Restoring a Struck-Off Company: Essential Steps for Reinstatement

Can A Company Be Restored After Strike Off?

Yes, a company can be restored after being struck off the register. The process and eligibility depend on the circumstances of the strike-off and how much time has passed since dissolution.

Voluntary Restoration

If your company was voluntarily struck off, you can apply for restoration within 6 years of dissolution. You’ll need to submit a court application and provide evidence that the company was trading at the time of dissolution. The court will consider factors such as:

- Reasons for the original strike-off

- Any objections to restoration

- Financial status of the company

If approved, you must pay any outstanding fees and file any missing documents. The company will then be restored to the register as if it had never been dissolved.

Court-Ordered Restoration

For companies struck off involuntarily (e.g. for non-compliance), you may be eligible for administrative restoration within 6 years. This process is simpler and doesn’t require a court order. You’ll need to:

- File any overdue accounts or confirmation statements

- Pay outstanding penalties

- Submit form RT01 to Companies House

If more than 6 years have passed, you’ll need to apply for court-ordered restoration. This involves presenting a strong case to the court explaining why restoration is necessary. Common reasons include:

- Pursuing legal claims

- Dealing with company property

- Addressing creditor concerns

The court will carefully review your application before making a decision.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

Process of Restoring a Company

Restoring a struck-off company involves submitting an application and potentially going through court proceedings. The specific steps depend on factors like how long ago the company was dissolved and the reasons for strike-off.

Filing an Application

To begin the restoration process, you’ll need to file an application with Companies House. Use form RT01 for administrative restoration if your company was struck off within the last 6 years. Include all overdue documents and pay any outstanding fees. You must also provide evidence that the company was trading or carrying on business immediately before being struck off.

For companies struck off more than 6 years ago, you’ll need to apply for a court order. Prepare a witness statement detailing why the company should be restored and gather supporting documents. The court may require additional evidence or explanations.

Court Proceedings

If court proceedings are necessary, you’ll need to submit your application to the appropriate court. For companies registered in England or Wales, apply to the High Court. Scottish companies must apply to the Court of Session, while Northern Irish companies apply to the Royal Courts of Justice.

During the hearing, present your case for restoration. The court will consider factors such as the reasons for strike-off, any creditor objections, and the public interest. If successful, the court will issue an order to restore the company. You’ll then need to deliver this order to Companies House within 7 days.

Implications of Restoration

Restoring a struck-off company has significant consequences for directors, shareholders, and the company’s finances. The process impacts legal responsibilities and financial obligations that must be carefully considered.

Impact on Directors and Shareholders

When a company is restored, directors resume their legal duties and responsibilities. You’ll need to ensure compliance with company law and file any outstanding accounts or confirmation statements. Shareholders regain their status and rights, including voting powers and dividend entitlements.

Directors may face personal liability for any debts incurred during the period of dissolution. It’s crucial to review any contracts or agreements entered into during this time, as they may need to be ratified or renegotiated.

The restoration also reinstates your ability to act on behalf of the company. This includes accessing bank accounts, entering into new contracts, and pursuing legal claims that may have been lost during dissolution.

Financial Repercussions

Restoration comes with financial implications that require careful planning. You’ll need to settle any outstanding debts, taxes, and penalties that accrued before and during the strike-off period. This may include corporation tax, VAT, and late filing penalties.

The company’s assets, which became property of the Crown upon dissolution, will be returned. However, you may need to pay fees to reclaim them. It’s essential to update your financial records and prepare new accounts to reflect the company’s current position.

You might also face costs associated with the restoration process itself, such as court fees if a court order is required. Additionally, consider the potential impact on your credit rating and relationships with suppliers and customers, which may need rebuilding.

Frequently Asked Questions

Company restoration involves legal processes, timeframes, and consequences. Directors face specific responsibilities when a company is struck off. Various methods exist for restoring dissolved companies in the UK.

What are the legal consequences for directors when a company is struck off?

Directors can face personal liability for company debts if they continue trading after strike-off. They may also be disqualified from acting as directors in the future.

Assets of the struck-off company become property of the Crown. Directors lose control over these assets and cannot access company bank accounts.

Under what circumstances can a dissolved company be restored in the UK?

A company can be restored if it was struck off by Companies House in error. Restoration is also possible if the company was solvent at the time of dissolution.

Companies dissolved due to failure to file accounts or confirmation statements can be restored. Restoration is permitted within six years of the dissolution date.

What is the procedure for administrative restoration of a company?

To apply for administrative restoration, submit form RT01 to Companies House. Pay the £100 restoration fee and any outstanding filing fees.

File all missing accounts and confirmation statements. Clear any penalties incurred for late filing. Provide evidence that the company was trading or had property when it was struck off.

How can a company be restored by court order after dissolution?

Apply to the court using a Part 8 claim form. Include supporting documents like the company’s certificate of incorporation and evidence of its trading status.

Pay the court fee and serve the application on the relevant parties. Attend a court hearing where a judge will decide on the restoration application.

What are the implications of a company being struck off due to non-filing of accounts?

Directors may face fines and legal action for failing to file accounts. The company loses its legal status and cannot continue trading.

Restoring the company requires filing all outstanding accounts and paying penalties. This can be costly and time-consuming, especially for long-dissolved companies.

How much time is allowed to reinstate a company after it has been struck off?

Companies have up to six years from the date of dissolution to apply for restoration. After six years, restoration is generally not possible.

For administrative restoration, all documents must be up to date within three months of the application. Court-ordered restorations may have more flexibility in timelines.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

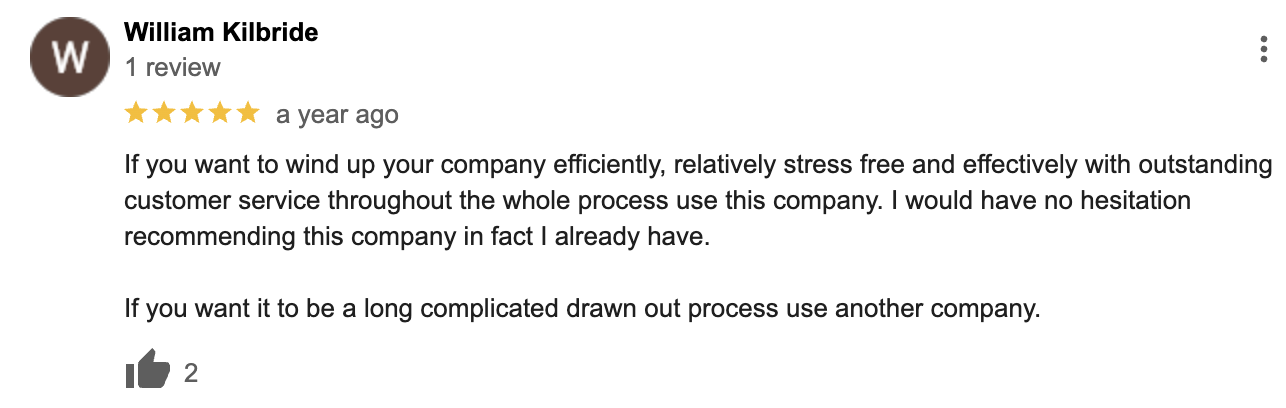

Google Reviews

&