Thinking about closing your company, but unsure about how the process works? For most UK company directors, one of the most important steps is filing a DS01 form online. This document acts as the formal trigger for striking off your company from the Companies House register.

Completing your DS01 form online is typically a straightforward, cost-effective method to close your limited company. However, there can be pitfalls along the way if you’re unfamiliar with the process. That’s why we’ve created this guide to help UK company directors to file DS01 online with confidence.

In this guide, we’ll explain who is eligible to submit a DS01 form online and walk you through the submission process. We’ll also help you to avoid common mistakes and show you how Anderson Brookes can support you every step of the way.

Need Support with Form DS01? Get in Touch

What is a DS01 form?

The Companies House DS01 form is the official application document used to permanently and voluntarily dissolve a UK limited company. By filing the form, you are requesting to strike off your company from the Companies House register.

Filing DS01 triggers a three-month notice period. During this time, interested parties can object to the dissolution if they have valid concerns. Once the process has been completed, your company will cease to exist legally. After dissolution begins, you can no longer trade or conduct business activities through the company.

Who can use a DS01 form?

While DS01 is an efficient way to close a company, it isn’t the right option for everyone. In fact, not all businesses are able to use this form, as certain eligiblility criteria apply. Your company needs to meet the following conditions in order to file a DS01:

- No trading or business activity in the last three months

- No name changes in the last three months

- No ongoing legal proceedings or insolvency processes

- No outstanding debts or agreements with creditors

- All employees must have been dismissed and paid

- Assets must have been distributed to shareholders appropriately

If your business does not meet these criteria- for example, if it is insolvent, then an alternative method such as voluntary liquidation may be more suitable. For more information, read our guide to options for company closure.

Why choose to file your DS01 online?

The DS01 form is available in both online and paper formats. However, Companies House strongly recommends that you file your DS01 online; only if you are unable to do so should you resort to the paper version. There are several key reasons why Companies House favours filing a DS01 online.

Online DS01 vs Paper DS01

- Filing DS01 is cheaper: it costs £33, compared to £44 if applying with a paper form.

- It’s quicker and more efficient to submit DS01 online.

- You also reduce the risk of errors with DS01 online.

- Finally, by filing online, you can be sure that your form arrives: you get immediate confirmation and no postal delays.

What do I need to do before I file a DS01 form?

Before you file to strike off your company, you need to gather specific information and documents. The majority of directors must provide their consent, and they remain personally liable for ensuring that all information provided is accurate.

Additionally, you will need to prepare documentation showing all company debts have been settled. This includes trade creditors, HMRC obligations, and any outstanding loans or finance agreements.

Keep copies of final accounts if prepared. Whilst not mandatory for strike-off, they provide useful reference information during the application process.

How to file a DS01 online: a step-by-step guide

The process for filing your DS01 application involves having all the right details ready. The form requires specific company information and must be completed accurately to avoid rejection. We’ll provide a step-by-step guide to DS01 below.

Before starting, here’s a list of what you’ll need to file DS01 online:

- Companies House sign-in details

- Company number and authentication code

- An email address for each director who needs to sign

- Debit/credit card (or a Companies House credit account)

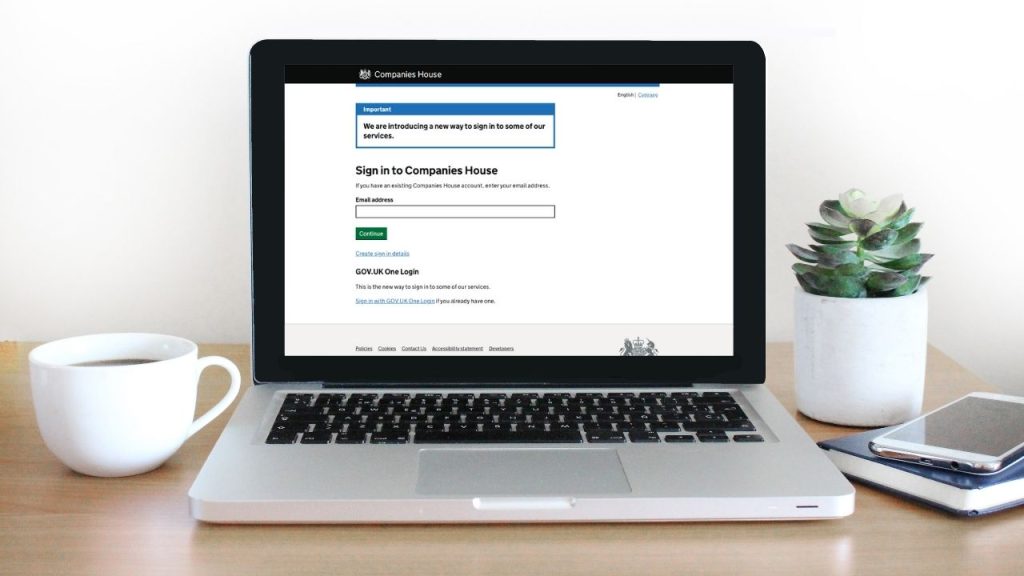

Step 1: Log into Companies House

To file your DS01 application online, you need an account with Companies House. Most company directors will already have one, but if you don’t, go to the official website and create your account. To access the Companies House online service, sign in using your company authentication code and registration number. If you’ve misplaced your authentication code, you can request a new one, though this may delay your application.Please note that you must be a current director of the company to proceed with the application. The system will verify your director status before allowing you to access the DS01 form.

Step 2: Complete the DS01 form

To fill out the application, you need to provide the following information:

- Company name and number

- Registered office address

- Director names and details

- Date of application

You must also declare that your company meets all the eligibility criteria for voluntary strike-off, as listed above. This includes confirming that the company has not traded in at least three months, that all debts have been settled and all assets distributed.

Step 3: Obtaining director approvals

A majority of directors must approve and sign a DS01 application. If your company only has one director, this step is straightforward. However, in firms with multiple directors, you are legally required to achieve consensus.

To be able to file DS01 online, more than half of your company’s directors have to provide their digital signatures. Only once this has been completed can you move onto the next step.

Step 4: Pay the application fee

The online DS01 application fee is £33, and is non-refundable once the application is submitted. Once your transaction has been completed, you’ll receive a payment confirmation and application reference number. Keep this reference for tracking your application’s progress through the strike-off process.

Accepted payment methods include:

- Debit cards (Visa or Mastercard)

- Credit cards (Visa, Mastercard or American Express)

Step 5: Notify interested parties

Within seven days of submitting the DS01, you must send a copy of the form to specific parties.

This includes:

- Shareholders

- Employees

- Creditors

- Directors who didn’t sign the application form

- Managers of employee pension funds

This is a legal requirement. Failing to inform these parties can result in fines and prosecution.

Step 6: Monitor The Gazette for publication

Companies House will publish a notice of your intention to dissolve the company in The Gazette, an official government journal of record.

Once this notice has been published, a two-month objection period begins. During this period, any interested parties may object to the dissolution by contacting Companies House directly. If no objections are received within two months, your company will be officially struck off.

Common mistakes when filing DS01 online

Filing DS01 online can be complicated, and certain errors frequently cause delays or rejections. Outstanding taxes, incomplete documentation, and failing to notify relevant parties are the most common issues that directors encounter.

Incorrect or incomplete information

You must provide accurate company details in every field of the DS01 form. Missing information or incorrect company numbers will result in automatic rejection by Companies House.

Missing signatures

When filing DS01 online, all relevant directors must provide a digital signature. Without this, your application will be rejected.

Unsettled liabilities

Companies House will reject your DS01 application if you have outstanding debts or unpaid taxes. HMRC must confirm that all tax obligations are settled before processing begins.

Misunderstanding notification duties

You must notify all interested parties within seven days of filing DS01. This includes creditors, employees, and shareholders who might be affected by the dissolution.

For more detail, visit our post on common mistakes to avoid when applying for company strike-off.

Can a DS01 application be stopped?

Yes. If you change your mind or circumstances shift you can withdraw the application using form DS02.

Common reasons for this include:

- Change in business circumstances

- New investment opportunities

- Creditor claims discovered after filing

- Legal disputes arising

Interested third parties can also object to the striking off if they have legitimate grounds, such as outstanding debts, legal disputes, or regulatory investigations. Resolving these objections requires addressing the underlying issue, providing evidence to Companies House, and reaching an agreement with the objector. It may potentially involve withdrawing the DS01 application.

If an objection is raised during the Gazette notice period, Companies House will halt the strike-off process until the matter is resolved.

What happens after your company is struck off?

Once Companies House confirms dissolution, your company ceases to exist as a legal entity. As a director, you will no longer be legally responsible for the company’s affairs. Any contracts or agreements in the company’s name become void, and shareholders lose their ownership rights.

Any remaining assets will automatically pass to the Crown as “bona vacantia”. It is therefore essential to:

- Close business bank accounts

- Settle outstanding contracts or obligations

- Distribute remaining company assets

Ensure everything is wrapped up prior to submission. You can find more on this in our guide on how to strike off a company in the UK.

What are the alternatives to using DS01 for dissolution?

Filing a DS01 is suitable for companies that are dormant, solvent and ready to close without dispute. However, DS01 voluntary strike off is not the only way to close your company. Several alternatives exist depending on your company’s circumstances and financial position.

- Creditors’ Voluntary Liquidation (CVL) is required when your company cannot pay its debts. This formal insolvency process involves appointing a licensed insolvency practitioner to wind up the company and distribute assets to creditors.

- Members’ Voluntary Liquidation (MVL) applies to solvent companies with significant assets or reserves. Directors must make a statutory declaration of solvency before proceeding with this route.

- Compulsory liquidation occurs when creditors or other parties petition the court to wind up your company. This typically happens when companies fail to pay debts or comply with legal obligations.

- Company administration provides temporary protection whilst attempting to rescue the business or achieve better outcomes for creditors than immediate liquidation.

- Dissolution by court order may occur following successful legal proceedings against the company.

Choose the appropriate method based on your company’s solvency, assets, and trading status. If your company owes taxes, staff wages, or other liabilities, voluntary liquidation may be the safer legal route. Contact Anderson Brookes if you’re unsure which route suits your circumstances best.

Questions? Speak to our experts today on 0800 1804 935.

Why it’s important to get professional advice

Even for straightforward dissolutions, professional advice can prevent costly missteps.

At Anderson Brookes, we:

- Review your company’s eligibility for DS01

- Advise on alternative closure routes if necessary

- Ensure full compliance with Companies House procedures

- Help notify all required parties

We’re here to support UK company directors through every stage of the closure process, ensuring clarity and legal confidence.

Frequently asked questions

How do I submit DS01 online?

You submit DS01 through the Companies House “close a company” service. You sign in, enter your company number and authentication code, confirm eligibility, collect director approvals, then pay the fee and submit the application.

Is DS01 the Companies House company closure form?

For voluntary strike off, yes. DS01 is the Companies House form used to apply to strike off and dissolve a company. If the company has debts or is insolvent, a formal insolvency process such as a CVL may be more appropriate.

How long does the DS01 process take?

Typically, the process takes around three months from submission to dissolution. The timeline includes the mandatory two-month objection period following Gazette publication. Prompt action at each step helps prevent unnecessary delays.

Can I file DS01 if my company has debts?

No, all debts must be settled before applying. If your company has outstanding liabilities, consider voluntary liquidation.

Is it cheaper to file DS01 online than by post?

Yes. An online DS01 application costs £33. Paper submissions cost £44 and take longer to process.

Do I need WebFiling to file DS01 online?

Not necessarily. Companies House notes that the DS01 online service uses sign-in details that are different to WebFiling. You’ll also need the company authentication code and an email address for each person signing.

What if a creditor objects to the strike-off?

Companies House will pause the strike-off process. You’ll need to resolve the issue directly or seek professional help.

Can I start a new business after dissolving one?

Yes. However, you may not reuse the same company name (known as phoenixing) for five years unless certain conditions are met.

How can I tell if DS01 is the right option?

This will depend on your company’s financial health and activity status. Anderson Brookes is here to provide personalised advice on the best route for closing your company.

If your company is facing financial difficulties, don’t wait until it’s too late. Contact Anderson Brookes today for expert, confidential advice tailored to your situation.