As a business owner or director looking to close your company, you may be asking yourself one question: what will liquidation cost? The answer will vary depending on the size of your company and the assets you hold. One of the most important factors, however, is which insolvency practitioner you choose. This can be key to securing affordable liquidation costs for your business.

In this post, we’ll break down the costs of company liquidation. We’ll show you how Anderson Brookes can help you to minimise the fees you pay, all while delivering high-quality service for businesses of all sizes, including SMEs. Read on for comprehensive advice from our team.

Table of Contents

Understanding Liquidation and Its Costs

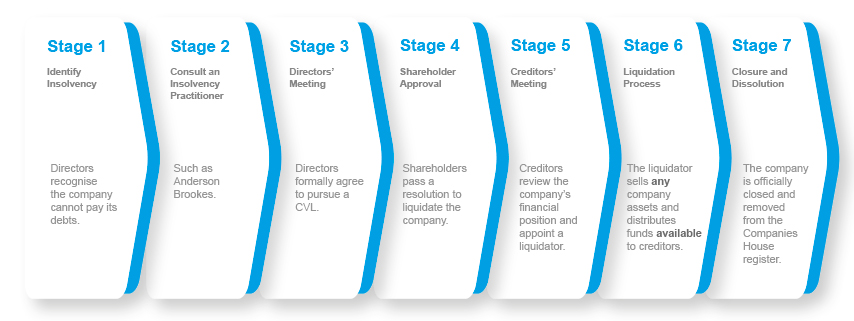

Liquidation refers to the formal process of closing your company by converting its assets into cash. You can pursue this path through two primary routes: Members’ Voluntary Liquidation (MVL) for solvent companies or Creditors’ Voluntary Liquidation (CVL) for insolvent ones.

A licensed insolvency practitioner (IP), such as Anderson Brookes, must oversee your liquidation process, ensuring compliance with legal requirements and proper distribution of funds. The process typically involves selling company assets, settling debts, and distributing remaining funds to shareholders according to their entitlements.

How Do We Ensure Affordable Liquidation Costs?

As a business owner or director, there are two key costs you need to be aware of: the statement of affairs fee and the liquidator’s fee.

The statement of affairs (SOA) fee is the IP’s fee for placing the company into liquidation. It includes the preparation of all paperwork, sending notices to creditors, and holding the meetings to place the company into liquidation, for example. The exact amount depends on the specifics, such as the assets and creditors involved. As a rough guide, expect this fee to come to around £3,000 to £8,000. It is payable from the company’s assets or by the director personally if there are no assets.

The liquidator’s fee, meanwhile, is for everything after the SOA stage. This includes everything beyond the creditors’ meeting. This fee is only payable from asset realisations. So if there are no assets, it is common to have no liquidator’s fee. Rest assured that we still provide our service even if there is no liquidator’s fee, and have a duty to do so.

Affordable Liquidation Costs with Anderson Brookes

How do we make sure that your liquidation costs are kept as affordable as possible? Anderson Brookes is a specialist working with limited companies who want to close their business. This includes helping companies with debts. We don’t have a complex group structure, hundreds of shareholders and many services. We focus on delivering the best service and value to our customers, at a time when cost is crucial. While by volume we are one of the largest insolvency practitioners, we are still an SME, like most of our clients.

Overview of Liquidation Expenses

Your liquidation costs will include several key elements:

Professional Fees:

- Insolvency practitioner charges

- Legal adviser fees

- Accountant fees for final accounts

Administrative Costs:

- Asset valuation by RICS experts

- Statutory advertising

- Document filing fees

The size of your company and complexity of its affairs significantly influence these costs. Small companies might face basic liquidation fees starting from £4,000, while larger organisations can expect higher charges.

You can often cover these expenses through the sale of company assets, making the process more manageable for your business.

IP Fees Quote

Need more detail about insolvency practitioner fees? Complete our quick form to get a personalised quote based on your circumstances.

Strategies for Reducing Liquidation Costs

Smart cost-cutting measures and proactive management can significantly lower the costs associated with business liquidation. Effective planning and strategic decisions help preserve value whilst minimising professional fees.

Negotiating with Creditors

Start discussions with creditors early to arrange payment plans or potential settlements. Many creditors prefer receiving partial payment through negotiation rather than risking complete non-payment.

Contact each creditor individually to explain your situation and propose realistic payment terms. Consider offering lump-sum settlements at reduced amounts for immediate payment.

Document all agreements in writing and ensure they’re legally binding. Professional guidance from an insolvency practitioner can strengthen your negotiating position.

Effective Asset Management

Create a detailed inventory of all company assets, including equipment, stock, and intellectual property. Quick identification helps maximise recovery values.

Prioritise selling high-value assets through specialist channels rather than general auctions. This approach typically yields better returns.

Consider staged asset disposal to maintain optimal pricing. Timing is crucial. Selling everything at once can flood the market and reduce values.

Maintain proper documentation of asset conditions and ownership to avoid disputes that could increase costs.

Legal Framework of Liquidation

Company liquidation in the UK operates under Section 1003 of The Companies Act, which establishes the fundamental rules and procedures for dissolving businesses.

A licensed insolvency practitioner must oversee the liquidation process to ensure compliance with legal requirements. These practitioners follow the Statement of Insolvency Practice 9 (SIP 9), which governs their fees and conduct.

Your company’s liquidation must adhere to strict regulatory guidelines that protect both creditors and shareholders. The framework ensures fair distribution of assets and transparent handling of all financial matters.

The legal structure recognises three primary types of liquidation: Compulsory Liquidation, Creditors’ Voluntary Liquidation (CVL), and Members’ Voluntary Liquidation (MVL). Each type follows specific legal protocols and requirements.

You must provide full disclosure of company assets and liabilities during the process. Failure to comply with these legal obligations can result in director disqualification or personal liability for company debts.

The framework includes mandatory creditor meetings and formal notifications through prescribed channels. Your insolvency practitioner will guide you through these statutory requirements to ensure full compliance.

Assets must be distributed according to a legally defined order of priority, with secured creditors typically receiving payment first, followed by preferential creditors and unsecured creditors.

Sectors We Support

We support company directors in every sector, from construction firms and logistics companies to pubs, cafés, restaurants, hotels, retailers and manufacturers. Our advice is always clear, confidential and shaped by real experience in your industry. Whether you’re dealing with unpaid tax, supplier pressure or falling income, our team understands the challenges and will guide you through the best next steps.

Role of Liquidators

A liquidator serves as the official administrator who takes control of a company’s affairs during the liquidation process. Their primary duty involves selling assets, settling debts and ensuring fair distribution of remaining funds.

Appointment and Responsibilities

When your company enters liquidation, a licensed insolvency practitioner takes legal control as the liquidator. They immediately gain authority over company assets and financial records.

The liquidator’s core duties include:

- Collecting and selling company assets

- Investigating company affairs and director conduct

- Distributing funds to creditors in order of priority

- Managing employee claims and redundancy processes

- Filing required reports with Companies House

We act impartially and follow strict regulatory guidelines throughout the process.

Fees and Payment Structures

Liquidator fees typically receive priority payment from the company’s assets. Your liquidator may charge through different methods:

- Time-based fees calculated at hourly rates

- Fixed fees agreed upfront

- Percentage of assets realised

- Combination of these approaches

You’ll receive a detailed fee estimate before the liquidation begins. The fees depend on factors like company size and complexity.

If insufficient assets exist, you may need to pay fees personally as the director. Some practitioners offer payment plans or fixed-cost packages for smaller companies.

Case Studies on Affordable Liquidation

Real-world examples demonstrate effective cost management in business closures whilst maintaining compliance with legal requirements and protecting stakeholder interests.

Small Business Liquidations

A local retail shop in Essex successfully completed liquidation for £2,800 through careful pre-planning and asset management. The owners worked directly with licensed practitioners to minimise costs.

A family-owned restaurant reduced liquidation expenses by maintaining detailed financial records and cooperating fully with appointed liquidators. This preparation shortened the process duration and lowered professional fees.

Corporate Downsizing and Cost Implications

Large manufacturers have demonstrated cost-effective liquidation strategies through phased closures. You can learn from their structured approach to asset disposal and creditor negotiations.

Key Cost-Saving Measures:

- Strategic timing of asset sales

- Early creditor communication

- Proper documentation preparation

- Efficient inventory management

Professional fees typically range from £4,000 to £15,000 for mid-sized companies. Your costs may decrease through advance planning and organised record-keeping.

Recent cases show that companies save 20-30% on liquidation costs when they prepare comprehensive financial statements before appointing practitioners.

Business Liquidation Process

At Anderson Brookes, we can place a company into liquidation within 8 days of instruction.

Contact us today for confidential advice.

Pre-Liquidation Planning

A thorough assessment of your company’s financial position and creation of a structured plan will significantly impact the success of your liquidation process while minimising costs and potential complications.

Conducting a Financial Analysis

Start by gathering all financial documents, including balance sheets, profit and loss statements, tax records, and asset registers. Make a complete list of your creditors, including amounts owed and payment terms.

Create an accurate inventory of all company assets, including:

- Physical equipment and stock

- Intellectual property

- Outstanding invoices

- Bank accounts and investments

Document all ongoing contracts, leases, and employee obligations that need addressing before liquidation begins.

Developing a Liquidation Strategy

Map out realistic timelines for settling accounts and disposing of assets. Consider which assets can be sold quickly versus those that might need more time to achieve optimal value.

Your strategy should prioritise:

- Asset valuation: Obtain professional valuations to set reasonable expectations

- Debt settlement: Plan how to handle secured and unsecured creditors

- Employee matters: Schedule consultations and redundancy arrangements

Create a detailed budget for the liquidation process, including projected costs for:

- Liquidator fees (£2,000-£6,000 + VAT). We specialise at working with SMEs – we can place businesses into liquidation within 8 days – and as we don’t offer wider accountancy services – as a specialist we really can offer value for money

- Legal documentation

- Asset storage and disposal

Consider alternative options like company dissolution if your business has minimal assets and liabilities.

Questions? Speak to our experts today on 0800 1804 935.

Alternatives to Liquidation

When facing financial difficulties, several formal options exist to help restructure or save your company whilst avoiding liquidation. These paths offer different levels of protection and flexibility for managing debt.

Voluntary Administration

A licensed insolvency practitioner takes control of your company’s affairs to assess its viability. The administrator has 8 weeks to develop a rescue plan.

Your company receives protection from creditor actions during this period through a statutory moratorium. This breathing space allows for proper evaluation of the business.

The administrator can continue trading your business, negotiate with creditors, and potentially sell profitable parts as a going concern.

This option works best when your business has a chance of recovery but needs professional intervention and temporary protection from creditors.

Company Voluntary Arrangement

A CVA allows you to make affordable monthly payments to creditors over 3-5 years whilst continuing to trade. You maintain control of daily operations.

Your company must demonstrate viable future trading prospects. An insolvency practitioner will help structure the proposal.

Key benefits include:

- Protection from creditor pressure

- Interest and charges typically frozen

- Existing contracts can continue

- Directors remain in control

75% of creditors must approve the arrangement by value. Once approved, all unsecured creditors are bound by its terms.

Receivership Options

Administrative receivership provides a structured approach when your company has defaulted on secured debt. The receiver’s primary duty is to the secured creditor.

The receiver can:

- Take control of specific assets

- Continue trading if beneficial

- Sell assets to repay the secured creditor

- Negotiate with potential buyers

Fixed charge receivership focuses solely on specific assets, like property or equipment. This targeted approach may help resolve particular debt issues while allowing continued trading.

Tax Considerations in Liquidation

When you liquidate your company, you must submit a corporation tax return up to the date of liquidation. The tax payment becomes due 9 months after this date.

Your liquidator’s fees can affect your tax position. These fees are typically deductible against capital gains tax but not against corporation tax, as they are considered closure costs rather than trading expenses.

HMRC has changed its approach to tax clearances in members’ voluntary liquidations. They no longer provide pre or post-tax clearances, which affects how you plan your liquidation timeline.

For Limited Liability Partnerships (LLPs), different rules apply. During liquidation, LLPs are taxed as companies from the date a liquidator is appointed or when the court issues a winding-up order.

Key Tax Points to Remember:

- Corporation tax returns must be filed for the period up to liquidation

- Tax payments are due within 9 months

- Liquidator fees may be offset against capital gains

- No tax clearances are provided by HMRC for voluntary liquidations

The method you choose for company closure can impact your tax position. A members’ voluntary liquidation and a strike-off have different tax implications, making it essential to select the most tax-efficient option for your circumstances.

Impact of Liquidation on Employees and Stakeholders

Liquidation creates significant changes for both employees and stakeholders, requiring careful management of redundancies, entitlements, and communication processes.

Employee Redundancies and Entitlements

Your employment rights remain protected during liquidation. The appointed liquidator must follow strict legal procedures regarding redundancies and payment of entitlements.

You’re entitled to claim redundancy pay, unpaid wages, holiday pay, and notice pay through the National Insurance Fund if your employer cannot pay. These payments are subject to statutory limits.

The liquidator will provide you with form RP1 to make claims. You must submit this within 12 months of losing your job.

Key entitlements:

- Up to 8 weeks’ unpaid wages

- Up to 6 weeks’ holiday pay

- Statutory notice pay

- Redundancy pay based on age and length of service

Stakeholder Communications

Your role as a stakeholder requires clear information about the liquidation process. The liquidator must provide regular updates about asset sales and potential returns.

Secured creditors receive priority in payment distributions. You’ll receive formal notices about creditor meetings and voting rights on important decisions.

Communication channels:

- Written notices via post or email

- Creditor meetings

- Online portals for claim submissions

- Direct contact with the liquidator’s office

Keep all documentation related to your claims and attend scheduled meetings to protect your interests.

Long-Term Effects of Liquidation on Brand Value

Liquidation can significantly impact your brand’s long-term value, even after your business has closed its doors. The way you handle the liquidation process shapes public perception and influences future business ventures.

A poorly managed liquidation often leads to damaged relationships with suppliers, customers, and industry partners. These stakeholders may hesitate to work with you or your future ventures, creating lasting repercussions in your professional network. Your brand’s reputation can suffer from rushed or disorganised liquidation sales.

Key reputation factors to monitor:

- Quality of customer service during closeout

- Treatment of employees

- Communication transparency

- Product pricing strategies

The marketplace remembers how you exit your business. A professional, well-planned liquidation helps preserve your brand’s dignity and maintains goodwill within your industry sector.

Your intellectual property value may decline during liquidation. Trademarks, patents, and brand assets often lose substantial worth when associated with a failed business venture.

Strategic considerations for brand protection:

- Maintain consistent communication

- Honour customer commitments

- Preserve professional relationships

- Document brand assets properly

Digital footprints remain long after liquidation ends. Your online reviews, social media presence, and business listings continue to influence public perception of your brand legacy.

Frequently Asked Questions

Understanding liquidation costs requires examining key factors like company size, assets, creditors, timeline and practitioner fees. These elements directly impact the total expenses involved in winding up a business.

What factors determine the cost of company liquidation?

The size and complexity of your company significantly affect liquidation costs. Larger businesses with more assets and creditors typically incur higher fees.

The location of your business and choice of Insolvency Practitioner can influence pricing. Different regions and practitioners maintain varying fee structures.

Asset valuation, documentation requirements and the number of creditors all play crucial roles in determining final costs.

How can one minimise the expenses associated with liquidating a business?

Maintaining organised financial records helps reduce the time practitioners spend reviewing documents. This directly lowers your costs.

Working proactively with creditors before liquidation can streamline the process. Clear communication often leads to more efficient proceedings.

What duties does an Insolvency Practitioner perform in a liquidation process, and how are their fees structured?

Practitioners handle asset valuation, creditor negotiations and legal documentation. They also manage the distribution of funds and ensure compliance with regulations.

Most practitioners charge either fixed fees or hourly rates. Fixed fees provide cost certainty, while hourly rates depend on the complexity and duration of the process.

In what scenarios is Members’ Voluntary Liquidation considered, and what costs are involved?

Members’ Voluntary Liquidation suits solvent companies looking to close operations and distribute assets to shareholders. This process requires a declaration of solvency.

Costs typically include practitioner fees, legal expenses and asset valuation charges. The process generally costs more than dissolution but offers greater protection.

How does the speed of the liquidation process affect overall expenses?

Quick liquidations often cost less due to reduced administrative time and fewer ongoing expenses. Delays can increase costs through additional paperwork and practitioner hours.

Complex cases requiring extensive creditor negotiations or legal procedures take longer and cost more.

What are the implications of liquidation for a company and its directors?

Directors of limited companies maintain protection from personal liability in most cases. Your personal credit score typically remains unaffected.

The company name becomes available for others to use after liquidation. You must follow specific rules about using similar names in future businesses.

Professional restrictions may apply to directors involved in failed companies. These limitations typically last for a specified period.