Insolvency in the UK: Essential Steps for Business Recovery and Liquidation

Understanding Insolvency in the UK

Insolvency in the UK is a complex legal and financial concept with significant implications for businesses. It involves specific legal frameworks, key indicators, and statutory procedures that companies must navigate carefully.

Definition and Legal Framework of Insolvency

Insolvency occurs when a company can’t pay its debts as they fall due or when its liabilities exceed its assets. The Insolvency Act 1986 is the primary legislation governing insolvency in the UK. This Act outlines various procedures for companies facing financial distress, including:

- Administration

- Company Voluntary Arrangements (CVAs)

- Liquidation

Licensed insolvency practitioners play a crucial role in managing these processes. They step in to handle the company’s affairs, often replacing management to ensure fairness and efficiency in resolving financial difficulties.

Key Indicators of Insolvency

Recognising the signs of insolvency early is vital for businesses. Some key indicators include:

- Cash flow problems: Consistently struggling to pay bills on time

- Mounting debts: Increasing reliance on credit to cover operational costs

- Creditor pressure: Receiving legal notices or threats of legal action

- Declining profits: Persistent decrease in revenue and profitability

Other warning signs may include bounced cheques, maxed-out credit lines, and difficulty securing new finance. If you spot these indicators, it’s crucial to seek professional advice promptly to explore potential solutions and avoid personal liability.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

Types of Insolvency Procedures in the UK

UK law provides several options for businesses facing financial difficulties. These procedures aim to either rescue the company or maximise returns for creditors.

Company Voluntary Arrangement (CVA)

A CVA allows a company to reach an agreement with its creditors to repay all or part of its debts over time. This procedure is often used by businesses that are viable but struggling with temporary cash flow issues.

To initiate a CVA, the company directors must work with an insolvency practitioner to create a proposal. This proposal outlines how the company will repay its debts and is presented to creditors for approval.

If 75% of creditors (by value) agree to the proposal, the CVA becomes binding on all creditors. The company can then continue trading while adhering to the agreed repayment plan.

Administration

Administration is designed to help struggling companies survive or achieve a better outcome for creditors than immediate liquidation. An administrator, who must be a licensed insolvency practitioner, takes control of the company’s affairs.

The main objectives of administration are:

- Rescue the company as a going concern

- Achieve a better result for creditors than immediate liquidation

- Realise property to make a distribution to secured or preferential creditors

Administration provides a temporary freeze on creditor actions, giving the company breathing space to restructure or find a buyer.

Liquidation

Liquidation, also known as ‘winding up’, is the process of closing a company and selling its assets to repay creditors. There are three types of liquidation:

- Compulsory liquidation: Initiated by creditors through a court order

- Creditors’ voluntary liquidation: Initiated by shareholders when the company is insolvent

- Members’ voluntary liquidation: Used for solvent companies that are no longer needed

In all cases, a liquidator is appointed to manage the process. They gather and sell the company’s assets, investigate its affairs, and distribute any proceeds to creditors according to a strict order of priority.

Legal Obligations and Director Responsibilities

Directors face crucial legal duties when their company becomes insolvent. Understanding these obligations is essential to avoid personal liability and potential disqualification.

Duties During Insolvency

When a company is insolvent, directors must prioritise creditors’ interests over shareholders’. You’re required to take steps to minimise potential losses to creditors. This includes carefully considering whether to continue trading.

If you decide to trade, ensure it’s in the creditors’ best interests. Keep detailed records of decisions and seek professional advice. Directors must also avoid preferential payments to certain creditors over others.

It’s crucial to regularly assess the company’s financial position. If there’s no reasonable prospect of avoiding insolvency, you must take appropriate action, such as initiating formal insolvency proceedings.

Consequences of Wrongful Trading

Wrongful trading occurs when directors continue to trade despite knowing the company can’t avoid insolvency. You may be held personally liable for company debts if found guilty.

Courts consider whether you took every step to minimise potential losses to creditors. Consequences can include:

- Personal financial liability

- Repayment of money to the company

- Contribution to the company’s assets

To protect yourself, maintain accurate financial records and seek professional advice early. Document all decisions and actions taken to safeguard creditors’ interests.

Director Disqualification Risks

The Insolvency Service can investigate directors’ conduct in insolvent companies. If found unfit to manage a company, you may face disqualification for 2 to 15 years.

Grounds for disqualification include:

- Continuing to trade when the company is insolvent

- Failing to keep proper accounting records

- Not paying tax owed by the company

- Using company money or assets for personal benefit

To mitigate these risks, always act in good faith and fulfil your duties diligently. Seek professional advice if you’re unsure about your responsibilities or the company’s financial position.

Steps To Take If Facing Insolvency

When your business is facing insolvency, swift and strategic action is crucial. Prioritise seeking expert guidance, open communication with creditors, and a thorough review of your financial records.

Seek Professional Advice

Contact a licensed insolvency practitioner immediately. They can assess your company’s financial situation and outline potential options. An insolvency practitioner will help you understand the legal implications and guide you through the process.

Consider engaging a solicitor with expertise in insolvency law. They can provide valuable legal advice on your rights and obligations as a director.

Consult with your accountant to get a clear picture of your financial position. They can help prepare accurate financial statements and projections.

Remember, early intervention often leads to better outcomes. Don’t delay in seeking professional help.

Communicate With Creditors

Be proactive in reaching out to your creditors. Explain your company’s financial difficulties honestly and transparently. Many creditors prefer to work with businesses to find solutions rather than pursue legal action.

Consider negotiating payment plans or temporary payment holidays. Be realistic about what your company can afford to repay.

Keep detailed records of all communications with creditors. This demonstrates your commitment to resolving the situation and can be useful if formal insolvency proceedings become necessary.

If you receive legal notices or court summons, respond promptly and seek legal advice immediately.

Review Financial Records And Compliance

Conduct a thorough review of your company’s financial records. Ensure all accounts are up-to-date and accurately reflect your current financial position.

Check that you’ve complied with all statutory obligations, including filing accounts and tax returns. Address any outstanding issues promptly.

Identify any personal guarantees or other liabilities that may affect you as a director. Understanding these can help you make informed decisions about the company’s future.

Review all contracts and ongoing financial commitments. Consider which ones are essential for the business and which could potentially be renegotiated or terminated.

Assess your company’s assets and liabilities carefully. This information will be crucial in determining the most appropriate course of action.

Impact of Insolvency on Stakeholders

Insolvency proceedings can have far-reaching consequences for various parties associated with a business. The effects ripple through the organisation, affecting employees, creditors, and shareholders in distinct ways.

Employees

When a company becomes insolvent, employees often face significant challenges. You may experience:

- Job losses and redundancies

- Delayed or unpaid wages

- Uncertainty about your future employment

The Redundancy Payments Service can assist you in claiming owed wages and statutory payments. You’re entitled to claim up to 8 weeks of unpaid wages, up to 6 weeks of holiday pay, and statutory notice pay.

If your employment continues under a new owner, your rights are protected under TUPE regulations. This ensures the transfer of your existing employment terms and conditions.

Creditors

As a creditor, insolvency can severely impact your financial position. Your recovery options depend on:

- The type of creditor you are (secured, preferential, or unsecured)

- The insolvency procedure in place

- Available assets for distribution

Secured creditors, such as banks with charges over company assets, typically have priority. Preferential creditors, including employees, follow. Unsecured creditors often recover the least, if anything at all.

You’ll be notified of insolvency proceedings and may participate in creditors’ meetings. These meetings allow you to vote on important decisions, such as appointing an insolvency practitioner.

Shareholders

As a shareholder, insolvency often results in significant financial losses. Your position in the distribution hierarchy means:

- You’re last in line to receive any returns

- Your shares may become worthless

- You might lose your entire investment

In some cases, you could face additional liabilities if you’re found to have acted improperly as a director. This might include wrongful trading or breaching fiduciary duties.

Despite these challenges, you may have opportunities to participate in restructuring efforts or negotiate with creditors to salvage some value from your investment.

Recent Developments in UK Insolvency Law

The UK has seen significant changes to its insolvency legislation in recent years. These updates aim to enhance business rescue options and streamline insolvency processes for companies facing financial distress.

Corporate Insolvency and Governance Act 2020

The Corporate Insolvency and Governance Act 2020 marked the largest overhaul of UK insolvency law in over two decades. This legislation introduced new tools to help struggling businesses:

- A new restructuring plan, similar to the US Chapter 11 procedure

- A standalone moratorium giving companies breathing space from creditors

- Protection of supplies to enable companies to continue trading during restructuring

These measures provide more options for companies to avoid insolvency and continue operations. The Act also temporarily eased some insolvency rules during the COVID-19 pandemic to support businesses facing unprecedented challenges.

Ongoing Changes in Insolvency Practices

Beyond legislative changes, the UK insolvency landscape continues to evolve:

- Introduction of firm-level regulation for insolvency practitioners

- Creation of a public register for authorised insolvency professionals

- Clarification on the priority of debts in moratorium situations

These updates aim to improve transparency and efficiency in insolvency processes. The role of insolvency practitioners is also evolving, with increased focus on business rescue and potential reputational risks. Practitioners must now navigate complex restructuring plans and moratorium procedures, requiring new skills and expertise.

Insolvency Process – Quick Example

Checklist For Directors Facing Insolvency

When facing insolvency, directors must take prompt and decisive action. This checklist outlines key steps to navigate the challenging process, prepare for potential proceedings, and engage with relevant stakeholders.

Immediate Steps To Take

- Seek professional advice from a licensed insolvency practitioner or solicitor specialising in corporate insolvency.

- Review your company’s financial position, including cash flow, assets, and liabilities.

- Stop incurring new debts and halt any payments that may be deemed preferential.

Maintain detailed records of all financial transactions and board decisions. Consider calling an emergency board meeting to discuss the situation and agree on a course of action.

Create a list of all creditors, including amounts owed and payment terms. Prioritise essential payments to keep the business running, if possible.

Preparing For Insolvency Proceedings

- Gather all relevant financial documents, including accounts, tax returns, and bank statements.

- Compile a list of company assets and their estimated values.

- Review any personal guarantees you may have given for company debts.

Familiarise yourself with your legal duties as a director during insolvency. Be prepared to provide a statement of affairs detailing the company’s financial position.

Consider potential insolvency procedures, such as administration or liquidation, and their implications for the business and stakeholders.

Engaging Stakeholders

- Communicate openly and honestly with employees about the company’s situation.

- Inform key suppliers and customers of potential disruptions to business operations.

- Engage with creditors to explore possible repayment plans or debt restructuring

Be transparent with shareholders about the company’s financial difficulties. Provide regular updates on the steps being taken to address the situation.

Consider appointing a spokesperson to manage communications with stakeholders and the media, if necessary. Maintain a professional and empathetic approach in all interactions.

How Anderson Brookes Can Assist

Anderson Brookes offers specialised services to help businesses navigate insolvency challenges. Our team provides expert guidance, free initial consultations, and tailored solutions for companies facing financial difficulties. Our focus includes:

- Debt management

- Financial restructuring

- Liquidation processes

- Asset disposal

Our expertise extends to dealing with creditors, including HMRC and bailiffs, ensuring you receive well-rounded support during challenging times.

Free Initial Consultation

We provide a no-obligation initial consultation to assess your situation. During this meeting or call, you can:

- Discuss your business’s financial challenges

- Explore potential debt solutions

- Receive advice on whether liquidation might be appropriate

- Understand the implications of CCJs and other legal actions

This free service allows you to gain valuable insights without committing to any specific course of action.

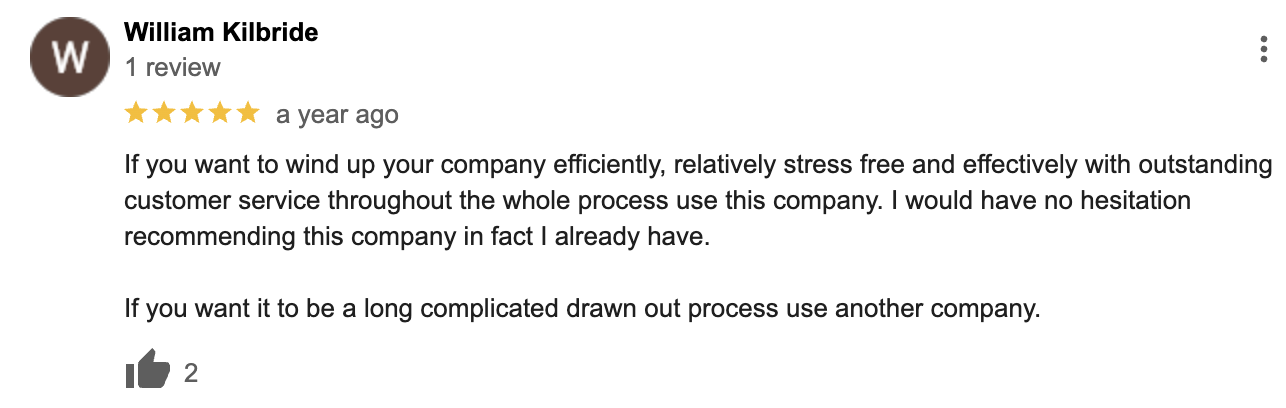

Success Stories and Tailored Solutions

Anderson Brookes prides itself on delivering bespoke solutions for each client. We recognise that every business faces unique challenges and work to develop strategies that address your specific needs.

Our approach includes:

- Analysing your financial situation in detail

- Identifying viable options for recovery or closure

- Implementing tailored debt management plans

- Assisting with voluntary liquidation when appropriate

By focusing on individualised solutions, Anderson Brookes has helped thousands of businesses manage insolvency successfully, whether through restructuring or orderly wind-down processes.

Frequently Asked Questions

Insolvency can be a complex issue for UK businesses. Understanding the key aspects of insolvency proceedings, legal frameworks, and preventative measures is crucial for company directors and stakeholders.

What are the key signs that a company is facing insolvency?

Warning signs of insolvency include persistent cash flow problems, mounting debts, and difficulty paying creditors on time. You may notice a decline in sales, increasing pressure from creditors, or the inability to secure additional financing.

Late payments to suppliers and staff are also red flags. If your company is consistently relying on overdrafts or maxing out credit lines, it could indicate financial distress.

How does the Insolvency Act 1986 govern proceedings for insolvent companies in the UK?

The Insolvency Act 1986 provides the legal framework for handling corporate insolvency in the UK. It outlines procedures for various insolvency processes, including administration, liquidation, and company voluntary arrangements.

This Act defines the rights of creditors and the responsibilities of insolvency practitioners. It also sets out the rules for appointing administrators and liquidators, and the steps they must follow during insolvency proceedings.

What are the different types of insolvency proceedings available to businesses in the UK?

UK businesses have several options when facing insolvency. Administration aims to rescue the company as a going concern or achieve a better result for creditors than immediate liquidation.

Company Voluntary Arrangements (CVAs) allow businesses to reach agreements with creditors to repay debts over time. Liquidation involves selling company assets to repay creditors and dissolving the business.

How can a director’s personal liabilities be affected in the event of limited company bankruptcy?

In a limited company, directors are typically protected from personal liability for company debts. However, this protection can be lost in certain circumstances.

If you’ve engaged in wrongful or fraudulent trading, provided personal guarantees for company loans, or breached your duties as a director, you may become personally liable for company debts.

What role does a cash flow forecast play in preventing business insolvency?

A cash flow forecast is a vital tool for managing your company’s financial health. It helps you anticipate periods of potential cash shortages and plan accordingly.

By regularly updating your cash flow forecast, you can identify potential insolvency risks early. This allows you to take proactive measures, such as negotiating payment terms with creditors or seeking additional financing.

What is the process for declaring insolvency for a business within the UK?

To declare insolvency, you must first determine that your company is unable to pay its debts. You should then seek advice from a licensed insolvency practitioner.

The practitioner will review your company’s financial situation and advise on the most appropriate course of action. This may involve initiating formal insolvency proceedings through the courts or negotiating with creditors.

You may also like:

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

Google Reviews

&