If you’re closing a limited company with VAT debt, the right approach depends on whether the company can still pay its debts as they fall due. If it can’t, closing the company properly matters, because HMRC will be a key creditor and directors have legal duties once insolvency is on the table.

If your limited company has accrued VAT debt and faces insolvency, you must act swiftly and responsibly. Ignoring VAT arrears can lead to severe penalties, enforcement actions by HMRC, and potential personal liability. This comprehensive guide outlines the precise steps and legal obligations directors must follow when closing a limited company with VAT debt.

Anderson Brookes helps directors choose the safest route and take the right steps quickly, whether that is negotiating with HMRC, restructuring, or placing the company into liquidation.

Closing Limited Company with VAT Debt: Quick Answers

Can you close a limited company with VAT debt?

The short answer is yes, but you can’t simply “shut it down” and hope the VAT debt disappears. How you close the company needs to match the company’s financial position:

- If the company is solvent (it can pay its debts), you may be able to close it through a solvent process, including dissolution in some circumstances.

- If the company is insolvent (it cannot pay debts as they fall due, or liabilities exceed assets), you should take advice quickly. In many cases, a Creditors’ Voluntary Liquidation (CVL) is the most appropriate route.

Can you strike off a company with VAT debt?

In practice, trying to strike off a company while it has VAT debt often creates problems. HMRC can object to a strike-off application, and directors can face serious consequences if they try to dissolve a company to avoid paying creditors.

If VAT arrears are a factor, it’s usually better to pause, assess solvency, and choose a route that deals with HMRC properly.

Table of Contents

Understanding the urgency of VAT debt

VAT debt is different from other debts as HMRC classifies it as a preferential debt. This means HMRC receives priority during asset distribution when a company closes. Failing to act quickly can escalate the situation, resulting in aggressive debt recovery actions, including compulsory liquidation or personal liability for company directors.

Need confidential advice about closing your company? Contact us today.

Fast facts for directors: Immediate steps to manage VAT debt

| Action Step | Description | Importance |

|---|---|---|

| Acknowledge insolvency | Recognise the inability to meet VAT debts promptly. | Crucial |

| Cease trading responsibly | Stop incurring additional debt immediately. | High |

| Contact HMRC promptly | Negotiate a Time to Pay (TTP) arrangement. | High |

| Avoid voluntary strike-off | HMRC will object to dissolution attempts. | Essential |

| Initiate CVL | Engage a licensed insolvency practitioner for liquidation. | Essential |

| Understand director responsibilities | Ensure no wrongful trading or misconduct occurs. | Crucial |

Your options if the company has VAT debt

Option 1: Agree a Time to Pay arrangement with HMRC

If the underlying business is viable and the company can meet a realistic repayment plan, a Time to Pay arrangement may be an option. HMRC will normally want a clear explanation of why arrears built up, evidence the company can afford repayments, and up-to-date filings.

This route is often most suitable when:

- VAT arrears are the main issue, rather than multiple overdue creditors

- Cashflow can support a monthly repayment plan

- You can keep ongoing VAT liabilities current

Option 2: Consider a Company Voluntary Arrangement (CVA)

If you can’t pay VAT due to temporary issues, then it may be worth considering a CVA. A CVA can help a company repay debts over time while continuing to trade. It can be appropriate where the business has a solid core, but needs breathing space to catch up. A CVA isn’t right for every case, and it depends on creditor support and a credible proposal.

Option 3: Close the company via Creditors’ Voluntary Liquidation (CVL)

If the company cannot manage HMRC debts, including paying VAT debt, and has no realistic prospect of recovering, a CVL may be the most appropriate and responsible way to close the company. It puts an insolvency practitioner in control of the process, stops directors carrying the burden alone, and ensures creditors are treated fairly.

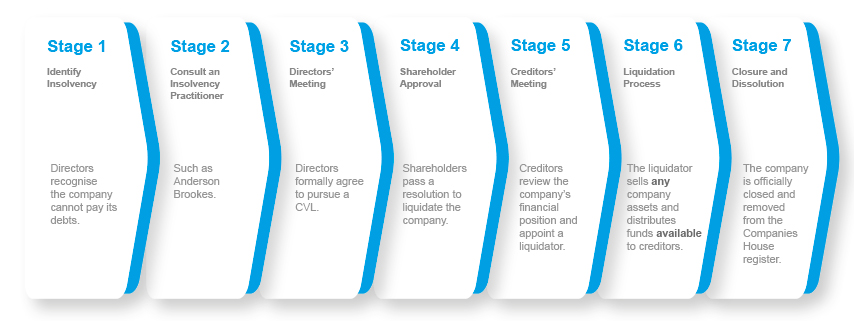

How to close a limited company with VAT debt: step-by-step CVL guide

Step 1: Hold a shareholders’ meeting

Directors call a general meeting. Shareholders pass a resolution stating the company cannot continue due to insolvency. At least 75% of shareholders must agree.

Step 2: Appoint an insolvency practitioner

Select a licensed insolvency practitioner who will manage the liquidation. Their role is essential for asset realisation, creditor communications, and legal compliance.

Step 3: Advertise the resolution

The insolvency practitioner publishes a notice in The Gazette within 15 days, making the liquidation public and notifying creditors formally.

Step 4: Notify Companies House

Send a copy of the resolution to Companies House within 15 days of passing. The insolvency practitioner manages these communications.

Step 5: Asset realisation and debt repayment

The insolvency practitioner liquidates company assets and distributes proceeds. HMRC, as a preferential creditor for VAT debts, receives priority. Remaining debts are written off if assets are insufficient.

Step 6: Final reporting and dissolution

The insolvency practitioner investigates directors’ conduct, ensures all legal obligations are met, and formally applies for company dissolution.

What happens to VAT debt after liquidation?

In a CVL, the company’s assets are gathered and realised (where possible), and the proceeds are distributed to creditors according to legal priority. If there are insufficient assets, creditors may not be repaid in full.

A key point for directors: company VAT debt is usually the company’s liability, not the director’s personally, unless there are specific factors such as personal guarantees, certain director conduct issues, or other legal routes HMRC may consider in limited circumstances.

This is why choosing the correct closure route and taking advice early matters.

Director liabilities and responsibilities

Directors must understand potential personal risks when dealing with VAT debts:

- Wrongful trading: Continuing operations while insolvent can lead to personal liability for debts.

- Personal guarantees: Directors remain personally responsible for debts covered by guarantees even after liquidation.

- HMRC investigations: HMRC may investigate directors for misconduct or deliberate non-payment of VAT.

Ensuring transparent financial management and prompt engagement with insolvency practitioners mitigates these risks significantly.

Can directors claim redundancy?

If you received a salary from your limited company, you might qualify for redundancy payments. These claims can offer financial relief during company closure. An insolvency practitioner can assist you in making a claim to the Redundancy Payments Service.

Timescales and costs

Every case is different, but most directors want clarity on two things: how quickly the pressure reduces, and what the process involves.

Typical timescales

- Initial assessment and advice: often within days

- Preparation of paperwork and information gathering: typically 1–2 weeks (case dependent)

- Liquidator appointment and commencement: once resolutions and notices are in place

- Liquidation administration: can run for months, depending on assets, investigations, and complexity

Costs

Costs depend on complexity, assets, and the level of work required. Anderson Brookes will talk you through likely CVL costs at the start so you can make an informed decision.

Prevent future VAT issues

Avoid repeating VAT debt problems by implementing robust financial controls:

- Regularly review financial positions

- Set aside funds for VAT as part of budgeting

- Maintain proactive cash flow management

FAQs

Can I dissolve a company if I owe VAT?

If the company owes VAT, dissolution is often not straightforward. HMRC can object, and trying to dissolve to avoid VAT can lead to serious issues. If the company is insolvent, a CVL is often the appropriate route.

What if HMRC is already taking enforcement action?

If enforcement action has started, speed matters. Contacting an insolvency practitioner early can help you understand options, whether there is scope for a payment plan, and whether liquidation is the safest route.

Will I be personally liable for the company’s VAT debt?

VAT debt is normally a company liability. Personal exposure can arise in specific circumstances, such as personal guarantees or certain conduct issues. Getting advice early helps you understand your position clearly.

Can I keep trading while I have VAT arrears?

You may be able to keep trading if the company is viable and there is a realistic plan to address arrears and keep future VAT liabilities current. If the company is insolvent, continuing to trade without a plan can increase risk.

Can I strike off the company instead of liquidating it?

If there is VAT debt, strike-off is often challenged by HMRC and can create complications. For directors facing VAT arrears, it is usually better to take advice and choose the correct formal route.

If you’re weighing up dissolution vs liquidation, our guide on how to strike off a company explains the strike-off route and when it may apply.

How long does it take to close a limited company with VAT debt?

Timeframes vary. Some companies can move into liquidation quickly once information is ready, while more complex cases take longer. The fastest path is usually to gather key documents and get early advice.

Professional support from Anderson Brookes

Navigating VAT debt and company closure requires expert support. Anderson Brookes specialises in insolvency procedures, ensuring directors remain compliant and protected. We provide:

- Clear advice on insolvency and VAT debt management

- Negotiation support for Time to Pay arrangements

- Expert handling of the Creditors’ Voluntary Liquidation process

- Assistance with director redundancy claims

If you’re under pressure from HMRC or you are unsure which route is right, Anderson Brookes can help you understand your options and act quickly. We will explain the practical steps, the likely timeline, and what the process means for you as a director.

Contact Anderson Brookes for a free, confidential consultation today.