Company in Financial Difficulty? Your Complete Guide to UK Business Debt Solutions

When your company faces financial difficulties, the stress can feel overwhelming. You’re not alone – thousands of UK business owners find themselves in similar situations every year. The key difference between those who recover and those who don’t is understanding your options and acting decisively before the situation spirals out of control.

This comprehensive guide explains every debt solution available to UK limited companies, from negotiating with HMRC to formal insolvency procedures. Whether you’re dealing with cash flow problems, mounting tax debts, or considering closure, understanding your options helps you make informed decisions that protect both your business and personal interests.

The most important thing to remember is that financial difficulties don’t automatically mean business failure. Many companies successfully navigate temporary problems through proper planning and professional guidance. However, ignoring the situation or hoping it resolves itself almost always makes things worse and reduces your available options.

Recognising the Warning Signs of Company Financial Difficulty

Early Warning Indicators

Financial difficulties rarely appear overnight. Most companies show warning signs months before reaching crisis point. Recognising these early indicators gives you time to act before options become limited.

Cash Flow Problems represent the most common early warning sign. If you’re consistently struggling to pay suppliers on time, using overdrafts to cover basic expenses, or delaying HMRC payments to fund operations, your company may be heading towards insolvency.

Increasing Debt Levels that grow faster than revenue indicate structural problems. When debt payments consume increasing portions of your monthly income, or when you’re borrowing to service existing debts, the business model may no longer be sustainable.

Customer Payment Issues can quickly destabilise cash flow. If major customers are paying later than usual, disputing invoices, or reducing orders significantly, this affects your ability to meet ongoing obligations.

HMRC and Tax Debt Escalation

HMRC debt represents a particularly serious form of financial difficulty because of the tax authority’s enhanced powers and preferential status in insolvency. Understanding how HMRC debt escalates helps you recognise when immediate action becomes essential.

VAT Arrears often create the first serious pressure point. Unlike other creditors, HMRC views VAT as money collected on their behalf rather than company funds. Missing VAT payments triggers rapid escalation, with enforcement action possible within 30 days of the due date. If you’re struggling with VAT payments, our comprehensive guide on what to do when you can’t pay your VAT bill provides immediate steps you can take.

PAYE and National Insurance debts carry similar urgency because they represent employee deductions that should have been paid to HMRC. Directors can face personal liability for these debts in certain circumstances, making prompt resolution crucial.

Corporation Tax arrears, whilst slightly less urgent than VAT and PAYE, still require immediate attention. HMRC’s enhanced creditor status since 2020 means corporation tax debts rank above many other creditors in insolvency proceedings. For comprehensive strategies on managing all types of tax debt, see our complete guide to HMRC debt management.

The Danger of Continuing to Trade While Insolvent

Once your company becomes technically insolvent – unable to pay debts as they fall due – continuing to trade creates significant risks for directors. Understanding these risks helps you make informed decisions about when to seek professional help.

Wrongful Trading occurs when directors continue operating an insolvent company without reasonable prospect of avoiding liquidation. This can result in personal liability for debts incurred during the wrongful trading period.

Personal Guarantees become particularly dangerous when companies are insolvent. Directors often provide personal guarantees for business loans, leases, or supplier agreements. Continuing to trade while insolvent can increase personal exposure under these guarantees.

Fraudulent Trading represents the most serious risk, occurring when business is conducted with intent to defraud creditors. While rare, accusations of fraudulent trading can result in unlimited personal liability and criminal prosecution.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

Understanding Your Debt Solution Options

When your company faces financial difficulties, multiple solutions exist depending on your specific circumstances. The key is choosing the right approach based on your company’s viability, debt levels, and future prospects.

Quick Comparison: Your Main Options

| Solution | Best For | Timeline | Cost | Outcome |

|---|---|---|---|---|

| HMRC Time to Pay | Tax debt only, viable business | 2-4 weeks | Free | Spread payments over 6-12 months |

| Informal Arrangements | Temporary cash flow issues | 1-2 weeks | Minimal | Negotiated payment terms |

| Company Voluntary Arrangement | Viable business, unsustainable debt | 8-12 weeks | £8,000-£15,000 | Reduced debt payments over 3-5 years |

| Administration | Business rescue possible | 4-8 weeks | £15,000-£40,000 | Restructure or sale as going concern |

| Creditors’ Voluntary Liquidation | Company cannot continue | 8 days to start | £4,000-£12,000 | Orderly company closure |

| Members’ Voluntary Liquidation | Solvent company closure | 4-6 weeks | £3,000-£8,000 | Tax-efficient extraction of value |

Informal Arrangements and Negotiations

Before considering formal procedures, several informal options may resolve temporary financial difficulties. These approaches work best when problems are recent and the business remains fundamentally viable.

Direct Creditor Negotiations can provide breathing space without formal procedures. Many suppliers and lenders prefer negotiated settlements to the uncertainty and costs of formal insolvency. Successful negotiations require honest communication about your situation and realistic proposals for payment.

Standstill Agreements temporarily freeze debt collection activities while you develop a recovery plan. These agreements typically last 3-6 months and provide protection from legal action whilst you implement operational changes or seek additional funding.

Informal Payment Plans with major creditors can provide structured debt repayment without formal procedures. Unlike statutory arrangements, these rely on goodwill and can be withdrawn if circumstances change. However, they’re often quicker and less expensive to arrange.

Time to Pay Arrangements with HMRC

For companies primarily struggling with tax debts, Time to Pay (TTP) arrangements offer structured repayment options that avoid enforcement action whilst maintaining trading operations.

Eligibility Requirements for TTP arrangements include being up to date with tax filings, having a viable business plan for recovery, and demonstrating ability to maintain current tax obligations alongside historical debt repayment.

Application Process varies by tax type. VAT debts under £100,000 can often be arranged online, whilst larger debts or PAYE arrears typically require telephone applications with detailed financial information.

Success Factors for TTP arrangements include realistic repayment proposals (typically 75% of monthly disposable income), demonstrated commitment to compliance, and clear evidence that financial difficulties are temporary rather than structural.

Company Voluntary Arrangements (CVA)

A Company Voluntary Arrangement provides formal protection from creditors whilst implementing a structured debt repayment plan over 3-5 years. CVAs work particularly well for companies with viable operations but unsustainable debt levels.

How CVAs Work involves proposing reduced payments to creditors over an extended period. If 75% of creditors by value approve the proposal, it becomes binding on all unsecured creditors. Directors retain control of the company throughout the arrangement.

Typical CVA Terms include monthly payments representing a percentage of available cash flow, often resulting in creditors receiving 25-75% of amounts owed. The arrangement typically lasts 3-5 years, with any remaining debt written off upon successful completion.

CVA Benefits include protection from creditor action, potential debt write-offs, continued trading under director control, and improved creditor relationships through structured repayment. However, CVAs require creditor approval and ongoing compliance with payment terms.

Formal Insolvency Procedures

Administration

Administration provides court protection whilst a licensed insolvency practitioner develops plans to rescue the company or achieve better outcomes for creditors than immediate liquidation.

When Administration Works best for companies with viable core operations but facing temporary difficulties, businesses requiring operational restructuring, or situations where asset sales as a going concern would benefit creditors more than piecemeal liquidation.

The Administration Process begins with appointing a licensed administrator who takes control of company operations. The administrator has 8 weeks to propose a strategy, which might include continuing to trade, selling the business as a going concern, or implementing operational changes.

Administration Outcomes can include successful company rescue, sale to new owners, or structured liquidation that maximises creditor returns. The process provides flexibility to explore multiple options whilst protecting the company from creditor action.

Creditors’ Voluntary Liquidation (CVL)

When a company cannot be rescued, Creditors’ Voluntary Liquidation provides an orderly closure process that demonstrates responsible director action whilst protecting against wrongful trading allegations.

CVL Suitability applies to companies that are insolvent and cannot return to profitability, businesses where directors wish to retire or pursue other opportunities, or situations where liquidation provides the best outcome for all stakeholders. For companies specifically dealing with limited company debt, CVL often represents the most practical solution.

The CVL Process involves directors resolving to wind up the company, appointing a licensed liquidator, and notifying all creditors of the decision. The liquidator then realises company assets and distributes proceeds to creditors according to legal priorities. You can find detailed information about the complete process in our voluntary liquidation guide.

CVL Benefits include protection from wrongful trading allegations, professional management of creditor claims, potential redundancy payments for directors who were also employees, and a clear endpoint that allows directors to move forward with new ventures.

The process typically takes 3-12 months depending on asset complexity, with most straightforward cases completing within 6 months. Costs are usually covered by company assets, though directors may need to fund initial expenses if no assets remain.

Voluntary Liquidation Process – Example

Members’ Voluntary Liquidation (MVL)

For solvent companies that no longer need to trade, Members’ Voluntary Liquidation provides tax-efficient closure whilst extracting remaining value for shareholders.

MVL Requirements include the company being able to pay all debts within 12 months, directors making a statutory declaration of solvency, and shareholders resolving to wind up the company.

Tax Advantages of MVL include potential capital gains treatment for distributions rather than income tax, entrepreneurs’ relief reducing capital gains tax to 10%, and efficient extraction of company value for shareholders.

MVL Process involves directors’ solvency declaration, shareholder resolution, liquidator appointment, and asset realisation. The process typically costs £3,000-£8,000 but can save significant tax for profitable companies with substantial reserves.

Dealing with Specific Debt Types

HMRC Debt Management

HMRC represents one of the most challenging creditors for financially distressed companies due to their enhanced powers and preferential status. Understanding how to manage different types of tax debt is crucial for company survival.

VAT Debt Strategies require immediate attention because VAT is considered money collected on HMRC’s behalf. Contact the VAT helpline before payment deadlines with realistic proposals. Consider VAT schemes like cash accounting or annual accounting to improve cash flow management.

PAYE and National Insurance debts carry particular urgency because they represent employee deductions. Directors can face personal liability for these debts, making prompt resolution essential. HMRC typically expects these debts to be prioritised over other obligations.

Corporation Tax Arrangements often receive more flexible treatment than VAT or PAYE, but still require proactive management. HMRC may accept longer payment terms for corporation tax whilst maintaining stricter requirements for VAT and PAYE compliance.

Bounce Back Loan Complications

Many companies struggling with financial difficulties also have outstanding Bounce Back Loans (BBL) from the pandemic period. Understanding how these debts affect insolvency options is crucial for proper planning.

BBL in Liquidation typically results in the debt being written off if the loan was used for legitimate business purposes. However, misuse of BBL funds can result in personal director liability and potential criminal prosecution. Our Bounce Back Loan liquidation checklist provides a practical step-by-step guide for directors facing this situation.

Evidence Requirements for BBL compliance include maintaining records of how funds were used, ensuring all expenditure was for business purposes, and demonstrating that the loan supported genuine business operations rather than personal benefit.

Director Protection from BBL liability requires proper documentation of fund usage, evidence that the company was viable when the loan was taken, and demonstration that directors acted responsibly throughout the process.

When Strike-Off Is NOT an Option

Many directors mistakenly believe they can simply dissolve a company with debts by filing a DS01 form with Companies House. This approach creates significant personal risk and is not legally permissible for companies with outstanding obligations.

Strike-Off Requirements include the company having no debts, not having traded for at least 3 months, and being up to date with all filings. Companies with HMRC debts, outstanding supplier invoices, or other liabilities cannot use this route. Our detailed guide on how to strike off a company in the UK explains the complete eligibility criteria.

Creditor Objections are almost certain when companies with debts attempt dissolution. HMRC actively monitors the dissolution gazette and will object to any strike-off involving outstanding tax liabilities. This can result in the company being restored to the register, often with additional penalties and costs.

Director Risks from attempting inappropriate strike-offs include personal liability for company debts, director disqualification proceedings, and potential criminal prosecution for attempting to avoid creditor obligations. For companies with debts, formal insolvency procedures provide proper legal protection.

Supplier and Trade Creditor Management

Trade creditors often represent the largest proportion of company debts and require careful management during financial difficulties. Understanding creditor priorities and negotiation strategies can preserve important business relationships.

Communication Strategies with suppliers should be proactive and honest about difficulties whilst proposing realistic solutions. Many suppliers prefer negotiated arrangements to the uncertainty of formal insolvency procedures.

Priority Creditor Identification helps focus efforts on relationships most critical to business continuity. Key suppliers, major customers, and strategic partners may warrant special attention to preserve future trading relationships.

Negotiation Tactics include proposing partial payments, extended terms, or alternative arrangements like asset guarantees. Success often depends on demonstrating commitment to resolution and providing realistic timescales for improvement.

When to Seek Professional Help

Early Intervention Benefits

Professional advice during the early stages of financial difficulty provides more options and typically results in better outcomes for all stakeholders. Understanding when to seek help can make the difference between recovery and failure.

Cost Savings from early intervention can be substantial. Professional advisors contacted within 30 days of identifying serious problems typically achieve outcomes costing 20-40% less than delayed intervention. This occurs because more assets remain available and fire-sale scenarios are avoided.

Option Preservation depends on timing. Many debt solutions become unavailable once enforcement action begins or assets deteriorate. Early professional involvement preserves maximum flexibility in choosing appropriate solutions.

Director Protection improves significantly with early professional advice. Insolvency practitioners can advise on wrongful trading risks, help document responsible decision-making, and provide protection from personal liability allegations.

Choosing the Right Professional Support

Different types of financial difficulty require different professional expertise. Understanding which professionals can help with specific problems ensures you get appropriate advice without unnecessary costs.

Licensed Insolvency Practitioners handle formal procedures like CVL, administration, and CVA. They must hold appropriate licences and insurance, providing creditor confidence and legal compliance. Choose practitioners with experience in your business sector and transparent fee structures.

Specialist Tax Advisors help with complex HMRC negotiations and tax planning. For companies with substantial tax debts or technical tax issues, specialist advice can identify opportunities for legitimate reductions and optimal negotiation strategies.

Business Turnaround Specialists focus on operational improvements and recovery planning. These professionals help identify underlying problems and implement changes that address root causes rather than just symptoms.

Red Flags Requiring Immediate Professional Help

Certain situations require immediate professional intervention to prevent serious deterioration or protect director interests. Recognising these red flags helps ensure timely action when stakes are highest.

HMRC Enforcement Notices including winding-up petition threats, asset seizure warnings, or personal liability assessments require immediate professional response. Delayed action often eliminates options and increases personal risk.

Creditor Legal Action such as statutory demands, county court judgments, or bailiff visits indicates escalating pressure that requires professional management. Self-representation in legal proceedings rarely succeeds and often worsens situations.

Director Disqualification Risks arise when companies continue trading whilst insolvent or when director conduct falls below required standards. Professional advice helps document appropriate decision-making and provides protection from disqualification proceedings.

The Role of Licensed Insolvency Practitioners

What Insolvency Practitioners Do

Licensed insolvency practitioners provide specialist expertise in managing financially distressed companies and implementing formal debt solutions. Understanding their role helps you work effectively with these professionals.

Initial Assessment involves reviewing company finances, creditor positions, and director circumstances to identify appropriate options. Practitioners can quickly assess whether companies are viable candidates for rescue procedures or require closure.

Procedure Implementation includes handling all legal requirements, creditor communications, and regulatory compliance. Practitioners manage complex administrative requirements whilst directors focus on business operations or personal planning.

Asset Realisation involves identifying, securing, and selling company assets to maximise creditor returns. Professional management often achieves significantly better prices than desperate sales by distressed directors.

Regulatory Protection and Standards

All UK insolvency practitioners must meet strict regulatory requirements that provide protection for companies and creditors using their services.

Licensing Requirements include professional qualifications, practical experience, and ongoing education. Practitioners must hold licences from recognised professional bodies and maintain professional indemnity insurance.

Regulatory Oversight involves regular monitoring visits, complaints procedures, and disciplinary processes. Professional bodies can impose sanctions ranging from additional training requirements to licence revocation for poor performance.

Fee Regulation** requires practitioners to justify charges and obtain appropriate approvals. Recent regulatory changes have strengthened creditor rights to challenge excessive fees and demand detailed justification of costs. Understanding typical fee structures helps you budget appropriately – our guide to insolvency practitioner fees in the UK provides comprehensive information about what to expect.

Working Effectively with Your Practitioner

Successful outcomes from formal procedures depend heavily on effective collaboration between directors and insolvency practitioners. Understanding how to work productively with these professionals improves results for everyone involved.

Information Provision should be comprehensive and accurate from the outset. Organised financial records, complete creditor details, and honest assessment of company circumstances enable practitioners to provide better advice and achieve superior outcomes.

Ongoing Communication helps practitioners understand business operations and identify optimal strategies. Regular updates on trading performance, creditor negotiations, and operational changes help practitioners adapt strategies as circumstances evolve.

Realistic Expectations about timescales, costs, and likely outcomes help avoid disappointment and conflict. Practitioners should provide clear explanations of process requirements and realistic assessments of possible results.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

How Anderson Brookes Can Help Your Company

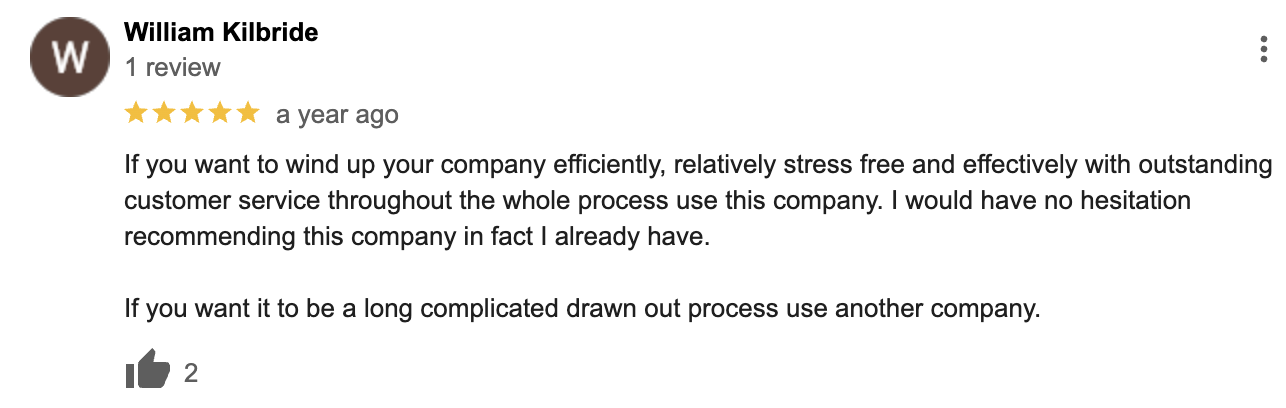

At Anderson Brookes, we understand that facing company financial difficulties is one of the most stressful experiences any business owner can endure. With over 20 years of experience helping companies navigate financial crises, we provide practical solutions that protect both your business interests and personal position. You can learn more about our comprehensive approach at Anderson Brookes debt solutions.

Our Comprehensive Approach to Company Debt Solutions

Free Initial Consultation – We begin every relationship with a detailed assessment of your company’s financial position at no cost. During this consultation, we review your debts, assets, and trading position to identify all available options. You’ll receive clear, honest advice about the most appropriate solutions for your specific circumstances.

HMRC Debt Specialists – Our team has extensive experience negotiating with HMRC on behalf of companies facing tax debt pressures. We can help arrange Time to Pay agreements, negotiate payment terms, and ensure you understand your obligations and options. Our successful track record with HMRC negotiations often achieves better outcomes than companies can secure independently.

Formal Insolvency Procedures – As licensed insolvency practitioners, we can implement all formal debt solutions including CVL, administration, and CVA procedures. Our expertise ensures these processes are handled efficiently and cost-effectively, with transparent fee structures that provide certainty during difficult periods.

Director Protection – We understand the personal pressures facing company directors during financial difficulties. Our advice includes guidance on director duties, wrongful trading risks, and personal liability protection. We help document appropriate decision-making and ensure you understand your legal position throughout any procedure.

Specialist Expertise in Complex Situations

Bounce Back Loan Guidance – Many companies we help are dealing with outstanding Bounce Back Loans alongside other debts. We provide specialist advice on how BBL affects your options and ensure you understand the compliance requirements that protect you from personal liability.

Multi-Creditor Negotiations – When your company faces pressure from multiple creditors, coordinated professional management often achieves better outcomes than individual negotiations. We can manage creditor communications and develop comprehensive solutions that address all stakeholder interests.

Sector-Specific Knowledge – Our team has extensive experience across multiple business sectors, understanding the unique challenges facing retail, construction, manufacturing, and service businesses. This sector knowledge helps us identify appropriate solutions and realistic timescales for your specific industry.

Transparent Costs and Clear Communication

Fixed Fee Options – For many procedures, we offer fixed fee arrangements that provide cost certainty during uncertain times. Our fees are clearly explained upfront, with no hidden charges or unexpected costs.

Regular Updates – Throughout any procedure, we provide regular updates on progress, costs, and expected timescales. You’ll always understand what’s happening with your case and what to expect next.

Plain English Advice – We explain complex legal and financial concepts in straightforward terms that help you make informed decisions. Our goal is ensuring you understand your options and feel confident about the path forward.

Fast Response When Time Is Critical

Rapid Intervention – When companies face immediate threats like winding-up petitions or bailiff action, we can respond quickly to protect your position. Our experience with urgent situations often prevents serious escalation and preserves more options.

8-Day Liquidation Process – When CVL is the appropriate solution, we can place companies into liquidation within 8 days of instruction. This rapid process helps stop creditor pressure whilst ensuring all legal requirements are properly met.

24/7 Availability – Financial crises don’t respect business hours. When you need urgent advice, our team is available to provide guidance and support when you need it most.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

Your Next Steps

If your company is facing financial difficulties, don’t wait for the situation to deteriorate further. Early professional advice consistently achieves better outcomes and preserves more options for directors and creditors alike.

Contact us today for your free consultation:

- Phone: 0800 1804 935 (free from mobiles)

- Email: advice@andersonbrookes.co.uk

During your initial consultation, we’ll:

- Assess your company’s financial position comprehensively

- Explain all available options in clear, practical terms

- Provide realistic timescales and cost estimates

- Answer all your questions about process and outcomes

- Help you understand your personal position and protection

Remember, seeking professional advice doesn’t commit you to any particular course of action. It simply ensures you understand your options and can make informed decisions about your company’s future with confidence.

Why Choose Anderson Brookes?

? Licensed Insolvency Practitioners – Fully qualified and regulated professionals ? 20+ Years Experience – Extensive track record helping companies in financial difficulty

? Free Initial Consultation – No cost assessment of your situation

? Transparent Fees – Clear pricing with fixed fee options available

? Fast Response – Urgent cases handled within 24 hours

? Comprehensive Solutions – All debt solutions available under one roof

? Director Protection – Specialist advice on personal liability and risks

? Proven Results – Thousands of successful cases across all business sectors

Don’t let financial difficulties spiral out of control. Professional help is available, costs less than most people expect, and can make the difference between recovery and failure. Contact Anderson Brookes today to discuss your options and take the first step towards resolving your company’s financial challenges.

The sooner you act, the more options remain available. Call 0800 1804 935 now for your free, confidential consultation.