Insolvency Practitioner Fees in the UK

Insolvency practitioner fees can vary widely depending on the procedure you need, how complex the case is, and how the fees are agreed. If you are a director considering liquidation, administration, or a CVA, it helps to understand what you are paying for, what you can ask for in writing, and how disbursements affect the final bill.

In this guide, Anderson Brookes explains the most common fee structures, typical cost drivers, and the checks you should make before you appoint an IP. We also cover how to find an insolvency practitioner and confirm they are licensed, so you can compare like for like.

Table of Contents

Quick Summary: What Insolvency Practitioner Fees Usually Include

- Professional fees: the IP’s work (set as a fixed fee, time cost, a percentage, or a mix).

- Disbursements: third-party costs like advertising, insurance, valuations, and storage.

- How fees are approved: in formal procedures, fees normally require creditor approval and must follow the relevant rules and guidance.

When you request a quote, ask for a written breakdown showing the fee basis, hourly rates (if time cost), and estimated disbursements.

Definition and Role of Insolvency Practitioners

Insolvency practitioners are licensed professionals authorised to handle the affairs of insolvent businesses and individuals. All UK practitioners must hold a licence from one of five recognised professional bodies and conform to the Insolvency Act 1986 and Insolvency Rules 2016.

Their primary responsibilities include: assessing financial viability, protecting and selling assets, distributing funds to creditors, and investigating potential misconduct. In a typical liquidation, practitioners spend 42% of their time on asset realisation, 27% on investigations, 18% on creditor communication, and 13% on administration. This is of course only a guide.

Practitioners must carry professional indemnity insurance of at least £250,000 per claim (though many carry higher) and are subject to regular regulatory inspections. Their role as officers of the court means they have significant legal powers, including the ability to void transactions made before insolvency and pursue directors for wrongful trading if necessary. Communication and transparency really is the key and this is why we offer a free consultation and free advice to ensure the right decisions and make – and that you ensure compliance.

Basis of Fee Calculation

Time-Cost Basis

Most insolvency practitioners charge using the time-cost basis, accounting for 76% of all UK insolvency cases, according to 2023 Insolvency Service data. This method multiplies hours worked by hourly rates. Current market rates in 2025 range from £120-£175 for administrators and assistants, £200-£350 for managers and senior insolvency professionals, and £375-£650 for partners and appointment-takers. These seem like huge sums but specialist firms, licensed insolvency practitioners like Anderson Brookes, have created efficient systems focused on customer service, ensuring compliance, transparency. Keeping a complex process simple and therefore keeping our fees low.

The sector reports a typical small business liquidation requires 35-50 hours of work, meaning time-cost fees generally range from £6,000-£15,000. Time records must detail specific tasks, for example: “3.2 hours reviewing company books and records”, rather than vague descriptions. Creditors can and should challenge records lacking sufficient detail. It is important to remember that this average is likely to be inflated due to large and complex insolvencies. At Anderson Brookes our focus is small and medium businesses and we have been working with company directors for over 20 years.

Fixed Fee Arrangements

Fixed fees provide certainty but are only offered in 18% of cases, typically for straightforward liquidations. Standard fixed fees for a simple company liquidation currently range from £3,500-£7,500 depending on company size and complexity. These fees cover all work from appointment to case closure, regardless of how long the process takes. You can see from the testimonials above and below this section – that we fully appreciate the importance of cost and provide competitive quotes, often saving customers thousands of pounds.

The key benefit is predictability: the fee won’t increase if complications arise. The drawback is practitioners may decline fixed fee arrangements for potentially complex cases. If you request a fixed fee, verify exactly what’s included and what would trigger additional charges.

Anderson Brookes is proud to offer fixed fee arrangements.

Percentage of Realisations or Distributions

This method of fee calculation links practitioner payment directly to money recovered for creditors. Standard percentage rates in 2024 typically follow a sliding scale: 15-20% on the first £10,000, 10-15% on the next £90,000, and 5-8% on amounts over £100,000.

This approach creates clear alignment with creditor interests but can yield disproportionate fees in high-asset cases. For example, a straightforward £500,000 property sale could generate fees exceeding £40,000 despite requiring similar work to a £100,000 property sale. Only 6% of cases now use pure percentage fees, though many practitioners propose hybrid models combining fixed and percentage elements.

IP Fees Quote

Need more detail about insolvency practitioner fees? Complete our quick form to get a personalised quote based on your circumstances.

Questions to Ask an Insolvency Practitioner About Fees

- Is the quote fixed fee, time cost, percentage, or a hybrid?

- If time cost, what are the hourly rates by staff grade and what work is estimated?

- What disbursements are likely (advertising, insurance, valuations, storage) and what could change them?

- How will fees be approved in the procedure you are using?

- How often will you receive cost updates and progress reports?

- Who is your day-to-day contact and who signs off key decisions?

Insolvency Practitioners’ Fees and Liquidation Costs

Insolvency practitioner (IP) fees are, of course, a key part of overall liquidation costs. The most common type of liquidation in the UK is a Creditors’ Voluntary Liquidation (CVL), and our detailed article Understanding the Costs of a Creditors’ Voluntary Liquidation (CVL) in the UK explains how these costs work in practice.

In short, there are two separate fees in a CVL:

-

The Statement of Affairs (SOA) fee – paid up front, this covers the preparation of paperwork, creditor notifications, and meetings needed to place the company into liquidation. It usually falls between £3,000 and £8,000.

-

The Liquidator’s fee – drawn only from asset realisations after liquidation begins. If the company has no assets, this fee may not be recovered, but the liquidator still has to complete all statutory duties.

Together, these fees reflect both the set-up of the liquidation and the work required to close the company properly. If you want to understand the detail and see examples, take a look at our full guide to CVL costs.

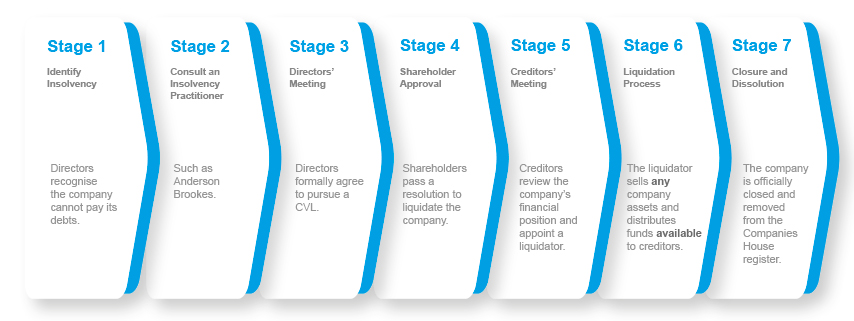

Business Liquidation Process

At Anderson Brookes, we can place a company into liquidation within 8 days of instruction.

Contact us today for confidential advice.

Fee Structures You May Find in Different Insolvency Procedures

Liquidation

Liquidation fees divide into two distinct charges:

Statement of Affairs (SOA) Fee: This upfront fee covers work to place the company into voluntary liquidation. Current market rates range from £3,000-£8,000 depending on company size.

This fee must be paid before liquidation begins, typically from company funds or personally by directors if no company funds remain. The SOA fee covers statutory forms, creditor notices, and the creditors’ decision procedure.

Liquidator’s Fee: This covers all work from appointment until case closure, including asset sales, investigations, and creditor distributions. This fee comes solely from realised assets.

Average total liquidation costs for small to medium companies range from £5,000-£20,000, with complexity and asset values being the primary variables.

Administration

Administration fees typically exceed liquidation costs due to the added complexity of attempting business rescue or achieving better creditor outcomes than liquidation.

Administrator fees average £15,000-£60,000 depending on business size and complexity. Time-cost billing dominates due to the unpredictable nature of administrations. The 2024 market rate for pre-pack administrations (where a buyer is arranged beforehand) is £12,000-£30,000.

Monthly fee updates are mandatory in administrations, providing creditors with regular oversight of mounting costs.

Company Voluntary Arrangement (CVA)

CVA fees split between:

Nominee Fee: £5,000-£10,000 for preparing and implementing the Company Voluntary Arrangement. This covers financial reviews, proposal preparation, and creditor meetings.

Supervisor Fee: Typically 10-15% of funds distributed to creditors over the CVA term (usually 3-5 years), reflecting the ongoing work of monitoring payments and creditor communication.

For a typical small business CVA with monthly contributions of £3,000 over 5 years (£180,000 total), supervisor fees would range from £18,000-£27,000, paid incrementally throughout the arrangement.

Individual Voluntary Arrangement (IVA)

IVA fees are tightly regulated under the IVA Protocol, with standard fees including:

Nominee fee: £1,000-£2,000 Setup fee: £1,500-£2,500 Annual supervision fee: £1,000-£1,500

Most IVA practitioners now charge a straightforward percentage (usually 15%) of total contributions. For a typical 5-year IVA with £300 monthly payments (£18,000 total), this would mean total fees of approximately £2,700.

Factors Influencing Fee Levels

Complexity and Size of the Case

The scale and intricacy of a company’s financial situation significantly affects fee levels. Larger businesses with multiple subsidiaries require more time and resources to manage properly. Complex corporate structures need more thorough investigation, often requiring specialised teams to untangle financial arrangements.

Businesses in regulated industries such as healthcare or finance may require sector-specific expertise, which can command higher rates. Additionally, companies with international elements often involve higher costs due to cross-border considerations and the need to navigate multiple legal frameworks.

Asset Realisation and Distribution Efforts

The nature and value of a company’s assets play a crucial role in determining practitioner fees. The process of identifying, securing, and realising assets can be time-consuming, particularly for businesses with diverse or hard-to-value assets. Complex asset portfolios require specialised valuation expertise and careful sales strategies to maximise returns.

The effort required to distribute funds to creditors also impacts fees. Cases with a high number of creditors or complex creditor hierarchies typically involve more administrative work. Disputed assets or creditor claims can significantly increase costs as they often require legal intervention and extended negotiation periods.

Duration of the Insolvency Process

The length of time an insolvency case takes to resolve directly affects the total fees charged. Prolonged cases often result from legal disputes or challenges to the insolvency process. Difficulties in realising assets in challenging market conditions can extend the timeline considerably, as can complex negotiations with creditors.

Cases involving fraud investigations or director misconduct proceedings typically take longer to resolve, requiring additional work by the practitioner. Each month that a case remains open generally incurs ongoing costs, which is why efficient case management is critical for controlling expenses.

Questions? Speak to our experts today on 0800 1804 935.

Approval and Regulation of Fees

Insolvency practitioner fees face strict regulatory control through a three-tier system of creditor approval, professional body oversight, and legal compliance requirements.

Creditor approval mechanisms provide the first level of fee control. For fees to be approved, they typically require either a creditors’ committee vote or a general creditor resolution. The 2016 Insolvency Rules strengthened this process by requiring 50% of unsecured creditors by value to approve fees. Practice shows that active creditor engagement reduces average fees by challenging excessive charges.

Regulatory body oversight comes from the recognised professional bodies (RPBs) like the ICAEW, IPA and ACCA. These bodies regularly monitor compliance with the Statements of Insolvency Practice (SIPs), particularly SIP 9 which governs fee charging. Monitoring visits examine fee documentation, approval processes and time records. Practitioners found overcharging face penalties ranging from fines to licence revocation.

Legal framework and compliance is governed primarily by the Insolvency Act 1986 and Insolvency Rules 2016. These laws mandate specific approval processes, detailed fee estimates, and regular progress reports. The laws balance fair practitioner remuneration against protecting creditor interests. Courts have powers to review and reduce fees if deemed excessive, providing an ultimate safeguard for creditors.

Transparency and Disclosure

Requirement for Fee Estimates and Reports

Since 1 October 2015, insolvency practitioners must provide upfront estimates of their fees and expenses. This requirement applies to all new insolvency cases. Practitioners must outline their proposed basis for remuneration, whether fixed fee, percentage, or time-cost.

You’ll receive a detailed breakdown of estimated hours and rates for different staff levels. This allows you to assess the reasonableness of proposed fees before work begins.

Regular progress reports are mandatory. These updates give you insights into actual time spent, costs incurred, and any revisions to initial estimates. You can compare these against the original projections to monitor expenses.

Rights of Stakeholders to Access Information

As a creditor, you have enhanced rights to access fee-related information. You can request additional details about an insolvency practitioner’s time recordings and expenses at any point during the proceedings.

Practitioners must respond promptly to such requests, typically within 14 days. They should provide a comprehensive breakdown of tasks performed, time spent, and associated costs.

You also have the right to challenge fees if you believe they are excessive. This can be done through creditors’ meetings or by application to the court. The burden of proof lies with the insolvency practitioner to justify their charges.

These measures aim to empower you with the information needed to make informed decisions about fee approvals and to hold practitioners accountable for their costs.

Sectors We Support

We support company directors in every sector, from construction firms and logistics companies to pubs, cafés, restaurants, hotels, retailers and manufacturers. Our advice is always clear, confidential and shaped by real experience in your industry. Whether you’re dealing with unpaid tax, supplier pressure or falling income, our team understands the challenges and will guide you through the best next steps.

Potential Disputes and Challenges Over Fees

When concerns arise about insolvency practitioner fees, formal mechanisms exist to challenge potentially excessive charges.

The primary method for contesting fees begins with direct communication with the practitioner. Requesting detailed time records and fee breakdowns often resolves misunderstandings. If this proves unsatisfactory, formal written complaints to the practitioner’s firm must be addressed within eight weeks under professional standards requirements.

For unresolved disputes, escalation to the practitioner’s regulatory body is the next step. Each recognised professional body maintains a complaints procedure specifically for fee disputes. The Insolvency Service reports that approximately 12% of fee complaints result in some fee reduction when reviewed by regulatory bodies.

As a final recourse, court applications under Rule 18.35 of the Insolvency Rules 2016 allow formal judicial review of fees. Courts can and do reduce fees deemed excessive, though this process involves costs. Recent case law (Fielding v Hunt, 2022) established that courts will particularly scrutinise time charges for routine administrative tasks and will expect substantial discounts for such work.

For fee disputes involving relatively small amounts (under £5,000), the Insolvency Service’s Complaints Gateway provides a less formal review process. Approximately 8% of all fee complaints in 2023 were resolved through this mechanism.

How to Minimise Insolvency Practitioner Costs

Academic research and Insolvency Service data consistently demonstrate that proactive directors can reduce insolvency costs by 20-40%. Four specific strategies prove most effective:

Directors who consult insolvency practitioners within 30 days of identifying insolvency pay an average of 27% less in total fees.

This occurs because company assets remain intact, preventing fire-sale scenarios where assets fetch significantly less than market value. Contact a qualified practitioner as soon as cash flow problems become severe, typically when you cannot pay HMRC or critical suppliers.

Organised financial documentation reduces billable hours. Practitioners charge by the hour for sorting through disorganised records. Providing the following specific documents in digital format can reduce fees by 15-20%:

- Last three years’ annual accounts

- Last six months’ bank statements

- Complete creditor list with contact details and amounts

- Asset register with purchase dates and estimated values

- HMRC correspondence regarding outstanding taxes

Active director involvement throughout the process reduces complications. Regular communication with your practitioner (responding to queries within 24 hours) prevents delays and reduces total fees. Practitioners report that cooperative directors typically see fees 15-25% lower than those who disengage after appointment.

Negotiate fee structures before appointment. Request detailed fee proposals from at least three licensed practitioners. For straightforward liquidations, insist on fixed fees rather than time-based billing. For larger cases, consider hybrid arrangements with caps on hourly rates. Always get fee structures in writing, and ensure the proposal specifies what would trigger additional charges beyond the agreed amount.

Recent Developments and Reviews

The UK has seen significant changes in the regulation and oversight of insolvency practitioner fees in recent years, driven by concerns about transparency and value for money.

Government Reviews on Insolvency Practitioner Fees

In 2013, Professor Elaine Kempson conducted a comprehensive review of insolvency practitioner fees for the UK government. This landmark study highlighted significant concerns about fee levels and the limited control creditors had over them. The review found that in 71% of cases, unsecured creditors received less than 20% of what they were owed, with insolvency fees consuming a substantial portion of available assets.

Following this review, the government implemented substantial reforms through the Small Business, Enterprise and Employment Act 2015. These changes focused on improving transparency and strengthening creditor rights regarding fee arrangements. The Insolvency Service now conducts annual monitoring of compliance with these regulations, publishing findings that help shape ongoing improvements to the system.

Changes in Regulatory Framework

The Insolvency (Amendment) Rules 2015, which came into force on 1 October 2015, introduced several key changes that directly impact how insolvency practitioners charge and justify their fees:

Practitioners must now provide detailed upfront fee estimates before appointment, giving creditors a clearer understanding of likely costs. These estimates must include breakdowns of anticipated work, hourly rates, and expected timeframes.

The rules also require practitioners to provide regular updates on costs throughout the insolvency process, including explanations for any deviations from initial estimates. Creditors now have enhanced powers to challenge and approve fees, with specific provisions for different types of insolvency proceedings.

Additionally, regulatory bodies have implemented more stringent oversight mechanisms, including targeted monitoring visits and stricter requirements for fee justification. Recent data suggests these changes have helped moderate fee increases, though significant variations still exist between simple and complex cases.

Example Scenarios

Manufacturing Company Liquidation: Benefits of Early Intervention

A West Midlands manufacturing company with £3.2 million turnover faced insolvency after losing its largest customer. The directors sought professional advice immediately upon recognising they couldn’t meet the next quarter’s HMRC payments.

The appointed practitioner charged a £5,500 Statement of Affairs fee and an 8% Liquidator’s fee on assets realised. By acting promptly, machinery and equipment were sold for near-market value (£635,000) rather than through distressed sales. Stock was sold to competitors at 60% of cost value rather than the typical 15-20% in delayed liquidations.

The early intervention allowed for negotiation with the landlord, preserving the three-month rent deposit (£32,000). Total recovered: £762,000, with unsecured creditors receiving 42p in the pound – significantly above the national average.

Had the directors delayed by three months (as often occurs), asset values would have deteriorated substantially, demonstrating how timing can significantly impact recoveries.

Retail Chain CVA: Advantages of Fixed Fee Arrangements

A retail chain with 8 locations and 52 staff faced difficulties after poor performance at three new stores created unsustainable losses. With £720,000 in unsecured debt and valuable leasehold interests, the directors sought insolvency advice.

The practitioner proposed a Company Voluntary Arrangement with monthly contributions of £12,000 for 5 years. The fee proposal compared:

- Time-cost basis: Estimated at £82,000 over the 5-year term

- Percentage basis: 15% of contributions (£108,000)

- Fixed fee: £70,000 (£25,000 nominee fee + £9,000 annual supervision fee)

Creditors approved the fixed fee proposal, ensuring certainty for all parties. The company successfully completed the CVA, with unsecured creditors receiving 85p in the pound. The fixed fee arrangement demonstrated considerable savings compared to percentage-based fees, highlighting the importance of discussing fee structures before appointment.

How Anderson Brookes Can Assist

At Anderson Brookes, we offer clear, practical insolvency services for limited companies with transparent fee structures and proven expertise in maximising returns to creditors.

We provide detailed fee estimates before appointment, with clear breakdowns of all anticipated charges. Our statements specify exactly what work is covered and what might trigger additional fees. The vast majority of our cases complete within our initial fee estimates.

Fixed fee options for certainty: For straightforward liquidations, we offer fixed fees ranging from £3,500-£7,500 depending on company size and complexity. These fixed arrangements cover all work from initial consultation through to case closure, providing financial certainty during a difficult period.

Free initial consultation: We assess your specific situation without charge, providing clear options and fee estimates. This consultation includes reviewing your company structure, creditor position, and potential personal liability risks.

Support throughout the process: Our service includes guidance for directors facing personal guarantee claims. We help directors understand their options through structured approaches that comply with regulatory requirements.

Specialist expertise at competitive rates: Our practitioners have extensive insolvency experience, with particular expertise in retail, construction, and manufacturing sectors. Despite this expertise, our fee rates remain competitive compared to many other firms.

To discuss your specific situation and understand potential costs, contact us on 0800 1804 935 or email advice@andersonbrookes.co.uk. All consultations are strictly confidential and come without obligation.

Frequently Asked Questions

What are the typical fees charged for corporate liquidation?

For straightforward small business liquidations (turnover under £1 million), typical fees range from £4,000-£10,000. Medium-sized companies (£1-5 million turnover) typically face fees of £8,000-£20,000. These figures represent total costs including both the Statement of Affairs fee and Liquidator’s fee.

In cases with substantial assets or complex legal issues, fees can exceed £25,000. London-based practitioners generally charge more than those in regional centres. It’s advisable to obtain multiple quotes to compare fees for similar services.

How are fees for official receivers determined in compulsory liquidation?

Official receivers’ fees in compulsory liquidations follow a statutory scale set by the Insolvency Service. Current rates include a fixed administration fee of £6,000 plus a percentage of assets realised: 15% on the first £75,000 and 6% on amounts above that.

Unlike private practitioners, official receivers cannot negotiate fees. These costs are prioritised for payment before unsecured creditors, similar to private practitioner fees. Compulsory liquidation typically costs more than voluntary liquidation due to court fees and the prescribed fee structure.

What can a company expect to pay for insolvency legal advice?

Initial insolvency consultations with specialist solicitors can be costly, though many firms (including Anderson Brookes) offer free initial consultations. For comprehensive insolvency legal advice, expect to pay:

- Basic situation assessment and options review: £500-£1,000

- Legal support through voluntary liquidation: £1,500-£4,000

- Defending wrongful trading allegations: £5,000-£15,000+

- Representation in complex court proceedings: £10,000-£50,000+

These legal costs are separate from insolvency practitioner fees and often must be paid personally by directors rather than from company funds.

What expenses are typically included in insolvency proceedings?

Beyond practitioner fees, standard disbursements in insolvency proceedings include:

- Statutory advertising: £200-£400

- Insurance for company assets: Variable (typically £500-£2,000)

- Agents’ fees for asset valuations and sales: 2-5% of asset value

- Document storage costs: From £300 typically but this really can vary

- Software licensing for creditor management: £200-£500

- Legal disbursements: Variable

These costs are usually paid from company assets before distributions to creditors. In insolvencies with limited assets, practitioners may require directors to cover essential disbursements upfront. Always request a detailed breakdown of anticipated disbursements before appointment.

Can an insolvency practitioner give a fixed fee for liquidation?

Sometimes. Fixed fees are more common where the case is straightforward and the scope is clear. Ask what is included, what is excluded, and what would trigger additional charges.

What should an insolvency practitioner fee quote include?

A written fee basis, hourly rates by staff grade (if time cost), estimated disbursements, and how often you will receive updates. If it is a fixed fee, ask what is included and what could increase the cost.

Are disbursements negotiable?

Some disbursements are unavoidable third-party costs, but you can still ask what is expected, what is optional, and whether cheaper alternatives exist.

Why do quotes vary so much between firms?

Differences often come down to scope, assumptions about complexity, reporting frequency, approach to investigations, and whether the quote includes disbursements.