Voluntary Strike Off vs Voluntary Liquidation - Key Differences

Anderson Brookes Insolvency Practitioners help directors close limited companies quickly, legally and with expert guidance every step of the way.

Free Advice & Quote

Why Directors Choose Anderson Brookes

With more than 25 years’ experience and thousands of directors helped, we’re trusted by business owners across the UK. You can speak directly with an expert insolvency practitioner and we’ll help you understand your options clearly and quickly. We specialise in working with small and medium businesses and we understand your perspective and priorities.

Ready to

Move On?

If you’re ready to close your company, stop creditor pressure, or just want to understand your next steps, we’re here to talk.

Call us now on 0800 1804 935 or request a call back - we’re here to help.

When it comes to closing a limited company in the UK, two common routes are voluntary strike off and voluntary liquidation. Each has its own rules, uses and consequences. Choosing the wrong one can lead to delays, unexpected costs, or even legal issues. Here’s a clear, practical comparison to help you decide which approach is right for your business.

Quick Definitions

Voluntary Strike Off: A director-led process used to close a company that is solvent, inactive and has no debts or assets. You submit a DS01 form to Companies House and, assuming no objections are received, the company is struck off the register.

Voluntary Liquidation: A formal legal process led by a licensed insolvency practitioner (IP). It’s used when a company is either solvent (MVL) or insolvent (CVL), and directors want to close it down in a structured and fully compliant way.

At-a-Glance Comparison Table

| Feature | Voluntary Strike Off | Voluntary Liquidation (MVL or CVL) |

|---|---|---|

| Company Status | Must be solvent and inactive | MVL: Solvent / CVL: Insolvent |

| Debts Owed | No outstanding debts allowed | CVL handles unpaid debts legally |

| Process Led By | Company directors | Licensed insolvency practitioner |

| Notice to Creditors | Directors must notify all parties | IP handles formal notifications and legal disclosures |

| Protection from Legal Action | None – company can be reinstated | CVL offers legal protection from creditor claims |

| Risk of Personal Liability | Higher, especially if creditors object | Lower – IP involvement shows reasonable conduct |

| Cost | Low government fee | Professional fees apply |

| Speed | Usually takes around 2 months | Liquidation begins quickly, but full closure may take longer |

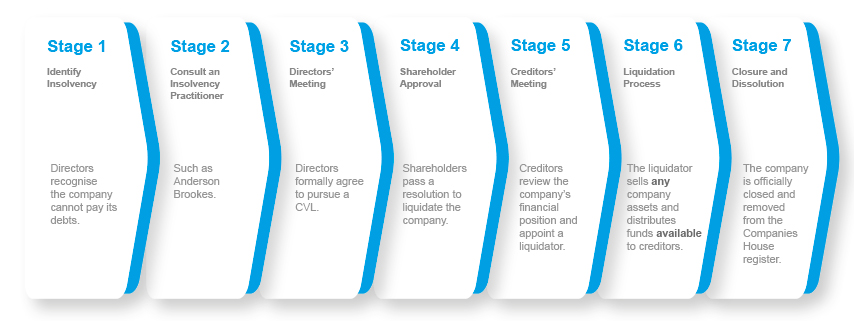

Example CVL Process - Voluntary Liquidation

When to Use Voluntary Strike Off

This is best suited for businesses that:

-

Have ceased trading for at least 3 months

-

Have no assets or liabilities

-

Are not under threat of liquidation or legal action

-

Have informed all creditors, employees and HMRC

Strike off is quick and cheap, but risky if not handled properly. If a creditor isn’t told or objects, the company can be reinstated and you could be personally investigated.

When Voluntary Liquidation Is a Better Option

Use liquidation when:

-

The company has debts or assets to deal with

-

You want a clean legal end to the business

-

You need help managing creditor claims

-

You want formal closure by an insolvency professional

For solvent companies, a Members’ Voluntary Liquidation (MVL) can provide tax-efficient distribution of remaining assets. For insolvent companies, a Creditors’ Voluntary Liquidation (CVL) helps prevent legal action and ensures creditors are treated fairly.

Risks of Using the Wrong Option

Trying to strike off a company that owes money can backfire. HMRC, suppliers or lenders can object and even apply to have the company reinstated. This can result in serious consequences, including personal liability for directors and investigation into your conduct.

Liquidation provides stronger protection. Once an IP is appointed and the company enters liquidation, you demonstrate clear intent to comply with insolvency law and protect creditors’ interests.

Need Help Choosing the Right Path?

Speak to the experienced, licensed team at Anderson Brookes. We offer free initial advice and will help you understand the risks and benefits of each option, so you can make the right decision with confidence.

Email: advice@andersonbrookes.co.uk

Phone: 0800 1804 935 (freephone)

Whether you’re ready to close a debt-free company or need urgent advice on dealing with business debts, we’re here to help.

Testimonials

Our clients praise our professionalism, reliability, and the exceptional support we provide during challenging times, helping thousands of company directors through insolvency, liquidation, and business debt solutions.