When a company enters a Creditors’ Voluntary Liquidation (CVL), employees have certain legal protections and entitlements. You may be eligible for redundancy payments and other forms of compensation. In this article we cover the statutory requirements and expectations, as well as the more human side of managing your team.

Table of Contents

Employee Rights During a CVL

Overview of Employee Protections in Insolvency

In a CVL, you retain important rights as an employee. Your employment contract typically terminates when the liquidator is appointed. You can claim unpaid wages, holiday pay, and notice pay as preferential creditors. The government’s Redundancy Payments Service (RPS) may cover these claims if the company cannot pay.

The RPS can pay:

- Up to 8 weeks’ unpaid wages

- Up to 6 weeks’ holiday pay

- Statutory notice pay

- Statutory redundancy pay

There are caps on these payments based on length of service and weekly pay. You must submit claims to the RPS within 6 months of dismissal.

Redundancy Rights and Payments

If you’ve worked for the company for at least 2 years, you’re entitled to statutory redundancy pay. The amount depends on your age, weekly pay, and length of service.

Statutory redundancy pay rates:

- 5 week’s pay for each year under 22

- 1 week’s pay for each year aged 22-40

- 5 weeks’ pay for each year 41 or older

The maximum weekly amount is £571 (as of April 2024), and the total payout is capped at £17,130. You won’t pay tax on statutory redundancy pay. If your employer offers a higher amount, the excess may be taxable.

Redundancy Process in a CVL

During a Creditors’ Voluntary Liquidation (CVL), employees face unavoidable redundancy. The process involves specific steps for managing layoffs, providing notice, and fulfilling legal consultation requirements.

How Redundancies Are Managed

In a CVL, the appointed liquidator oversees the redundancy process. They’ll inform employees of the company’s situation and their impending job losses. The liquidator will provide details on claiming redundancy pay and other entitlements.

Employees become preferential creditors for certain claims. These include:

- Unpaid wages (up to £800)

- Accrued holiday pay

- Unpaid pension contributions

The liquidator will assist employees in submitting claims to the Redundancy Payments Service (RPS). This government body handles payments when the company lacks funds.

Notice Periods and Final Pay

Employees are entitled to statutory notice periods based on their length of service:

- 1 week for 1 month to 2 years’ employment

- 1 week per year for 2-12 years’ employment

- 12 weeks for over 12 years’ employment

If the company can’t provide notice, employees may claim pay in lieu of notice from the RPS. Final pay calculations include:

- Wages owed

- Holiday pay

- Statutory redundancy pay (if eligible)

Consultation Requirements with Employees

UK law mandates consultation periods for collective redundancies:

- 30 days for 20-99 redundancies

- 45 days for 100+ redundancies

In a CVL, these timelines may be impractical. The liquidator must still consult with employees or their representatives where possible. They should discuss:

- Reasons for the redundancies

- Ways to avoid or minimise job losses

- How to mitigate the effects on employees

While full consultation might not be feasible, the liquidator should make efforts to engage with staff and provide as much information as possible about the process and their rights.

Claims Employees Can Make During a CVL

Employees affected by a Creditors’ Voluntary Liquidation (CVL) have several options for financial compensation. The government’s National Insurance Fund provides support for redundancy pay, notice pay, unpaid wages, and holiday pay. Understanding these claims and how to access them is crucial for employees facing job loss due to company liquidation.

Redundancy Pay Calculation

- Under 22: 0.5 week’s pay per year of service

- 22-40: 1 week’s pay per year of service

- Over 41: 1.5 weeks’ pay per year of service

Notice pay is based on your normal weekly wage, regardless of whether you work during your notice period or not.

Unpaid Wages and Holiday Pay

You can claim up to 8 weeks of unpaid wages, including commission and overtime. The maximum weekly amount is £571. Holiday pay claims cover up to 6 weeks of accrued but untaken holiday. This includes holidays accrued during your notice period.

If you’ve been laid off or put on short-time working before the CVL, you might be eligible for guarantee pay. This covers up to 5 days in any 3-month period, at a daily rate of £31.

How to Claim Through the Redundancy Payments Service

To claim, you’ll need to contact the Redundancy Payments Service (RPS). They’ll require:

- Your National Insurance number

- Employee reference number

- Dates of employment

- Details of your salary and job role

The insolvency practitioner handling the CVL will provide you with an RP1 form or a case reference number. Use this to start your claim online or by phone. Claims are typically processed within 14 days, but complex cases may take longer.

Remember to claim within 6 months of your employment ending. If you miss this deadline, you may lose your right to claim these payments.

Impact on Pension Contributions

Pension contributions are significantly affected during a Creditors’ Voluntary Liquidation (CVL). Employee pensions may face disruption, and understanding the implications is crucial for protecting your retirement savings.

What Happens to Workplace Pension Schemes

When a company enters CVL, workplace pension schemes often experience disruption. If you’re enrolled in a defined contribution scheme, your employer may cease making agreed-upon contributions. This can lead to a shortfall in your pension pot.

For defined benefit schemes, the Pension Protection Fund (PPF) acts as a safety net. The PPF may step in to ensure you receive a portion of your expected benefits if your employer can’t meet its pension obligations.

It’s important to note that any personal contributions you’ve made to your pension should remain protected, as these are typically held separately from company assets.

Steps Employees Should Take to Protect Their Pension

To safeguard your pension during a CVL, take proactive steps:

- Contact your pension provider: Inform them of the company’s liquidation and request details about your pension’s status.

- Gather documentation: Collect payslips, pension statements, and employment contracts as evidence of your contributions.

- Seek professional advice: Consult a financial advisor or pension specialist to understand your options and potential next steps.

- Check PPF eligibility: If you’re in a defined benefit scheme, determine if you qualify for PPF protection.

- Consider pension transfers: Explore the possibility of transferring your pension to a new scheme, but be cautious of potential fees or penalties.

Managing Employee Concerns During a CVL

During a Creditors’ Voluntary Liquidation (CVL), addressing employee concerns is crucial. Effective communication and support resources can help ease the transition for staff members affected by the company’s closure.

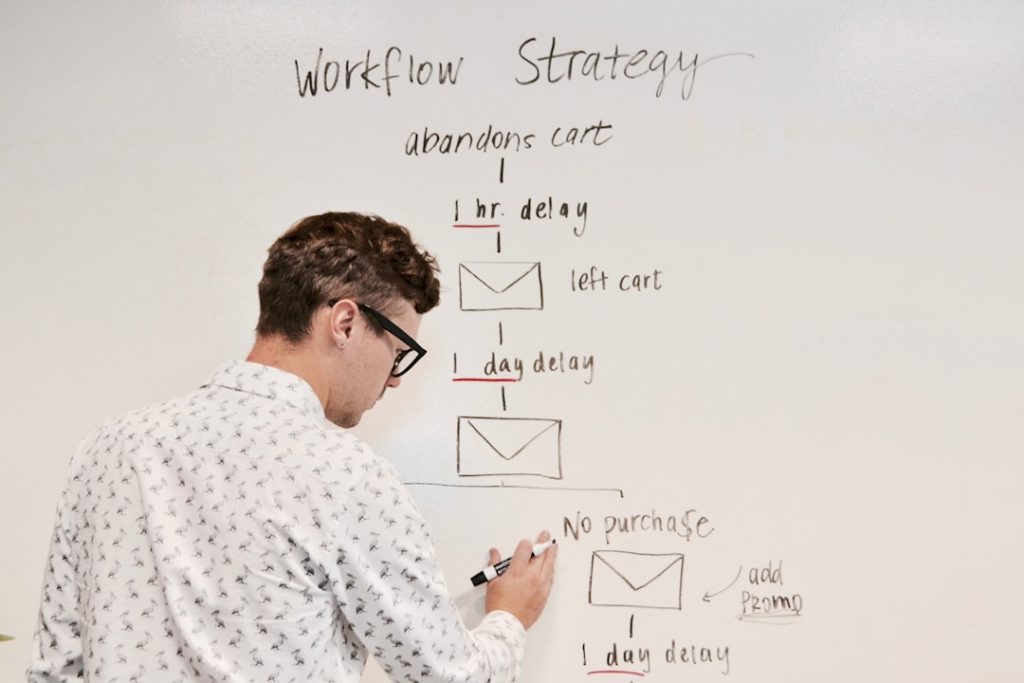

Clear Communication of the Process

Keep employees informed about the CVL process from the outset. Arrange a company-wide meeting to explain the situation and its implications. Provide regular updates through various channels, such as emails, meetings, and notice boards.

Be transparent about the timeline and expected outcomes. Address common questions regarding redundancy, outstanding wages, and future job prospects. Ensure that information is consistent and accurate to prevent confusion and rumours.

Encourage open dialogue by setting up one-on-one sessions or small group discussions. This allows employees to ask questions and express their concerns privately.

Providing Support Resources for Employees

Offer guidance on redundancy rights and entitlements. Provide information on how to claim statutory redundancy pay and other benefits from the National Insurance Fund.

Set up an employee assistance programme or connect staff with external support services. This may include career counselling, CV writing workshops, and job search assistance.

Create a resource pack with useful contacts, such as government agencies, financial advisors, and mental health support services. Consider bringing in specialists to offer on-site advice sessions on topics like financial planning and job searching.

Maintain an open-door policy for employees to discuss their concerns throughout the CVL process. Assign a dedicated point of contact for employee queries to ensure consistent and timely responses.

Practical Support Through the Transition

Beyond the formal requirements, there are several ways we’ve seen directors provide valuable support to their staff:

- Writing strong reference letters highlighting employees’ skills and contributions

- Reaching out to business contacts about possible job openings

- Allowing reasonable time off for job interviews

- Setting up a dedicated email address for forwarding job opportunities

- Creating a LinkedIn group for team members to stay connected and share leads

One of our clients, a retail business owner in Birmingham, contacted competitors who were expanding to recommend his staff. This practical approach helped several employees find new positions quickly.

Looking After Wellbeing

The emotional impact of job loss shouldn’t be underestimated. We’ve found that recognising the stress your employees are under and pointing them towards support can make a significant difference.

Simple measures include:

- Sharing information about local job centres

- Providing links to financial advice services

- Offering details for mental health support organisations

- Keeping communication channels open for questions that arise

Finding Closure as a Team

Many of the companies we’ve helped through liquidation have found value in marking the end of the business in some way. A final team gathering, whether it’s a lunch or informal meeting, gives everyone a chance to say goodbye and acknowledge what you’ve achieved together.

While the business may be ending, the relationships and skills developed don’t have to. We’ve seen strong professional networks emerge from company closures, with former colleagues continuing to support each other long after the liquidation process is complete.

At Anderson Brookes, we believe that handling this human aspect of liquidation with care and respect reflects the values of responsible business leadership. How you manage this final chapter can leave a lasting impression on your team and local business community.

The road ahead may be challenging, but with proper guidance, both you and your employees can move forward confidently into your next opportunities.

How Anderson Brookes Supports Employers in Managing Employees During a CVL

At Anderson Brookes, we understand that one of the hardest parts of going through a Creditors’ Voluntary Liquidation (CVL) is the impact on your employees. These are the people who’ve helped build your business, and telling them about the company’s financial problems can be emotionally challenging.

Breaking the News to Your Team

When we work with directors facing company closure, we always emphasise the importance of honest communication. Your employees will appreciate straightforward information about what’s happening and how it affects them.

We recommend holding a company meeting as soon as the decision to liquidate has been made. During this meeting, we can help you:

- Explain what a CVL means in simple terms

- Outline what will happen over the coming weeks

- Talk through how staff will be paid any money they’re owed

- Answer questions about redundancy and the claims process

In our experience, employees most worry about when their last day will be, whether they’ll be paid what they’re owed, and how to find a new job. Having clear answers ready for these questions can make a difficult situation a bit easier for everyone.

Frequently Asked Questions

Employees facing redundancy due to a Creditors’ Voluntary Liquidation (CVL) have specific entitlements and rights. Understanding the process of compensation, claim prioritisation, and legal protections is crucial for workers in this situation.

What are the entitlements for employees facing redundancy due to company liquidation?

Employees made redundant due to a CVL are entitled to claim statutory redundancy pay if they’ve worked for the company for at least two years. This includes notice pay, holiday pay, and any unpaid wages. The National Insurance Fund covers these payments if the company can’t afford them.

How does employee compensation get handled during a compulsory voluntary liquidation (CVL)?

During a CVL, employee compensation is typically handled by the liquidator. They’ll assess outstanding wages and entitlements. If the company lacks funds, employees can claim from the Redundancy Payments Service, which is part of the Insolvency Service.

What rights do employees have if their employer enters voluntary liquidation?

Employees have the right to claim redundancy pay, unpaid wages, holiday pay, and pay in lieu of notice. They’re also entitled to a written statement of the reasons for dismissal and the right to appeal against unfair dismissal.

In what order are employees’ claims processed during the liquidation of a company?

Employee claims are considered preferential debts in a CVL. They rank after secured creditors but before unsecured creditors. The order typically is:

- Secured creditors

- Employee claims (up to statutory limits)

- Other preferential creditors

- Unsecured creditors

How are unpaid wages and benefits addressed during a company’s liquidation process?

Unpaid wages and benefits are addressed as preferential debts in the liquidation process. Employees can claim up to £800 of unpaid wages and any accrued holiday pay as a preferential debt. Amounts over this limit become unsecured claims.

Can employees claim unfair dismissal if their contracts are terminated as a result of CVL?

Termination due to a genuine CVL is usually considered a fair reason for dismissal. However, if proper procedures weren’t followed or if the CVL was used as a pretext for unfair dismissal, employees may have grounds for a claim. Seek legal advice if you suspect unfair treatment.