You filed form DS01 to close your company. Then a notice arrived. HMRC has objected. A DS01 objection pauses the strike off and raises questions about tax returns, outstanding liabilities, and what to do next. It is common, especially where Corporation Tax, VAT or PAYE is overdue. You are not alone and you still have options that protect you and your business.

We explain what an HMRC objection to strike off means in plain English, how the timeline works, and the safest routes to resolution. You will see when it makes sense to settle debts and reapply, agree a Time to Pay, or move to a formal liquidation.

If you want tailored advice now, Anderson Brookes’ licensed insolvency team can review your position and outline clear next steps.

What a DS01 Objection Means

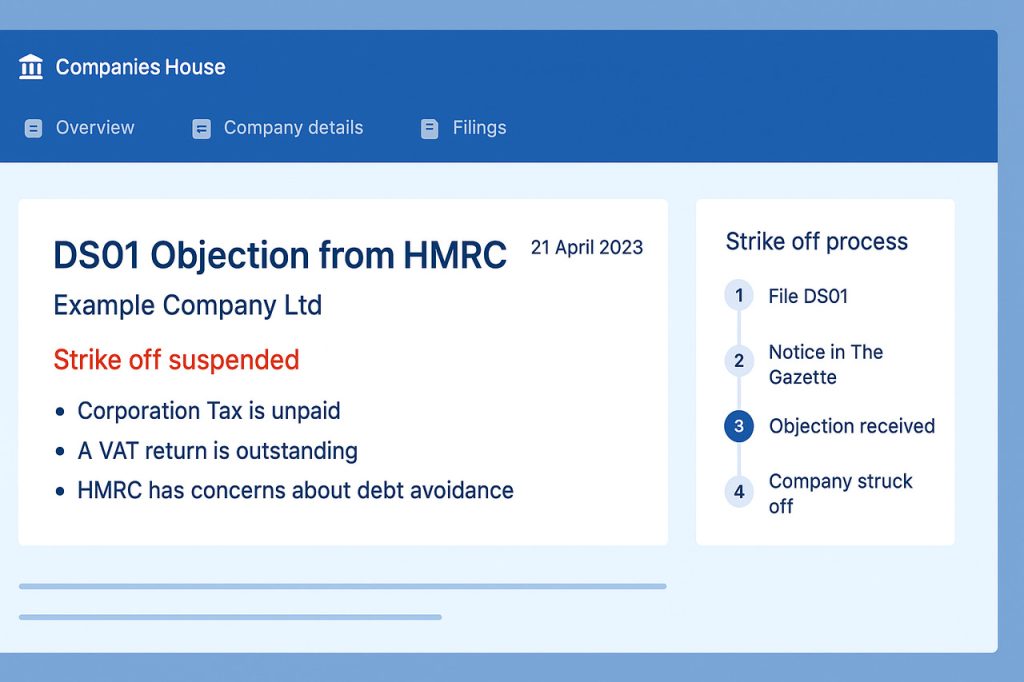

When striking off a limited company in the UK, a crucial step is filing form DS01. This begins the legal process of removing your company from the register held by Companies House. Once complete, your company is said to have been ‘struck off‘. However, things aren’t always straightforward. There’s a two-month window in which interested parties can object. If you want the official overview of who can object and what happens next, see the GOV.UK guidance on objecting to a company being struck off.

A DS01 objection stops the strike-off. Companies House will mark the application as suspended. Your company stays active and you remain a director with the same legal duties.

In practical terms, an HMRC objection to strike off does three things:

- It pauses dissolution and keeps the company active on the register.

- It keeps your director duties in place until the issue is resolved.

- It usually points to unpaid tax, missing returns, or an open HMRC compliance issue.

The objection usually arrives after the DS01 is advertised in The Gazette. Creditors then have a chance to respond. HMRC often objects where tax is owed or filings are missing.

An objection means you cannot dissolve the company until the issue is resolved. You can fix the reason for the objection and reapply. You can withdraw the DS01. Or you can choose a different route that deals with the debts in full.

Common Reasons HMRC Objects

- Corporation Tax, VAT or PAYE is unpaid.

- One or more tax returns are outstanding.

- HMRC believes the strike off is being used to avoid debts.

- Trading or bank activity suggests the company is not dormant.

- There are open compliance checks or penalties.

Impacts of an Objection

- The strike-off is paused.

- HMRC can renew its objection if the problem remains.

- If you pay the debt and complete any missing returns, HMRC may allow the strike off to continue.

- If the company is insolvent, a voluntary liquidation is often safer than repeated DS01 attempts.

If you are unsure whether your company qualifies, use our guide to strike-off eligibility criteria to check the basics before you decide your next move.

Why HMRC Objects So Often

HMRC watches The Gazette for strike off notices. Objections are routine when tax is due or filings are missing. An objection protects the public purse and stops companies using dissolution to sidestep liabilities.

Typical triggers include unpaid Corporation Tax, VAT or PAYE, late or missing returns, open compliance checks, or signs the company is still trading. If there are tax arrears, HMRC may prefer repayment, a Time to Pay plan, or formal insolvency over dissolution.

Trying to dissolve with debts can lead to enforcement, court action, or a winding up petition. If tax arrears are significant, closing a limited company with HMRC debts using a CVL may be safer than repeated DS01 attempts.

Sectors We Support

We support company directors in every sector, from construction firms and logistics companies to pubs, cafés, restaurants, hotels, retailers and manufacturers. Our advice is always clear, confidential and shaped by real experience in your industry. Whether you’re dealing with unpaid tax, supplier pressure or falling income, our team understands the challenges and will guide you through the best next steps.

First Steps After Receiving an Objection to Strike Off

Stay calm. Your company is still active and you remain a director. You have options.

Confirm what HMRC says is outstanding.

Gather recent HMRC letters, tax accounts, and any missing returns. Make a simple list of Corporation Tax, VAT, PAYE, penalties, and due dates.Decide whether to fix and continue or change course.

If the debts are manageable, settle them and complete the filings. If the company cannot pay its debts, consider a formal route that deals with liabilities in full.If you plan to continue with dissolution, clear the issues first.

Pay the arrears, file any missing returns, and keep bank activity dormant. When ready, you can file form DS01 online or follow the step-by-step guide to DS01 to avoid errors.If you change course, withdraw the application.

Use DS02 to withdraw your DS01. This reduces the risk of being seen as attempting to dissolve with debts.Keep stakeholders informed.

Tell staff, banks, landlords, and suppliers what is happening.Check the wider picture before you reapply.

Confirm there are no assets left in the company and review the tax implications of strike-off so you do not create avoidable bills.

Your Options Explained

Receiving a DS01 objection is a signal to pause and choose the safest route. The right choice depends on solvency, outstanding returns, and whether there are HMRC or other creditor pressures. Here are the practical paths we help you weigh.

Option A: Settle Liabilities and Reapply

If the company is solvent and debts are manageable, clear the arrears, file missing returns, and keep the account dormant. Recheck the eligibility criteria before you proceed. This path keeps costs low and avoids further enforcement, provided everything is up to date.

Good for: small balances, no trading, all filings complete.

Watch out for: assets still in the company, late returns, or new activity that could trigger another objection.

Option B: Time to Pay with HMRC

Where cash is tight but the business can repay over time, a Time to Pay arrangement can defuse the objection. HMRC looks for realistic proposals and on-time payments. Once the plan is in place and returns are filed, you can consider reapplying for strike off later, or continue trading if that is your goal.

Good for: temporary cash flow pressure.

Watch out for: missed instalments, which can restart recovery action.

Option C: Creditors’ Voluntary Liquidation

If the company is insolvent, a voluntary liquidation is usually safer than repeated strike off attempts. Liquidation deals with unsecured debts, investigates the position properly, and closes the company in an orderly way. We explain the process, costs, and director duties so you know what to expect. For tax debts in particular, this route can reduce risk and end the pressure sooner.

Good for: persistent arrears, multiple creditors, or legal action.

Watch out for: trying to dissolve while insolvent, which can lead to renewed objections or a winding up petition.

Option D: Withdraw DS01 and Regroup

If the timing is wrong or new issues have surfaced, withdraw the application, fix the problems, then choose your route with a clear plan. When you later reapply, confirm filings are current, creditors are informed, and funds or assets have been dealt with to reduce the chance of another objection.

Good for: preventing escalation while you get things in order.

Watch out for: drifting. Set clear deadlines and next steps.

DS01 Objection Process and Timeline

This is the typical sequence of events you may experience when receiving a DS01 objection.

- DS01 filed and advertised

Companies House accepts your DS01 and places a notice in The Gazette. Creditors are alerted and can object during the notice period. - Objection received

When HMRC objects, Companies House marks the strike off as suspended. Your company stays active. Director duties continue. - Objection duration

An objection usually runs for a fixed period, often three months. HMRC can renew it if the underlying issue remains outstanding. - What you can do during the suspension

You can pay arrears, file missing returns, or propose a realistic Time to Pay. If the reason for the objection is resolved, HMRC may allow the strike off to proceed, or you can reapply once you’re fully compliant. - If the problem isn’t fixed

Renewed objections are common where debts or filings are still outstanding. Repeated DS01 attempts can waste time and increase risk if the company is insolvent. - When to change route

If cash flow is tight or liabilities are large, switching to a formal process is often safer than waiting out objections. It reduces the chance of enforcement and gives clarity on timelines.

To reduce delays next time, check for common strike-off mistakes that often trigger or extend objections.

Free Confidential Advice & Quote

Common Mistakes that Make Objections More Likely

Avoiding a fresh DS01 objection starts with simple fixes. These are the pitfalls we see most often.

Applying while ineligible. Trading continues, bank activity shows movement, or liabilities are unpaid.

Missing returns. Late Corporation Tax, VAT, or PAYE filings trigger fast objections.

Unpaid tax or penalties. Even small balances can stop a strike off.

Assets left in the company. Cash, stock, or a live bank account suggests the business is still active.

Not telling creditors. Lack of notice can prompt objections and complaints.

Incorrect or incomplete DS01. Errors on names, dates, or signatures slow everything down.

Ignoring letters. HMRC or Companies House reminders often include short deadlines.

Trying again too soon. Reapplying without fixing the root cause invites another objection.

Prevention Checklist

- Confirm solvency and stop trading if you plan to dissolve.

- Reconcile the bank and close active accounts after clearing liabilities.

- File every outstanding tax return and check for penalties.

- Pay balances or agree a realistic Time to Pay.

- Remove or distribute remaining assets correctly.

- Keep clear records of what you have done and when.

- Tell affected parties in writing and keep copies.

- Review your application carefully before submission.

Restoration Issues

Restoration is when a dissolved company is put back on the register. A creditor or HMRC can ask the court to restore a company if they need to recover money or investigate what happened. It can also happen if assets were left in the company when it was struck off.

Why Restoration Happens

- Debts or returns were outstanding at the time of dissolution.

- Money or property remained in the company, including a bank balance.

- There is a need to bring the company back to recover assets or pursue claims.

What It Means for You

- The company becomes active again.

- Accounts and tax returns must be brought up to date.

- Penalties and interest can build while filings are late.

- Directors may face tougher scrutiny if strike off was used to avoid debts.

How to Avoid Restoration

- Do not dissolve with unpaid liabilities or missing returns.

- Ensure there are no assets left in the company before you close it.

- Choose the right process if the company is insolvent, rather than trying repeated strike off attempts.

- Keep clear records of decisions and payments.

If a past dissolution is already causing problems, we can review your position, explain the restoration process, and map the safest route to a clean resolution.

How We Help at Anderson Brookes

We start with a short, focused call to understand your position. We check solvency, missing returns, and any urgent HMRC action. You get clear options and next steps in writing. What we do for you:- Review filings, tax accounts, penalties, and timelines.

- Liaise with HMRC to confirm balances and discuss practical solutions.

- Advise whether to reapply for strike off, agree a Time to Pay, or start a creditors’ voluntary liquidation.

- Prepare the paperwork, guide communications, and keep you updated.

- Prioritise director protection and compliance at every stage.

FAQs

What does “objection to strike off” mean?

It means a creditor, often HMRC, has asked Companies House to stop the company being dissolved. If you have submitted DS01, the strike off is suspended while the reason for the objection remains unresolved. The usual fix is to pay what is due, file missing returns, or agree a Time to Pay, then reapply once the company is eligible.

Why did HMRC object to my DS01?

Most objections happen because tax is owed or returns are missing. HMRC also objects if it believes dissolution is being used to avoid liabilities.

Can I appeal an HMRC DS01 objection?

There is no formal appeal. Resolve the reason for the objection by paying arrears, filing returns, or agreeing terms with HMRC. The objection can then lapse or not be renewed.

How long does an objection last?

Typically around three months at a time. HMRC can renew if debts or compliance issues remain unresolved.

Can I reapply after paying what’s due?

Yes. Once liabilities and filings are up to date and the company is otherwise eligible, you can submit a fresh DS01.

Should I withdraw my DS01 with DS02?

Withdraw if you need time to fix problems or you plan to take a different route. Withdrawing reduces the risk of repeated objections while you get compliant.

Is liquidation better than strike off if I have debts?

If the company is insolvent, a creditors’ voluntary liquidation is often safer. It deals with unsecured debts in an orderly way and avoids the cycle of repeated DS01 objection renewals.

Am I personally liable for company debts?

Limited liability generally protects you. Personal guarantees, overdrawn director loan accounts, or misconduct can create personal exposure. Get advice before you act.

What happens if I ignore the objection?

The company remains active. HMRC can pursue enforcement, including court action. Delays often increase costs and risk.

Can I trade while the strike off is suspended?

You can, but trading while trying to dissolve usually creates fresh liabilities and may trigger further objections. Decide on a clear route first.

Will an objection affect my credit rating?

The objection itself doesn’t set a score, but public records, arrears, and court action can affect creditworthiness and supplier confidence.

Are assets a problem during strike off?

Yes. Cash, stock, property, or a live bank balance suggest the company isn’t dormant. Assets must be dealt with correctly before dissolution.