shoulders.

What You Can Expect From Us

- Free consultation: A calm call to understand your position and map the safest next steps.

- Clear options: We set out rescue and closure routes in plain English, with likely timelines and outcomes.

- Bank and creditor liaison: We handle difficult calls, request time where viable, and keep communication professional.

- Robust forecasting: A practical 13-week cash flow so you can make decisions with confidence.

- Compliance first: We protect records, guide board minutes, and help you meet your duties to creditors.

- If closure is right: We prepare the documents, manage the CVL process, and support you through to completion.

Why Choose Anderson Brookes?

- Licensed insolvency practitioners. Regulated, experienced, and focused on doing things properly.

- Speed and care. Fast response with a supportive, human approach.

- Transparent costs. No surprises. We agree fees and explain how they work.

- Practical results. We aim to stabilise cash, reduce stress, and close matters cleanly where needed.

Talk to Us Today

If your overdraft has been called in, do not wait. A short conversation can change the direction of the next few weeks. Call us now on 0800 1804 935 for confidential, regulated advice.

FAQs

Can a bank withdraw a business overdraft without notice?

Often, yes. Most business overdrafts are repayable on demand, and facility letters usually state this clearly. Ombudsman decisions confirm banks can call in an overdraft where terms allow, although they must still act fairly.

What if I’ve signed a personal guarantee for the overdraft?

If the company cannot repay, the lender may demand payment from the guarantor. Enforcement can follow if no acceptable proposal is made, so take advice early and keep written records of discussions.

Can I pay staff or HMRC first to keep things going?

Be careful. Selective payments can be challenged as a “preference” if insolvency is likely. Employees who lose their jobs in an insolvency can usually claim certain amounts from the government scheme. Get advice before making any targeted payments.

Will I be disqualified as a director after a CVL?

Not automatically. The liquidator files a conduct report, and the Insolvency Service decides whether to investigate. Disqualification happens only where misconduct is proven.

How quickly can a CVL start, and how long does it take?

Timing depends on your records, creditor position, and logistics. The appointment can be arranged quickly with a licensed insolvency practitioner, while the full process can take several months.

For more on typical concerns, see our common questions about CVLs.

Next Steps: Confidential Advice Today

If your business overdraft withdrawn notice has arrived, you do not have to face it alone. Take stock, protect cash, and speak to a licensed professional.

We will review your position the same day, explain your options in plain English, and set out a safe plan. If rescue is viable, we help you negotiate time and stabilise cash. If closure is right, we handle the process carefully and compliantly.

Call us now on 0800 1804 935, email advice@andersonbrookes.co.uk or get in touch via our contact page. We will come back with clear next steps and timelines. It is confidential, practical, and focused on reducing stress fast.