Comprehensive Liquidation Advice for UK Businesses: Essential Steps for a Smooth Closure

Understanding Company Liquidation

Company liquidation is a formal process to wind up a business’s affairs and dissolve it. It involves selling assets, settling debts, and distributing remaining funds to shareholders. The UK has specific legal procedures governing liquidation.

Definition and Purpose of Liquidation

Liquidation is the process of closing down a company and terminating its operations. Its primary purpose is to realise the company’s assets, settle outstanding debts, and distribute any remaining funds to shareholders.

There are two main types of liquidation:

- Voluntary liquidation: Initiated by the company’s directors or shareholders

- Compulsory liquidation: Forced by creditors through a court order

Liquidation aims to:

- Ensure fair treatment of creditors

- Maximise asset value for debt repayment

- Investigate potential wrongdoing by directors

- Provide an orderly closure of the business

For insolvent companies, liquidation offers a way to deal with debts that cannot be repaid. For solvent firms, it provides a structured method to cease operations and distribute assets.

Legal Framework Governing Liquidation in the UK

The Insolvency Act 1986 and the Company Directors Disqualification Act 1986 form the primary legal basis for company liquidations in the UK. These laws outline the procedures, rights, and responsibilities of all parties involved.

Key aspects of the legal framework include:

- Appointment of liquidators: Licensed insolvency practitioners manage the process

- Creditor rights: Secured and unsecured creditors have different priorities for repayment

- Director duties: Directors must cooperate with liquidators and may face disqualification for misconduct

- Employee rights: Employees can claim unpaid wages and redundancy pay through the National Insurance Fund

The Companies Act 2006 also plays a role, particularly in voluntary liquidations of solvent companies. It sets out the procedures for shareholder resolutions and the appointment of liquidators.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles)

Types of Company Liquidation

Company liquidation in the UK comes in three main forms. Each type serves a specific purpose and follows distinct procedures depending on the company’s financial situation and the reasons for closing down.

Creditors’ Voluntary Liquidation (CVL)

CVL is the most common type of liquidation for insolvent companies. You might choose this option when your business can no longer pay its debts. The process begins with a shareholders’ meeting to pass a resolution for winding up the company.

A licensed insolvency practitioner is then appointed as liquidator. They’ll take control of the company’s assets, sell them, and distribute the proceeds to creditors. This process can help protect you from accusations of wrongful trading.

CVL offers several advantages:

- You initiate the process, maintaining some control

- It can relieve the stress of mounting debts

- It may prevent compulsory liquidation

The cost of a CVL typically starts from £3,000 plus VAT. Some firms offer payment terms to make this more manageable.

Compulsory Liquidation

This type of liquidation is initiated by creditors who are owed £750 or more. They can petition the court to wind up your company if you’ve failed to pay a statutory demand or CCJ.

If the court grants the winding-up petition, your company will be forcibly closed. The Official Receiver is initially appointed as liquidator, though an insolvency practitioner may take over later.

Key points about compulsory liquidation:

- It’s often seen as a last resort for creditors

- You lose control of the process

- The liquidator will investigate directors’ conduct

- It can lead to personal liability if wrongful trading is proven

This process can be costly and damaging to your reputation. It’s usually best to explore other options before reaching this stage.

Members’ Voluntary Liquidation (MVL)

An MVL is used for solvent companies that no longer serve a purpose. You might choose this option if you’re retiring or restructuring your business interests.

To qualify, your company must be able to pay all its debts within 12 months. Directors must sign a declaration of solvency, and shareholders must pass a resolution to wind up the company.

Benefits of an MVL include:

- Tax-efficient distribution of assets to shareholders

- A clean, professional way to close a solvent company

- Potential to claim Business Asset Disposal Relief (formerly Entrepreneurs’ Relief)

The cost of an MVL typically starts from £995 plus VAT, with additional fees for insurance bonds and advertising. It’s often suitable for companies with £25,000 or more to distribute.

Signs Your Business May Need Liquidation

Recognising the signs of financial distress is crucial for UK business owners. Early identification can help you make informed decisions about your company’s future.

Financial Indicators of Insolvency

Cash flow problems often signal potential insolvency. If you’re struggling to pay suppliers, staff, or HMRC on time, it’s a red flag.

Mounting debts and creditor pressure are key indicators. You may receive legal notices or face County Court Judgments (CCJs).

Your company’s balance sheet might show more liabilities than assets. This negative equity position suggests insolvency.

Consistently declining profits or increasing losses over multiple accounting periods are worrying trends. If you’re relying on personal funds or additional loans to keep the business afloat, it’s time to seek advice.

Operational Challenges Leading to Liquidation

Loss of key clients or contracts can severely impact your business viability. If you’re unable to replace this lost income, liquidation might be necessary.

Difficulty in securing new finance or credit terms from suppliers often indicates a lack of confidence in your business’s future.

Falling behind competitors or failing to adapt to market changes can lead to declining sales and eventual closure.

Unresolved legal disputes or regulatory issues might force liquidation if they threaten your company’s ability to operate.

Staff resignations, especially in key roles, can signal internal recognition of the company’s struggles. This can further compound operational difficulties.

The Liquidation Process Explained

Liquidation involves legally dissolving a company and selling its assets. This process has significant implications for all stakeholders, including directors, employees, and creditors.

Role of Insolvency Practitioners

Insolvency practitioners play a key role in company liquidations. They are appointed to oversee the entire process, ensuring it follows legal requirements.

These professionals assess the company’s financial situation and determine the best course of action. They communicate with creditors, manage asset sales, and distribute proceeds fairly.

Insolvency practitioners also investigate the company’s affairs and director conduct. This helps identify any potential wrongdoing or misconduct that may have led to the company’s downfall.

Voluntary Liquidation – Insolvency Advisory Process – Quick Example

Asset Realisation and Distribution

Asset realisation is a key step in liquidation. The appointed liquidator identifies and values all company assets, including property, equipment, and inventory.

These assets are then sold through various means, such as auctions or private sales. The goal is to maximise returns for creditors.

Once assets are sold, the liquidator distributes the proceeds according to a strict order of priority. Secured creditors are typically paid first, followed by preferential creditors like employees. Unsecured creditors receive any remaining funds.

Impact on Employees and Creditors

Liquidation often results in job losses for employees. They become preferential creditors for unpaid wages and holiday pay.

The government’s Redundancy Payments Service may cover some employee entitlements if the company can’t pay. Employees can claim up to 8 weeks’ unpaid wages and up to 6 weeks’ holiday pay.

Creditors face the risk of not receiving full payment for amounts owed. Secured creditors have the best chance of recovering their debts, while unsecured creditors may receive little or nothing.

Creditors can attend meetings during the liquidation process to stay informed and vote on important decisions. This helps ensure transparency and fairness throughout the proceedings.

Legal Obligations and Director Responsibilities

Directors face crucial legal duties and potential consequences when navigating company liquidation. Your role shifts significantly during insolvency, requiring careful attention to statutory obligations and creditor interests.

Duties During Insolvency

When your company becomes insolvent, your primary duty shifts from promoting shareholder interests to acting in creditors’ best interests. You must:

- Cease trading immediately if continuing would worsen creditors’ position

- Seek advice from a licensed insolvency practitioner promptly

- Avoid taking on new credit or making preferential payments

- Maintain accurate financial records and cooperate fully with liquidators

Directors who fail to uphold these duties risk personal liability for company debts.

Potential Liabilities and Penalties

Breaching your legal obligations can lead to severe consequences:

- Wrongful trading: You may be held personally liable if you continued trading whilst knowing (or should have known) there was no reasonable prospect of avoiding insolvency.

- Fraudulent trading: Carrying on business with intent to defraud creditors is a criminal offence, potentially resulting in fines, disqualification, or imprisonment.

- Misfeasance: Misusing company assets or breaching fiduciary duties can lead to personal liability for losses.

- Disqualification: Directors found unfit to manage a company may be disqualified for up to 15 years.

Seek professional advice to ensure compliance and protect yourself from these risks.

Alternatives to Liquidation

Several options exist for UK businesses facing financial difficulties that can help avoid liquidation. These alternatives aim to restructure debt, reorganise operations, or secure additional financing to keep the company viable.

Company Voluntary Arrangements (CVAs)

A CVA is a legally binding agreement between a company and its creditors. It allows the business to repay debts over an extended period, typically 3-5 years. To implement a CVA, you’ll need approval from 75% of your creditors by value.

CVAs offer flexibility in restructuring debts whilst maintaining control of your company. You can continue trading, preserve jobs, and potentially return to profitability.

Key benefits of CVAs:

- Protection from legal action by creditors

- Ability to retain assets and continue trading

- Opportunity to restructure lease agreements

However, CVAs require careful planning and professional guidance to ensure success.

Administration as a Rescue Mechanism

Administration is a formal insolvency procedure designed to rescue struggling companies. An insolvency practitioner takes control of your business to protect it from creditor actions and attempt a turnaround.

The administrator has several options:

- Restructure the company

- Sell the business as a going concern

- Realise assets to repay creditors

Administration provides a moratorium on creditor actions, giving your business breathing space to reorganise. It can lead to a pre-pack sale, where the company’s assets are sold to a new entity, often involving existing management.

Advantages of administration:

- Legal protection from creditors

- Professional expertise in business rescue

- Potential for business continuity

Administration can be complex, but it offers a chance to save viable parts of your business.

![]()

Checklist for Directors Considering Liquidation

Directors facing financial difficulties must carefully evaluate their options and follow proper procedures when considering liquidation. This checklist outlines key steps to take, from assessing your company’s financial health to communicating with stakeholders.

Assessing Financial Health

Review your company’s financial statements, including balance sheets, profit and loss accounts, and cash flow projections. Analyse your debts, assets, and liabilities to determine if you can meet upcoming financial obligations.

Compare your current financial position to previous periods to identify trends. Look for signs of insolvency, such as persistent losses or inability to pay creditors on time.

Consider seeking a professional valuation of company assets. This will help you understand the true value of your business and its potential liquidation value.

Seeking Professional Advice

Consult a licensed insolvency practitioner as soon as possible. They can provide expert guidance on your options and help you make informed decisions about your company’s future.

Arrange a meeting with your accountant to discuss your financial situation in detail. They can offer insights into your company’s financial health and potential turnaround strategies.

Speak with a solicitor specialising in insolvency law. They can advise you on your legal obligations and potential personal liabilities as a director.

Communicating with Stakeholders

Inform your shareholders about the company’s financial difficulties. Be transparent about the situation and discuss potential courses of action, including liquidation.

Meet with key creditors to discuss your financial position. Explore the possibility of negotiating payment terms or debt restructuring before deciding on liquidation.

Brief your employees on the company’s situation. Be honest about potential outcomes, including the possibility of redundancies if liquidation becomes necessary.

Consider informing customers and suppliers about your financial challenges. This can help maintain trust and potentially lead to supportive arrangements.

Expert Liquidation Advice from Anderson Brookes

If your business is facing financial difficulty and you’re considering closing it down, we offer clear, practical liquidation advice to help you understand your options.

We specialise in voluntary liquidation and can support you with everything from winding-up procedures and asset sales to dealing with creditors and legal obligations. Our in-house Licensed Insolvency Practitioner will ensure the process is handled properly and in line with UK regulations.

If you’re under pressure from legal action or bailiffs, we can step in quickly to provide support and reduce the stress on you and your business.

We also offer a free, confidential consultation so you can speak to us about your situation. We’ll explain the options available, give honest advice, and help you decide on the best way forward—with no pressure and no obligation.

Get in touch for expert liquidation advice you can trust.

You may also like:

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

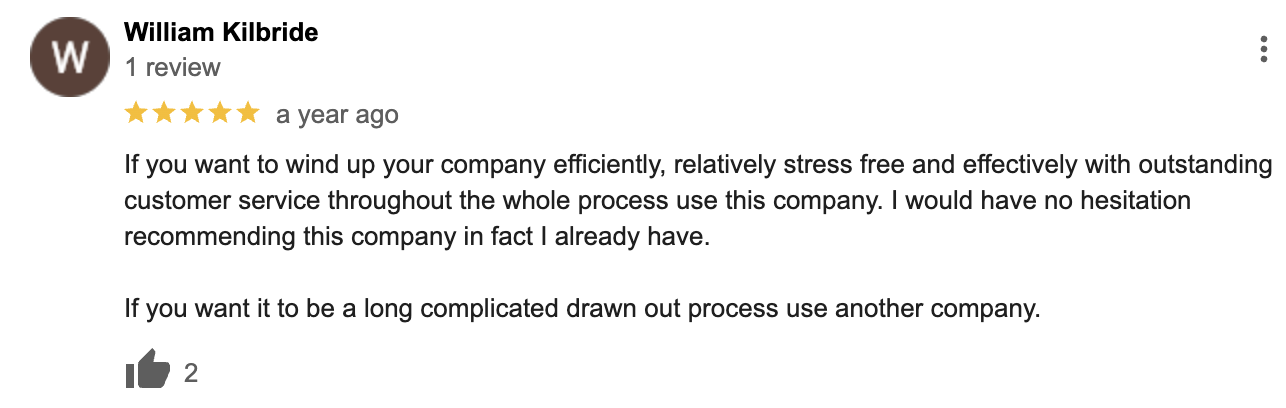

Google Reviews

&

Frequently Asked Questions

Liquidation can be a complex process for UK businesses. These common questions address key aspects of company liquidation, from director implications to creditor compensation.

What are the implications for directors after a company enters liquidation?

Directors face several potential consequences when a company enters liquidation. You may be disqualified from acting as a director for up to 15 years if found guilty of wrongful trading or other misconduct. Personal liability for company debts is possible in cases of fraudulent trading or breach of fiduciary duties.

Your conduct will be investigated by the liquidator. If you’ve acted responsibly, you shouldn’t face personal repercussions.

What are the primary reasons a company may go into liquidation?

Companies often enter liquidation due to insolvency, inability to pay debts, or persistent financial struggles. Other reasons include:

- Declining market conditions or loss of major contracts

- Irrecoverable bad debts

- Legal disputes or regulatory issues

- Retirement of key shareholders with no succession plan

Sometimes, solvent companies liquidate to distribute assets and close down efficiently.

How can a company be liquidated most cost-effectively in the UK?

To liquidate cost-effectively, consider these steps:

- Opt for a Creditors’ Voluntary Liquidation (CVL) if insolvent, as it’s typically cheaper than compulsory liquidation.

- Choose a licensed insolvency practitioner with competitive fees.

- Prepare thorough financial records to streamline the process.

For solvent companies, a Members’ Voluntary Liquidation (MVL) is often the most tax-efficient route.

What is the duration a company can remain in the liquidation phase in the UK?

The liquidation timeframe varies depending on the company’s complexity and assets. A straightforward liquidation might conclude within 6-12 months. More complex cases involving legal disputes or asset realisations can take several years.

There’s no strict time limit, but liquidators aim to complete the process efficiently.

In what order are creditors compensated during the liquidation process in the UK?

Creditor compensation follows a strict order of priority:

- Secured creditors (e.g., banks with fixed charges)

- Preferential creditors (e.g., employees for unpaid wages)

- Unsecured creditors (e.g., suppliers, HMRC for taxes)

- Shareholders (if any funds remain)

This order ensures fair distribution of available assets.

How is a company with outstanding HMRC liabilities liquidated?

Companies with HMRC debts can still enter liquidation. The process is similar to liquidating a company with other creditors:

- Appoint a licensed insolvency practitioner.

- They’ll communicate with HMRC and other creditors.

- HMRC debts are typically treated as unsecured claims in the liquidation.

You must disclose all HMRC liabilities to the liquidator. They’ll handle negotiations and settlements with HMRC as part of the liquidation process.