Closing a Limited Company with a Bounce Back Loan: Expert Guide

Many UK directors are struggling with Bounce Back Loan repayments and considering company closure. If you’re in this position, understanding your options and the proper process for closing a limited company with outstanding BBL debt is crucial to protect yourself from potential personal liability.

Can I Liquidate a Company with a Bounce Back Loan?

Yes, you can liquidate a company with an outstanding Bounce Back Loan. Creditors’ Voluntary Liquidation (CVL) is the proper legal process for closing an insolvent company that cannot repay its debts, including BBLs. This is entirely different from simply dissolving or striking off your company, which isn’t appropriate when debts remain outstanding.

Because Bounce Back Loans are unsecured debts with no personal guarantees, directors are typically not personally liable when the company is properly liquidated through a CVL. The liquidation process provides a clean break and legal closure of the business, ensuring all procedures are correctly followed and creditors are treated fairly according to insolvency legislation.

What Happens to a Bounce Back Loan When You Liquidate?

When your company enters liquidation, your BBL is treated as an unsecured debt within the liquidation process. The appointed Insolvency Practitioner will take control of company assets and sell them to generate funds for creditors. Any proceeds are distributed according to the legal hierarchy, with secured creditors paid first, followed by preferential creditors, and then unsecured creditors, which includes the BBL lender.

In most cases, there won’t be sufficient funds to repay the BBL in full. The remaining unpaid portion is claimed by the lender against the government guarantee that backed these loans. Once the liquidation process completes, the debt is written off and directors have no further liability for the loan, provided there has been no misuse of funds or director misconduct.

Can’t Afford to Pay Back Bounce Back Loan?

If your company cannot repay its BBL, you should first consider whether the business might be viable with some restructuring. The government introduced the Pay As You Grow scheme, which allows you to extend your BBL term from 6 to 10 years, take payment holidays, or make interest-only payments temporarily. These measures might ease immediate cash flow pressures if your business has reasonable prospects for recovery.

For businesses with deeper financial problems but potential viability, a Company Voluntary Arrangement might be appropriate. This formal arrangement allows your company to continue trading while paying creditors an affordable amount over 3-5 years, potentially including your BBL debt at a reduced rate.

However, if your company is truly insolvent with no realistic prospect of recovery and cannot repay its BBL, liquidation through a CVL provides a structured, legal closure process. This is often the most appropriate solution when debt problems extend beyond the BBL to other creditors, including HMRC, suppliers or landlords.

Can I Dissolve a Company with a Bounce Back Loan?

No, you cannot legally dissolve or strike off a company with outstanding BBL debt. Company dissolution is only appropriate for businesses with no debts or liabilities. Attempting to dissolve a company with outstanding BBL debt constitutes a breach of your duties as a director and can have serious consequences.

If you try to strike off your company despite having BBL debt, the lender will almost certainly object to the dissolution. Companies House will then reject your application. Even if the dissolution somehow proceeds, HMRC or other creditors can apply to have the company reinstated at any time in the future, leaving you with ongoing uncertainty and risk.

Furthermore, the Insolvency Service is actively monitoring company dissolutions, particularly where government-backed lending was involved. Directors who inappropriately dissolve companies with BBL debt may face personal liability for that debt, disqualification proceedings, and in some cases, criminal charges for fraud.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

You may also like:

Personal Liability Concerns with Bounce Back Loans

Directors are generally not personally liable for BBLs during a proper liquidation process because these loans did not require personal guarantees and were backed by a 100% government guarantee. However, this protection only applies if you’ve used the funds properly and followed your director duties.

The Insolvency Service actively investigates cases where BBL funds were misused, such as being used for personal expenses rather than legitimate business needs, transferred to other companies or individuals improperly, or used to pay dividends or repay director loans when the company was insolvent.

If you continued trading while knowing the company was insolvent, worsening creditors’ positions (wrongful trading), or provided false information when applying for the BBL, you could face personal liability despite the government guarantee. In such cases, directors could be ordered to contribute personally to the company’s debts, face disqualification for up to 15 years, and in serious cases, criminal prosecution.

Voluntary Liquidation Process – Quick Example

How to Properly Close a Company with BBL Debt

The correct process for closing a company with BBL debt begins with seeking professional advice from a licensed Insolvency Practitioner. They’ll review your company’s financial position and help determine if liquidation is truly necessary or if rescue options might be viable.

If liquidation is the appropriate path, you’ll need to prepare comprehensive financial documentation, including BBL paperwork and records showing how the funds were used. The liquidator is formally appointed through a shareholders’ resolution, after which they take control of the company and its assets.

Throughout the liquidation, you must cooperate fully with the liquidator’s investigation into the company’s affairs and help them realise company assets. The liquidator will handle communications with all creditors, including the BBL lender, and distribute any available funds according to the statutory order of priority.

Once the liquidation process completes, which typically takes 9-12 months, you’ll receive confirmation that your duties as a director have been discharged, and the company will be formally dissolved. At Anderson Brookes we can place a company into liquidation within 8 days! While not fully complete it often offers the solution company directors are looking for.

How Anderson Brookes Can Help

At Anderson Brookes, we specialise in helping directors navigate the complex process of closing companies with Bounce Back Loan debt. Our experienced Insolvency Practitioners provide a full BBL closure assessment to identify the right solution for your specific situation.

We handle all aspects of the CVL process, from initial documentation to creditor communications and final dissolution. Our team provides tailored guidance to minimise personal risk during the liquidation process and conducts a thorough BBL compliance review to identify any potential issues before they become problems.

Many directors don’t realise they may be entitled to statutory redundancy payments when their company enters liquidation. Our team can assist with these claims, which can provide valuable financial support during this difficult transition. We also provide comprehensive post-liquidation support to help you rebuild your career after company closure.

Contact Us for Expert BBL Advice

If you’re worried about closing your limited company with an outstanding Bounce Back Loan, contact Anderson Brookes for confidential, expert advice from our team of licensed Insolvency Practitioners.

For a Free Consultation, email advice@andersonbrookes.co.uk or call our freephone number 0800 1804 935 (free from mobiles).

Our experienced team will help you understand your options and guide you through this challenging process with minimal stress and risk. With proper professional guidance, you can ensure your company closure is handled legally and ethically, protecting your future interests and career.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

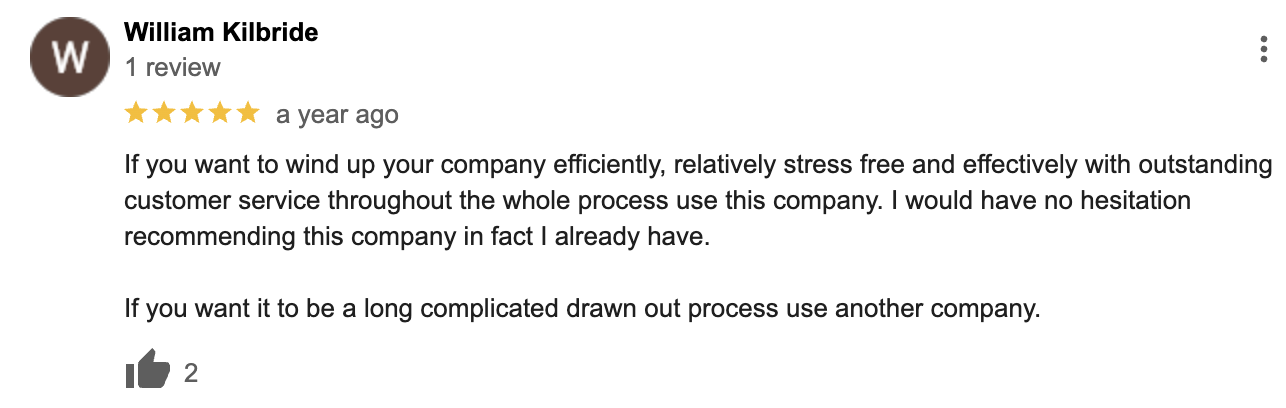

BBL Google Reviews

&