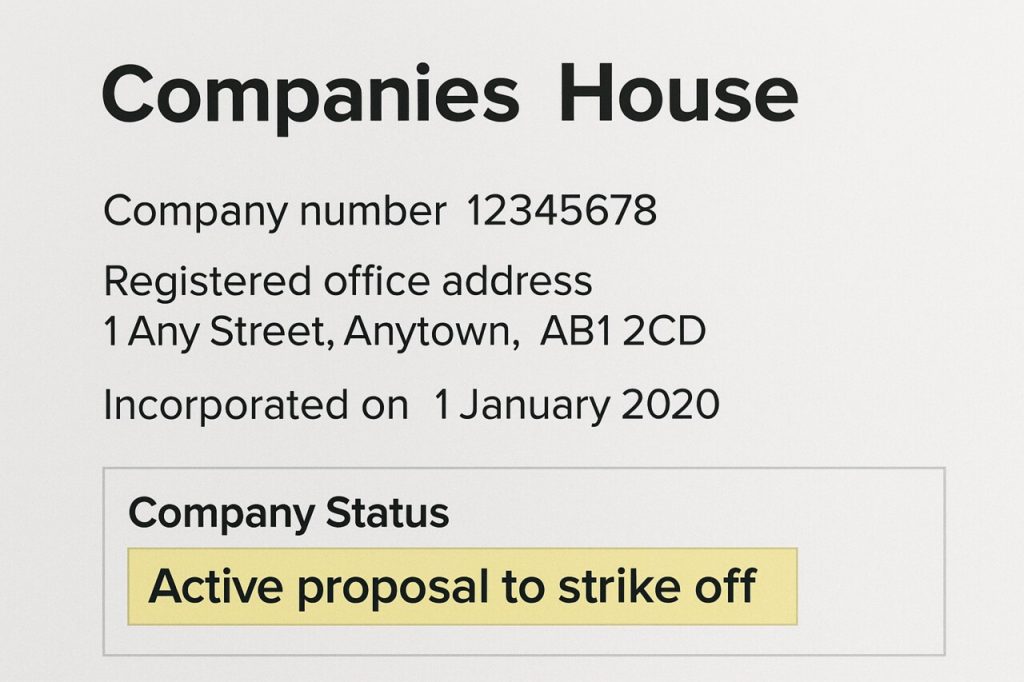

You log in to Companies House and notice a new status next to your company name: “active proposal to strike off”. It is short, blunt and worrying. You may be wondering if this means you are about to lose the company, whether you will be left with unpaid debts, and what it says to your bank, suppliers or customers who can all see the same public record.

The good news is that this status does not mean everything is already lost. It does mean something is happening, and that you need to understand who started it and why. Once you know that, you can decide whether to let the strike-off go ahead or take steps to stop it, withdraw it or use other solutions that might protect the business and you.

What Does “Active Proposal to Strike Off” Mean on Companies House?

When you see “active proposal to strike off” on Companies House, it means there is a live process in place to remove your company from the official register. In simple terms, someone has started the formal steps to close and dissolve the company. Once that process completes, the company will be struck off and will no longer exist as a legal entity.

Active Proposal to Strike Off at a Glance

- What it means: Companies House is in the process of removing the company from the register (dissolution).

- How it starts: Either the directors applied to close the company (voluntary strike-off) or Companies House began action (often after missed filings).

- What happens next: A notice is published and there’s a window for objections before the company is struck off.

- When to act quickly: If the company has debts, Bounce Back Loans/tax liabilities, or assets (including money in the bank), get advice before letting the strike-off complete.

Why Would You See an Active Proposal to Strike Off?

There are two broad reasons this status appears. Either the directors have asked for the company to be struck off, or Companies House has started the process because it believes the company is no longer operating or meeting its filing duties. It does not indicate which route applies, only that the process is underway.

In many cases, the directors themselves have filed a strike-off application. This is often done using form DS01 or the online service to bring a dormant or no-longer-needed company to an orderly end. The status shows that Companies House has accepted that application and has started the formal process, including placing a notice in The Gazette so that creditors and other parties know what is happening.

In other situations, the status appears because Companies House has begun its own action. This usually follows missed accounts or confirmation statements, or letters that are not answered. Here, there has been no voluntary choice to close the company. Instead, the registrar is using its power to remove a company that appears to have stopped functioning.

It is also important to understand what “active proposal to strike off” is not. It is not the same as a compulsory strike-off that has already completed, and it is not the final step in every case. There is a period of time while the proposal is active when creditors, HMRC and others can object, and when you can ask for the process to be stopped or withdrawn.

Official guidance from Companies House explains that once the objection period passes without valid challenge, the registrar can strike the company off and publish a final notice of dissolution. At that point, any remaining assets, such as balances in a bank account, may pass to the Crown, and the company can no longer trade or enter new agreements. For that reason, the “active proposal to strike off” stage is the key moment to review your position and decide whether to act.

Voluntary vs Compulsory Strike-Off: Key Differences

Not every strike-off is the same. The words on Companies House look similar, yet the reasons and risks can be very different. Understanding which type you are dealing with is the first step in making a safe decision.

Quick Overview

| Type of strike-off | Who starts it | Typical reason | How it feels in practice |

|---|---|---|---|

| Voluntary strike-off | The company’s directors | Company has stopped trading and has no debts | Planned, chosen route to close a clean company |

| Compulsory strike-off | Companies House | Missed filings or signs the company is not active | Warning that something is wrong or being ignored |

Voluntary Strike-Off

Voluntary strike-off is usually a deliberate choice. Directors apply to close a company that is no longer needed. Often this is a dormant company, a side project that has ended, or a business that has wound down with all bills paid.

You normally start this process by filing a DS01 form or using the online service. A notice is then placed in The Gazette. If no one objects, the company is eventually removed from the register and dissolved. For companies with no creditors and no loose ends, this can be a straightforward way to bring things to an orderly close.

Even then, it is important to be sure that there are no unpaid taxes, staff claims or old supplier invoices. If anything has been missed, creditors can still object to the strike-off, or try to restore the company later in order to bring a claim.

Compulsory Strike-Off

Compulsory strike-off is very different. Here, Companies House begins the process because it believes the company is no longer carrying out business or has failed to meet basic legal duties, such as filing accounts or confirmation statements.

You might first notice a formal notice in The Gazette, or a letter warning that the registrar intends to strike the company off. If nothing is done, this can move through to dissolution, even if there are debts and unresolved issues left behind.

Compulsory strike-off is often a symptom of wider problems, for example missed deadlines, pressure from HMRC, or wider insolvency issues affecting the business. It is rarely safe to ignore. If you still have creditors, tax liabilities or director guarantees, you normally need to take advice and decide whether to bring filings up to date, move into a rescue process, or manage a controlled closure instead.

Official guidance from Companies House on striking a company off explains that it is a criminal offence to apply for strike-off when you know there are outstanding debts or plans to misuse the process. That is why it is so important to be honest about the company’s position before allowing any strike-off to continue.

Sectors We Support

We support company directors in every sector, from construction firms and logistics companies to pubs, cafés, restaurants, hotels, retailers and manufacturers. Our advice is always clear, confidential and shaped by real experience in your industry. Whether you’re dealing with unpaid tax, supplier pressure or falling income, our team understands the challenges and will guide you through the best next steps.

Who Can Initiate a Strike-Off?

Once you know the type of strike-off, the next question is who actually pulled the trigger. The “active proposal to strike off” label on Companies House tells you that a process has started, but not who started it or what stage it has reached.

Who Can Start a Voluntary Strike-Off?

For a typical limited company, voluntary strike-off is started by the directors. More than half of the directors need to sign the application. In practice, that often means all directors agreeing that the company has served its purpose, has paid what it owes, and should now be closed.

To begin, you or your accountant will usually:

- Check that the company meets the conditions for voluntary strike-off, including that it has not traded, changed name or entered into new agreements in the last three months.

- File form DS01 online or by post.

- Inform anyone who might be affected within seven days, including creditors, employees, shareholders and pension trustees.

Once Companies House accepts the application, it will place a notice in The Gazette. At this point, the public record will usually show “active proposal to strike off”.

When Companies House Starts the Process

Companies House can also initiate strike-off on its own. This often happens when:

- accounts are overdue

- confirmation statements are not filed

- post is returned from the registered office

- there are signs that the company has stopped trading

In this case, you have not asked for the company to be removed. Instead, the registrar is using its legal powers to tidy up the register and close companies that appear inactive. A notice will again be placed in The Gazette, and the “active proposal to strike-off” status will appear on the company’s page.

If the company still owes money, this can be dangerous. Allowing a company with unpaid business debt to slip into dissolution can leave creditors frustrated and may lead to later action to restore the company, or closer scrutiny of director conduct.

What the Timing Looks Like

Every case is slightly different, however the broad timeline is often as follows:

- An application is received from the directors, or Companies House decides to start strike-off.

- Companies House sends letters and places a notice in The Gazette announcing the proposal to strike the company off.

- The “active proposal to strike off” status appears on the public record.

- There is a period, usually at least two months, during which creditors, HMRC and others can send objections.

- If no valid objection is received, a final notice is placed in The Gazette and the company is struck off and dissolved.

If objections are received, or you ask for the application to be withdrawn, the status can change and the strike-off may be suspended. This breathing space is often the best moment to take professional advice and decide whether to put the company back on a compliant footing, look at rescue options, or move into a more formal insolvency process that deals with creditors in a structured way.

Free Confidential Advice & Quote

How Can Creditors and HMRC Object?

When a company is part way through the strike-off process, other people still have a chance to step in. If someone is owed money or has another valid concern, they can ask Companies House to pause or stop the strike-off.

Who Is Allowed to Object?

In most cases, the people who can object include:

- HMRC

- trade creditors, lenders and landlords

- employees with unpaid wages or claims

- shareholders or other “interested parties” who will be affected by the closure

GOV.UK guidance on how to object to a limited company being struck off explains that an objection is allowed where there is a good reason to stop the company being removed from the register, such as unpaid debts or ongoing legal action.

Typical Reasons for Objections

Common reasons for an objection include:

- tax debts, unpaid PAYE, VAT or Corporation Tax

- outstanding supplier invoices or loan repayments

- unpaid wages or redundancy pay

- a live or planned court claim

- a current or threatened winding-up petition

Professional articles aimed at creditors stress that a swift objection helps protect the chance to recover what is owed, because it keeps the company on the register while debts are pursued.

How Do Objections Work in Practice?

In practical terms, the objection process usually follows a simple pattern:

- A creditor or other party spots the Gazette notice or sees the “active proposal to strike off” on Companies House.

- They submit an objection, often through the online service, explaining why the company should not be removed and what is owed.

- Companies House considers the objection and, if it is valid, suspends the strike-off.

- The company remains on the register while the creditor decides what to do next.

Commonly, a successful objection will stop the strike-off for several months at a time. If no action is taken, the creditor can renew the objection and keep the company from being dissolved while they investigate or start formal recovery action.

What Happens If an Objection Is Upheld?

If an objection is accepted, the immediate effect is simple. The strike-off is suspended and your company remains “alive” on the register. It can still be chased, taken to court or put into a formal insolvency process.

That can feel frustrating if you were hoping for a quick, quiet closure. However, it is often a sign that there are real issues to deal with. Ignoring the objection will not make it go away. In some cases, creditors may move from objecting to starting their own actions, such as a winding-up petition or enforcement through the courts.

This is often the moment when calm, regulated advice makes the biggest difference. A realistic plan can help you agree terms with creditors, decide whether the business can be rescued, or choose a more structured closure route instead.

When Is It Safe to Let a Strike-Off Proceed?

Not every company with an active proposal to strike off should be saved at all costs. Sometimes the process is exactly the right way to close a simple, clean company. In other cases it can be unsafe, or even unlawful, to let it continue.

A good way to think about it is to ask two questions:

- Is the company genuinely free of debt and disputes?

- Is there still a real business to protect?

When Letting a Strike-Off Proceed Might Be Appropriate

Letting a strike-off run its course may be reasonable where all of the following are true:

- the company has stopped trading and has no future plans

- all creditors, including HMRC, have been paid in full

- staff have been properly paid and any redundancy handled

- there are no ongoing legal claims or disputes

- bank accounts have been emptied and any remaining assets dealt with correctly

Companies House guidance on striking off makes it clear that you can only apply for strike-off if the company has not traded in the last three months, has not changed its name, and is not threatened with liquidation or part of an arrangement with creditors. It is an offence to apply for strike-off if these conditions are not met.

Where a small, simple company meets those rules, voluntary strike-off can be a low-cost, tidy way to bring things to an end. You still need to keep paperwork, tax records and supporting documents in case there are later questions, but the process itself can be straightforward.

When Strike-Off Can Be Challenged or Become Risky for Directors

Strike-off becomes risky when it is used as a shortcut to avoid difficult conversations. Warning signs include:

- unpaid tax, supplier or landlord debts

- missed accounts or returns

- pressure from HMRC or other creditors

- threats of legal action or statutory demands

- the business still trading or taking new orders

Guidance from the Insolvency Service and Companies House confirms that using strike-off to try to defeat creditors can lead to restored companies, personal claims against directors and, in serious cases, investigation and enforcement action.

Recent company insolvency statistics also show that many struggling firms end up in formal procedures rather than disappearing quietly. Around 53 companies in every 10,000 on the effective register entered insolvency over the last year, according to official figures for England and Wales. This underlines how common it is for indebted companies to need a structured solution.

If your company is in financial difficulty and still has outstanding debts, it is usually safer to pause and get regulated advice rather than rely on strike-off. An experienced adviser can:

review whether the company is insolvent

explain the risks of wrongful trading or personal liability

help you decide between rescue options and more formal closure routes

Choosing the right path is not about keeping a business alive at any cost. It is about protecting you, treating creditors fairly and making sure that whatever happens next is handled correctly and legally.

How to Stop, Withdraw or Suspend an Active Proposal to Strike Off

Once you know what type of strike-off you are facing, the next question is whether you want it to continue. If you have debts, staff, leases or a viable business to protect, you may decide that you need to stop, withdraw or at least pause the process.

Step 1: Find Out Who Started the Strike-Off and Why

Start by checking:

- whether the application was made by the directors

- or whether it has been started by Companies House because filings are overdue

If you are unsure, look back over recent forms, emails from your accountant and letters from Companies House. This will usually make it clear whether someone in the business has filed a strike-off application, or whether the registrar is acting because it believes the company is no longer operating.

At the same time, take an honest snapshot of the company’s position:

- up to date list of creditors, including HMRC

- what is owed, and whether payments are being missed

- any leases, guarantees or personal liabilities

- whether the business is still trading or could trade profitably again

This does not need to be perfect, but it will help you decide whether strike-off is still sensible or whether you need a more managed route.

Step 2: Withdrawing a Voluntary Strike-Off

If the strike-off was started by the directors and you now believe it is not appropriate, you can ask Companies House to withdraw it. You might do this if:

- debts have come to light that you thought were settled

- a creditor has expressed concern about the process

- you decide the business is viable and should keep trading

To withdraw, you usually need to complete the appropriate form or use the online service, and submit it promptly. Companies House will then update the record and stop the strike-off process. The company will remain on the register and will continue as normal.

You can do this yourself or ask your accountant or adviser to help. Either way, it is important to tell key creditors what you are doing, especially if they were worried about being left unpaid.

Step 3: Objecting to or Suspending Compulsory Strike-Off

If Companies House has started strike-off because accounts or confirmation statements are overdue, you can often stop the process by putting your filings and communication back on track. That might mean:

- filing outstanding accounts and confirmation statements

- updating the registered office address

- replying to letters and emails from Companies House

Once you do this, Companies House may decide that the company is still active and suspend or cancel the strike-off. The “active proposal to strike off” status can change as a result.

You can also object to compulsory strike-off if you need the company to stay on the register. For example, you may be in the middle of selling the business, arranging new finance, or preparing a formal insolvency procedure. In those situations, keeping the company live is essential.

Step 4: If a Creditor Has Already Stopped the Strike-Off

Sometimes you will find that a creditor, HMRC or a landlord has already objected, and that the strike-off is suspended. In that case, the focus shifts to negotiation and planning.

Useful steps include:

- speaking to the creditor to understand their concerns

- explaining that you are taking advice and gathering information

- agreeing a short pause while you work on a proposal

In many cases, a creditor will be willing to hold back further action if they can see that you are engaging with the problem and seeking regulated advice. If you ignore them, they are more likely to move towards enforcement, court action or their own insolvency petition.

Strike-Off Suspended: What Does This Mean?

If your company’s status changes to something like “strike-off action suspended”, it is a warning light rather than a green light. It means:

- the company is still on the register

- the strike-off is on hold

- creditors still have full rights to pursue what they are owed

This period is an opportunity. You can use it to fix filing issues, agree a plan with creditors, or move into a formal process that deals with debts in an organised way. Leaving it to chance can make things worse and limit your options later.

Closing a Limited Company with Debts?

Fast and Stress-Free Solutions.

Start closing your limited company today. Placed into liquidation within 8 days. We fully understand that timing is critical.

Worried about your Bounce Back Loan?

Need to close your limited company? Speak to an expert who’s helped thousands do the same – even with company debts or creditor pressure.

Stop Creditor Pressure

Getting constant calls from creditors? Closing your company through liquidation can give you the relief to move forward.

Directors: Avoid Risks When Winding Up Your Company

We guide you, simply, honestly. Let us handle everything.

Rescue and Restructuring Options

Sometimes an active proposal to strike off is simply the wrong tool. If there is still a real business to protect, or debts that cannot be ignored, you may be better off using rescue or restructuring options instead of letting the company dissolve.

Our role is to help you decide whether the company can be saved, and if so, how.

Checking Whether the Business Can Be Rescued

A calm, structured review with a licensed insolvency practitioner will usually cover:

current trading performance and realistic forecasts

level and type of debt, including tax, landlords and lenders

any personal guarantees or security over assets

the attitude of key creditors

whether there is a core profitable business once debt pressure is addressed

This helps answer a simple question: if you could deal with the historic debt, would the business have a future? If the answer is yes, rescue options move to the front of the queue.

Using a CVA to Manage Debt While Trading

A CVA, or Company Voluntary Arrangement, is a formal agreement between your company and its unsecured creditors. You make an affordable single monthly payment, usually over a set number of years, and the remaining unsecured debt can be written off at the end of the term, as long as you keep to the agreed plan.

Key features include:

you stay in control of the company with support from an insolvency practitioner

creditors stop individual recovery action once the CVA is in place

the business can keep trading and keep staff where viable

A CVA is often used where there is a solid core business, but cash flow has been overwhelmed by historic debts, unexpected events or one-off setbacks.

Protection Through Company Administration

In more urgent situations, company administration can provide breathing space. When a company enters administration, an insolvency practitioner takes control. There is usually a legal moratorium that stops most creditor actions while a rescue or sale is explored.

Administration can be used to:

stabilise a company under heavy creditor pressure

protect value while a buyer is found

restructure operations and reduce costs

achieve a better outcome for creditors than immediate liquidation

It will not be right for every business, but it can be a powerful tool where there is still real value and jobs to protect, yet immediate closure would waste that value.

Refinancing and Informal Arrangements

Not every situation needs a full formal procedure. In some cases, the answer lies in:

new lending or investment

refinancing existing borrowing on more suitable terms

realistic time to pay arrangements with HMRC or key suppliers

These options will usually depend on creditors trusting the plan and believing in the future of the business. A clear, realistic proposal, supported by regulated advice, can make that conversation easier and help restore confidence.

The Bigger Picture

All of these tools sit within the wider framework of corporate insolvency in the UK. Each option has rules, protections and duties for directors. The right choice depends on your company’s assets, debts, trading outlook and the level of creditor pressure.

Our job is to guide you through that framework in plain English. We help you understand what each option would mean in practice, not just on paper, so that you can choose a path that protects the business where possible and protects you as a director.

When Liquidation or Formal Closure Is the Right Step

Rescue is not always the safest answer. Sometimes the honest, protective choice is to close the company in a controlled way rather than keep trading and hope things improve.

When You Should Think About Liquidation

You may need to consider liquidation where:

The company is clearly insolvent, so it cannot pay debts as they fall due.

There is no realistic plan to turn trading performance around.

Pressure from HMRC, lenders or landlords is intense and ongoing.

You are worried about your duties as a director if the company keeps trading.

In these situations, trying to use strike-off can be misleading and risky. A formal liquidation, usually a Creditors’ Voluntary Liquidation (CVL), brings in an insolvency practitioner to take control, realise assets and distribute any funds fairly to creditors.

Official insolvency statistics for England and Wales show that CVLs make up the majority of company insolvencies in recent years, which underlines that this route is widely used and understood rather than a rare step for “failed” businesses. Linking your next decision to what actually protects creditors and directors is more important than trying to avoid a label.

Strike-Off vs Liquidation

It can help to think about the key differences:

Purpose

Strike-off is an administrative way to remove a company from the register.

Liquidation is a formal process designed to deal with an insolvent company and its debts.

Oversight

Strike-off has limited external oversight once the application is made.

Liquidation is led by a licensed insolvency practitioner who must report on director conduct.

Creditors

Strike-off can leave creditors feeling shut out, which is why they often object.

Liquidation gives creditors a clear, structured route to submit claims.

Directors

Using strike-off to sidestep debts can lead to investigations and, in serious cases, personal consequences.

Voluntary liquidation shows that you have faced the company’s position head on and sought to treat creditors fairly.

If liquidation is the right outcome, it does not mean you cannot move on. Many directors go on to start fresh businesses or new careers after a CVL, once they have addressed historic debt in a transparent way and met their duties properly.

Other Forms of Formal Closure

Sometimes, dissolution will still have a role even when there have been debts in the past. For example, where a company has gone through a liquidation and everything is complete, it may eventually be removed from the register. In other cases, a dissolved company can be brought back to life through a court process so that someone can pursue a claim.

The key is that these steps sit within a formal framework. They are not shortcuts. Deciding whether you need strike-off, liquidation or another route is where good advice makes all the difference.

FAQs

What does “active proposal to strike off” mean?

It means there is an active process underway to remove the company from the Companies House register. If it completes, the company will be dissolved and will no longer exist as a legal entity.

How long does an active proposal to strike off last?

It usually runs over a period of weeks to a few months. The key point is that there is normally a formal window for objections before dissolution happens, so it’s best to act as early as possible if you need to stop it or deal with debts/assets first.

Can I stop or withdraw an active proposal to strike off?

Often, yes, but the right approach depends on why the strike-off started. If the directors applied voluntarily, it may be possible to withdraw the application. If it’s a compulsory strike-off (for example, due to missed filings), you normally need to bring filings up to date and deal with any underlying issues. Creditors and HMRC can also object, which can pause the process.

Does an active proposal to strike off make me personally liable for company debts?

Not automatically. Limited companies are separate legal entities. However, you can become personally liable if you have given personal guarantees, taken money improperly, or traded in a way that breaches your duties. If you are worried about this, you should get regulated advice as soon as possible.

Can I still trade while the company has an active proposal to strike off?

In many cases you technically can, but it is rarely wise. Trading while you are trying to strike-off can send mixed messages to creditors and may even breach Companies House rules about when you are allowed to apply. If you need to keep trading, it is usually better to withdraw the strike-off and look at a proper rescue or restructuring plan.

What happens to tax debts and Bounce Back Loans if the company is struck off?

If the company is dissolved while it still has significant debts, those debts may become harder to enforce in the short term. However, that does not mean they simply vanish. Creditors, including HMRC or a Bounce Back Loan lender, can often apply to restore the company to the register so they can pursue what they are owed. In serious cases, they may ask for investigations into how the company was run before dissolution.

Can a creditor stop the strike-off, even if I started it?

Yes. Creditors can object to strike-off and ask Companies House to suspend it. If their objection is accepted, the company remains on the register and the strike-off is put on hold. They may then choose to negotiate, issue a claim, or in some cases start their own insolvency proceedings. Ignoring creditor letters at this stage usually makes the outcome worse, not better.

What if I ignore everything and let the strike-off go through?

If no one objects and Companies House completes the process, the company is dissolved. Any remaining assets may pass to the Crown. Problems can still come back later. A creditor may apply to restore the company, or you may face questions if your conduct is reviewed by the Insolvency Service or another regulator.

Can a struck-off company be restored?

In some cases, yes. Creditors, former directors or other interested parties can apply to the court to restore a dissolved company to the register if they have a valid reason, such as pursuing a claim or dealing with assets that were left behind. That is one reason why trying to hide problems through strike-off is rarely a lasting solution.

Plan the Safest Way Forward with Anderson Brookes

Seeing “active proposal to strike off” next to your company name can feel like the beginning of the end. In reality, it is often a turning point. You still have choices, and you do not have to make them alone.

We offer calm, confidential conversations that focus on understanding what the Companies House status really means in your case, working out whether the business can be saved, or whether closure is the safer path, and protecting you as a director while treating creditors fairly.

Depending on your situation, that might involve:

withdrawing an unsafe strike-off and putting proper plans in place

exploring rescue tools such as CVAs, administration or refinancing

using a managed liquidation where the company cannot realistically continue

Everything is explained in plain English. You stay in control of the decisions, and we support you with the detail, the paperwork and the discussions with creditors, HMRC and Companies House.

If you are worried about an active proposal to strike off, or feel that your company might be heading in that direction, it is much easier to help when you get in touch early.

Call 0800 1804 935 for a free consultation, or email us at advice@andersonbrookes.co.uk. You can also contact us online.