What to Do When You Can’t Pay Your Tax Bill: Immediate Steps

Don’t Ignore the Problem

The worst approach when you can’t pay tax is ignoring HMRC communications. HMRC is relentless in their pursuit of tax debts and has significant enforcement powers at their disposal. Failing to meet your obligations will initially result in financial penalties that increase the amount you owe, along with interest charges that begin accruing from the moment your payment is late.

The situation can quickly escalate to HMRC sending bailiffs or enforcement officers to your business premises to identify goods for seizure. Further action may include distraint, statutory demands, or even winding-up petitions for debts as small as £750.

Unlike most consumer debts which become statute-barred after a certain period, HMRC has the power to pursue tax debts indefinitely. This means tax arrears will not simply “go away” if ignored, making early intervention essential.## Prevention Strategies for Future Tax Compliance

Avoiding future tax payment difficulties requires proactive financial management. Consider establishing a dedicated tax account where you set aside funds for tax liabilities as income is received, particularly for VAT and PAYE. Implementing monthly financial reviews helps identify potential issues before they become critical, while quarterly tax planning sessions with your accountant can prevent unexpected liabilities.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

Many successful businesses maintain an emergency cash reserve specifically to handle tax obligations during difficult trading periods. This approach, combined with realistic financial forecasting, provides the foundation for sustainable tax compliance even when business conditions become challenging.

With Anderson Brookes’ support and the implementation of robust financial practices, your company can overcome current tax difficulties and establish a stronger foundation for future success. Contact our team today to take the first step toward resolving your HMRC debt issues.### Time to Pay Arrangements

A Time to Pay arrangement often provides the most practical solution when you can’t pay tax. This approach allows your limited company to pay HMRC debt in affordable instalments, giving you breathing space while demonstrating your commitment to meeting your obligations.

Anderson Brookes has significant experience in negotiating Time to Pay arrangements with HMRC. Although HMRC typically limits these arrangements to 12 months, our team of Licensed Insolvency Practitioners can prepare formal proposals that may lead to more accommodating terms. Our experience shows that HMRC are generally open to discussing reasonable offers of repayment when proposals are presented professionally and comprehensively.

To set up a successful payment plan, you’ll need your tax reference number, UK bank account details for Direct Debit authorisation, information about any missed payments, and comprehensive details of your company’s income and expenditure. HMRC is unlikely to agree to an arrangement if you’ve previously broken payment terms, cannot demonstrate sustainable repayment capability, or haven’t submitted all required tax returns.

When applying for a Time to Pay arrangement, HMRC will want to see evidence of your commitment to resolving the situation. This includes implementing cost-cutting measures, securing alternative finance to improve cash flow, plans for non-essential asset disposal, and restructuring initiatives. You’ll also need to provide detailed cash flow forecasts and a clear business plan showing how you’ll manage both the tax debt and ongoing obligations.# Limited Company Tax Debt: What to Do When You Can’t Pay HMRC

As a limited company director in England and Wales, facing HMRC debt can be overwhelming. Whether you can’t pay VAT, corporation tax, PAYE, or other tax obligations, understanding your options is crucial for your business’s survival. Anderson Brookes Insolvency Practitioners can help you navigate this challenging situation with expert advice and practical solutions.

Understanding Corporation Tax for Limited Companies

Corporation Tax is a corporate tax imposed on the profits of limited companies trading and registered in the UK. All company directors must register their business for corporation tax with HMRC within three months of starting to trade, though dormant companies are exempt until they begin trading.

The current Corporation Tax landscape in 2025 features a Small Profits Rate of 19% for companies with profits under £50,000, while the Main Rate stands at 25% for companies with profits exceeding £250,000. Companies falling between these thresholds benefit from a marginal relief system, providing a gradual increase from the lower to the higher rate.

For most companies, Corporation Tax is due nine months and one day following the accounting period end date. If your company’s accounting period ends on 31st March, your payment would be due by 1st January the following year. Companies with profits below £1.5m typically make a single annual payment, while those with higher profits usually pay in quarterly instalments.

Recognising the Warning Signs of HMRC Debt

Cash flow problems can quickly escalate into serious tax debt issues. You might notice warning signs such as repeatedly missing tax payment deadlines or using VAT or PAYE funds to cover other business expenses. Perhaps you’ve started receiving payment reminders or warning letters from HMRC, or you find yourself avoiding opening HMRC correspondence altogether. Many companies are also finding it increasingly difficult to pay Corporation Tax due to rising costs, particularly with the recent increase in employer National Insurance contributions.

What to Do When You Can’t Pay Your Tax Bill: Immediate Steps

Don’t Ignore the Problem

The worst approach when you can’t pay tax is ignoring HMRC communications. HMRC is relentless in their pursuit of tax debts and has significant enforcement powers at their disposal. Failing to meet your obligations will initially result in financial penalties that increase the amount you owe, along with interest charges that begin accruing from the moment your payment is late.

The situation can quickly escalate to HMRC sending bailiffs or enforcement officers to your business premises to identify goods for seizure. Further action may include distraint, statutory demands, or even winding-up petitions for debts as small as £750.

Unlike most consumer debts which become statute-barred after a certain period, HMRC has the power to pursue tax debts indefinitely. This means tax arrears will not simply “go away” if ignored, making early intervention essential.

Contact HMRC or Seek Expert Help

If you’re unable to pay your tax bill or believe you’ll have to pay it late, communication is key. Anderson Brookes can help you approach HMRC in the most effective way, often achieving better outcomes than if you were to negotiate directly.

For immediate guidance, you can contact HMRC directly through their dedicated helplines for Corporation Tax (0300 200 3840), VAT (0300 200 3831), PAYE (0300 200 3819), or Self Assessment (0300 200 3820). However, for a more strategic approach, we recommend contacting Anderson Brookes on 0800 1804 935. Our team can provide expert advice and represent you in negotiations with HMRC, leveraging our extensive experience to secure more favourable terms.

Prepare Financial Information

Before discussing payment options with HMRC, it’s essential to prepare comprehensive financial information. This should include an accurate assessment of your company’s financial position, detailed cash flow forecasts, and evidence of steps you’re taking to improve your company’s finances. You’ll also need a realistic proposal for payment, information about cost-cutting measures you’ve implemented, and details about any assets that could potentially be sold to reduce the debt.

Anderson Brookes can help you prepare this information in a format that will be taken seriously by HMRC, significantly improving your chances of securing a workable arrangement. Our expertise in presenting cases to HMRC has helped numerous businesses navigate their way through tax difficulties successfully.

Solutions for HMRC Debt: Your Options

Time to Pay Arrangements

A Time to Pay arrangement often provides the most practical solution when you can’t pay tax. This approach allows your limited company to pay HMRC debt in affordable instalments, giving you breathing space while demonstrating your commitment to meeting your obligations.

Anderson Brookes has significant experience in negotiating Time to Pay arrangements with HMRC. Although HMRC typically limits these arrangements to 12 months, our team of Licensed Insolvency Practitioners can prepare formal proposals that may lead to more accommodating terms. Our experience shows that HMRC are generally open to discussing reasonable offers of repayment when proposals are presented professionally and comprehensively.

To set up a successful payment plan, you’ll need your tax reference number, UK bank account details for Direct Debit authorisation, information about any missed payments, and comprehensive details of your company’s income and expenditure. HMRC is unlikely to agree to an arrangement if you’ve previously broken payment terms, cannot demonstrate sustainable repayment capability, or haven’t submitted all required tax returns.

When applying for a Time to Pay arrangement, HMRC will want to see evidence of your commitment to resolving the situation. This includes implementing cost-cutting measures, securing alternative finance to improve cash flow, plans for non-essential asset disposal, and restructuring initiatives. You’ll also need to provide detailed cash flow forecasts and a clear business plan showing how you’ll manage both the tax debt and ongoing obligations.

VAT Specific Approaches

If your company is specifically struggling with VAT payments, you might benefit from considering the Annual Accounting Scheme, which helps with cash flow by allowing one annual VAT return rather than quarterly submissions. Alternatively, the Cash Accounting Scheme enables you to pay VAT only when customers pay you, rather than when you issue invoices, which can significantly help businesses with slow-paying clients.

For online VAT payment plans, HMRC has specific eligibility criteria. Your company must have missed a VAT payment deadline, owe £100,000 or less, be able to clear the debt within 12 months, and have no other outstanding tax debts or payment plans. The debt must also relate to an accounting period that started in 2023 or later. Companies using the Cash Accounting Scheme, Annual Accounting Scheme, or making payments on account typically cannot use the online system and should seek specialist advice instead.

Alternatives When Time to Pay Isn’t an Option

If HMRC isn’t willing to offer a Time to Pay arrangement or your company simply can’t afford to repay the debt within 12 months, Anderson Brookes will discuss alternative options with you. Our team understands the full range of possibilities and can guide you through more formal restructuring solutions when necessary.

Formal Insolvency Options

When your company’s HMRC debt becomes truly unmanageable with no realistic prospect of repayment, Anderson Brookes can guide you through formal insolvency procedures tailored to your circumstances.

A Company Voluntary Arrangement (CVA) provides a structured approach for businesses that remain viable despite current financial difficulties. This legally binding agreement typically allows partial repayment of debts over 3-5 years, giving your company the breathing space needed to recover while protecting it from creditor action. Anderson Brookes can assess whether your business is suitable for a CVA and manage the entire process from proposal to implementation.

For companies needing more significant protection while restructuring, Administration might be appropriate. This process provides a moratorium against creditor action, preventing any ongoing or impending legal proceedings while a strategy is developed. The breathing space created allows for considered decision-making without the immediate pressure of enforcement action.

In situations where the company cannot continue trading, a Creditors’ Voluntary Liquidation (CVL) offers an orderly closure process. This director-initiated procedure for insolvent companies involves liquidating assets and distributing proceeds to creditors according to the statutory order of priority. Anderson Brookes can manage this process sensitively, ensuring you meet your legal obligations while minimising stress during a difficult period.

It’s worth noting that if you don’t proactively address insolvency through voluntary measures, HMRC can force your company into compulsory liquidation for tax debts of just £750 or more. Voluntary processes generally offer directors more control and often result in better outcomes for all stakeholders.

Voluntary Liquidation Process – Quick Example

Consequences of Ignoring HMRC Debt

Failing to engage with HMRC about tax debt triggers a series of increasingly serious enforcement actions. Initially, HMRC will attempt contact through letters, texts, and possibly visits to your home or workplace. If these approaches don’t result in a resolution, their substantial powers come into play.

HMRC may instruct debt collection agencies to pursue the money or use direct recovery powers to collect funds straight from company bank accounts. They can send enforcement agents to take control of company assets for auction, with all associated costs added to your debt. Legal action may follow, potentially resulting in County Court Judgments against your company.

For business taxes, HMRC has the power to issue a winding-up petition, forcing your company into compulsory liquidation. They might also demand security deposits for future tax liabilities or issue Personal Liability Notices that transfer certain tax debts directly to directors. In serious cases, directors face potential disqualification for up to 15 years, severely limiting future business activities.

Before taking such severe steps, HMRC will inform you of their intentions and explain your rights and options. However, once enforcement machinery is in motion, it becomes increasingly difficult to negotiate favourable terms, highlighting the importance of early intervention.

Director Responsibilities and HMRC Debt

As a director of a limited company facing tax difficulties, you have specific legal responsibilities that require careful attention. You must continue filing returns on time even when you can’t pay the associated tax, and you need to ensure your company doesn’t continue trading if it becomes insolvent. The law also requires you to treat all creditors fairly without giving preference to others over HMRC, while maintaining proper accounting records throughout to demonstrate responsible management.

It’s worth remembering that HMRC stands as the most common creditor for UK businesses. Tax debt problems affect many companies, but addressing them promptly is essential to protect both your company and your position as a director. Taking professional advice early can make the difference between business recovery and failure.

How Anderson Brookes Can Help

Anderson Brookes specialises in helping business owners and company directors struggling with HMRC debt. Our team brings decades of experience to your situation, providing comprehensive guidance and practical support when you need it most.

We excel at negotiating Time to Pay arrangements with HMRC, preparing formal repayment proposals that present your case in the most favourable light. Our expertise extends to advising on Company Voluntary Arrangements when longer-term restructuring is needed, and managing Creditors’ Voluntary Liquidation when that becomes the most appropriate option. We also provide expert advice on dealing with bailiffs and County Court Judgments, often finding solutions even when you’ve already attempted to negotiate with HMRC directly.

Many of our clients come to us after trying to resolve HMRC issues themselves. We understand that HMRC is often restricted in the type of agreement they can make directly with business owners. However, once presented with a formal proposal prepared by our Licensed Insolvency Practitioners, they frequently become more accommodating. This professional approach can make the difference between rejection and acceptance of payment proposals.

For immediate assistance with your HMRC debt, you can call us free on 0800 1804 935 or email an advisor at advice@andersonbrookes.co.uk. All initial consultations are provided without obligation, giving you the opportunity to discuss your situation and explore potential solutions in complete confidence.

Prevention Strategies for Future Tax Compliance

Avoiding future tax payment difficulties requires proactive financial management. Consider establishing a dedicated tax account where you set aside funds for tax liabilities as income is received, particularly for VAT and PAYE. Implementing monthly financial reviews helps identify potential issues before they become critical, while quarterly tax planning sessions with your accountant can prevent unexpected liabilities.

Many successful businesses maintain an emergency cash reserve specifically to handle tax obligations during difficult trading periods. This approach, combined with realistic financial forecasting, provides the foundation for sustainable tax compliance even when business conditions become challenging.

With Anderson Brookes’ support and the implementation of robust financial practices, your company can overcome current tax difficulties and establish a stronger foundation for future success. Contact our team today to take the first step toward resolving your HMRC debt issues.

You may also like:

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

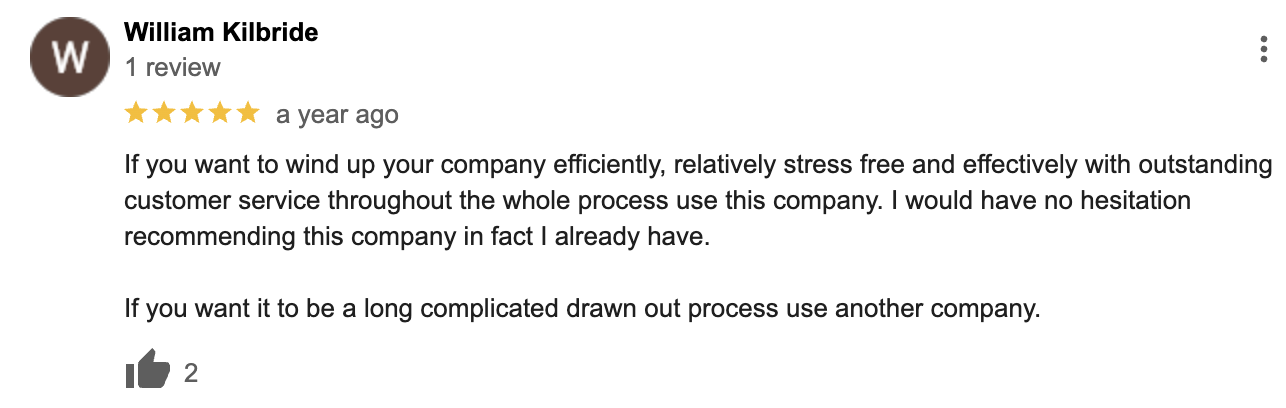

Google Reviews

&