What Is an Insolvency Practitioner: Key Roles

Overview

What is an Insolvency Practitioner?

An Insolvency Practitioner (IP) is a licensed professional authorised to act on behalf of companies and individuals facing financial difficulties or insolvency. These specialists serve as the official mechanism for resolving debt problems, working to minimise the negative impact on all parties involved. IPs can assist directors of both insolvent companies struggling with debt and solvent companies looking to close down and distribute profits efficiently. Most commonly, company directors voluntarily approach an IP when facing financial challenges, though in cases of compulsory liquidation, the courts may appoint an Official Receiver who might later request an IP’s involvement.

The role requires significant expertise in both financial matters and insolvency legislation. IPs provide crucial guidance during difficult periods, helping business owners understand their options and legal obligations.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

Insolvency Practitioner – Google Review

When to Use an Insolvency Practitioner

Is an Insolvency Practitioner the Same as a Liquidator?

No, a liquidator is just one of several roles an Insolvency Practitioner may assume. When working with limited companies, IPs typically take on three primary functions:

Liquidator: In this capacity, the IP handles both solvent and insolvent liquidations. Their responsibilities include:

- Realising company assets

- Distributing proceeds appropriately to creditors in insolvent cases

- Distributing funds to directors and shareholders in solvent liquidations (MVLs)

Administrator: When appointed as an administrator, the IP manages:

- Company administration processes

- Pre-pack administration arrangements

- Working towards better outcomes for creditors

- Arranging company sales or facilitating orderly business closures

Nominee and Supervisor: For Company Voluntary Arrangements (CVAs), the IP serves in dual roles:

- As nominee: Creating viable proposals and producing Statements of Affairs

- As supervisor: Overseeing the agreement throughout its duration and monitoring business performance

Each role requires specific expertise and follows different procedural requirements depending on the company’s circumstances.

What Qualifications Does an Insolvency Practitioner Have?

Insolvency Practitioners must possess rigorous qualifications beyond standard accountancy credentials. While many IPs come from accountancy backgrounds and hold qualifications such as ACCA, ACA or CIMA, these alone are insufficient for practising insolvency work.

To become a licensed IP, professionals must pass the Joint Insolvency Examination Board (JIEB) examinations. This challenging assessment consists of two papers covering:

- Personal insolvency law

- Corporate insolvency law

- Application of knowledge to real-world scenarios

The JIEB exams are renowned for their difficulty, requiring an in-depth working understanding of insolvency legislation and practice. Only those with comprehensive knowledge and practical experience tend to succeed.

When seeking insolvency assistance, it’s vital to verify that you’re dealing with a properly licensed practitioner. Some advisory firms lack in-house licensed IPs and merely refer cases elsewhere while charging referral fees. Always confirm you’re speaking directly with a firm employing licensed practitioners to avoid unnecessary costs.

Are Insolvency Practitioners Regulated?

Yes, Insolvency Practitioners operate under strict regulation. In the UK, insolvency work is governed by the Insolvency Act 1986, which establishes the legal framework for all insolvency proceedings. IPs must adhere to these regulations and are subject to regular inspections from their authorising professional body.

Several recognised professional organisations oversee IPs, including:

- The Insolvency Practitioners Association (IPA)

- The Institute of Chartered Accountants in England and Wales (ICAEW)

- The Institute of Chartered Accountants of Scotland (ICAS)

While these different bodies license practitioners, all maintain identical standards regarding professional performance and conduct. This regulatory framework ensures that all IPs work to the same high standards, providing protection for businesses and individuals using their services.

The strict regulation helps maintain confidence in the insolvency system and ensures that practitioners act in the best interests of all parties involved in insolvency proceedings.

How Much Does an Insolvency Practitioner Cost?

The fees for insolvency services vary depending on the complexity of your case, the procedure required, and the time commitment involved. For straightforward cases, you can expect these approximate costs:

| Procedure | Typical Cost Range |

|---|---|

| Creditors’ Voluntary Liquidation (CVL) | Around £5,000 |

| Members’ Voluntary Liquidation (MVL) | Slightly less than a CVL |

| Company Voluntary Arrangement (CVA) | Higher, with ongoing monthly fees |

| Administration | More time-intensive, generally higher fees |

Voluntary Liquidation Process Example – 7 Steps

Anderson Brookes can place a company into liquidation within 8 days

CVAs and administrations typically cost more than straightforward liquidations because they require continuous supervision and management over extended periods. With CVAs, an ongoing monthly supervisor’s fee applies, though this is incorporated into the payment structure agreed with creditors. Importantly, creditors must approve these fees as they directly affect the funds available for distribution.

Company assets usually finance insolvency procedures, but in cases where insufficient funds exist (particularly in CVLs), directors might need to contribute personal capital or find alternative funding sources. It’s advisable to discuss fee structures transparently with your chosen IP before proceeding.

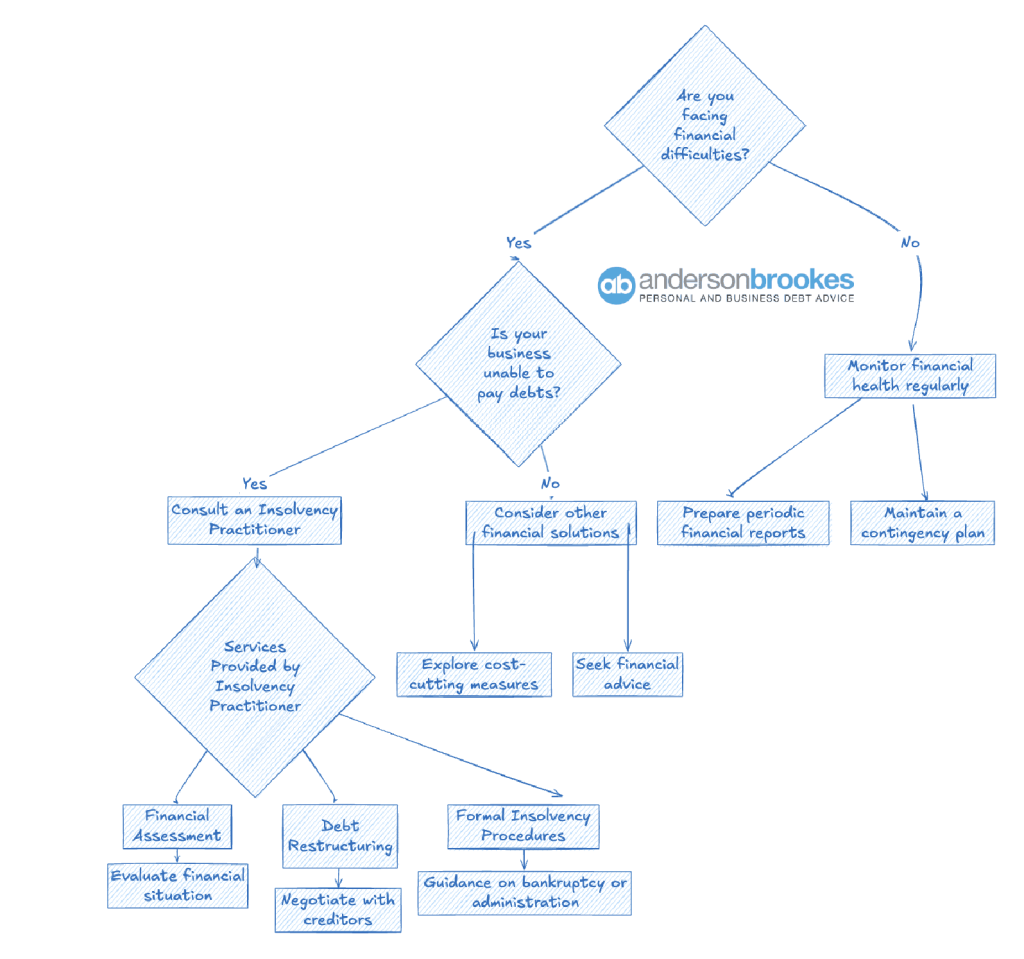

When Should I Contact an Insolvency Practitioner?

The optimal time to seek an Insolvency Practitioner’s advice is at the first signs of financial difficulty, not when your situation becomes critical. Early intervention provides significantly more options for business rescue and recovery.

Early warning signs that warrant IP consultation include:

- Consistent cash flow problems

- Difficulty meeting tax obligations

- Mounting creditor pressure

- Missed supplier payments

- Declining profit margins

By approaching an IP during these initial stages of distress, you maximise your company’s survival chances. Early consultation allows for a wider range of solutions, such as:

- Informal negotiations with creditors

- Time to Pay arrangements with HMRC

- Company Voluntary Arrangements

- Restructuring options

Waiting until your financial situation deteriorates further typically limits your choices, often leaving liquidation as the only viable option. Remember that consulting an IP doesn’t automatically mean your business will close – many practitioners specialise in business rescue and can help identify sustainable paths forward.

Can My Choice of Insolvency Practitioner Be Changed?

Yes, your choice of Insolvency Practitioner can be changed, though the process differs depending on the stage of proceedings. Creditors have significant influence in this regard and can remove or replace an IP during a decision procedure. Before formal appointment, creditors vote on the proposed practitioner, and if they decide against your selection, they must nominate an alternative liquidator or administrator.

Frequently Asked Questions

What duties does an insolvency practitioner carry out?

An insolvency practitioner (IP) performs numerous essential functions when managing financial distress situations. They assess the financial position of struggling businesses or individuals, determining the most appropriate course of action. IPs handle formal proceedings such as liquidations, administrations, and voluntary arrangements.

Their responsibilities include realising and distributing assets to creditors, investigating the causes of insolvency, and sometimes pursuing claims against directors for wrongful trading. They must also maintain detailed records and provide regular reports to creditors and regulatory authorities.

How can one qualify as an insolvency practitioner in the UK?

Becoming an IP in the UK requires completing a rigorous qualification process. You must first obtain the Joint Insolvency Examination Board (JIEB) qualification, which involves passing challenging examinations covering various aspects of insolvency law and practice.

Before sitting these exams, you typically need several years of relevant experience working in insolvency. After passing, you must secure authorisation from a recognised professional body such as the Insolvency Practitioners Association, Institute of Chartered Accountants, or Insolvency Service.

The process typically takes 5-10 years of dedicated study and practical experience. Continuing professional education is mandatory to maintain your licence.

What distinguishes an insolvency practitioner from an administrator?

An insolvency practitioner is the broader professional qualification, while an administrator represents one specific role an IP might undertake. All administrators must be licensed IPs, but not all IPs work as administrators.

When appointed as an administrator, an IP takes control of a company through a formal administration procedure with the specific aim of rescuing the business as a going concern. Their powers and duties are defined by the administration order.

IPs can take on various other roles beyond administration, including liquidator, trustee in bankruptcy, supervisor of voluntary arrangements, and receiver.

How are insolvency practitioner fees structured and determined?

IP fees typically follow one of three structures: time-cost basis, fixed fee, or percentage of assets realised. Most commonly, IPs charge hourly rates that vary based on seniority and complexity of the case.

Fees must be approved by creditors or the court before payment. For time-cost arrangements, IPs must provide detailed breakdowns of time spent and tasks completed. The approving body can challenge fees they consider excessive.

In cases with limited assets, IPs might work under a fixed fee arrangement or sometimes at risk if insufficient assets exist to cover their costs.

What are the responsibilities of a personal insolvency practitioner?

Personal insolvency practitioners specialise in helping individuals facing financial difficulties rather than companies. They advise on options including Individual Voluntary Arrangements (IVAs), bankruptcy, and Debt Relief Orders.

When managing an IVA, they negotiate with creditors to establish affordable repayment plans and then supervise these arrangements. In bankruptcy cases, they assess and realise assets, distribute funds to creditors, and investigate the bankrupt’s affairs.

They must balance their duties to both the debtor and creditors while ensuring compliance with insolvency regulations and ethical standards.

Is it necessary to be a chartered accountant to work as an insolvency practitioner?

No, you don’t need to be a chartered accountant to become an insolvency practitioner, though many IPs do come from accounting backgrounds. The essential requirement is passing the JIEB examinations and securing authorisation from a recognised regulatory body.

Professionals from legal backgrounds can also qualify as IPs. The focus is on demonstrating thorough knowledge of insolvency legislation and procedures rather than specific prior qualifications.

What matters most is obtaining relevant experience in insolvency work and passing the required examinations. Various routes exist for gaining the necessary experience, including working directly for insolvency firms or in related financial or legal roles.