If your pub is facing financial difficulties, seeking professional advice is crucial. A licensed insolvency practitioner can assess your situation and provide tailored guidance. They’ll explain your legal obligations to creditors and help you navigate the complex landscape of UK insolvency laws.

Expert advice can also help you avoid potential pitfalls and ensure you’re taking appropriate action in challenging circumstances. In this article we provide the quick facts and answers we know you will want to understand quickly. If you’d like to understand each step in greater depth, a full, detailed assessment can be found after our quick overview.

Pub Liquidation: Quick Overview

Understanding Creditors’ Voluntary Liquidation for Pubs

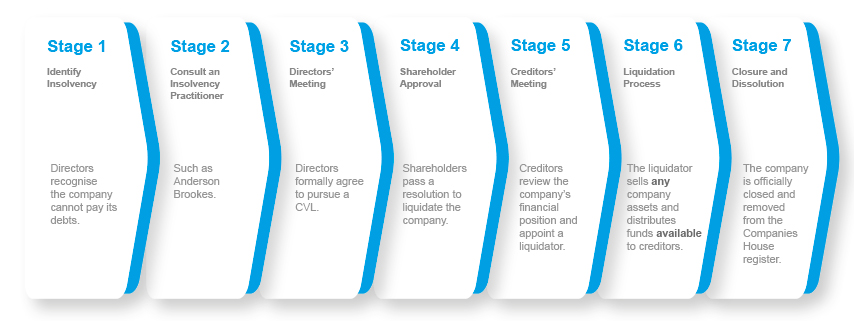

Creditors’ Voluntary Liquidation (CVL) is a formal process for limited companies that can no longer meet their financial obligations. It involves closing the pub permanently under the supervision of a licensed insolvency practitioner. The liquidator’s role includes:

- Realising company assets

- Distributing proceeds to creditors

- Removing the company from the Companies House register

- Investigating the reasons for business failure

CVL allows you to initiate the process and choose your liquidator, giving you more control over the situation. Anderson Brookes can place your pub into liquidation within 8 days!

CVL for Pubs: Liquidation Process in 7 Steps

For free, confidential advice, contact Anderson Brookes today.

advice@andersonbrookes.co.uk

0800 1804 935

Key Considerations for Pub Liquidation

When contemplating liquidation for your pub, several concerns may arise:

- Director liability: You could become personally liable for company debts in certain situations.

- Personal guarantees: Lenders may pursue you for outstanding debts if you’ve provided personal guarantees.

- Wrongful trading: Continuing to trade while insolvent can lead to serious consequences.

It’s essential to address these issues promptly and seek professional guidance to protect your interests.

Benefits of Voluntary Liquidation for Pub Owners

Opting for voluntary liquidation can offer several advantages:

- Greater control over the timing and process

- Fulfilment of legal obligations as a director

- Potential eligibility for redundancy pay

- Avoidance of compulsory liquidation by creditors

By taking proactive steps, you can manage the situation more effectively and potentially mitigate some of the negative impacts.

Claiming Redundancy as a Pub Owner

As a pub owner, you may be eligible for redundancy pay if:

- You’ve worked as an employee under a contract for at least two years

- You’ve worked a minimum of 16 hours per week in a practical role

The average claim for director redundancy is around £9,000. To determine your eligibility and pursue a claim, consult with an insolvency expert who can guide you through the process.

Next Steps for Pub Liquidation

If you’re considering liquidation for your pub, follow these steps:

- Seek professional advice immediately

- Explore potential rescue options (e.g., alternative funding, debt restructuring)

- Consider formal rescue procedures like Company Voluntary Arrangements (CVAs) or administration

- Investigate HMRC’s Time to Pay scheme for tax arrears

- If liquidation is necessary, choose a reputable insolvency practitioner

- Prepare all required documentation and information

- Cooperate fully with the liquidator throughout the process

Remember, acting swiftly and seeking expert guidance can help you navigate this challenging situation more effectively and ensure the best possible outcome for all parties involved.

Frequently Asked Questions

What happens to staff when a pub goes into liquidation?

When your pub enters liquidation, employees face redundancy. You must inform them promptly about the situation. Staff may be eligible for redundancy pay and other entitlements from the National Insurance Fund. The liquidator will assist with claims and provide necessary documentation.

How do you start the liquidation process for a pub?

To initiate liquidation:

- Consult an insolvency practitioner

- Hold a board meeting to pass a winding-up resolution

- Notify shareholders and call a general meeting

- Appoint a liquidator at the meeting

- File required documents with Companies House

The process typically takes 4-6 weeks to begin once you’ve decided to liquidate.

How long does pub liquidation usually take?

The duration varies based on the pub’s complexity:

- Simple cases: 6-12 months

- Complex cases: 12-24 months or longer

Factors affecting timeline:

- Asset value and ease of sale

- Number of creditors

- Legal disputes

- Tax complications

What are a pub owner’s legal duties during liquidation?

As a pub owner, your key legal responsibilities include:

- Cooperating fully with the liquidator

- Providing all financial records and company information

- Attending meetings and interviews as required

- Ceasing trading and not incurring new debts

- Avoiding preferential payments to specific creditors

- Refraining from using or disposing of company assets

Failure to meet these obligations may lead to personal liability or disqualification as a director.

How does liquidation affect pub creditors?

Creditors are impacted in several ways:

- Secured creditors have first claim on assets

- Preferential creditors (e.g., employees) are paid next

- Unsecured creditors receive any remaining funds

- Payments are made in order of priority set by law

- Creditors may receive only a portion of what they’re owed

- Some debts may be written off entirely

The liquidator will communicate with creditors throughout the process.

What consequences might a pub landlord face after liquidation?

Potential outcomes for pub landlords post-liquidation:

- Restriction on using similar business names

- Possible director disqualification (up to 15 years)

- Personal liability for certain debts if misconduct proven

- Difficulty obtaining future credit or directorships

- Potential tax implications

- Loss of personal assets if personal guarantees were given

Seek professional advice to understand your specific situation and minimise negative consequences.

Anderson Brookes: Your Ideal Insolvency Specialist for Pubs, Bars and Clubs

Expert Debt Resolution Tailored to the Hospitality Sector

Anderson Brookes offers specialist debt resolution and insolvency services tailored specifically for pubs, bars and clubs. Having worked with hundreds of hospitality businesses, we understand the unique financial challenges you face. Our bespoke solutions ensure efficient, cost-effective and fully compliant support. When necessary, we can facilitate the placement of businesses into liquidation within just eight days.

With an in-house Licensed Insolvency Practitioner, Anderson Brookes delivers streamlined and effective insolvency procedures, safeguarding your interests and assisting you in making informed decisions about your financial future.

Pub Liquidation: Detailed Assessment

The Unique Challenges of Pub Liquidation

Pubs face distinctive challenges when entering liquidation that set them apart from other businesses. The hospitality sector operates with specific financial pressures and regulatory frameworks that can complicate the winding-up process.

Licensed premises often involve complex lease arrangements with breweries or pub companies that include tie agreements, minimum purchase obligations, and property maintenance clauses. These contractual obligations don’t simply disappear when a pub enters liquidation and must be carefully addressed by the insolvency practitioner.

Stock management presents another significant consideration. Alcoholic beverages and perishable food items typically lose substantial value in liquidation scenarios. Unlike manufacturing equipment or office furniture, alcohol inventory might need to be sold quickly, often at a steep discount, or returned to suppliers if permitted by trading terms.

The premises licence represents a valuable asset that requires special consideration. Unlike physical assets, a premises licence is a regulatory permission that cannot simply be transferred as part of normal asset sales without proper procedures. The Licensing Act 2003 governs how premises licences are handled during insolvency. When a pub company enters liquidation, the premises licence doesn’t automatically transfer to the liquidator. Instead, within 28 days, the licence must be formally transferred or it may lapse, potentially diminishing the value of the business significantly.

Additionally, pubs frequently operate as the heart of communities, especially in rural areas. This creates emotional complexities that can make the decision to liquidate particularly difficult for owners who may have strong personal ties to their customers and staff. The closure of a pub often reverberates beyond the immediate business, affecting the wider local economy and community fabric.

Many struggling pubs attempt to trade through difficult winter months in hopes of summer recovery, only to find themselves in deeper financial distress. This delayed action often reduces the options available and can potentially increase directors’ personal exposure. The timing of facing reality is crucial. Waiting until financial distress becomes acute often reduces the options available and increases potential personal liability.

Financial Warning Signs and Alternative Solutions

The decision to close a pub is rarely taken lightly. Most pub owners have invested not just money, but years of their lives and considerable emotional energy into their establishments. However, recognising when closure has become the most responsible option is an essential business skill.

Several financial indicators suggest liquidation might be the appropriate path forward. Cash flow problems that persist despite attempts to boost sales or reduce costs often signal fundamental business issues. When supplier invoices age beyond 90 days, utility companies threaten disconnection, or you’re regularly juggling which creditors to pay each month, these patterns indicate serious financial distress.

The pub sector faces unique challenges that can accelerate financial decline. Changing consumer habits, with people increasingly drinking at home rather than in pubs, have created long-term structural challenges. Rising costs across utilities, staff wages, and stock prices have further squeezed profit margins in recent years. Business rates represent another significant burden for pub operators. Despite various relief schemes, many pubs face disproportionately high business rates compared to their turnover.

Before pursuing liquidation, several rescue options might help avoid closure entirely. Restructuring your pub’s operations can sometimes turn around performance. This might involve reviewing staffing levels, opening hours, or your food and drink offerings. Many pubs have found success by refocusing their business model – perhaps emphasising food service if drink sales are declining, or creating unique experiences that cannot be replicated by drinking at home.

Negotiating with creditors directly can sometimes produce workable solutions. Major creditors such as breweries and pub companies may be willing to restructure payment terms rather than lose a customer entirely. HMRC also offers Time to Pay arrangements for tax arrears in certain circumstances, which can ease immediate pressure while a longer-term solution is developed.

For pubs with viable underlying businesses, a Company Voluntary Arrangement (CVA) offers a formal framework for restructuring debts. This legally binding agreement between your pub and its creditors typically allows for reduced monthly payments over an extended period, giving the business breathing space to recover while still providing creditors with better returns than liquidation might offer.

Preparing Your Pub for the Liquidation Process

If liquidation becomes inevitable for your pub, proper preparation can make the process smoother and potentially improve outcomes for all involved. Taking the right steps before appointing a liquidator helps protect your position as a director while ensuring the most efficient handling of the business closure.

Gathering comprehensive financial documentation is essential. This includes at least three years of accounts, management information, bank statements, creditor and debtor lists, and details of all assets owned by the business. Having this information readily available helps the liquidator assess the situation quickly and accurately, potentially reducing professional fees and speeding up the process.

Asset inventory requires particular attention. Pub businesses often accumulate substantial fixtures, fittings, and equipment over the years. Creating a detailed list with estimated values and proof of ownership helps the liquidator maximise realisations. Remember to include less obvious assets such as intellectual property (including your pub name and logo), website domains, and social media accounts. Fixtures and fittings in pubs often have substantial book value but realise much less in liquidation scenarios. Bespoke bar installations, branded furniture, and specialised catering equipment typically sell at significant discounts to their original cost.

Staff communication planning is particularly important in the pub sector, where employees often have close relationships with customers. Developing a clear communication strategy for when the liquidation is announced helps maintain dignity and respect through a difficult process. Remember that employees become preferential creditors for certain claims, including unpaid wages and holiday pay.

Customer management also requires careful consideration. Regular patrons may have substantial emotional investment in your pub, and news of closure can spread quickly in local communities. Planning how and when to communicate with customers helps maintain goodwill and manage the pub’s final trading period more effectively.

Stock management presents specific challenges for pubs entering liquidation. Alcoholic beverages subject to duty might have specific requirements for disposal or transfer. Some suppliers may have retention of title clauses allowing them to reclaim unpaid-for stock. Understanding these obligations before liquidation helps avoid complications later.

Personal Financial Protection During Pub Liquidation

When your pub business enters liquidation, the separation between business and personal finances becomes critically important. Understanding how to protect your personal position while fulfilling your responsibilities as a director is essential for navigating this challenging period.

Personal guarantees represent the most significant risk to pub owners’ personal finances. These are commonly required by breweries, landlords, equipment finance companies, and banks when extending credit to pub businesses. When the company enters liquidation, these guarantees become directly enforceable against your personal assets. Identifying all personal guarantees early in the process allows for proactive management rather than reactive crisis handling.

Director’s loan accounts require careful scrutiny before liquidation. If you have taken money from the business that was classified as a loan rather than salary or dividends, this creates a director’s loan account that becomes payable to the company (and therefore its creditors) upon liquidation. Conversely, if you’ve lent money to the business, you become a creditor in the liquidation process, though often with lower priority than secured creditors.

Joint homeownership considerations are vital if your family home might be at risk due to personal guarantees or other business liabilities. Understanding how joint ownership works and potentially restructuring assets before financial distress becomes acute can sometimes help protect family homes, though any transfers made to deliberately avoid creditors can be reversed by liquidators.

Redundancy entitlements often surprise pub owners who are also employees of their companies. If you’ve been paying yourself through PAYE and meet certain criteria, you may be entitled to redundancy pay when your pub enters liquidation. This can provide valuable financial support during the transition period following business closure. The average claim for director redundancy is around £9,000, providing a potential financial cushion during the transition period.

Tax implications of liquidation can be complex. Depending on how the business was structured and closed, various tax liabilities or reliefs might apply. These could include capital gains tax considerations, business asset disposal relief (formerly entrepreneurs’ relief), and potential income tax implications for distributions received during the liquidation process.

Life After Pub Liquidation

The closure of your pub through liquidation marks the end of one chapter, but it doesn’t define your entire professional future. Many pub owners go on to successful careers within or outside the hospitality sector after navigating the liquidation process.

Professional restrictions following liquidation are more limited than many directors fear. Unless you’re subject to a disqualification order due to misconduct, you remain free to start another business or take up a directorship elsewhere. The main restriction relates to using the same or similar name as your liquidated pub business for five years without court permission or meeting specific exemption criteria.

Industry reentry strategies vary depending on your circumstances and aspirations. Some former pub owners choose to remain in the sector but in employed roles with large pub chains, bringing valuable operational experience without the financial risks of ownership. Others pursue consulting roles, helping other hospitality businesses avoid the difficulties they experienced. The insights gained from running a pub – even one that ultimately didn’t succeed – provide valuable experience that many organisations value.

Environmental considerations can sometimes create unexpected complications during pub liquidations. Older pub buildings may contain asbestos, particularly in ceiling tiles, insulation, and pipe lagging. Underground fuel storage tanks present another potential environmental concern in some rural pubs. Grease traps and drainage systems in pub kitchens can also create environmental complications that may require specialist cleaning before premises can be surrendered.

Modern pubs rely increasingly on technology systems that require specific consideration during liquidation. EPOS systems and other hardware often operate under lease agreements rather than outright ownership. Customer data represents both an asset and a potential liability, subject to GDPR regulations even during liquidation. Social media accounts and online presence also require management, as pub businesses often build substantial followings that may have value.

Emotional recovery deserves as much attention as financial and professional considerations. Business failure can trigger grief, loss of identity, and damaged confidence. Acknowledging these emotional impacts and seeking appropriate support helps create a foundation for future success. The hospitality sector remains dynamic and continues to offer opportunities for those with passion and insight. While the traditional pub model faces challenges, innovations in the broader hospitality and leisure sectors create new niches where experienced operators can thrive.