Facing liquidation as a company director can be an overwhelming experience, and you may find that it takes a toll on both your personal and professional life. Understanding what happens during liquidation can help to make the process simpler and smoother.

In this guide, we’ll explain the director’s role in company liquidation, outline key legal responsibilities, and walk through the potential outcomes and implications of the process. Our goal is to give you the knowledge you need to navigate this period and to safeguard your future.

What are the types of liquidation process?

Before we move onto exploring the role of a director, we need to have a firm grounding in the different kinds of company liquidation. Each of these processes involves winding up the business, ceasing trading activities, selling company assets and distributing the proceeds to creditors. However, there are some crucial differences that you need to know.

The main types of liquidation are:

- Creditors’ Voluntary Liquidation (CVL): This is initiated by directors when a company is insolvent.

- Compulsory Liquidation: A court-ordered process that is typically triggered by a creditor’s petition.

- Members’ Voluntary Liquidation (MVL): Used by solvent companies to close operations and distribute remaining assets to shareholders.

In this guide, we’ll focus primarily on CVL and compulsory liquidation, either of which may apply in scenarios where a company cannot meet its financial obligations.

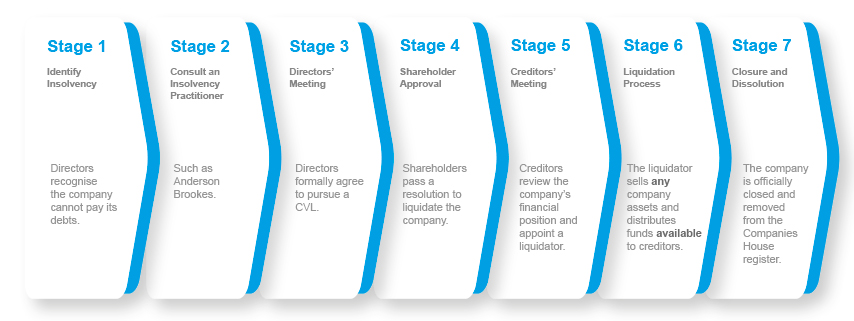

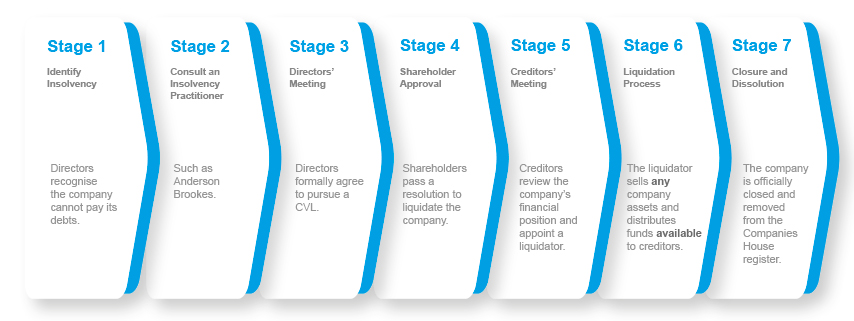

Starting the process of liquidation

CVLs and compulsory liquidations both arise when a company is insolvent. This situation is more common than you may think, with 23,872 registered company insolvencies in the UK in 2024 alone.

As a director, it’s important to take swift and decisive action when it becomes clear that your company is insolvent. Doing so helps to prevent further damage to the company’s financial position. Here’s what you need to do:

- Stop trading immediately: Ceasing all business activity helps prevent further losses and demonstrates responsible conduct.

- Seek professional advice: Contacting a licensed insolvency practitioner (IP), such as the team at Anderson Brookes, is one of the most important steps. We will assess your situation and guide you through the appropriate liquidation route.

- Prepare a Statement of Affairs: This document details the company’s assets, liabilities, and creditors. It helps the IP understand the company’s financial position.

- Provide full access to records: Directors must hand over all company documentation, including financial records, contracts, tax filings, payroll information, and bank statements.

Remember: failing to carry out these responsibilities can lead to serious legal and financial consequences.

Voluntary Liquidation Example

At Anderson Brookes, we can place a company into liquidation within 8 days of instruction.

Contact us today for confidential advice.

What is the role of an insolvency practitioner?

Insolvency practitioners are licensed professionals who are authorised to advise on and manage insolvency procedures for both companies and individuals. In the UK, we are regulated by bodies such as ICAEW, IPA or the Insolvency Service.

An IP assesses the financial health of a business, including its debts, assets and ability to pay creditors. This enables us to offer guidance to directors regarding their legal duties and the options available to them, including liquidation. Liquidation can either be started by the directors themselves (a CVL) or by a petition from a creditor or court (compulsory liquidation).

Once this process begins, an insolvency practitioner will be appointed. Our role is to act as liquidator and assumes control of the company. Our responsibilities include:

- Realising company assets (e.g. property, stock, equipment)

- Distributing proceeds to creditors in order of priority

- Investigating the conduct of directors in the lead-up to insolvency

- Reporting to the Insolvency Service on whether any misconduct has occurred

The IP’s investigation is especially significant. If the directors are found to have acted improperly, further action may be taken.

What are the legal obligations of a director during liquidation?

Company directors face strict legal requirements during the liquidation process. They must comply with specific duties under the Insolvency Act 1986 to avoid personal liability, disqualification, or criminal sanctions.

Acting in the interests of creditors

Once a company enters liquidation, the primary duty of a director is to act in the interests of creditors rather than those of shareholders. This means every decision and action must consider the best interests of those to whom the company owes money.

Accurate and complete financial records

Directors are legally required to maintain accurate and up-to-date financial records both before and during insolvency. Proper records help to establish what has happened in the company’s final period and are essential for the liquidator’s investigation. If records are found to be lacking, directors can face penalties or even be disqualified.

Filing documentation

Directors must file all necessary documentation with the liquidator and Companies House promptly. This may include lists of creditors, debtor schedules, employee claims, and outstanding contracts. Liquidators depend on full and timely documentation to carry out their duties and report on directors’ conduct.

Can a director become personally liable for company debts?

Although limited companies offer protection from personal liability, this protection is not absolute. In some circumstances, a director may hold personal liability for company debts during the liquidation process. We will run through some of these circumstances below.

Personal guarantees

A personal guarantee is a formal agreement where a director agrees to repay specific company debts if the business cannot. These are common requirements for bank loans, supplier credit, and lease agreements. If the company enters liquidation and cannot meet its obligations, the creditor may enforce the personal guarantee.

- Personal guarantees are legally binding and are not automatically cancelled by company liquidation.

- The director’s personal assets, such as property or savings, may be at risk.

- If multiple directors have signed, liability may be “joint and several”, meaning creditors can pursue any or all signatories for the full amount.

Director’s loan accounts

If a company director has withdrawn more from the company than they have paid in, this creates an overdrawn loan position. During liquidation, the liquidator reviews these accounts to determine if money is owed back to the company. An overdrawn director’s loan account is treated as a company asset and the liquidator will typically require immediate repayment.

- Directors cannot write off the loan—they are personally liable for repayment.

- Failure to repay may lead to legal action or bankruptcy proceedings.

- If the director cannot pay, settlement options such as instalments or asset realisation may be considered by the liquidator.

Wrongful or fraudulent trading

Directors can be held personally liable if they continue trading when they knew (or ought to have known) that the company was insolvent. This is known as wrongful trading. An IP will examine the period leading up to liquidation to determine if this occurred. If proven, the court can order directors to contribute to the company’s debts.

Fraudulent trading may also result in personal liability. This is where a director knowingly attempts to defraud the company’s creditors. It is a criminal offence and can result in fines, disqualification, and even imprisonment.

Can a director be disqualified during the liquidation process?

Director disqualification is a legal process that can impact individuals who have failed in their duties during company liquidation. Disqualified directors face serious restrictions on future business activities and must comply with public oversight mechanisms.

It is relatively rare, affecting around 1,200 directors in the UK each year. However, the consequences are severe: if disqualified, you could be banned from holding the directorship of a company for up to 15 years.

Reasons why a director may be disqualified include:

- Failing to maintain proper company accounts

- Not submitting tax returns or payments

- Trading while insolvent

- Failing to cooperate with the liquidator

Disqualification not only impacts your ability to act as a director but also affects your professional reputation and future business opportunities.

Redundancy for directors

If you are a director who also worked for the company under a formal contract and were paid through PAYE, you may be eligible for statutory redundancy pay and other employee entitlements. These could include:

- Redundancy pay

- Holiday pay

- Notice pay

- Unpaid wages

Claims are typically made through the Redundancy Payments Service (RPS). An insolvency practitioner can help determine your eligibility and guide you through the claims process.

Future prospects and restrictions for directors

After your company enters liquidation, it’s natural to wonder what happens next. Will you be able to set up a new business in the future? The answer is (usually) yes – directors are not automatically barred from starting or running other businesses after their company has gone into liquidation.

However, it’s essential for company directors to seek specialist legal and insolvency advice if they are considering re-entering business after liquidation. Professional advice can clarify the director’s rights and obligations, reduce the risk of unintentional misconduct, and help with compliance.

Restrictions may apply to directors, particularly in instances of wrongful or fraudulent trading. Additionally, there are specific limitations around trading names to prevent phoenixing.

Phoenixing refers to closing a company and opening a new one with a similar name. This practice is tightly regulated in the UK to prevent misleading creditors and customers, though you may be able to do so if:

- The new company buys the business and name from the liquidator

- You obtain court permission

- The name has been used continuously for at least 12 months before liquidation by a company that was not dormant

Sectors We Support

We support company directors in every sector, from construction firms and logistics companies to pubs, cafés, restaurants, hotels, retailers and manufacturers. Our advice is always clear, confidential and shaped by real experience in your industry. Whether you’re dealing with unpaid tax, supplier pressure or falling income, our team understands the challenges and will guide you through the best next steps.

5 practical steps for directors

Liquidation can be daunting, but there are steps directors can take to minimise the impact and protect their future. Here are our five tips:

- Document decisions: Keep clear records of all financial decisions and actions taken.

- Communicate with creditors: Be transparent and cooperative throughout the process.

- Work closely with the IP: Honesty and full disclosure are essential.

- Consider your future plans: Seek legal and financial advice on your options after liquidation.

- Review personal finances: Assess your exposure to personal guarantees and explore ways to manage any resulting liabilities.

How Anderson Brookes can help

At Anderson Brookes, we understand how stressful company liquidation can be for directors. Our team of experienced insolvency specialists can:

- Assess your company’s financial position

- Explain your options clearly and confidentially

- Support you through Creditors’ Voluntary Liquidation

- Help you minimise legal and financial risks

- Assist with redundancy claims and future planning

We pride ourselves on providing practical, empathetic advice tailored to your unique situation.

Frequently asked questions

Can I start a new company after liquidation?

Yes, but restrictions apply to using the same or similar name. Disqualified directors, however, may be unable to start a new company for up to 15 years.

Will I lose my home or personal assets?

Personal assets are usually protected when closing down a limited company. Exceptions to this rule are if you’ve given personal guarantees or have acted improperly.

How long does liquidation take?

The process can take several months, depending on the complexity of the company’s affairs.

What happens to company debts?

Unsecured debts are written off once assets are distributed, but personally guaranteed debts remain the director’s responsibility.

Can I still be a director in another company if I filed for liquidation?

Yes, unless you have been disqualified. Many directors go on to successfully run other businesses.

If your company is facing financial difficulties, don’t wait until it’s too late. Contact Anderson Brookes today for expert, confidential advice tailored to your situation.