Common Mistakes to Avoid When Applying for Company Strike Off: Key Pitfalls for Directors

Mistakes In Filing Form DS01

Filing Form DS01 accurately is crucial when applying to strike off your limited company. Common errors can lead to delays or rejection of your application. Pay close attention to detail and double-check all information before submission.

Quick Summary Table: Common Mistakes to Avoid When Applying for Company Strike Off

| Common Mistake | Description |

| Failing to notify creditors | Directors must inform creditors, as undisclosed debts can lead to legal action. |

| Not closing bank accounts | Leaving accounts open can result in complications with remaining funds or liabilities. |

| Ignoring employee rights | Redundancy pay and other obligations must be settled before applying for strike-off. |

| Mismanaging company assets | Assets must be distributed properly, or they risk becoming property of the Crown (bona vacantia). |

| Incomplete paperwork | Errors or omissions in the DS01 form can delay or invalidate the application. |

| Applying with ongoing legal action | Strike-off applications will be rejected if the company faces unresolved legal disputes. |

| Overlooking tax liabilities | All HMRC obligations, including VAT and Corporation Tax, must be cleared prior to closure. |

| Using strike-off to avoid debt | This is illegal, and creditors can apply for reinstatement of the company to recover debts. |

| Not informing stakeholders | Failure to notify shareholders and directors can lead to disputes and potential legal issues. |

| Ignoring personal guarantees | Directors may remain personally liable for debts if they provided guarantees. |

Missing Information

Incomplete forms are a frequent cause of rejection. Ensure you fill in all required fields on the DS01 form. Don’t forget to include your company name and registration number. Provide accurate contact details for the company and directors. List all trading names used by the business in the past 12 months.

Include the date when you stopped or plan to stop trading. This helps Companies House determine if your company is eligible for strike off. If you’ve already ceased trading, state the exact date. For future cessation, provide your intended date.

Incorrect Signatures

Proper signatures are vital for a valid DS01 application. A majority of directors must sign the form. For a company with two directors, both must sign. If there are three directors, at least two signatures are required.

Directors must sign in the designated spaces on the form. Use black ink for clear, legible signatures. Printed names or electronic signatures are not acceptable. Each signing director must also print their name clearly next to their signature.

Ensure all signing directors are currently registered with Companies House. Signatures from former directors or non-directors will invalidate your application.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

Communication Errors

Proper communication is crucial when applying for company strike off. Failing to inform relevant parties or disregarding legal obligations can lead to serious consequences and delay the process.

Failing To Notify Creditors

When applying for strike off, you must inform all creditors of your intentions. This includes banks, suppliers, and any other parties to whom your company owes money. Neglecting this step can result in objections to the strike off application.

Send formal notices to all known creditors, detailing your plans to dissolve the company. Allow sufficient time for responses and address any concerns raised. Keep records of all communications for future reference.

Be aware that creditors can block the strike off if they feel their interests are at risk. Settling outstanding debts before applying can help smooth the process.

Ignoring Employee Rights

Overlooking employee rights during company strike off can lead to legal issues and financial penalties. You must fulfil all obligations to your staff before dissolving the company.

Inform employees about the impending closure as soon as possible. Provide clear timelines and details about their final pay, redundancy packages, and any outstanding benefits.

Ensure all wages, holiday pay, and statutory redundancy payments are settled. Issue P45 forms and provide references if requested. Failure to meet these obligations can result in claims against the company or its directors, even after dissolution.

Consider seeking legal advice to ensure you’re meeting all employment law requirements during the closure process.

Overlooking Legal Obligations

When applying for a company strike off, it’s important to address all legal obligations before proceeding. Failure to do so can lead to serious consequences and potential rejection of your application.

Final Tax Settlements

You must ensure all tax affairs are in order before applying for strike off. This includes settling any outstanding corporation tax, VAT, and PAYE liabilities. HM Revenue & Customs (HMRC) should be notified of your intention to close the company.

Submit final tax returns and accounts to HMRC. Pay any remaining taxes owed promptly. If you’ve overpaid, request a refund before dissolution.

Remember to cancel your VAT registration if applicable. Failure to address tax matters can result in HMRC objecting to the strike off application.

Unresolved Disputes

Any ongoing legal disputes or pending litigation must be resolved before applying for strike off. This includes:

- Customer or supplier disputes

- Employment tribunals

- Contractual disagreements

- Intellectual property claims

Attempting to dissolve a company with unresolved legal issues can be viewed as an attempt to evade responsibilities. Creditors or other parties may object to the strike off.

Seek legal advice if you’re unsure about any potential disputes. It’s essential to address and settle all matters before proceeding with the application.

Avoid Costly Mistakes – Get Expert Advice Today

Applying for company strike off can be a complex process with potential pitfalls. To navigate this successfully, seeking expert advice is crucial.

Professional guidance can help you avoid costly errors and ensure compliance with legal requirements. Consult with accountants, solicitors, or company dissolution specialists who understand the intricacies of the process. We are here to help and offer a free consultation.

These experts can review your situation and provide tailored advice. They’ll help you:

- Ensure all debts are settled

- Properly distribute company assets

- Notify relevant parties (HMRC, creditors, employees)

- Handle any outstanding legal matters

Don’t underestimate the value of experience. Professionals have seen various scenarios and can anticipate potential issues you might overlook.

While there’s a cost associated with expert advice, it’s often far less than the potential expenses of making mistakes. Errors could lead to fines, legal complications, or even personal liability.

Remember, every company’s situation is unique. What worked for another business might not apply to yours. Personalised advice ensures you’re taking the right steps for your specific circumstances.

By investing in expert guidance, you’re protecting yourself and your business. It provides peace of mind and helps ensure a smooth, legally compliant company dissolution process.

Anderson Brookes are licensed insolvency practitioners and have advised thousands of businesses and company directors in your situation.

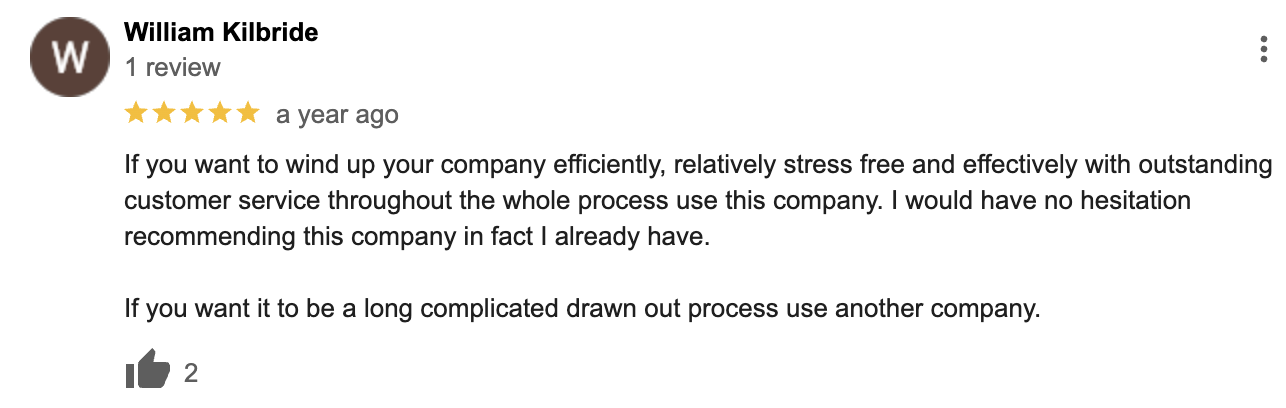

Our Google Reviews

&

Frequently Asked Questions

Navigating the company strike-off process can be complex. These common questions address key aspects of eligibility, debts, legal implications, asset management, creditor notification, and application retraction.

What are the eligibility criteria for applying for a strike-off of a company?

To be eligible for strike-off, your company must not have traded or carried out business activities in the last three months. You cannot apply if your company is subject to legal proceedings or has entered into a Company Voluntary Arrangement or other insolvency procedure.

Ensure all statutory filings are up-to-date before applying. This includes filing annual accounts and confirmation statements with Companies House.

Can outstanding debts affect the strike-off process of a company?

Yes, outstanding debts can significantly impact the strike-off process. If your company has unpaid creditors, they may object to the strike-off application. This can halt or delay the process.

It’s crucial to settle all debts before applying for strike-off. If unable to pay, your company may be considered insolvent and ineligible for voluntary strike-off.

What are the legal consequences for directors after a company is struck off?

Directors remain legally responsible for the company’s affairs even after strike-off. You may face personal liability for any debts or obligations not settled before dissolution.

Failure to properly wind up the company’s affairs can lead to disqualification from acting as a director in the future. Keep all business records for seven years after strike-off.

How should assets be handled before applying for a company strike-off?

All company assets must be properly disposed of before applying for strike-off. This includes closing bank accounts, transferring or selling property, and dealing with intellectual property rights.

Distribute any remaining assets to shareholders after settling all debts. Failing to do so can result in assets becoming bona vacantia, passing to the Crown.

What is the correct procedure for notifying creditors of a company’s impending strike-off?

You must inform all known creditors of your intention to strike off the company. Send a formal letter detailing the planned strike-off and the reasons behind it.

Provide creditors with a reasonable timeframe to respond or raise objections. This demonstrates transparency and reduces the risk of objections during the strike-off process.

How do I retract an application for company strike-off if circumstances change?

To withdraw a strike-off application, file form DS02 with Companies House. This form must be signed by the majority of directors.

Act promptly if you need to withdraw. Once the first gazette notice is published, you have limited time to stop the process before the company is struck off.