If business rates arrears are piling up and pressure is mounting, you’re not alone. It is still possible to close a company with business rates debt, and there are clear, regulated steps that protect you while bringing the business to an orderly end.

At Anderson Brookes, we are licensed insolvency practitioners who guide you through every stage of a Creditors’ Voluntary Liquidation. Where documents and approvals are ready, we can place a company into liquidation in as little as eight days, helping you stop the spiral and move on with confidence.

Accountants are often the first to spot the early signs of financial distress in their clients. Having the knowledge and confidence to give the right guidance is vital. That is why Anderson Brookes offers free CPD-accredited training designed specifically for accountants.

What Are Business Rates Arrears?

Before we discuss how to close a company with business rates debt, let’s start with an overview of the topic. Business rates are a local tax on most non-domestic properties, based on rateable value and a multiplier set each year. Your council is responsible for billing and collection.

However, sometimes, arrears can build up. Cashflow pressure, seasonal sales, rising costs or a vacant unit can mean a bill goes unpaid. Missed instalments can quickly snowball once reminders, surcharges and recovery costs are added. When this happens, councils can take action.

While each council has its own process, the broad steps are similar: reminder or final notice, court summons for a liability order, and then enforcement agents to collect the debt or take control of goods. Where arrears remain significant, some councils consider winding-up action.

If enforcement agents are appointed, they may visit your trading address to agree payment or a controlled goods agreement. Fees are added at each stage, which increases the total owed. If payments cannot be maintained, goods listed may be removed and sold.

Closing a Limited Company with Debts?

Fast and Stress-Free Solutions.

Start closing your limited company today. Placed into liquidation within 8 days. We fully understand that timing is critical.

Worried about your Bounce Back Loan?

Need to close your limited company? Speak to an expert who’s helped thousands do the same – even with company debts or creditor pressure.

Stop Creditor Pressure

Getting constant calls from creditors? Closing your company through liquidation can give you the relief to move forward.

Directors: Avoid Risks When Winding Up Your Company

We guide you, simply, honestly. Let us handle everything.

Close a Company with Business Rates Debt via CVL

If the company cannot pay its bills as they fall due and there is no realistic rescue plan, a Creditors’ Voluntary Liquidation is usually the right route to close a company with business rates debt in a controlled, compliant way.

CVL is often the best fit because it:

- Brings everything into one process. All unsecured debts, including council business rates, are dealt with inside the liquidation. When planning a CVL, directors often ask what happens to company debts in liquidation and how claims are shared.

- Stops escalation. Once a liquidator is appointed, recovery action pauses and contact with creditors is channelled through us.

- Protects your position. Acting early helps demonstrate you have taken reasonable steps. We guide you on records, asset preservation and communications.

Why Strike-Off Is Rarely Suitable

Applying to strike the company off when there are arrears usually triggers objections from creditors or the council. The company is unlikely to meet the eligibility criteria for strike-off. Enforcement can continue and time is lost without resolving the underlying problems. CVL provides a clear, recognised framework to close properly.

When a Different Option Might Apply

- Company Voluntary Arrangement. If the business is fundamentally viable and creditors are likely to agree terms, an arrangement can restructure debts while trading continues.

- Administration. Used less often for small companies with rates arrears, but it can protect value where a turnaround or business sale is realistic.

If viability has gone, CVL remains the practical route to closure.

How Liquidation Treats Business Rates Debt

Where Council Rates Sit Among Creditors

Unpaid business rates usually sit with other unsecured creditors. In a CVL, unsecured claims are gathered and dealt with together. Distributions follow a statutory order after costs and any secured or preferential claims.

What Happens After Appointing a Liquidator

When a liquidator is appointed, recovery contact is directed to us. The council submits a claim for arrears and any pre-appointment recovery fees. We verify the balance, add it to the schedule of claims, and handle correspondence.

Occupation and Ongoing Liability

If the company is still in occupation before the liquidator takes office, business rates may continue to accrue for that period. As soon as a liquidator is appointed, we review property status, leases and handback options so rates do not build unnecessarily. When premises are vacated and properly documented, future liability for the company stops from the relevant date.

Controlled Goods and Previous Enforcement

Where enforcement agents have visited before liquidation, their fees and any controlled goods agreements are addressed inside the process. Goods that belong to the company are gathered for valuation and sale where appropriate, with proceeds paid into the estate for all creditors.

Realistic Outcomes

Unsecured creditors, including the council, often receive only a partial return, or sometimes no return, depending on asset values and prior claims. The key benefit of CVL is bringing every liability into one framework so closure is orderly and compliant, without ongoing pursuit against the company.

Stopping Pressure from Enforcement Agents

When a liquidator is appointed to close a company with business rates debt, recovery contact is redirected and enforcement activity pauses while claims are handled inside the process. A short options call will clarify timing, creditor contact and what happens to company debts.

Councils may instruct enforcement agents to collect unpaid non-domestic rates. If you have a controlled goods agreement, keep records of any items listed and avoid moving them without advice. If liquidation is appropriate, we coordinate with the council and their agents so assets are dealt with correctly and fairly. For practical guidance on visits, fees and controlled goods, see our overview of bailiffs.

Immediate Steps that Reduce Risk

- Keep recent accounts, invoices and bank statements ready so the position can be verified quickly.

- Note any cash or stock held on site and secure company assets.

- Avoid new credit you are unlikely to repay and keep trading decisions cautious pending advice.

- Arrange an options call promptly. Acting early can prevent avoidable costs and helps protect your position.

Director Responsibilities and Personal Risk

Once you suspect the company cannot pay its debts, your duty shifts to protecting creditors. Keep accurate records, avoid disposing of assets at undervalue, and take regulated advice before making big decisions.

Wrongful Trading

Continuing to trade when there is no reasonable prospect of avoiding insolvent liquidation can be challenged. The test looks at what a reasonable director would have done. Acting promptly, seeking advice, and reducing losses all help show you took sensible steps.

Transactions to Avoid

- Paying some creditors ahead of others without good reason

- Moving assets out of the company for little or no value

- Repaying director loans or connected parties first

These can be reversed by a liquidator if they harm the collective position of creditors.

Personal Guarantees and Joint Liability

If you have signed a personal guarantee, the lender may still pursue you for any shortfall. Guarantees often attach to bank facilities, asset finance and some leases. Gather the paperwork so we can assess exposure and, where possible, agree a sensible approach.

Records that Help Protect You

Keep recent management accounts, aged debtor and creditor lists, bank statements, VAT and PAYE returns, key contracts, lease documents, and details of any guarantees. Good records support fair outcomes and speed up the process.

Compliant Closure with CVL

We set clear expectations around interviews, books and records, and what happens to directors when closing a business with debt.

A quick call with Anderson Brookes lets you pause risky decisions, secure assets, and plan next steps. Where documents and approvals are ready, we can place a company into liquidation in as little as eight days, which helps draw a line under mounting pressure.

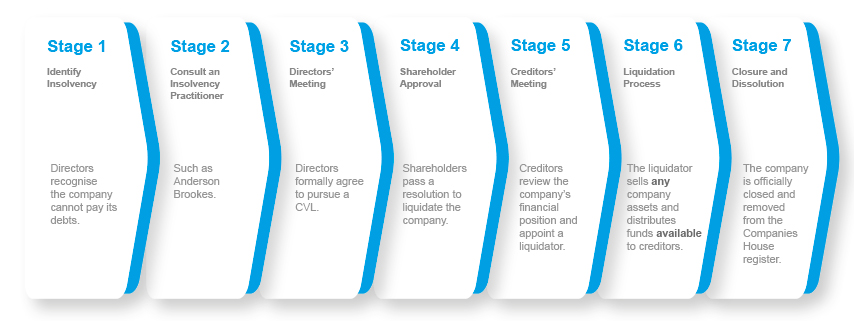

Closing via a CVL: Example Process

Need confidential advice about closing your company? Contact us today.

Step-by-Step CVL Guide: Close a Company with Business Rates Debt

- Free, confidential options call

We review your position, including business rates arrears, other creditors and any enforcement already in motion. You get clear next steps and a plan that fits your circumstances. - Prepare the paperwork

We help you gather recent accounts, bank statements, creditor schedules, lease details and a list of assets. This speeds up the Statement of Affairs and keeps the process smooth. - Board meeting and resolutions

Directors resolve that the company cannot continue and should enter Creditors’ Voluntary Liquidation. Shareholders pass the necessary special resolution to wind up and appoint a liquidator. - Appointment of a licensed insolvency practitioner

On appointment, we take control of the process. Creditor contact is directed to us, claims are invited, and recovery pressure eases while everything is handled within the liquidation. - Trading position and property

If the company is still in occupation, we confirm handback or termination so business rates do not keep building. Stock, equipment and other assets are safeguarded and valued. - Employee, supplier and council communication

We provide clear notices and templates so staff, councils and suppliers understand what is happening, what information is needed and how claims will be dealt with. - Realising assets and agreeing claims

Assets are marketed and realised where appropriate. Funds are distributed according to the statutory order, which explains how unsecured claims such as council business rates are treated. - Reporting and investigations

Directors provide books and records and answer standard questions. We complete the required reports and keep you informed of progress throughout. - Finalisation and dissolution

Once assets are dealt with and claims agreed, we complete final returns. The company is then dissolved and removed from the register.

Costs, Fees and Funding

What Fees Cover

Liquidation fees cover the licensed work needed to close the company properly: taking office as liquidator, communicating with creditors and the council, gathering and valuing assets, statutory reporting, and distributing funds. We scope work at the outset so business liquidation fees stay proportionate to the case.

How Fees Are Paid

Where possible, fees are paid from asset realisations such as stock, equipment, debtor collections or refundable deposits. If asset values are low, a contribution from directors or a third party is sometimes agreed so the process can proceed. Asset values, creditor numbers and records all influence the cost of liquidation for businesses with debt.

Keeping Costs Proportionate

Fixed or capped pricing can be available in straightforward matters so you know the likely cost before you commit.

Other Costs

Insolvency bond and necessary disbursements, valuation and auction costs where assets are sold, registered office and statutory advertising, and property security where premises need securing.

Free Confidential Advice & Quote

What to Do If You Have Business Rates and HMRC Arrears

It is common to see VAT, PAYE or Corporation Tax arrears alongside council rates. CVL brings all unsecured debts into one process so every creditor is treated fairly. If rescue might still be possible, we can also look at practical routes to stabilise cashflow first.

When closure is the right outcome, HMRC and the council submit claims inside the liquidation and contact is routed through us. This keeps conversations consistent and avoids conflicting demands while assets are realised and funds distributed according to the statutory order.

- When a Time to Pay arrangement could help: Cashflow forecasting, creditor priorities and managing HMRC debt can point to a rescue where appropriate.

- Closing with HMRC arrears: Where tax arrears are significant, closing a company with HMRC debts brings PAYE, VAT and Corporation Tax into one process.

- If tax bills cannot be paid right now: Before any formal step, there are practical actions directors can take when they can’t pay tax.

FAQs

Will liquidation write off business rates debt?

Once the company enters liquidation, unpaid business rates become part of the unsecured creditor pool. Any available funds are shared according to the statutory order. If there is no dividend for unsecured creditors, the balance is not paid by the company after dissolution.

Can directors be personally liable for business rates?

Personal liability for business rates is unusual unless there are guarantees or misconduct findings. Keep records, avoid favouring some creditors over others without good reason, and take advice before making large payments or moving assets.

What if enforcement agents have already visited?

Do not move controlled goods without advice. Keep copies of any notices and inventories. If CVL is appropriate, enforcement is addressed inside the process and contact is channelled through us.

Can I keep trading while arranging a CVL?

Only where trading does not risk worsening the position of creditors and you have taken regulated advice. Many companies choose to pause or wind down to avoid new liabilities while the paperwork is prepared.

How long does closure take?

Timeframes vary with complexity, creditor numbers and records. The key milestone is appointment of the liquidator. Acting early and preparing documents promptly keeps the timetable tight.

Support for the Next Step

If you are ready to draw a line under mounting pressure, we will guide you through an orderly Creditors’ Voluntary Liquidation and handle council and HMRC claims within a single, regulated process. You will know what happens, when it happens, and who is dealing with it at each stage.

Start with a confidential options call to Anderson Brookes and we will set out clear steps based on your position. We will handle the paperwork, creditor contact and closure so you can move forward with confidence.