Understanding the Company Liquidation Process: Essential Steps for UK Firms

Introduction To Company Liquidation

Company liquidation is a critical process for businesses facing financial difficulties or those wishing to close voluntarily. It involves winding up a company’s affairs and dissolving it as a legal entity.

Definition and Purpose of Liquidation

Liquidation refers to the formal procedure of closing down a limited company. Its primary purpose is to sell off the company’s assets, settle business debts with creditors, and distribute any remaining funds to shareholders. This process can be voluntary, where directors choose to wind up the business, or compulsory, initiated by creditors or courts.

Liquidation serves several purposes. It provides a structured way to end a company’s operations, ensuring all legal obligations are met. For struggling businesses, it offers a way to address insolvency and protect creditors’ interests. It can also be used to close solvent companies that are no longer needed.

Legal Framework Governing Liquidation in the UK

The UK’s legal framework for company liquidation is primarily set out in the Insolvency Act 1986 and the Companies Act 2006. These laws outline the procedures, rights, and responsibilities of all parties involved in the liquidation process.

Key aspects of the legal framework include:

- The appointment of licensed Insolvency Practitioners as liquidators

- Statutory order of creditor payment

- Directors’ duties and potential liabilities

- Protection of employees’ rights

The framework also defines different types of liquidation, such as Creditors’ Voluntary Liquidation (CVL) and Compulsory Liquidation. Each type has specific rules and procedures that must be followed to ensure a lawful and orderly winding up of the company.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

Types of Company Liquidation

Company liquidation in the UK takes three main forms, each suited to different business circumstances and financial situations. Understanding these options is crucial for directors and shareholders facing potential insolvency or voluntary closure.

Creditors’ Voluntary Liquidation (CVL)

CVL is the most common type of liquidation for insolvent companies. You initiate this process when your company can’t pay its debts and you choose to involve creditors in the liquidation. Here’s what you need to know:

- Directors can propose CVL, but shareholders must agree

- An insolvency practitioner is appointed as liquidator

- Creditors have significant input in the process

- Assets are sold to repay debts in order of priority

- The company is struck off the register after liquidation

CVL offers a structured way to close your insolvent business, protecting you from wrongful trading accusations if handled properly.

Compulsory Liquidation

This type occurs when creditors force your company into liquidation through a court order. Key points include:

- Usually initiated by creditors owed £750 or more

- Court appoints an official receiver as liquidator

- Directors lose control of the company

- Investigations into directors’ conduct are standard

- Can result from unpaid taxes or CCJs

Compulsory liquidation is often seen as a last resort and can have serious implications for directors’ future business activities.

Members’ Voluntary Liquidation (MVL)

MVL is for solvent companies that wish to close voluntarily. This option is suitable when:

- Your company can pay all debts within 12 months

- Shareholders agree to wind up the business

- You want to extract funds tax-efficiently

- The company has reached the end of its useful life

Directors must swear a declaration of solvency. An insolvency practitioner is appointed to realise assets and distribute funds to shareholders. MVL can be a tax-efficient way to close a solvent company, particularly for retiring directors or those looking to claim Entrepreneurs’ Relief.

The Liquidation Process Step-By-Step

Liquidating a company involves several key stages, from the initial decision to wind up operations through to the final dissolution. Each phase requires careful management and adherence to legal procedures.

Initial Assessment and Decision-Making

When your company faces financial difficulties, you must first evaluate its viability. Consult with financial advisors and review your accounts thoroughly. If recovery seems unlikely, liquidation may be the best option.

Consider all alternatives, such as restructuring or seeking additional funding. Weigh the pros and cons of each option carefully.

Once you decide to liquidate, hold a board meeting to formally agree on this course of action. Document this decision in the company minutes.

Appointment of a Licensed Insolvency Practitioner

Selecting a qualified insolvency practitioner (IP) is crucial. Research potential IPs and arrange consultations to find the best fit for your situation.

The IP will guide you through the liquidation process and handle most of the legal requirements. They’ll assess your company’s financial position and advise on the most appropriate type of liquidation.

You’ll need to provide the IP with all relevant financial documents and information about your company’s assets and liabilities.

Notification to Creditors and Stakeholders

Your IP will notify all known creditors of the liquidation. This includes suppliers, lenders, and HMRC. They’ll send a formal notice outlining the situation and inviting creditors to submit claims.

Inform your employees about the liquidation. The IP will explain their rights and any redundancy procedures.

You must also notify Companies House and any other relevant regulatory bodies.

Realisation and Distribution of Assets

The IP will take control of the company’s assets and begin the process of selling them. This may include:

- Inventory

- Equipment

- Property

- Intellectual property

They’ll aim to get the best possible price for these assets.

Once assets are sold, the IP distributes the funds to creditors according to a legally defined order of priority. Secured creditors are typically paid first, followed by preferential creditors (e.g., employees), and then unsecured creditors.

Final Reporting and Dissolution

The IP prepares a final report detailing all actions taken during the liquidation. This includes:

- Assets realised

- Distributions made

- Reasons for the company’s failure

They’ll send this report to creditors and Companies House.

Once all matters are settled, the IP applies to have the company struck off the register. Companies House will then publish a notice of the company’s dissolution in the Gazette.

After a short period, assuming no objections, your company will be officially dissolved and cease to exist as a legal entity.

Liquidation Process – Quick CVL Example

Legal Obligations and Director Responsibilities

Directors face crucial legal duties when a company enters liquidation. These responsibilities extend beyond normal business operations and carry serious consequences if not handled properly.

Duties During Insolvency

When a company becomes insolvent, directors must prioritise creditors’ interests over shareholders’. You’re obligated to minimise potential losses to creditors and avoid taking actions that could worsen the company’s financial position.

Key duties include:

- Ceasing trading if there’s no reasonable prospect of avoiding insolvency

- Seeking professional advice from insolvency practitioners

- Providing full and accurate information to the liquidator

- Cooperating fully with the liquidation process

You must hand over all company assets, records and paperwork to the appointed liquidator. Failure to comply can result in personal liability or legal action.

Consequences of Wrongful Trading

Wrongful trading occurs when directors continue to operate a company despite knowing it can’t avoid insolvency. This can lead to serious repercussions:

- Personal liability for company debts

- Fines or legal action against directors

- Requirement to contribute to the company’s assets

To avoid wrongful trading allegations, keep detailed records of decisions and seek professional advice early. Document your rationale for continuing to trade if you believe the situation can improve.

Director Disqualification Risks

Directors found guilty of misconduct during insolvency proceedings may face disqualification. This can last up to 15 years, preventing you from acting as a director or being involved in company management.

Grounds for disqualification include:

- Failing to keep proper accounting records

- Continuing to trade when the company is insolvent

- Failing to file accounts or returns with Companies House

- Using company money or assets for personal benefit

To mitigate these risks, maintain thorough documentation of your actions and decisions throughout the liquidation process. Seek legal advice if you’re unsure about your responsibilities or potential liabilities.

Impact On Employees And Creditors

Company liquidation significantly affects both employees and creditors. The process triggers important legal rights and obligations that can have lasting financial consequences.

Employee Rights And Redundancy Payments

When a company enters liquidation, employees are automatically dismissed. You have the right to claim redundancy pay if you’ve worked for the company for at least two years. This includes:

- Up to £571 per week for each year of service (as of April 2024)

- A maximum of 20 years’ service can be claimed

- Payments are age-dependent: 0.5 week’s pay per year under 22, 1 week’s pay for ages 22-41, and 1.5 week’s pay for 42 and over

You can also claim arrears of wages up to £800, unpaid holiday pay, and notice pay. These claims are submitted to the Redundancy Payments Service, which typically pays within 6 weeks.

Creditor Claims And Payment Hierarchy

In liquidation, creditors are paid according to a strict hierarchy:

- Secured creditors (e.g. banks with charges over company assets)

- Preferential creditors (including employees for certain claims)

- Unsecured creditors (e.g. suppliers, customers)

- Shareholders

As an employee, you’re considered a preferential creditor for some claims, giving you priority over unsecured creditors. However, the amount you can recover depends on the company’s available assets.

To make a claim, you must submit a proof of debt form to the liquidator. Be aware that unsecured creditors often recover little or nothing in liquidation proceedings.

Alternatives to Liquidation

Businesses facing financial difficulties have several options besides liquidation. These alternatives can help companies restructure debts, improve cash flow, and potentially continue operations.

Company Voluntary Arrangements (CVAs)

CVAs offer struggling businesses a chance to restructure their debts whilst continuing to trade. This formal agreement between a company and its creditors allows for partial repayment of debts over an extended period.

You’ll need to propose a realistic repayment plan, typically spanning 3-5 years. If 75% of creditors approve, the CVA becomes legally binding on all unsecured creditors.

During a CVA, you retain control of your business but must adhere to the agreed terms. This option can provide breathing space to turn your company around whilst protecting it from legal action by creditors.

Administration as a Rescue Mechanism

Administration aims to rescue a company as a going concern or achieve a better result for creditors than immediate liquidation. An insolvency practitioner takes control of your business to restructure it or sell it as a whole.

You’ll benefit from a moratorium on creditor actions, giving your company valuable time to address its financial issues. The administrator may:

- Negotiate with creditors

- Sell unprofitable parts of the business

- Secure new investment

Administration can lead to a company voluntary arrangement, a pre-pack sale, or orderly wind-down if rescue proves impossible.

Informal Negotiations with Creditors

Before considering formal insolvency procedures, you might explore informal negotiations with your creditors. This approach can be quicker and less costly than formal alternatives.

You can propose:

- Extended payment terms

- Debt write-offs

- Reduced interest rates

To succeed, you’ll need to present a convincing case for your company’s viability. Prepare detailed financial information and a clear plan for addressing your debts.

Whilst informal agreements aren’t legally binding, they can provide flexibility and maintain better relationships with creditors. However, all creditors must agree, and you remain vulnerable to legal action if negotiations break down.

Checklist For Directors Considering Liquidation

Directors facing potential company liquidation must carefully evaluate their options and fulfil legal obligations. This checklist outlines key steps to consider when contemplating liquidation.

Evaluating Financial Health

Conduct a thorough assessment of your company’s financial position. Review balance sheets, cash flow statements, and profit and loss accounts. Compare assets against liabilities to determine solvency.

Calculate your debt-to-income ratio and evaluate your ability to meet upcoming financial obligations. Identify any overdue creditor payments or pending legal actions.

Consider engaging an independent financial advisor to provide an objective analysis. They can help you explore alternatives to liquidation, such as refinancing or restructuring.

Examine your company’s future prospects, including market conditions and potential for turnaround. Be realistic about growth projections and the likelihood of securing additional funding.

Seeking Professional Advice

Consult a licensed insolvency practitioner (IP) as soon as possible. They can provide expert guidance on your options and legal responsibilities.

Arrange meetings with your company’s accountant and solicitor to discuss the implications of liquidation. They can help you understand the tax consequences and potential legal liabilities.

Consider seeking advice from business turnaround specialists. They may offer strategies to avoid liquidation or minimise its impact.

Ensure you document all consultations and advice received. This demonstrates your commitment to acting in the best interests of creditors and shareholders.

Communicating With Stakeholders

Prepare a communication plan for employees, suppliers, customers, and shareholders. Be transparent about the company’s situation whilst maintaining confidentiality where necessary.

Schedule meetings with key creditors to discuss potential repayment plans or negotiate debt settlements. This may help avoid forced liquidation.

Inform your bank and other financial institutions about the company’s financial difficulties. They may offer support or alternative arrangements.

Consider appointing a spokesperson to handle media enquiries if your company’s situation is likely to attract public attention.

Maintaining Compliance And Records

Ensure all statutory records and accounts are up-to-date and accurately maintained. This includes financial statements, tax returns, and Companies House filings.

Review all ongoing contracts and lease agreements. Identify any early termination clauses or penalties that may apply in the event of liquidation.

Safeguard company assets and avoid any transactions that could be seen as preferential or undervalued. These may be challenged during the liquidation process.

Document all board meetings and decisions related to the company’s financial situation. Keep detailed records of efforts made to improve the company’s position.

Familiarise yourself with directors’ duties under the Insolvency Act 1986. Be aware of potential personal liability for wrongful trading if you continue to operate an insolvent company.

How Anderson Brookes Can Assist

Anderson Brookes offers comprehensive liquidation services for UK businesses facing closure. Our experienced team provides expert guidance through every step of the liquidation process, ensuring compliance and maximising outcomes for all parties involved.

Our Expertise in Company Liquidation

Anderson Brookes specialises in voluntary liquidation, offering a full range of services to wind up your company’s affairs efficiently. Our licensed insolvency practitioners have extensive experience handling complex liquidations across various industries. We can place a business into liquidation within 8 days, which is often of key importance for company directors. Our IPs:

- Assess your company’s financial situation

- Advise on the most appropriate liquidation route

- Handle all legal paperwork and regulatory filings

- Manage creditor communications and negotiations

- Oversee asset valuation and disposal

- Distribute proceeds to creditors

We stay up-to-date with the latest insolvency regulations, ensuring your liquidation process complies with all legal requirements and runs smoothly.

Free Consultations and Tailored Solutions

You can benefit from Anderson Brookes’ free initial consultation to discuss your company’s situation. We will:

- Review your financial records

- Explain liquidation options and alternatives

- Address your concerns about personal liability

- Outline potential outcomes for creditors and employees

Based on this assessment, we develop a tailored liquidation plan suited to your specific circumstances. Our flexible approach ensures you receive the most appropriate solution for your business’s needs.

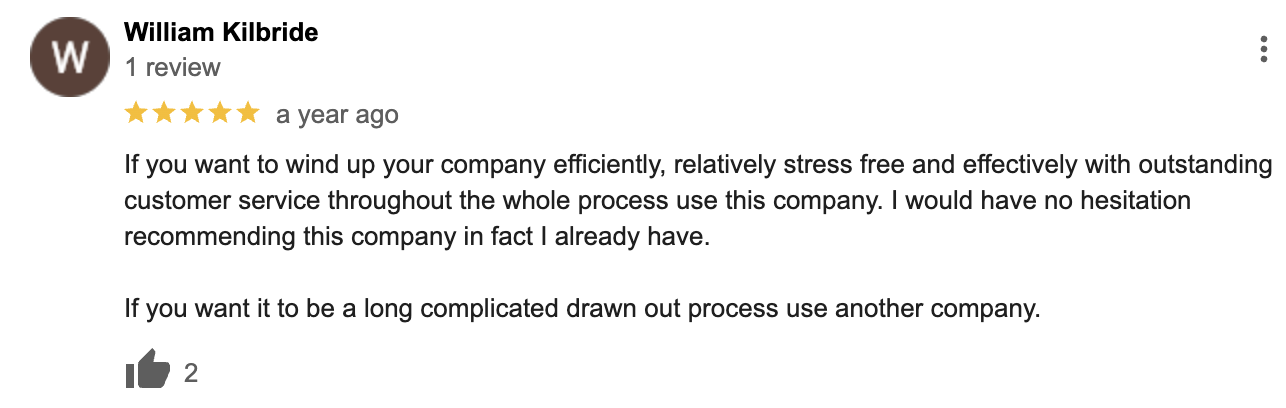

Success Stories and Client Testimonials

Anderson Brookes has a proven track record of successfully guiding businesses through liquidation – we have helped thousands of company directors! Our clients frequently praise our:

- Clear communication throughout the process

- Cost effective fees and structure

- Compassionate approach to sensitive situations

- Efficiency in completing liquidations promptly

Liquidation Google Reviews

&

Frequently Asked Questions

Company liquidation raises many important questions for business owners and stakeholders. The following addresses some of the most common queries about the liquidation process in the UK.

What are the implications for directors when a company enters liquidation?

When a company enters liquidation, directors lose control over the business. You must cease trading immediately and hand over all company records and assets to the appointed liquidator.

Your conduct leading up to the insolvency may be investigated. If found guilty of wrongful trading or other misconduct, you could face personal liability or disqualification.

What are common grounds for a company being put into liquidation?

Insolvency is the primary reason for liquidation. This occurs when a company cannot pay its debts as they fall due or when liabilities exceed assets.

Other grounds include shareholder disputes, retirement of key personnel, or strategic business decisions to close operations.

Could you detail the sequential steps involved in the liquidation process?

The liquidation process typically follows these steps:

- Decision to liquidate

- Appointment of a liquidator

- Cessation of trading

- Asset valuation and sale

- Debt collection

- Creditor claims assessment

- Distribution of funds

- Company dissolution

What is the most cost-effective method to liquidate a company?

Creditors’ Voluntary Liquidation (CVL) is often the most cost-effective method for insolvent companies. It allows directors to initiate the process without court involvement.

For solvent companies, Members’ Voluntary Liquidation (MVL) can be tax-efficient and straightforward.

Is it possible for someone to become a director again after their company has been liquidated?

Yes, you can become a director again after liquidation, unless disqualified. Disqualification typically occurs if you’re found guilty of misconduct or unfit to manage a company.

The disqualification period can range from 2 to 15 years, depending on the severity of the misconduct.

What occurs to employees’ positions when a company is liquidated?

In liquidation, employees are usually made redundant. You’re entitled to claim for unpaid wages, holiday pay, and statutory redundancy from the National Insurance Fund.

The liquidator will provide necessary information and assist with claim forms. Employees become preferential creditors for certain claims.