Free Advice from a Licensed Insolvency Practitioner

Anderson Brookes Insolvency Practitioners help directors close limited companies with debt quickly, legally and with expert guidance every step of the way.

Speak to us today

Get Advice from the Experts

When you’re facing financial difficulties, obtaining early and accurate advice from a Licensed Insolvency Practitioner (IP) can make a significant difference. At Anderson Brookes, our fully qualified IPs provide free, confidential initial consultations, ensuring you clearly understand your options and next steps without immediate financial commitment.

Why Seek Free Advice Early?

Financial distress is daunting, and many directors delay seeking help due to uncertainty or fear. However, early advice offers the best chance of resolving issues positively. A Licensed Insolvency Practitioner can:

Assess your financial situation accurately.

Provide clear explanations of potential risks and liabilities.

Outline realistic and practical solutions to manage or resolve debts.

Prevent escalating legal actions or creditor pressure.

Benefits of Free Insolvency Advice

Choosing Anderson Brookes for your initial consultation ensures:

| Benefit | Explanation |

| Professional Expertise | Advice directly from licensed and regulated insolvency specialists with extensive industry experience. |

| Confidentiality | Complete discretion and confidentiality from your first contact, allowing you to discuss sensitive financial matters openly. |

| No Immediate Cost | Initial advice is genuinely free, enabling you to make informed decisions without additional financial pressure. |

| Clarity and Confidence | Gain a clear understanding of your options, helping you feel confident and prepared to take necessary steps. |

What Happens During Your Free Consultation?

Your initial consultation with a Licensed Insolvency Practitioner involves:

| Step | What Happens |

|---|---|

| 1. Financial Review | Your IP will review your company’s financial position confidentially, including debts, assets, and cash flow concerns. |

| 2. Discussing Options | Based on your circumstances, the IP will explain viable options such as liquidation, CVA, administration, or informal arrangements. |

| 3. Addressing Personal Risks | The IP will clarify any potential personal liabilities, such as personal guarantees or director loan accounts, ensuring you fully understand your position. |

| 4. Clear Recommendations | You will receive honest, professional advice outlining recommended next steps and potential outcomes clearly and transparently. |

Why Directors Choose Anderson Brookes

With more than 25 years’ experience and thousands of directors helped, we’re trusted by business owners across the UK. You can speak directly with an expert insolvency practitioner and we’ll help you understand your options clearly and quickly. We specialise in working with small and medium businesses and we understand your perspective and priorities.

Ready to

Move On?

If you’re ready to close your company, stop creditor pressure, or just want to understand your next steps, we’re here to talk.

Call us now on 0800 1804 935 or request a call back - we’re here to help.

Testimonials

Our clients praise our professionalism, reliability, and the exceptional support we provide during challenging times, helping thousands of company directors through insolvency, liquidation, and business debt solutions.

Arrange Your Free Consultation Today

At Anderson Brookes, we understand how challenging financial distress can be. Our Licensed Insolvency Practitioners offer compassionate, clear, and professional guidance, helping you find a practical route forward.

For immediate, free, and confidential support:

Email: advice@andersonbrookes.co.uk

Phone: 0800 1804 935 (freephone)

Take the first step today – let our expertise guide you safely through the insolvency process, providing peace of mind and a clear way forward.

Common Questions During Free Advice Sessions

Here are typical questions directors ask during free initial consultations:

What insolvency procedures are available for my company?

Can my business be rescued, or is liquidation inevitable?

Am I personally liable for my company’s debts?

What happens to my employees during insolvency?

What are the timescales involved, and what should I do next?

- How much does a liquidation cost and what are my options?

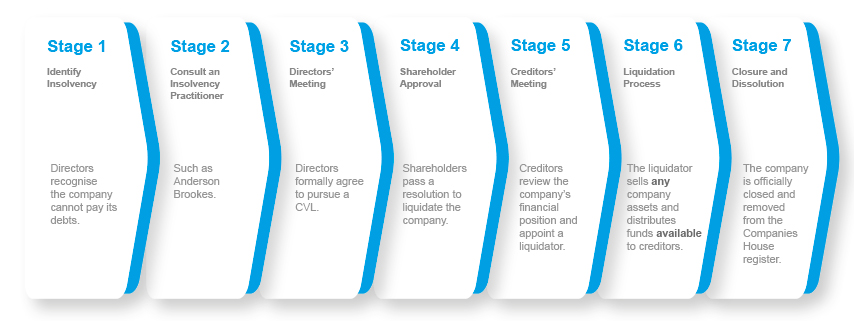

Questions are often on the CVL Process – timescales and simply how it all works. Below is a quick example of the process – Anderson Brookes can place a company into liquidation within 8 days!

Who Will You Speak With? Our Advisors

Our Team

At Anderson Brookes, our experienced and approachable team works closely with company directors across the UK to provide practical, straightforward insolvency advice and support.

Neil Batty

Managing Director

Rikki Burton

Licensed Insolvency Practitioner

Jasmine Baxter

Licensed Insolvency Practitioner

Rebecca Marden

Operations Manager

Mike Halliday

Senior Business Advisor

Ashley Jones

Insolvency Advice Manager

Frequently Asked Questions (FAQs)

Can I speak directly to an Insolvency Practitioner during my consultation?

Yes. All our consultations are directly with experienced Licensed Insolvency Practitioners who can provide immediate and accurate advice.

Is the free consultation genuinely without obligation?

Absolutely. Our free initial consultation places you under no obligation to proceed with any service.

How quickly can I arrange my free consultation?

Usually within 24 hours. We prioritise swift responses to ensure you receive prompt assistance when you need it most.

Will my creditors know if I seek advice from an Insolvency Practitioner?

No. Your consultation is completely confidential and your creditors will not be informed unless you choose to proceed with a formal insolvency procedure.