Insolvency Advisor: Expert Guidance for Businesses Facing Financial Difficulty – Navigate Your Company’s Fiscal Challenges

What Is An Insolvency Advisor?

Insolvency advisors provide crucial guidance to businesses facing financial difficulties. They offer expert advice on managing debt, restructuring operations, and navigating insolvency proceedings when necessary.

Defining The Role Of An Insolvency Advisor

An insolvency advisor is a financial professional specialising in helping businesses overcome financial distress. They assess a company’s financial situation, identify areas of concern, and develop strategies to improve cash flow and reduce debt.

These experts analyse financial statements, review contracts, and evaluate business operations to create tailored solutions. They may recommend cost-cutting measures, negotiate with creditors, or explore refinancing options.

Insolvency advisors also guide you through formal insolvency procedures if they become necessary. They explain the pros and cons of different options, such as administration, liquidation, or company voluntary arrangements (CVAs).

Are They Different From Insolvency Practitioners?

While the terms are often used interchangeably, there are some key differences between insolvency advisors and insolvency practitioners (IPs):

- Licensing: IPs must be licensed and regulated, while insolvency advisors may not require specific licences.

- Legal powers: IPs can legally act as business administrators, liquidators, or supervisors in formal insolvency proceedings. Advisors typically cannot take on these roles.

- Scope of work: Insolvency advisors often focus on preventing insolvency and exploring alternatives. IPs are more involved in managing formal insolvency processes.

Both professionals can provide valuable assistance to struggling businesses, but their specific roles and responsibilities may differ depending on your company’s situation.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

When Should You Consult An Insolvency Advisor?

Recognising the right time to seek professional advice is crucial for businesses facing financial challenges. Timely consultation can make the difference between recovery and collapse.

Early Warning Signs of Financial Trouble

Cash flow problems are often the first indicator of potential insolvency. If you’re consistently struggling to pay suppliers or staff on time, it’s a red flag.

Mounting debts and creditor pressure are also key signs. When creditors start demanding immediate payment or threatening legal action, it’s time to act.

Declining sales or profit margins over several quarters can signal deeper issues. If your business is consistently operating at a loss, seek advice promptly.

Maxed-out credit lines or difficulty securing additional financing are serious concerns. These can severely limit your options for managing cash flow.

Understanding Legal Obligations in Insolvency

Directors have a legal duty to act in creditors’ best interests when insolvency becomes apparent. Failing to do so can lead to personal liability.

You must avoid trading whilst insolvent. This means not incurring new debts when you have reasonable grounds to believe they can’t be repaid.

Seeking professional advice early can help protect you from accusations of wrongful trading. It demonstrates you’re taking responsible action.

Be aware of preferences – payments that unfairly benefit certain creditors over others. These can be challenged and potentially reversed in insolvency proceedings.

Avoiding Common Mistakes During Financial Distress

Don’t ignore the problem or hope it will resolve itself. Delaying action often worsens the situation and limits your options.

Avoid using personal funds to prop up the business without proper advice. This can blur the lines between personal and business liabilities.

Don’t make hasty decisions about asset sales or refinancing without expert guidance. These actions can sometimes worsen your position.

Maintain accurate and up-to-date financial records. Poor record-keeping can complicate the insolvency process and raise suspicions of misconduct.

Communicate openly with stakeholders, including creditors and employees. Transparency can help maintain trust and potentially open doors to negotiated solutions.

Services Offered By Insolvency Advisors

Insolvency advisors provide crucial support to businesses facing financial challenges. They offer a range of specialised services to help companies navigate difficult situations and make informed decisions about their future.

Assessing Your Business’s Financial Position

Insolvency advisors begin by conducting a thorough financial analysis of your company. They review your accounts, cash flow, assets, and liabilities to gain a clear picture of your financial health. This assessment helps identify the root causes of your financial difficulties and potential areas for improvement.

Key components of the financial assessment include:

- Balance sheet review

- Profit and loss analysis

- Cash flow projections

- Debt structure evaluation

Advisors use this information to determine the severity of your financial situation and recommend appropriate courses of action. They may also help you identify cost-cutting measures or revenue-boosting strategies to improve your financial position.

Exploring Rescue and Recovery Options

If your business has the potential for recovery, insolvency advisors can help you explore various rescue options. They work closely with you to develop tailored strategies that address your specific financial challenges and maximise your chances of survival.

Common rescue and recovery options include:

- Debt restructuring

- Negotiating with creditors

- Securing additional funding

- Operational restructuring

Advisors can guide you through the process of implementing these strategies, helping you communicate with stakeholders and manage any legal requirements. They may also assist in developing a turnaround plan to restore your business to profitability.

Advising On Liquidation, Administration, And CVAs

In cases where rescue is not feasible, insolvency advisors can guide you through formal insolvency procedures. They explain the different options available and help you choose the most appropriate course of action for your situation.

Formal insolvency procedures include:

- Liquidation (voluntary or compulsory)

- Administration

- Company Voluntary Arrangements (CVAs)

Advisors provide expert guidance on the legal and practical aspects of these procedures. They can help you understand the implications for your business, employees, and creditors. If necessary, they can assist in appointing licensed insolvency practitioners to manage the formal process.

How An Insolvency Advisor Supports Directors

Insolvency advisors provide crucial guidance to company directors facing financial difficulties. They offer expert support in navigating legal complexities, shielding directors from personal liability, and facilitating communication with creditors.

Ensuring Compliance With Insolvency Laws

Insolvency advisors help directors understand and adhere to complex insolvency regulations. They explain directors’ legal obligations and fiduciary duties, ensuring all actions comply with the Insolvency Act 1986 and Company Directors Disqualification Act 1986. These experts guide you through proper record-keeping practices and assist in preparing essential documentation for insolvency proceedings.

Advisors also help you avoid potential pitfalls, such as wrongful trading or fraudulent transactions. They review your company’s financial history to identify any issues that could lead to director disqualification or personal liability.

Directors and Personal Liability

An insolvency advisor plays a crucial role in safeguarding directors from personal financial exposure. They assess your company’s situation to determine if you’re at risk of personal liability for company debts.

Advisors guide you on managing overdrawn directors’ loan accounts and provide strategies to address them. They help you understand and navigate potential issues with personal guarantees on company loans or leases.

These experts also assist in documenting decision-making processes to demonstrate that you’ve acted responsibly and in the company’s best interests. This documentation can be vital if your actions come under scrutiny during insolvency proceedings.

Acting As A Bridge Between Creditors And Directors

Insolvency advisors facilitate communication between directors and creditors, helping to maintain professional relationships during challenging times. They assist in negotiating with creditors, including HMRC, to arrange payment plans or debt restructuring.

These experts help you prepare and present proposals to creditors, explaining your company’s financial situation and potential recovery plans. They can represent you in meetings with creditors, ensuring your interests are protected while addressing creditors’ concerns.

Advisors also guide you on how to approach secured creditors and manage ongoing essential supplier relationships. Their expertise can be invaluable in navigating complex creditor negotiations and finding mutually beneficial solutions.

Voluntary Liquidation – Insolvency Advisory Process – Quick Example

Benefits of Engaging an Insolvency Advisor

Engaging an insolvency advisor provides crucial support for businesses facing financial challenges. These professionals offer specialised expertise to guide you through complex situations and develop effective strategies for recovery.

Clear and Objective Guidance During Stressful Times

When your business is struggling financially, it’s easy to feel overwhelmed. An insolvency advisor offers a calm, neutral perspective to help you navigate these turbulent waters. They assess your situation objectively, free from emotional attachments that might cloud judgement.

These experts provide clarity on your options, explaining complex legal and financial concepts in terms you can understand. This knowledge empowers you to make informed decisions about your business’s future.

Insolvency advisors also act as a buffer between you and creditors, reducing stress and allowing you to focus on running your business. Their experience in negotiating with creditors can often lead to more favourable outcomes.

Proactive Problem-Solving for Business Recovery

Insolvency advisors don’t just help manage decline; they actively seek ways to turn your business around. They analyse your financial position, identify underlying issues, and develop tailored strategies for recovery.

These professionals can spot opportunities you might have missed. They may suggest restructuring options, cost-cutting measures, or alternative funding sources to improve your cash flow.

Insolvency advisors also help you create realistic business plans and financial forecasts. This proactive approach can prevent further deterioration of your financial situation and potentially save your business from closure.

Their expertise extends to implementing these plans effectively, monitoring progress, and making necessary adjustments along the way.

Avoiding Legal and Financial Pitfalls

Navigating insolvency involves complex legal and financial regulations. An experienced advisor ensures you comply with all relevant laws, protecting you from potential legal consequences.

They guide you through statutory obligations, such as filing necessary documents and meeting deadlines. This compliance is crucial to avoid penalties or personal liability issues.

Insolvency advisors also help you understand your rights and responsibilities as a director. They can advise on issues like wrongful trading, ensuring you don’t inadvertently breach your duties.

By engaging an advisor early, you may be able to explore alternatives to formal insolvency procedures. This could include negotiating informal arrangements with creditors or exploring pre-insolvency options that could save your business.

How To Choose The Right Insolvency Advisor

Selecting an experienced insolvency advisor is crucial for businesses facing financial difficulties. The right professional can provide expert guidance and tailored solutions to navigate complex insolvency procedures.

Key Questions To Ask Before Hiring

When interviewing potential insolvency advisors, ask about their qualifications and licensing. Enquire about their success rate in handling cases similar to yours. Request references from past clients and verify their credentials with professional bodies.

Discuss their fee structure upfront. Some advisors charge hourly rates, while others offer fixed fees. Ensure you understand all costs involved, including potential additional charges.

Ask about their availability and communication style. A good advisor should be accessible and keep you informed throughout the process.

Enquire about their network of professionals, such as accountants and lawyers. A well-connected advisor can provide comprehensive support.

Verifying Experience In Your Industry

Look for an insolvency advisor with specific experience in your industry. They should understand the unique challenges and regulations affecting your business.

Ask about their track record with similar companies. An advisor familiar with your sector can offer more targeted advice and strategies.

Request case studies or examples of how they’ve helped businesses in your industry overcome financial difficulties. This will give you insight into their approach and expertise.

Check if they have any specialised certifications or memberships in industry-specific organisations. These can indicate a deeper understanding of your sector’s nuances.

Understanding Their Approach To Tailored Solutions

A competent insolvency advisor should offer personalised solutions, not a one-size-fits-all approach. Discuss their process for assessing your business’s unique situation.

Ask how they develop tailored strategies. They should consider factors like your company’s size, structure, and specific financial challenges.

Enquire about the range of solutions they typically recommend. A good advisor should explain various options, from restructuring to formal insolvency procedures.

Discuss their approach to preserving business value and protecting jobs where possible. Understanding their priorities can help you gauge if their values align with yours.

Ask about their post-implementation support. A thorough advisor should offer guidance beyond the initial insolvency process to help your business recover and thrive.

Common Myths About Insolvency Advisors

Misconceptions about insolvency advisors can prevent businesses from seeking crucial help. Let’s address some of the most prevalent myths and set the record straight.

Advisors Are Only For Large Companies

Insolvency advisors work with businesses of all sizes. Small and medium enterprises often benefit greatly from their expertise.

You don’t need to be a corporate giant to access professional advice. Many advisors specialise in helping smaller businesses navigate financial difficulties.

These professionals can provide tailored solutions for your specific situation, regardless of your company’s size. They understand the unique challenges faced by smaller firms and can offer practical strategies to overcome them.

Using An Advisor Means Closing Your Business

Seeking help from an insolvency advisor doesn’t automatically lead to business closure. In fact, their primary goal is often to help you avoid insolvency altogether.

Advisors explore various options to keep your business afloat. These might include restructuring debt, negotiating with creditors, or implementing cost-saving measures.

If insolvency is unavoidable, advisors can guide you through processes like administration or company voluntary arrangements (CVAs). These options can give your business a chance to recover and continue operating.

Advisory Services Are Too Expensive

While professional advice comes at a cost, it’s often more affordable than you might think. Many advisors offer initial consultations at no charge.

The potential savings from expert guidance can far outweigh the fees. Advisors can help you avoid costly mistakes and identify opportunities for financial improvement.

Some advisors offer flexible payment terms or base their fees on the outcomes achieved. This can make their services more accessible, even for businesses facing financial strain.

Remember, the cost of not seeking advice when needed can be far greater in the long run.

What Happens Without An Insolvency Advisor?

Navigating financial difficulties without expert guidance can lead to serious consequences for your business. Proper advice is crucial for making informed decisions and mitigating risks.

Increased Risks Of Non-Compliance

Without an insolvency advisor, you may struggle to understand and meet your legal obligations. This can result in unintentional breaches of company law or insolvency regulations.

You might miss critical filing deadlines or fail to disclose required information to creditors and authorities. These oversights can attract penalties and damage your company’s reputation.

Creditors may lose trust in your ability to manage the situation, potentially leading to more aggressive recovery actions. This could accelerate your financial decline and limit your options for recovery.

Missed Opportunities For Business Recovery

An insolvency advisor can identify viable options for restructuring or turnaround that you might overlook. Without this expertise, you may miss crucial opportunities to save your business.

You might not recognise early warning signs of financial distress, such as persistent cash flow problems or mounting short-term liabilities. Addressing these issues promptly is often key to successful recovery.

Lacking professional guidance, you may struggle to negotiate effectively with creditors. This could result in less favourable terms for debt repayment or restructuring, further straining your finances.

Greater Exposure To Legal And Financial Consequences

Making decisions without expert advice can expose you to significant personal liability. You might inadvertently trade whilst insolvent, which can lead to serious legal repercussions.

Without proper guidance, you may fail to prioritise creditor payments correctly. This can result in preferential treatment of certain creditors, potentially leading to legal challenges and personal liability.

You might also struggle to navigate complex insolvency procedures, such as administrations or voluntary arrangements. Mistakes in these processes can be costly and may jeopardise any chance of business recovery.

Inadequate financial planning during insolvency can lead to asset undervaluation or improper disposal. This can result in reduced returns for creditors and potential legal action against directors.

Why Anderson Brookes Should Be Your Insolvency Advisor

Anderson Brookes offers tailored debt advice and resolution services backed by over 20 years of industry experience. Our team of financial advisors, insolvency practitioners, and legal experts provides comprehensive guidance for individuals and businesses facing financial difficulties.

Expert Knowledge Across Sectors and Solutions

Anderson Brookes’ team possesses in-depth knowledge of various industries and debt solutions – we specialise in advising business owners and company directors struggling with business debt. Our expertise covers a wide range of issues, including:

- Debt management

- CCJs

- HMRC tax problems

- Dealing with bailiffs

The firm’s advisers stay up-to-date with the latest insolvency regulations and practices. This ensures you receive accurate, current advice tailored to your specific situation.

Free Consultations to Help You Understand Your Options

Anderson Brookes offers free initial consultations to assess your financial situation. This no-obligation service allows you to:

- Discuss your concerns with experienced advisers

- Explore potential debt solutions

- Understand the implications of different insolvency procedures

During these consultations, you’ll receive clear, straightforward advice on the best course of action for your circumstances. The firm’s in-house Licensed Insolvency Practitioner is available should a formal insolvency procedure be required.

Frequently Asked Questions

Insolvency advisors play a crucial role in guiding businesses through financial difficulties. Understanding their qualifications, the steps involved in insolvency proceedings, and the implications for various stakeholders is essential.

What qualifications are required to become an insolvency advisor?

To become an insolvency advisor in the UK, you typically need a relevant degree in finance, accounting, or law. Professional qualifications from organisations like the Insolvency Practitioners Association (IPA) or the Association of Chartered Certified Accountants (ACCA) are also important.

Experience in financial management or corporate restructuring is valuable. Many advisors have backgrounds in accountancy or legal practice.

What are the initial steps a business should take when facing potential insolvency?

If your business is facing financial challenges, seek professional advice immediately. Contact an insolvency practitioner or financial advisor for an assessment of your situation.

Review your financial records and cash flow projections. Identify areas where costs can be reduced or revenue increased.

Consider negotiating with creditors to restructure debts or extend payment terms.

How does liquidation differ from other forms of insolvency proceedings?

Liquidation involves selling a company’s assets to repay creditors and ultimately dissolving the business. It’s a final resort when a company cannot continue trading.

Other insolvency proceedings, like administration or voluntary arrangements, aim to rescue the business or restructure its debts while allowing it to continue operating.

Liquidation is generally more straightforward but offers less flexibility for recovery.

Can a business recover from insolvency, and if so, what strategies are typically employed?

Yes, businesses can recover from insolvency with the right strategies. Restructuring debt through a Company Voluntary Arrangement (CVA) can help manage repayments.

Securing additional funding or investment may provide necessary capital. Streamlining operations, reducing costs, and focusing on core profitable activities are common recovery strategies.

Exploring new markets or diversifying product lines can also boost revenue and aid recovery.

What are the legal responsibilities of directors during a company’s insolvency?

Directors must prioritise creditors’ interests once insolvency becomes apparent. You’re required to minimise further losses and avoid wrongful trading.

Keep accurate financial records and cooperate fully with insolvency practitioners. Failing to meet these obligations can lead to personal liability or disqualification.

Directors should also be aware of potential investigations into their conduct leading up to insolvency.

How do insolvency procedures affect employees and creditors of a company?

Employees may face redundancy in insolvency situations. They become preferential creditors for certain wage-related claims.

Secured creditors have first claim on assets. Unsecured creditors often receive only a portion of what they’re owed, if anything.

The specific impacts depend on the type of insolvency procedure and the company’s financial position. Communication with both groups is crucial throughout the process.

You may also like:

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

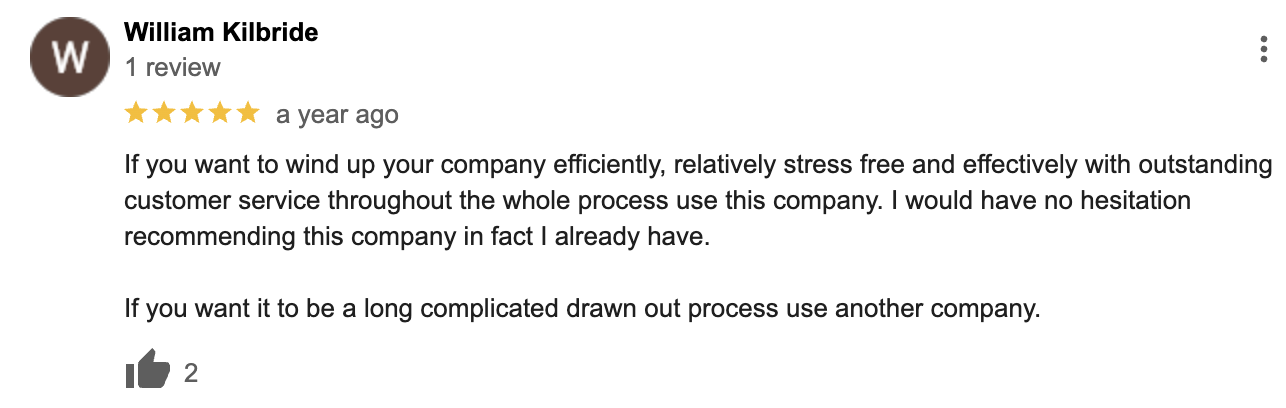

Google Reviews

&