CCJ County Court: Navigating Small Claims Procedures in the UK

Understanding CCJs

County Court Judgments (CCJs) are legal orders issued when individuals or businesses fail to repay debts. These judgments can have significant financial and legal consequences, affecting one’s credit score and ability to obtain future credit.

Definition of a County Court Judgment

A County Court Judgment is a formal court order registered against you when you fail to repay money owed. It’s issued by a county court in England, Wales, or Northern Ireland. CCJs are public records that remain on your credit file for six years, potentially impacting your creditworthiness.

CCJs can be issued for various types of debts, including:

- Unpaid loans

- Credit card balances

- Utility bills

- Rent arrears

The judgment specifies the amount owed and the repayment terms. If you receive a CCJ, it’s crucial to act promptly to minimise its impact on your financial standing.

The Process of Issuing a CCJ

The CCJ process begins when a creditor files a claim with the county court. You’ll receive a claim form detailing the alleged debt. You have 14 days to respond, either by:

- Paying the full amount

- Admitting the debt and proposing a repayment plan

- Disputing the claim

If you don’t respond or fail to reach an agreement, the court may issue a CCJ against you. You’ll then receive an order to pay, which outlines:

- The judgment amount

- Payment method

- Deadline for payment

It’s important to note that if you pay the full amount within one month of the judgment, you can apply to have the CCJ removed from the register. This can help protect your credit score from long-term damage.

Financial Implications of CCJs

County Court Judgments (CCJs) can significantly impact your financial situation. They affect your credit rating and may lead to various debt recovery actions.

Effect on Credit Rating

A CCJ remains on your credit file for six years from the date of judgment. This can make it challenging to secure loans, credit cards, or mortgages. Many lenders view CCJs as a red flag, indicating you’re a high-risk borrower.

Your credit score will likely drop, making it harder to access financial products. Some lenders may outright reject your applications, while others might offer less favourable terms, such as higher interest rates.

To minimise the impact, pay the CCJ promptly. If you settle within one month, you can apply to have it removed from your credit file. Otherwise, it will be marked as ‘satisfied’ but remain visible for the full six-year period.

Potential Debt Recovery Actions

If you don’t pay a CCJ, creditors can take further action to recover the debt. They may apply for an attachment of earnings order, which deducts money directly from your wages.

Bailiffs could be sent to your property to seize goods. In extreme cases, creditors might seek a charging order against your home, potentially leading to its forced sale.

You could face bankruptcy proceedings if the debt is substantial and you have multiple CCJs. To avoid these scenarios, consider:

- Negotiating a payment plan with creditors

- Seeking debt advice from organisations like Citizens Advice

- Exploring debt management options, such as Individual Voluntary Arrangements (IVAs)

Acting quickly and communicating with creditors can help you manage the situation and prevent more severe consequences.

Responding to a CCJ

Receiving a County Court Judgement (CCJ) can be concerning, but you have options. It’s crucial to act promptly and understand your rights and responsibilities.

Steps to Take upon Receiving a CCJ

First, carefully review the CCJ document. Check all details for accuracy, including your name, address, and the debt amount. If you believe the CCJ was issued in error, you can apply to have it set aside.

Contact the creditor immediately. Discuss your situation and explore potential repayment options. Keep records of all communications.

Consider seeking free debt advice from organisations like Citizens Advice or StepChange. They can help you understand your options and create a plan.

If you can’t afford to pay, you may be able to request a ‘variation’ to change the payment terms. You’ll need to complete an N245 form and provide evidence of your financial situation.

Options for Repayment

You have several repayment options when facing a CCJ:

- Pay in full within one month: If you pay the full amount within a month of the judgment date, it won’t appear on your credit file.

- Instalment plan: Request to pay in regular instalments based on your income and expenses.

- Suspend the judgment: If your circumstances are likely to improve soon, you can ask the court to temporarily suspend enforcement.

- Debt Relief Order (DRO) or bankruptcy: In severe cases, these options may be considered, but seek professional advice first.

Remember, ignoring a CCJ can lead to further legal action and additional costs.

Setting Aside a CCJ

You can apply to ‘set aside’ a CCJ if:

- You didn’t receive the claim form

- You responded to the claim in time

- You have a valid reason for not paying the debt

To set aside a CCJ:

- Complete form N244 (Application Notice)

- Pay the court fee (or apply for fee remission if eligible)

- Provide evidence supporting your application

The court will consider your application and may set a hearing date. If successful, the CCJ will be removed from the register and your credit file.

Act quickly, as it’s easier to set aside a CCJ within one month of the judgment date. After this, you’ll need to provide a good reason for the delay.

Prevention and Resolution

Taking proactive steps can help avoid CCJs and resolve financial disputes before they escalate. Effective communication and early action are key to preventing court involvement.

Advice on Avoiding CCJs

Pay bills on time to prevent debts from accumulating. Set up direct debits for regular payments to ensure you don’t miss due dates. Keep detailed records of all financial transactions and agreements.

If you’re struggling to meet payments, contact creditors promptly. Many are willing to negotiate alternative payment plans. Don’t ignore correspondence from creditors or courts, as this can lead to default judgments.

Regularly check your credit report for errors or fraudulent activity. Address any inaccuracies immediately to prevent unwarranted CCJs. Consider seeking financial advice if you’re consistently struggling with debt management.

Negotiating with Creditors

Approach creditors as soon as you anticipate payment difficulties. Be honest about your financial situation and propose a realistic repayment plan. Prepare a detailed budget showing your income and expenses to support your case.

Consider offering a lump sum settlement if possible, as creditors may accept a reduced amount for immediate payment. Request a payment holiday if you’re facing temporary financial hardship.

Get all agreements in writing and keep copies of correspondence. If negotiations stall, consider using a debt advisor or solicitor to mediate. They can often negotiate more favourable terms on your behalf.

Dispute Resolution and Mediation

Before a CCJ is issued, explore alternative dispute resolution methods. Mediation can be a cost-effective way to resolve disagreements without court involvement. Both parties can present their case to an impartial mediator who helps find a mutually agreeable solution.

Consider using the Small Claims Mediation Service for disputes under £10,000. This free service can often resolve issues quickly and without the need for a formal hearing.

If you receive a claim form, respond promptly. You can admit the claim, defend it, or make a counterclaim. Seeking legal advice at this stage can help you understand your options and potential outcomes.

Statutory Regulations

County Court Judgments (CCJs) are governed by specific legal frameworks and regulations. These laws aim to balance the rights of creditors with protections for consumers. Understanding the statutory landscape is crucial for both parties involved in CCJ proceedings.

Legal Framework Governing CCJs

The County Courts Act 1984 forms the primary legal basis for CCJs in England and Wales. It outlines the procedures for obtaining judgments and enforcing debts. The Civil Procedure Rules provide detailed guidance on court processes, including filing claims and serving notices.

The Courts Act 2003 established the Register of Judgments, Orders and Fines. This public record keeps CCJs for six years, impacting individuals’ credit scores. The Limitation Act 1980 sets time limits for bringing claims, typically six years for most debts.

The Consumer Credit Act 1974 regulates credit agreements and impacts how CCJs are issued for certain types of debt.

Consumer Rights and Protections

The Financial Conduct Authority (FCA) oversees lender behaviour, ensuring fair treatment of debtors. Their rules require creditors to consider alternatives to court action and provide clear information about CCJs.

You have the right to challenge a CCJ if you believe it’s unfair or incorrect. The ‘set aside’ procedure allows you to dispute judgments within specific timeframes. If successful, the CCJ can be removed from the register.

The Pre-Action Protocol for Debt Claims mandates that creditors take specific steps before court action. This includes providing detailed information about the debt and exploring settlement options.

Debt relief orders and bankruptcy can offer protection from CCJs in certain circumstances, giving you breathing space to address financial difficulties.

Long-Term Impact

A County Court Judgement (CCJ) can significantly affect your financial situation for years to come. It’s crucial to understand how long it remains on your record and the consequences for your future borrowing abilities.

CCJ Duration and Its Removal

A CCJ stays on your credit file for six years from the date of judgement. This period remains the same whether you pay the debt or not. If you settle the CCJ within one month of receiving it, you can apply to have it removed from the register and your credit file.

For CCJs older than one month, paying won’t remove it from your record, but it will be marked as ‘satisfied’. This status is slightly better for your credit score than an unpaid CCJ.

After six years, the CCJ is automatically removed from your credit file. However, it may still appear on other public records.

Consequences for Future Borrowing

A CCJ on your credit file can make it challenging to secure new credit. Lenders view CCJs as red flags, indicating past financial difficulties. You might face:

- Higher interest rates on loans and credit cards

- Reduced credit limits

- Rejection for mortgages or rental agreements

- Difficulty opening new bank accounts

Some lenders specialise in ‘adverse credit’ products, but these often come with less favourable terms. As time passes, the impact of a CCJ on your borrowing capacity lessens, especially if you demonstrate good financial behaviour.

To improve your chances of future borrowing, focus on:

- Paying off the CCJ as soon as possible

- Meeting all current financial obligations on time

- Building a positive credit history with smaller credit products

Frequently Asked Questions

County Court Judgements (CCJs) often raise numerous queries for individuals and businesses alike. Understanding the processes, implications, and potential actions related to CCJs is crucial for managing financial and legal obligations effectively.

How can one perform a check for a County Court Judgement at no charge?

You can check for CCJs against your name or business for free by searching the Registry Trust’s online database. This service allows you to view basic information about any CCJs registered against you.

For a more detailed search, you may need to pay a small fee. This comprehensive check provides full details of any judgements, including the amount owed and the creditor’s name.

What is the process involved in issuing a County Court Judgement?

The process begins when a creditor files a claim with the county court. If you fail to respond or pay the debt, the court may issue a CCJ.

You’ll receive official paperwork detailing the judgement and payment terms. It’s crucial to act promptly upon receiving this information to avoid further legal consequences.

How does one search for a specific case number in county court records?

To search for a specific case number, visit the official HM Courts and Tribunals Service website. Navigate to the court records section and enter the case number in the provided search field.

You may need to pay a fee for detailed information. Some courts also offer telephone or in-person services for case number searches.

What steps should be taken if a County Court Judgement has been received but the issuer is unknown?

Contact the court that issued the CCJ immediately. Request a copy of the judgement, which will include the creditor’s details.

Once you have this information, you can either pay the debt, negotiate with the creditor, or apply to have the judgement set aside if you believe it was issued in error.

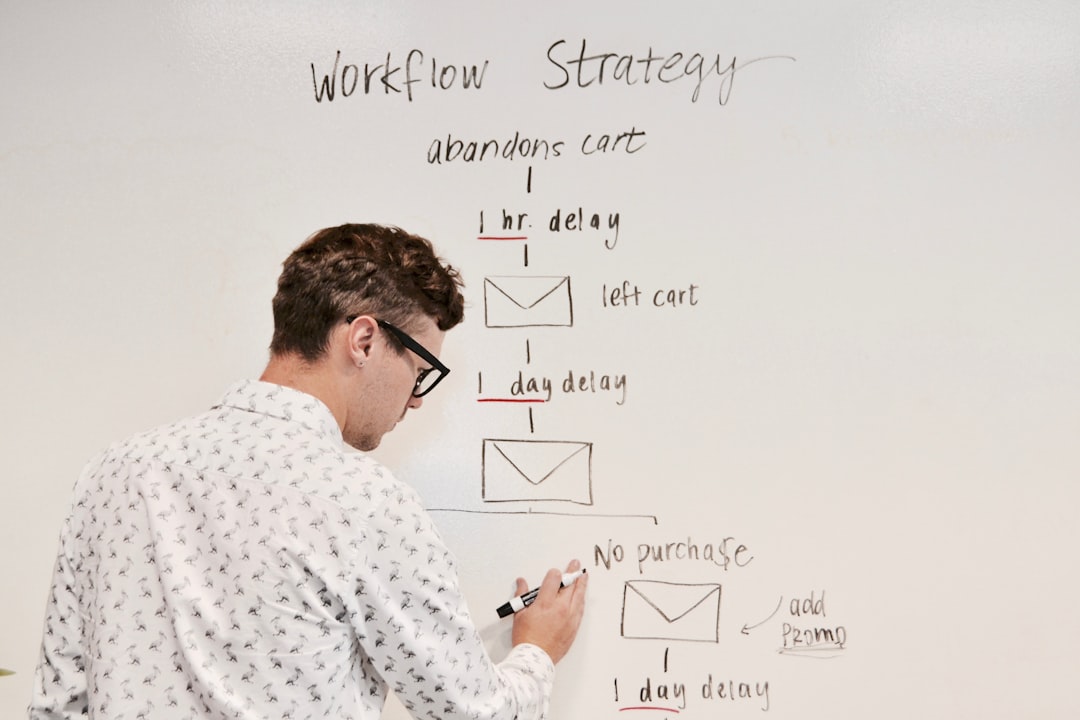

What is the procedure for issuing a County Court Judgement via online systems?

To issue a CCJ online, use the Money Claim Online (MCOL) service. Register an account and follow the step-by-step process to submit your claim.

Provide accurate details about the debtor and the amount owed. The court will process your claim and issue a CCJ if the debtor fails to respond or pay.

What are the consequences of non-payment of a County Court Judgement after six years?

After six years, a CCJ is automatically removed from your credit file. However, this doesn’t mean the debt is erased.

The creditor can still pursue payment through other legal means. They may apply to the court for a new CCJ or take other enforcement actions to recover the debt.