If you’re reading this, chances are you – or someone you know – is facing a tough situation. Maybe the business is struggling to pay suppliers. Maybe HMRC is knocking. Or maybe cash flow has dried up completely, and you’re unsure what happens next.

Whatever the reason, you’re not alone, and you’re certainly not the first to go through this. As someone who’s worked with countless directors over the years, We’ve put together this straightforward guide to help you understand business insolvency UK guidance in plain English. No jargon. No scare tactics. Just honest, helpful advice.

So, what exactly is business insolvency?

Let’s start with the basics. A business becomes insolvent when it can’t pay its bills when they’re due, or when its debts outweigh its assets.

We usually look at two key tests:

- The cash flow test – are you able to pay bills as they fall due?

- The balance sheet test – do your liabilities exceed your assets?

If the answer to either is no, then you’re likely trading while insolvent; and that comes with legal responsibilities. But don’t panic. Insolvency doesn’t automatically mean closure. It just means you need to tread carefully and explore your options.

Read our Complete Guide to UK Business Debt Solutions

Spotting the early signs of trouble

Over the years, I’ve noticed that many directors already know something’s wrong before they seek help. It might be a gut feeling, or a creeping sense of unease.

Here are a few common red flags:

- You’re constantly juggling payments to suppliers, staff, or HMRC

- The bank has pulled back on your overdraft or facilities

- You’re relying heavily on director loans or personal credit cards

- Your accountant is raising concerns, or worse, you haven’t spoken to them in months

If that sounds familiar, the sooner you act, the more solutions are usually on the table.

Insolvency vs liquidation: what’s the difference?

Insolvency is the state of financial distress. Liquidation is one of the formal processes that might follow if a business can’t be rescued. But the two aren’t the same. Think of insolvency as the warning light on your dashboard. Liquidation is one potential route; often a last resort, if the car can’t be repaired.

As a director, what are my legal duties?

Once a company becomes insolvent, your responsibilities shift. Your duty is no longer to the shareholders, but to the creditors: the people and organisations your company owes money to.

That means:

- Stopping any trading that could worsen their position

- Not favouring one creditor over another

- Keeping accurate records and seeking advice early

If you ignore this, there’s a risk of wrongful trading, and in extreme cases, you could be held personally liable. But don’t worry – if you’re acting in good faith and getting advice, you’re doing the right thing.

What are my options if my business is insolvent?

There’s no one-size-fits-all approach, and part of our role at Anderson Brookes is helping directors figure out the most practical and responsible path forward. Here are the most common options:

1. Company voluntary arrangement (CVA)

A CVA is like a payment plan for your business. It’s a legally binding agreement with your creditors to repay a portion of your debts over time – usually 3 to 5 years. The good news? You can carry on trading, keep your staff, and buy time to turn things around. But it does require the support of 75% (by debt value) of your creditors, and it has to be overseen by an insolvency practitioner like Anderson Brookes.

2. Administration

If things are more serious, administration might be a better fit. Here, control of the company passes to an administrator, and we assess whether the business can be rescued, sold, or wound down in a way that maximises returns to creditors. While in administration, you’re protected from legal action. It can be a really useful breathing space if there’s a chance of recovery or sale.

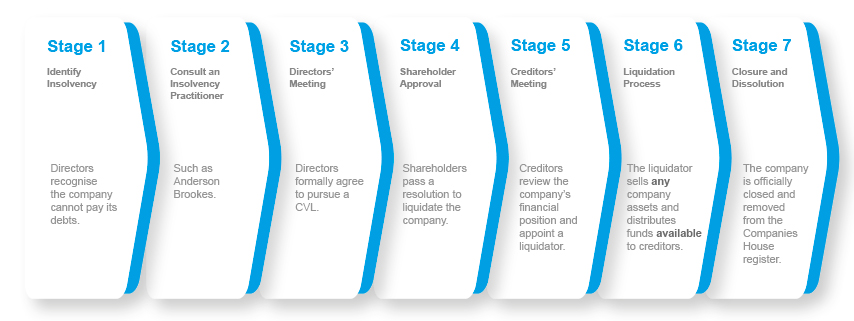

3. Creditors’ voluntary liquidation (CVL)

If your business has reached the end of the road, this is often the most straightforward way to close things down in an orderly fashion. A CVL is a process where you (as directors) acknowledge the business is insolvent and voluntarily place it into liquidation. We sell the assets, deal with creditors, and bring things to a close. It’s also often the cleanest option for directors who want to draw a line and move on.

4. Compulsory liquidation

This is where a creditor (usually someone you owe more than £750) forces the business into liquidation via a court process. It’s stressful, public, and often more damaging to your reputation. Where possible, we always recommend acting before things reach this stage. Voluntary action puts you in control and shows you’re being responsible.

5. Administrative receivership

This one’s rare these days, but you might come across it. It applies when a secured lender appoints a receiver to recover their debt. It’s only possible where a floating charge was granted before 2003, so it doesn’t come up too often now.

Voluntary liquidation example

What happens to me as a director?

This is often the scariest part for people. Most directors we speak to are honest, hardworking, and doing their best in difficult circumstances. During any formal insolvency process, your conduct will be reviewed (usually by the insolvency practitioner). If you’ve kept proper records, taken advice early, and acted in good faith, there’s rarely anything to worry about.

But if you’ve:

- Continued to rack up debts you knew couldn’t be repaid

- Paid off friends or family ahead of other creditors

- Transferred assets out of the business on the cheap

– then you might face consequences. The key is to document everything and ask for help early.

What about my staff?

If you have employees, they’ll be affected differently depending on the route you take:

- In a CVA, most employees stay on as normal

- In administration, we’ll try to protect jobs or transfer them in a sale

- In liquidation, sadly, most roles are terminated

Employees can claim redundancy and other owed payments through the government’s Redundancy Payments Service. There are caps and conditions, but we always help ensure staff get the information they need.

How are creditors paid?

There’s a strict order when it comes to distributing whatever money is recovered:

- Secured creditors (those with charges over assets)

- Preferential creditors (employees’ wages, certain HMRC debts)

- Unsecured creditors (suppliers, landlords, trade creditors)

- Shareholders (only if anything is left)

In practice, unsecured creditors often get little back; but again, a CVA or administration might improve those outcomes.

What does an insolvency practitioner actually do?

Think of us as part problem-solver, part mediator, and part process manager. Our role includes:

- Reviewing your financials and helping you understand your options

- Advising on the best route forward

- Acting as administrator or liquidator if required

- Handling communication with creditors, HMRC, banks, and staff

- Making sure everything is done legally, fairly, and with minimum stress

- We’re not here to judge or shame. Our job is to find the most constructive outcome for everyone involved.

Let’s bust some myths

I’ve heard every myth under the sun when it comes to insolvency. Here are a few I’d love to put to rest:

“I’ve failed.”

Not true. Business is tough. Countless successful people have faced insolvency and come back stronger.

“I’ll lose everything.”

In most cases, your personal assets are safe – unless you’ve signed personal guarantees.

“HMRC won’t agree to a deal.”

They absolutely will if the proposal is fair and realistic.

“It’s too late to do anything.”

It’s almost never too late to find a better way forward.

How to stay out of insolvency in the future

We can’t always avoid downturns, but here are a few habits that make a huge difference:

- Keep your accounts up to date and check your cash flow regularly

- Don’t be afraid to chase payments (early and often)

- Build relationships with your accountant and adviser—don’t hide from them

- Watch out for over-trading when things are going well

- If something doesn’t feel right, get it looked at

Final thoughts – guidance, not judgement

If your business is struggling, please know this: you’re not alone. The UK’s insolvency framework exists to support recovery as much as it does closure. There is business insolvency UK guidance out there—and it can make a world of difference.

If you’re unsure what to do next, don’t wait until a winding-up petition lands on your doorstep. Pick up the phone or drop a line. We’re here to help, not to judge. Whatever your next step looks like: rescue, restructure, or closure – there’s a way to do it responsibly and with dignity. And I promise, there is life after insolvency.