Insolvency Firms: Expert Support for Businesses in Financial Distress – Navigating Corporate Recovery

What Do Insolvency Firms Do?

Insolvency firms provide specialised financial and often legal services to businesses facing severe financial challenges. They offer expert guidance and practical solutions to help companies navigate insolvency proceedings or avoid them altogether.

Overview of Services Offered by Insolvency Firms

Insolvency firms, such as Anderson Brookes, provide a range of services tailored to businesses in financial distress. These include:

- Financial assessments and restructuring advice

- Negotiation with creditors

- Implementation of turnaround strategies

- Administration of formal insolvency procedures

We can assist with company voluntary arrangements (CVAs), administrations, and voluntary liquidations. Many firms also offer pre-insolvency services to help businesses avoid formal proceedings.

For solvent companies, insolvency firms can manage members’ voluntary liquidations (MVLs) to efficiently dissolve the business and distribute assets to shareholders.

How They Help Businesses Manage Financial Difficulties

Insolvency firms play an important role in guiding businesses through financial crises. They:

- Assess the company’s financial situation

- Identify potential recovery options

- Develop and implement restructuring plans

- Negotiate with creditors to secure better terms

These firms can help you explore alternatives to formal insolvency, such as refinancing or asset sales. If insolvency is unavoidable, they manage the process to ensure compliance with legal requirements and maximise returns for creditors.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

Insolvency – Google Review

When Should You Engage an Insolvency Firm?

Recognising the right moment to seek professional help is crucial for businesses facing financial difficulties. Timely intervention can make the difference between recovery and closure.

Signs Your Business May Be Facing Insolvency

Watch for persistent cash flow problems. If you’re struggling to pay suppliers or staff on time, it’s a red flag.

Mounting debts and creditor pressure are clear indicators. Are you receiving final demands or threats of legal action?

Declining sales or profit margins over several quarters should not be ignored. This trend often signals deeper financial issues.

Look out for:

- Bounced cheques or rejected payments

- Reliance on emergency loans or credit

- Inability to secure new finance

If you’re considering using personal funds to prop up the business, it’s time to seek expert advice.

Legal Obligations During Financial Distress

Directors have a legal duty to act in creditors’ best interests when insolvency threatens. Failure to do so can lead to personal liability.

You must avoid:

- Trading whilst insolvent

- Preferential payments to certain creditors

- Taking on new credit you can’t repay

Seek professional guidance to ensure you’re complying with insolvency laws. An insolvency practitioner can help you understand your obligations.

Keep detailed records of all financial decisions. This will protect you if your actions are later scrutinised.

The Importance of Acting Quickly

Early action can preserve more options for your business. The sooner you engage an insolvency firm, the more likely you are to achieve a positive outcome.

Delaying can:

- Reduce available assets

- Limit restructuring possibilities

- Increase personal risk for directors

Prompt intervention may allow for:

- Company voluntary arrangements

- Pre-pack administrations

- Negotiated settlements with creditors

Remember, insolvency firms offer confidential consultations. You can explore your options without committing to formal proceedings.

Don’t wait until a winding-up petition is served. By then, your choices may be severely limited.

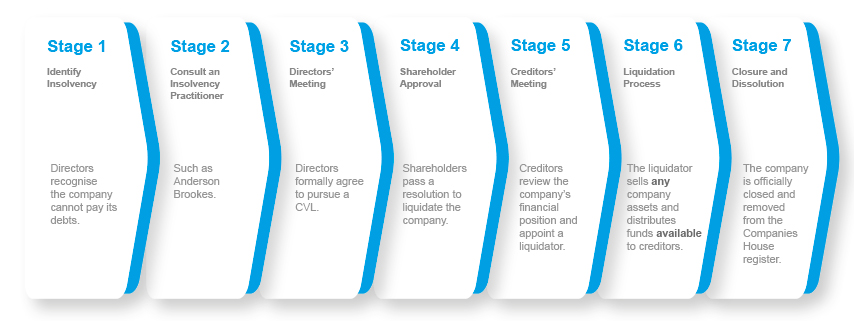

Insolvency Firm – The CVL Process – Example

We can place a company into liquidation within 8 days of instruction

Services Provided by Insolvency Firms

Insolvency firms offer a range of specialised services to assist businesses facing financial difficulties. These services aim to help companies navigate challenges and explore options for recovery or closure.

Business Rescue and Recovery Solutions

Insolvency practitioners provide expert guidance on business rescue strategies. They assess your company’s financial situation and recommend appropriate solutions. These may include:

- Company Voluntary Arrangements (CVAs)

- Administration procedures

- Turnaround management

CVAs allow you to negotiate with creditors and restructure debts. Administration offers protection from creditors while a recovery plan is developed. Turnaround management focuses on operational improvements to restore profitability.

Practitioners work closely with your management team to implement chosen strategies. They help streamline operations, reduce costs, and improve cash flow. Their goal is to stabilise your business and put it on a path to recovery.

Liquidation Services for Solvent and Insolvent Companies

When business rescue is not viable, insolvency firms guide you through the liquidation process. They handle both solvent and insolvent liquidations:

Solvent liquidations (Members’ Voluntary Liquidation):

- Distribute assets to shareholders

- Ensure tax-efficient closure

- Handle all legal requirements

Insolvent liquidations (Creditors’ Voluntary Liquidation or Compulsory Liquidation):

- Realise and distribute assets to creditors

- Investigate company affairs

- Dissolve the company

Practitioners manage the entire liquidation process, from initial assessment to final dissolution. They ensure all legal obligations are met and stakeholders’ interests are protected.

Support with Negotiations and Debt Restructuring

Insolvency firms play a crucial role in negotiations with creditors and debt restructuring. They:

- Analyse your financial position

- Develop realistic repayment proposals

- Negotiate with creditors on your behalf

Practitioners use their expertise to secure favourable terms for debt repayment. They may help you:

- Extend payment deadlines

- Reduce interest rates

- Write off portions of debt

Their goal is to create a sustainable debt structure that allows your business to continue operating. They also assist with implementing agreed repayment plans and monitoring progress.

Benefits of Working with an Insolvency Firm

Engaging an insolvency firm provides crucial support for businesses facing financial difficulties. These specialists offer valuable expertise and tailored solutions to help companies navigate complex financial challenges.

Access to Multi-Disciplinary Expertise

Insolvency firms employ professionals from various fields, including accountants, lawyers, and financial advisors. This diverse team brings a wealth of knowledge to your situation.

You’ll benefit from their combined experience in areas such as debt restructuring, tax law, and business recovery strategies. Their expertise can help you identify options you might not have considered on your own.

These specialists stay up-to-date with the latest regulations and industry trends. This ensures you receive current, relevant advice for your specific circumstances.

A Comprehensive Approach to Business Closure or Recovery

Insolvency firms offer a holistic view of your financial situation. They analyse all aspects of your business to determine the best course of action.

If recovery is possible, they’ll develop strategies to improve cash flow, negotiate with creditors, and restructure operations. These steps can help you avoid formal insolvency proceedings.

In cases where closure is inevitable, they’ll guide you through the process efficiently. This includes:

- Handling creditor communications

- Managing asset liquidation

- Ensuring compliance with legal requirements

Their involvement can reduce stress and help you navigate this challenging period more smoothly.

Guidance Tailored to Your Industry and Circumstances

Every business faces unique challenges, and insolvency firms recognise this. They provide customised advice based on your specific industry, company size, and financial situation.

You’ll receive guidance on industry-specific regulations and best practices. This targeted approach increases the likelihood of a positive outcome for your business.

Insolvency practitioners can also help you understand the long-term implications of different options. This allows you to make informed decisions about your company’s future.

Their expertise extends to identifying potential opportunities for restructuring or selling parts of the business. This can sometimes lead to unexpected positive outcomes, even in difficult circumstances.

Why Anderson Brookes Is the Insolvency Firm for You

Anderson Brookes offers expert insolvency guidance backed by decades of experience. We provide personalised support to businesses facing financial challenges across diverse sectors.

Proven Expertise in Business Insolvency

Anderson Brookes brings over 20 years of specialised knowledge to help companies navigate insolvency. Our team includes Licensed Insolvency Practitioners equipped to handle complex cases.

Our advisers stay up-to-date on the latest insolvency laws and regulations. This ensures you receive accurate, compliant advice tailored to your situation.

Anderson Brookes has successfully assisted businesses of all sizes, from sole traders to large corporations. Our extensive experience allows us to quickly assess your circumstances and recommend practical solutions.

A Track Record of Supporting Businesses Across Sectors

At Anderson Brookes we have worked with companies in diverse industries from construction, retailers, manufacturers, service providers, and pubs.

The firm’s advisers understand the unique pressures facing different types of businesses. This allows them to offer targeted advice that addresses your company’s particular needs.

Free Consultations to Explore Your Options

We offer free initial consultations to discuss your company’s financial situation. This no-obligation meeting lets you explore potential solutions without cost or commitment.

During your consultation, an experienced adviser will review your circumstances and explain relevant insolvency options. We answer your questions and outline possible next steps.

If formal insolvency proceedings are needed, Anderson Brookes can seamlessly transition to provide those services. Our in-house Licensed Insolvency Practitioner ensures continuity of care throughout the process.

Google Reviews

&

Questions? Speak to an expert today! 0800 1804 933

You may also be interested in:

Frequently Asked Questions

Businesses facing financial distress often have pressing questions about the insolvency process and available support. Insolvency firms play a key role in guiding companies through challenging times.

What are the key factors to consider when selecting an insolvency firm?

When choosing an insolvency firm, look for experience in your industry and a track record of successful outcomes. Consider their size, reputation, and range of services offered.

Ensure the firm has licensed insolvency practitioners who can provide expert advice tailored to your situation. Check their fees and payment structure to avoid surprises. You might be interested in – Insolvency Practitioners Fees.

How does the insolvency process work for businesses facing financial difficulties?

The insolvency process typically begins with an assessment of your company’s financial position. An insolvency practitioner will review your assets, liabilities, and cash flow.

They’ll explore options such as restructuring, administration, or liquidation. The chosen path depends on your business’s viability and the best interests of creditors.

What services do insolvency firms offer to support companies in distress?

Insolvency firms provide a range of services to help struggling businesses. These include financial analysis, debt restructuring, and negotiation with creditors.

They can assist with company voluntary arrangements (CVAs), administrations, and liquidations. Many firms also offer turnaround and recovery services to help viable businesses regain stability.

Can a business recover after going through an insolvency procedure?

Yes, businesses can recover after insolvency procedures. Many companies use processes like administration or CVAs to restructure and emerge stronger.

Success depends on factors such as the underlying business model, market conditions, and the effectiveness of the restructuring plan.

What are the potential consequences for directors of a company entering insolvency?

Directors may face personal liability if found guilty of wrongful or fraudulent trading. They could be disqualified from acting as directors for up to 15 years.

It’s crucial to seek professional advice early and act in the best interests of creditors to minimise personal risk during insolvency proceedings.