Comprehensive Guide to Voluntary Arrangements: Navigating Financial Challenges for UK Firms

What Is a Voluntary Arrangement?

Voluntary arrangements offer struggling UK businesses a structured path to address financial difficulties and negotiate with creditors. This formal process aims to help companies restructure debts and continue operations.

Definition and Purpose of Voluntary Arrangements

A voluntary arrangement, commonly known as a Company Voluntary Arrangement (CVA), is a legally binding agreement between an insolvent company and its creditors. It allows the business to repay debts over a set period, typically from future profits.

The primary purpose of a CVA is to provide breathing room for financially distressed companies. It enables them to:

- Restructure debts

- Negotiate more manageable repayment terms

- Continue trading whilst addressing financial issues

- Avoid liquidation or administration

CVAs offer a lifeline to businesses facing insolvency, balancing the interests of creditors and stakeholders.

Legal Framework Governing Voluntary Arrangements

The legal foundation for voluntary arrangements in the UK is established by the Insolvency Act 1986. This legislation outlines the process, requirements, and consequences of entering into a CVA.

Key aspects of the legal framework include:

- Appointment of an insolvency practitioner to oversee the process

- Proposal submission to creditors

- Creditor voting procedures (75% approval required)

- Implementation and monitoring of the agreed terms

The Companies Act 2006 also plays a role, particularly in relation to directors’ duties and corporate governance during the CVA process. These laws ensure that CVAs are conducted fairly and transparently, protecting the interests of all parties involved.

How Does a Voluntary Arrangement Work?

A voluntary arrangement provides struggling businesses a structured path to manage debts and continue operations. It involves negotiating new terms with creditors under the guidance of an insolvency practitioner.

Key Features of a Voluntary Arrangement

Voluntary arrangements offer flexibility in debt repayment. You’ll typically pay a portion of your debts over an agreed period, often 3-5 years. The arrangement freezes interest and charges on unsecured debts.

Creditors must approve the proposal, usually requiring 75% agreement by value. Once approved, it binds all creditors, even those who voted against it.

Your company continues trading during the arrangement. This allows you to maintain business relationships and potentially recover financially.

Eligibility Criteria for a Voluntary Arrangement

To qualify for a voluntary arrangement, your company must be insolvent or facing imminent insolvency. You need to show that the arrangement offers a better outcome for creditors than liquidation.

Your business should have a viable future. This means demonstrating that with reduced debt pressure, your company can return to profitability.

There’s no minimum debt level required, but the costs involved mean it’s typically suitable for companies with debts over £10,000.

The Role of an Insolvency Practitioner in Voluntary Arrangements

An insolvency practitioner plays a crucial role throughout the process. They’ll assess your company’s financial situation and help develop a realistic proposal.

The practitioner acts as the nominee, presenting the arrangement to creditors. They explain the terms and potential outcomes to help creditors make an informed decision.

If approved, the insolvency practitioner becomes the supervisor. They’ll oversee the arrangement, ensuring you meet agreed payments and report progress to creditors.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

The Voluntary Arrangement Process Step-by-Step

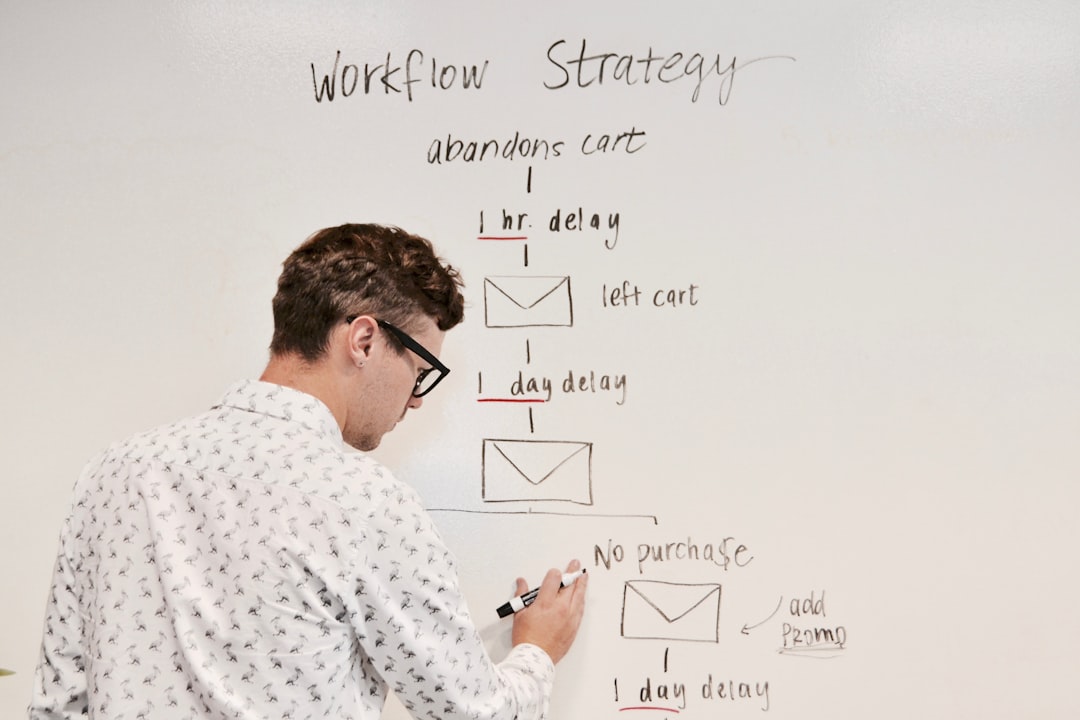

A Company Voluntary Arrangement (CVA) follows a structured process to help struggling businesses reach agreements with creditors. This legally-binding procedure involves several key stages, from initial engagement with professionals to ongoing implementation.

Engaging an Insolvency Practitioner to Draft the Proposal

To begin the CVA process, you’ll need to appoint a licensed Insolvency Practitioner (IP), such as Anderson Brookes. The IP will:

- Review your company’s financial situation

- Assess the viability of a CVA

- Gather necessary financial information

- Discuss potential terms with major creditors

The IP plays a crucial role in guiding you through the process and ensuring compliance with legal requirements. They’ll work closely with you to understand your business’s unique circumstances and develop a realistic proposal.

Preparing the Voluntary Arrangement Proposal

Once engaged, the IP will draft a detailed CVA proposal. This document outlines:

- Your company’s financial position

- Reasons for financial difficulties

- Proposed repayment terms

- Projected cash flow

- Comparison with alternative outcomes (e.g. liquidation)

The proposal must be fair and achievable. It typically includes a plan to repay a portion of debts over 3-5 years from future profits. The IP will help you strike a balance between creditor demands and your company’s ability to pay.

Creditor Meetings and Approval Requirements

After the proposal is finalised, the IP will:

- Send the CVA proposal to all creditors

- Call a creditors’ meeting (usually within 14-28 days)

- Chair the meeting to discuss and vote on the proposal

For the CVA to be approved:

- 75% (by value) of voting creditors must agree

- 50% of unconnected creditors must support it

If approved, the CVA becomes binding on all creditors, including those who voted against it or didn’t vote.

Implementation and Monitoring of the Arrangement

Once approved, you’ll need to:

- Make agreed payments to creditors via the IP

- Provide regular financial updates to the IP

- Adhere to any additional terms in the CVA

The IP will:

- Distribute payments to creditors

- Monitor your company’s compliance

- Provide annual reports to creditors

If you struggle to meet CVA terms, the IP can help renegotiate with creditors. Failure to comply may result in the CVA’s termination and potential liquidation. Successful completion of the CVA allows your company to continue trading debt-free.

Benefits and Challenges of Voluntary Arrangements

Voluntary arrangements offer struggling UK businesses a potential path to recovery, but they come with both advantages and potential pitfalls. Understanding these can help you make an informed decision about whether this option is right for your company.

Advantages of Choosing a Voluntary Arrangement

A voluntary arrangement can provide breathing room for your business. It allows you to negotiate new terms with creditors, potentially reducing debt payments and avoiding liquidation.

You’ll retain control of your company during the process, unlike in administration. This means you can continue trading and working towards recovery.

Creditors may be more likely to recover their money through a voluntary arrangement than through liquidation. This can make them more willing to agree to the terms.

The arrangement can help protect your business reputation. It shows you’re taking proactive steps to address financial difficulties rather than letting the situation deteriorate.

Potential Drawbacks to Consider

Voluntary arrangements require careful planning and execution. If you fail to meet the agreed terms, your company could face compulsory liquidation.

Your credit rating will be affected, which may make it harder to secure future financing or trade credit.

Some suppliers might be hesitant to work with your company during the arrangement period, potentially disrupting your supply chain.

The process can be time-consuming and may require significant upfront costs for professional fees.

Shareholders might see the value of their investments decrease, as the arrangement typically prioritises creditor repayments over dividends.

Public knowledge of the arrangement could impact customer confidence, potentially leading to a loss of business in the short term.

Who Can Benefit from a Voluntary Arrangement?

Voluntary arrangements offer a lifeline to various UK businesses facing financial difficulties. They provide an opportunity to restructure debts and continue operations under more manageable terms.

Businesses Facing Temporary Cash Flow Issues

Companies experiencing short-term financial strain can greatly benefit from voluntary arrangements. These agreements allow you to negotiate with creditors for more favourable repayment terms.

If your business is fundamentally sound but struggling with temporary setbacks, a voluntary arrangement can provide breathing space. It gives you time to address cash flow problems without the pressure of immediate debt repayment.

This option is particularly useful for seasonal businesses or those affected by unexpected market changes. You can propose a realistic repayment plan that aligns with your projected income, helping you navigate difficult periods.

Viable Companies Struggling with Debt

If your company is operationally strong but burdened by accumulated debt, a voluntary arrangement could be the solution. This process allows you to continue trading while addressing your financial obligations.

You can negotiate to pay a portion of your debts over an extended period, often at reduced rates. This approach can help you retain valuable assets and preserve your business relationships.

Voluntary arrangements are especially beneficial for companies with a clear path to profitability. By restructuring your debts, you can focus on growth and recovery without the constant threat of insolvency.

Directors Seeking an Alternative to Liquidation

As a director, you may find voluntary arrangements a preferable option to liquidation. This process allows you to maintain control of your company and avoid the stigma associated with insolvency.

Unlike liquidation, a voluntary arrangement gives you the chance to turn your business around. You can continue trading, preserving jobs and potentially recovering value for shareholders.

This option also offers more flexibility than administration. You retain day-to-day control of your company, working towards agreed targets without external intervention. It’s an opportunity to demonstrate your commitment to creditors and stakeholders.

Impact of a Voluntary Arrangement on Stakeholders

Voluntary arrangements significantly affect various parties involved in a company’s operations. The process reshapes relationships, alters financial obligations, and influences the future trajectory of the business.

Effects on Employees and Job Security

A voluntary arrangement can have mixed implications for employees. In many cases, it helps preserve jobs by allowing the company to continue trading. You might see reduced working hours or temporary pay cuts as part of cost-saving measures. However, some redundancies may be necessary to streamline operations.

Job security often improves in the long term if the arrangement succeeds. You’ll likely experience changes in workplace dynamics and potentially increased workloads as the company restructures. Clear communication from management is crucial during this period to maintain morale and productivity.

Implications for Creditors and Repayment Terms

Creditors face significant changes under a voluntary arrangement. You’ll typically receive a proposal outlining new repayment terms. These often include extended payment periods and potential reductions in the total amount owed.

Secured creditors usually maintain their position, while unsecured creditors may need to accept compromises. You might be asked to vote on the arrangement, with a majority agreement required for implementation. While you may recover less than originally owed, a successful arrangement often yields better returns than liquidation.

Shareholder Interests in a Voluntary Arrangement

As a shareholder, your stake in the company can be dramatically affected. Your shares may be diluted or even cancelled as part of the restructuring process. In some cases, you might be asked to inject additional capital to support the company’s recovery.

The arrangement can potentially preserve some value in your investment if successful. You’ll likely see changes in dividend policies and may face restrictions on share transfers. Your voting rights and influence on company decisions might also be altered during the arrangement period.

Common Misconceptions About Voluntary Arrangements

Voluntary arrangements are often misunderstood by business owners and creditors alike. Several myths persist about these financial tools, potentially deterring companies from exploring viable recovery options.

Voluntary Arrangements Are Only for Failing Businesses

Many believe voluntary arrangements are a last resort for businesses on the brink of collapse. This is not accurate.

Voluntary arrangements can benefit companies facing temporary cash flow issues or seeking to restructure debt. They’re proactive measures that can help stabilise finances before a crisis point.

Healthy businesses may use these arrangements to manage unexpected challenges or adapt to changing market conditions. By addressing financial concerns early, you can potentially avoid more severe measures like administration or liquidation.

A Voluntary Arrangement Is the Same as Liquidation

This misconception often leads to unnecessary panic. Voluntary arrangements and liquidation are fundamentally different processes.

Liquidation involves closing a business and selling its assets to repay creditors. In contrast, a voluntary arrangement aims to keep your company operational whilst negotiating new terms with creditors.

The goal is to create a sustainable plan for debt repayment that allows your business to continue trading. This can involve reduced payments, extended timelines, or partial debt write-offs.

Unlike liquidation, a successful voluntary arrangement can lead to business recovery and long-term viability.

Creditors Will Always Reject Proposals

Some business owners avoid voluntary arrangements, fearing automatic rejection by creditors. This fear is largely unfounded.

Creditors often recognise that a voluntary arrangement offers a better chance of recovering their money compared to liquidation. They may receive a higher percentage of the debt owed over time.

Your proposal needs to be realistic and well-prepared to gain creditor support. Demonstrating a clear path to profitability can increase the likelihood of acceptance.

Professional advice from insolvency practitioners can help you craft a compelling proposal. With a strong case, many businesses successfully secure creditor approval for their voluntary arrangements.

Checklist for Businesses Considering a Voluntary Arrangement

Before pursuing a Company Voluntary Arrangement (CVA), businesses must carefully evaluate their situation and prepare thoroughly. This checklist covers key steps to assess viability, gather essential documents, and engage with stakeholders.

Assessing Your Business’s Financial Viability

Conduct a thorough financial review of your company. Analyse cash flow projections for the next 12-18 months. Evaluate your assets, liabilities, and potential for future profitability.

Consider seeking professional advice from an insolvency practitioner or accountant. They can help determine if a CVA is the best option for your business.

Review your business model and identify areas for improvement or cost-cutting. This may include restructuring operations or renegotiating contracts with suppliers.

Assess your ability to meet proposed CVA payments alongside ongoing business expenses. Be realistic about your company’s capacity to fulfil these obligations.

Preparing Key Documents for the Process

Gather comprehensive financial records, including:

- Balance sheets

- Profit and loss statements

- Cash flow statements

- Tax returns

- Creditor and debtor lists

Draft a detailed business plan outlining your strategy for recovery. Include realistic financial projections and a clear timeline for debt repayment.

Prepare a statement of affairs, detailing your company’s assets and liabilities. This document will be crucial for creditors to assess your proposal.

Compile evidence of any attempts to improve your financial situation, such as cost-cutting measures or efforts to increase revenue.

Engaging Stakeholders Early

Identify key creditors and prioritise communication with them. Be transparent about your company’s situation and your intention to propose a CVA.

Schedule meetings with major creditors to discuss potential terms. This can help gauge their receptiveness to a CVA before formal proceedings begin.

Inform employees about the company’s financial challenges and the potential for a CVA. Address their concerns and explain how the arrangement might affect them.

Consider appointing a creditors’ committee to represent the interests of all creditors throughout the CVA process. This can foster trust and cooperation.

Consult with shareholders and directors to ensure alignment on the CVA strategy. Their support will be crucial for successful implementation.

How Anderson Brookes Can Support Your Voluntary Arrangement

Anderson Brookes offers comprehensive assistance for businesses considering voluntary arrangements.

We act as a mediator between your business and creditors, allowing for constructive dialogue.

Once approved, we oversee the implementation of the arrangement, ensuring compliance with agreed terms. This includes managing payments to creditors and providing regular progress reports.

We also help you explore alternatives to voluntary arrangements, such as company administration or liquidation, ensuring you choose the most suitable path for your business.

Anderson Brookes offers no-obligation, free initial consultations to discuss your business’s financial situation. During these meetings, our experts assess your circumstances and explain the various options available. We provide clear, jargon-free advice on the pros and cons of voluntary arrangements and alternative insolvency procedures. This allows you to make an informed decision about the best course of action for your company.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

Frequently Asked Questions

Company Voluntary Arrangements (CVAs) raise many important questions for businesses considering this option. Understanding the key aspects of CVAs can help companies make informed decisions about their financial future.

How does a Company Voluntary Arrangement affect company creditors?

A CVA impacts creditors by restructuring the company’s debts. Creditors may receive reduced payments or extended repayment terms.

The arrangement must be approved by at least 75% of creditors by value. Once approved, it becomes binding on all creditors, even those who voted against it.

Secured creditors retain their rights over any assets used as collateral.

What are the eligibility criteria for proposing a Company Voluntary Arrangement?

To propose a CVA, a company must be insolvent or facing imminent insolvency. The business should have a viable future and the potential to return to profitability.

The company must not have entered administration or liquidation. Directors must believe the CVA offers the best chance of recovery for the business and its creditors.

Can a Company Voluntary Arrangement be utilised to stop a winding-up petition?

A CVA can potentially halt a winding-up petition if implemented quickly. The company must apply for a validation order to continue trading whilst the CVA is being prepared.

If the CVA is approved by creditors, the court may dismiss or suspend the winding-up petition. This allows the company to continue operating under the terms of the CVA.

How long does a typical Company Voluntary Arrangement process take to implement?

The CVA implementation process typically takes 3-5 months. This includes preparation of the proposal, creditor meetings, and final approval.

Once approved, the CVA usually lasts 3-5 years. During this time, the company makes agreed payments to creditors under the supervision of an insolvency practitioner.

What are the consequences of a Company Voluntary Arrangement failure for a business?

If a CVA fails, the company may face liquidation or administration. Creditors can take legal action to recover their debts.

Directors may be investigated for wrongful trading if they continued to operate the business whilst knowing it couldn’t meet its obligations.

The company’s assets may be sold to repay creditors, and employees could lose their jobs.

How does a Company Voluntary Arrangement impact the directors of the company?

Directors retain control of the company during a CVA, unlike in administration. They continue to manage day-to-day operations and implement the agreed recovery plan.

Directors must comply with the terms of the CVA and work closely with the appointed insolvency practitioner. Failure to do so can lead to personal liability for company debts.

A successful CVA can protect directors from accusations of wrongful trading and potential disqualification.

You may also be interested in: